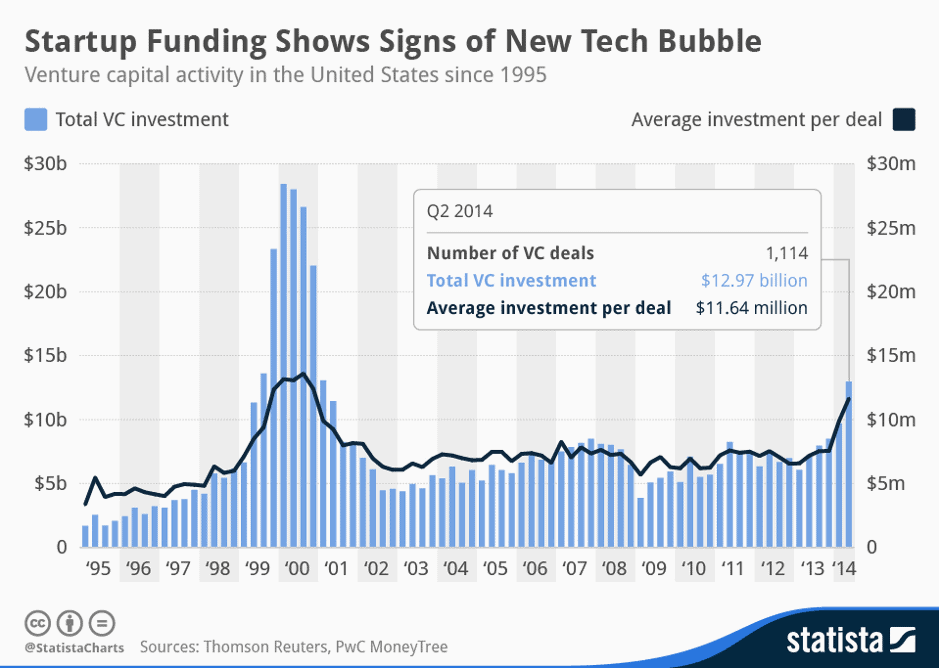

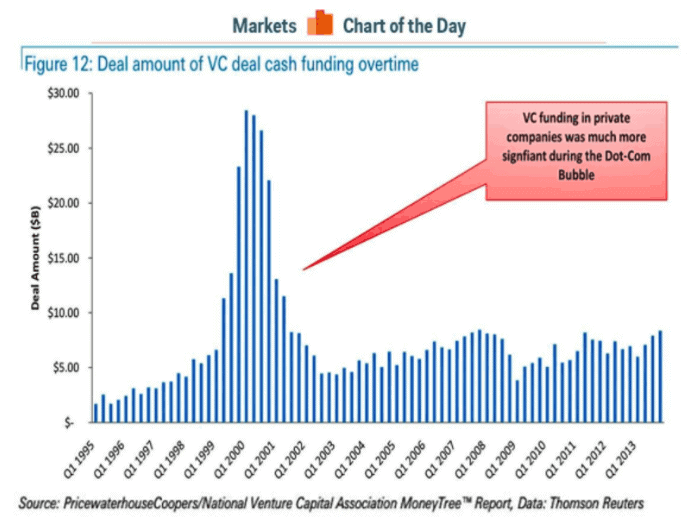

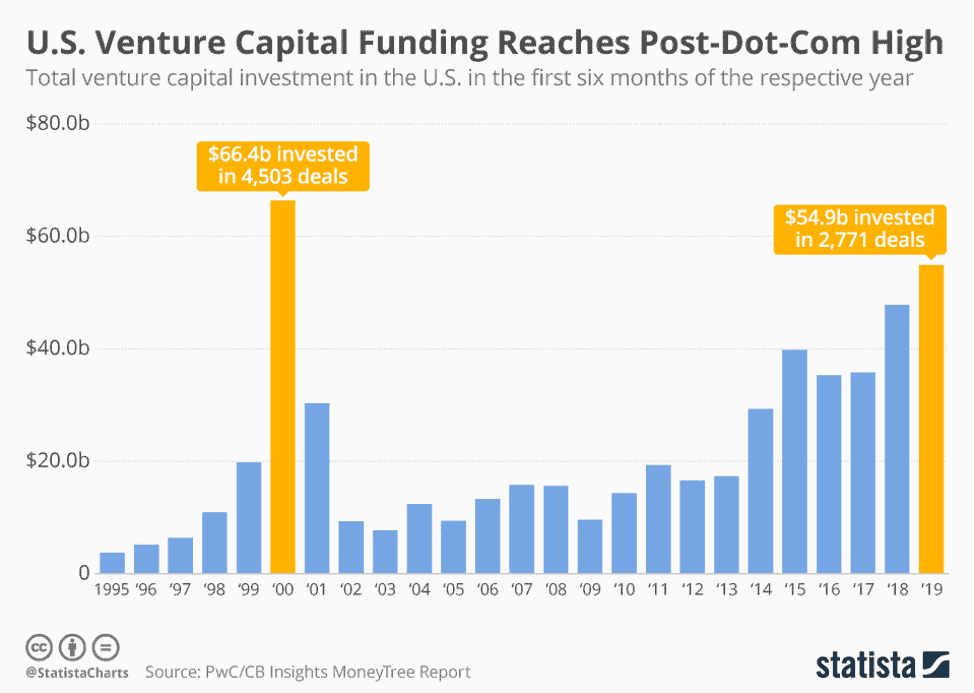

Venture capital saw significant growth in 2021 and early 2022, but it did not see the same level of growth in ESG considerations as other investment areas. This presents a significant opportunity for growth in social venture capital in the coming years as investors become more interested in aligning their financial goals with their values and positively impacting society.

The industry is starting to move in this direction, with more firms and sectors focusing on social and environmental impact. Many venture capital firms are now collaborating to improve their practices and support diversity and other critical missions. Additionally, more firms are hiring directors of sustainability and other professionals to steer investments and initiatives in ESG directions.

As investors become more conscious of the impact of their investments and as more companies take steps to address environmental, social and governance (ESG) issues, it's likely that we will see more growth in social venture capital in the coming years. This will provide a growing number of investors with an opportunity to earn financial returns while also making a positive impact on society.

Definition

Social venture capital (SVC) is a type of investment that aims to generate both financial returns and positive social or environmental impact. This approach combines the principles of traditional venture capital with the goal of addressing social and environmental issues. SVC funds typically invest in companies or organizations that are working to solve pressing social or environmental problems, such as poverty, climate change, or access to healthcare. These investments can be made in a variety of sectors, including technology, renewable energy, and education. SVC is gaining popularity as it allows investors to align their financial goals with their values and make a positive impact on the world while earning a return on their investment.

The Importance of Social Venture Capital

Social venture capital is a type of investment capital that is used to finance social enterprises, which are businesses that are established with the primary goal of achieving a social or environmental impact rather than solely maximizing profits. Social venture capital is becoming increasingly important as traditional sources of funding become harder to access, particularly for early-stage businesses.

There is growing awareness of the need to address social and environmental problems, traditional sources of funding becoming less reliable, social enterprises often having a greater impact on society and the environment, as well as being more sustainable than traditional businesses. Social enterprises are motivated by a desire to make a difference rather than maximize profits.

Therefore, social venture capital is an important source of funding for businesses that are making a positive impact on society and the environment and is increasingly being seen as an attractive investment opportunity for those looking to align their financial goals with their values and make a positive impact on the world.

Social Venture Capital Role

Social Venture Capital (SVC) is a form of private equity investment that targets companies with a social or environmental goal. SVC firms invest in businesses that strive to produce both financial returns and a positive social or environmental impact. The origins of SVC can be traced back to the venture philanthropy movement in the 1970s. In the early 2000s, a new generation of SVC firms emerged, inspired by the success of socially responsible businesses like Ben & Jerry's and Toms of Maine, which proved that companies with a social or environmental purpose could be profitable and have a global impact.

SVC firms invest in a wide range of organizations, including for-profit companies, social enterprises, and hybrid organizations. They tend to focus on sectors such as education, healthcare, energy, and agriculture and invest in companies at all stages of development, from startups to established businesses.

SVC firms use various financial tools, including debt, equity, and grants, and provide mentorship, networking, and technical assistance to their portfolio companies. SVC has been successful in supporting a number of companies that have a significant impact in their sectors, such as D-Rev, a design firm that creates affordable medical technologies for low-resource settings, and One Acre Fund, which provides smallholder farmers in Africa with financing, training, and market access.

SVC is still a relatively new field and is evolving as the needs of social entrepreneurs change. As more companies enter the space and more capital flows into SVC funds, the industry will continue to grow and mature. SVC is an innovative investment model that enables investors to align their financial goals with their values and make a positive impact on the world while earning a return on their investment.

Types of Social Ventures

Social venture capital (SVC) is a type of impact investing in which financial capital is provided to social ventures with a social or environmental mission. SVC investors seek both a financial return and a positive social or environmental impact, typically through equity investment in for-profit social ventures. SVC investors typically provide patient capital, which means they are willing to accept a lower financial return in exchange for the possibility of a higher social return, and they frequently provide assistance other than financial capital, such as mentorship, access to networks, and expertise.

Numerous types of social ventures may be appropriate for SVC, but some common themes include:

Ventures that address a social or environmental problem

These problems can include issues such as poverty, climate change, lack of access to healthcare and education, inequality, and more. Social ventures work towards solving these problems by creating sustainable and scalable solutions, which can have a positive impact on communities and the environment.

Ventures with a business model that is sustainable and scalable

Sustainability and scalability are important factors for social ventures to have a lasting impact. A sustainable business model is one that generates enough revenue to cover its costs and ideally generates a surplus that can be reinvested back into the business. A scalable business model is one that can grow and expand to reach more people or have a greater impact without incurring disproportionate costs. By having a sustainable and scalable business model, the social venture can continue to grow and have a positive impact on society and the environment.

Ventures with a talented and committed team

Having a talented and committed team is crucial for the success of a social venture. Social venture capital (SVC) investors often look for a team that has the passion, skills, and commitment to make the venture successful. A team that is passionate about the social or environmental problem they are trying to solve is more likely to put in the extra effort and determination to make the venture a success. A team with the necessary skills and experience to run and grow the business can help ensure the venture is sustainable and scalable. A committed team that is willing to work hard and make sacrifices to achieve the venture's goals is important for a social venture to be successful.

Ventures with a clear plan for how to use the capital

Having a clear plan for how to use the capital is important for social ventures looking to receive funding from social venture capital (SVC) investors. SVC investors want to see that the social venture has a clear understanding of the social or environmental problem it is trying to solve and how the capital will assist it in achieving its objectives. This includes a detailed financial plan, a clear revenue model, and a projected timeline for achieving specific milestones. The plan should also demonstrate a clear understanding of the market and the venture's target customers, as well as a realistic assessment of the competition and the venture's competitive advantages. Additionally, it should show that the team has a clear vision and mission for the venture and how they plan to scale up and have a greater impact.

Ventures that are ready for investment

Social ventures typically need to have reached a certain stage of development before they are ready for social venture capital (SVC) investment. SVC investors want to see that the venture has a viable product or service, has demonstrated initial traction with customers or users, and has a clear path to profitability. Having a minimum viable product (MVP) or service is important because it shows that the venture has a working prototype or proof of concept that can be tested and validated with customers or users. Initial traction with customers or users is also important, as it demonstrates that there is a market for the product or service and that the venture is on the right track to building a sustainable business. A clear path to profitability is important for SVC investors because it shows that the venture has a viable business model that can generate enough revenue to cover its costs and generate a financial return for the investors.

SVC can be a powerful tool for driving positive social and environmental change. By providing financial capital and support to social ventures, SVC helps these ventures to scale and achieve their impact goals and provides an opportunity for investors to align their financial goals with their values and make a positive impact on the world.

Social Venture Capital Challenges

Social venture capital (SVC) is a form of private equity investment that targets companies or organizations that aim to generate financial returns and make a positive social or environmental impact. SVC was created as an alternative to the limitations of traditional philanthropy and impact investing, which often have difficulty scaling and maintaining their impact, by providing funding and expertise to social enterprises to aid in their growth and impact objectives.

However, SVC also has its own set of challenges, such as the high risk of failure for early-stage companies with untested business models, difficulty in attracting top talent as many professionals prefer working for traditional private equity or venture capital firms, and challenges in raising capital as investors may be hesitant to invest due to perceived risks.

Despite these challenges, SVC can potentially drive significant social and environmental change. With the right combination of talent, funding, and expertise, SVC firms can help social enterprises to scale and achieve their impact goals. As more investors look to align their financial goals with their values and make a positive impact, SVC is likely to become a more prominent area of investment.

Social Venture Capital Benefits

Social venture capital (SVC) is a type of impact investing that provides financing and support to early-stage and growth-stage social enterprises. These enterprises are businesses that are established with the primary goal of achieving a social or environmental impact rather than solely maximizing profits. SVC aims to generate both financial return and social impact, unlike traditional philanthropy or government aid.

SVC investors seek to invest in companies that are addressing social and environmental problems in innovative ways, providing much-needed capital to help these companies grow and scale their operations. In addition to financial support, SVC investors also offer their expertise and networks to help social enterprises succeed.

Investors in SVC focus on investing in companies that address social and environmental issues in innovative ways, providing necessary funding for these companies to expand and improve their operations. Along with financial support, SVC investors also offer their expertise and connections to help these social enterprises succeed. SVC has become more popular in recent years, with a growing number of firms and individual investors participating. This type of impact investing has the potential to change the way we solve social and environmental problems by providing sustainable and efficient solutions.

SVC offers a number of potential benefits for social enterprises, such as helping them access the capital they need to grow and scale their operations, providing valuable expertise and networks that can help social enterprises succeed, and creating more sustainable and effective solutions to social and environmental problems. By providing both financial returns and social impact, SVC offers an attractive investment opportunity for those looking to align their financial goals with their values and make a positive impact on the world.

Social Venture Capital Risks

There are risks associated with social venture capital (SVC) investments, just as with any investment. These risks include:

The social or environmental problem may not be solved

Social venture capital investments carry the risk that the social or environmental problem the venture is trying to solve may not be solved. There are several reasons why this may happen:

- The problem is too big or complex to be solved by the enterprise alone: Some social or environmental problems are so big and complex that they require a coordinated effort from multiple stakeholders. If a social venture is not able to secure the necessary partnerships and collaborations, it may not be able to have a meaningful impact on the problem.

- The enterprise's solution is not effective: Even if a social venture has a good understanding of the problem it's trying to solve, its solution may not be effective in addressing the problem. This could be due to a lack of understanding of the target market, a lack of user engagement, or a lack of scalability.

- The enterprise is not able to scale its solution to reach a large enough number of people or businesses: Even if a social venture has a good solution, it may not be able to reach a large enough number of people or businesses to have a meaningful impact. This could be due to a lack of funding, a lack of partnerships, or a lack of regulatory support.

The enterprise may not be profitable

This could happen for a number of reasons:

- The enterprise is not able to generate enough revenue to cover its costs: Social ventures often have a social or environmental mission that is at odds with maximizing profit. This can make it difficult for the enterprise to generate enough revenue to cover its costs, especially in the early stages of development.

- The enterprise is not able to scale its operations efficiently: Scaling a social venture can be challenging, as the enterprise may not have the necessary resources or infrastructure to expand its operations. This can lead to increased costs and a lack of profitability.

- The enterprise encounters unexpected costs: Social ventures often operate in new or untested markets and may encounter unexpected costs, such as regulatory compliance costs, that can impact profitability.

The enterprise may not be able to attract further investment

This could happen for a number of reasons:

- The enterprise fails to meet milestones or targets set by investors: Social venture capital investors often provide funding in exchange for specific milestones or targets to be met by the enterprise. If the enterprise fails to meet these milestones or targets, it may be difficult to attract further investment.

- The enterprise encounters difficulties scaling its operations: Scaling a social venture can be challenging. If the enterprise encounters difficulties in this process, it may be viewed as a higher-risk investment by potential investors.

- The enterprise faces negative publicity: Negative publicity can hurt an enterprise's reputation and make it more difficult to attract further investment. Negative publicity can come in many forms, such as negative media coverage, legal issues, or regulatory issues.

The social or environmental problem may worsen

This could happen for a number of reasons:

- The enterprise's solution is ineffective and makes the problem worse: Even if a social venture has a good understanding of the problem it's trying to solve, its solution may not be effective in addressing the problem and could make it worse. This could be due to a lack of understanding of the target market, a lack of user engagement, or a lack of scalability.

- The enterprise's solution has negative unintended consequences: Even if a social venture's solution effectively addresses the problem, it may have negative unintended consequences. This could be due to a lack of understanding of the broader social or environmental context or a lack of consideration of the potential impacts of the solution on different stakeholders.

The enterprise may not be sustainable in the long-term

This could happen for a number of reasons:

- The enterprise's business model is not sustainable: A social venture may have a good solution to a social or environmental problem, but its business model may not be sustainable in the long term. This could be due to a lack of revenue streams, a lack of scalability, or a lack of profitability.

- The enterprise is too reliant on external funding: Social ventures often rely on external funding, such as grants or social venture capital, to cover their costs. If the enterprise is not able to attract further funding or generate enough revenue to cover its costs, it may not be sustainable in the long term.

- The enterprise is not able to adapt to changing market conditions: Social ventures often operate in new or untested markets, and the market conditions may change over time. If the enterprise is not able to adapt to these changes, it may not be sustainable in the long term.

Investors need to conduct thorough due diligence and have a clear understanding of these risks before making an investment in SVC. This can include assessing the effectiveness of the enterprise's solution, the scalability and sustainability of the enterprise's operations, and the enterprise's ability to attract further investment. Additionally, it's important to consider the long-term sustainability of the enterprise and the potential for negative unintended consequences.

Conclusion

Social venture capital is a form of impact investing that provides financial capital to social ventures with a social or environmental mission. It can provide significant benefits to both investors and social ventures, such as generating financial returns and positive social or environmental impact. However, it also carries a number of risks that should be taken into consideration.

It is critical to understand social venture capital and to educate investors and social ventures on its potential benefits and risks. People and organizations will be able to understand the concept and opportunities of social venture capital if more people and organizations are introduced to them. It may also help to increase the flow of capital to social ventures, which may result in more long-lasting and scalable solutions to societal and environmental issues. As a result, social ventures will be able to grow and develop in the future. It can also aid in the development of the social venture capital ecosystem.

References

New Approach to Social Venture Capital

More About Social Venture Capital

Venture capital is a type of financing for startup companies that have the potential to grow. In order to grow, companies require a certain amount of investment. Venture capital firms acquire equity or ownership shares of the business in return of the investment.

When businesses are starting from scratch, they typically have limited or no funding at all. This is when investors come in and lend money to emerging startup businesses that have the potential for long-term growth. Entrepreneurs with little or no operating history can now obtain capital to launch their businesses thanks to venture capitalists and investors. Venture capital investments are considered high-risk investments, but they also have the potential for a high return. Investors take the risk of investing in venture capital in exchange for an equity stake with potentially large returns if the businesses succeed.

Venture capitalists and other investors take into account:

- The potential growth

- The strength of the management group

- The innovation of the products or services

It is undeniable that a startup may suffer a loss; venture capital firms can typically absorb several losses; however, this must be accompanied by investment in a runway success to continue generating returns for investors.

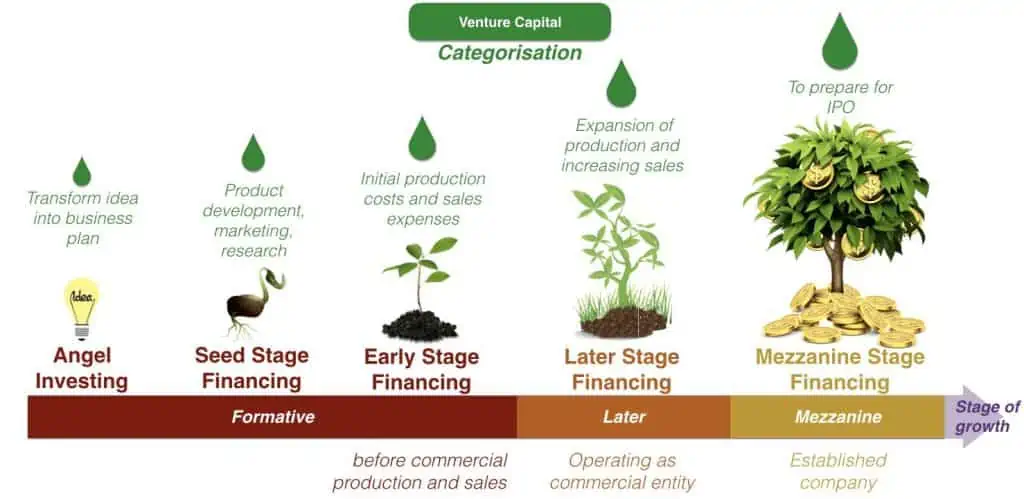

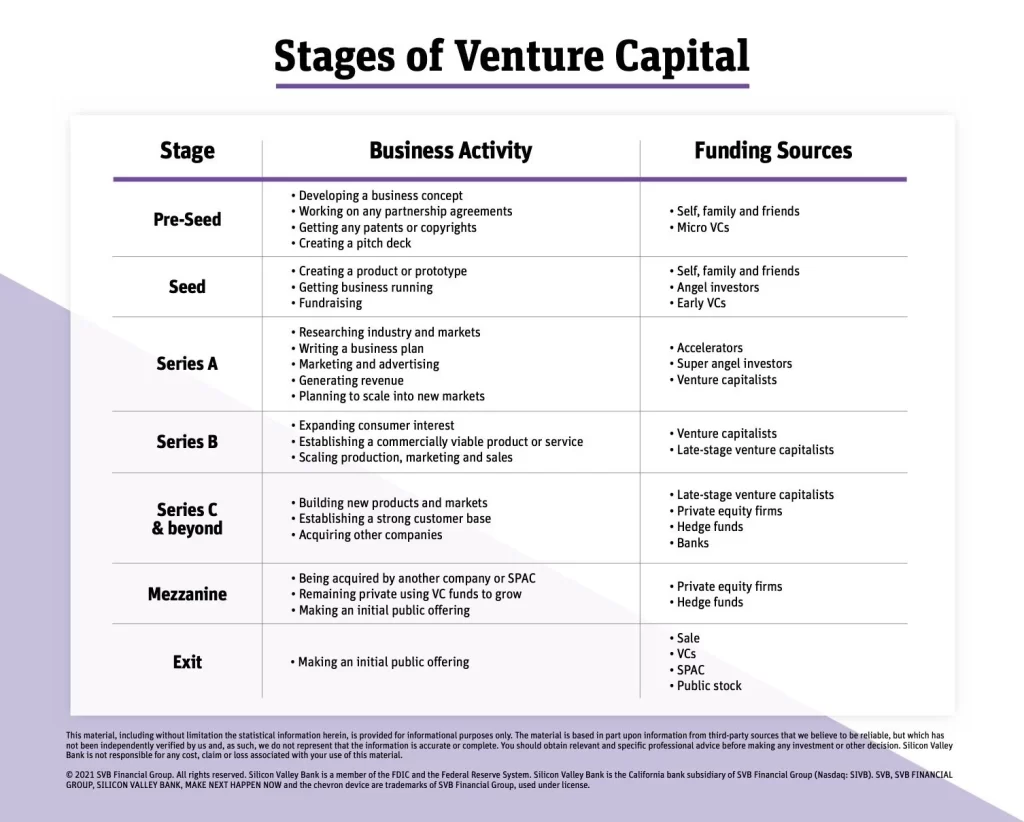

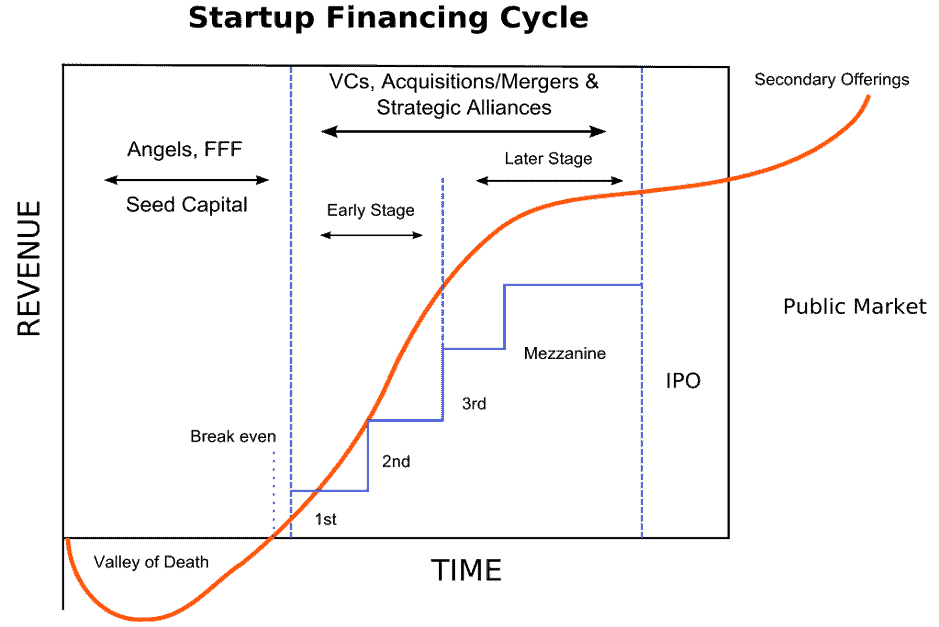

5 Stages of Venture Capital

Venture capital has five main stages, plus two transitions that take place before and after Venture Capital funding.

The Pre-Seed Stage

The stage before obtaining venture capital funding is known as pre-seed or bootstrapping. The pre-seed stage is when the company is formed and a product or service prototype is evaluated to determine the concept's marketability. At this stage, it is not possible to apply for funding to venture capital in exchange for equity. Therefore, the funding will rely on personal resources and contacts to establish the business.

Many business owners seek advice from founders who have gone through similar situations during the pre-seed stage. A successful business typically starts with an established business model and strategy guided by the founders. A partnership agreement, copyrights, or any other legal matter that is essential to the success of the businesses should be worked out at this time. These problems may become insurmountable in the future, causing investors to withdraw their investment from a business with unresolved legal issues.

At this stage, the most common investors are:

- Startup founder

- Friends and family

- Early-stage investors (Micro VCs)

The Seed Stage

Now that the businesses have some experience, the business can show that it has the potential to grow and flourish. To convince venture capital that the idea has a workable investment opportunity, a presentation must be created to pitch the idea to investors. The majority of the modest funds that are raised during the seed stage are used for particular tasks like:

- Market research

- Business plan development

- Setting up the management team

- Product development

The target is to raise enough capital to demonstrate to future investors that the businesses have the capacity to grow and scale.

In order to help you establish credibility, seed-stage venture capitalists frequently participate in pitching concurrently with other investment rounds. A representative from the venture capital firm will most likely join the board to oversee operations and ensure everything goes as planned.

This is the most expensive stage of funding in terms of equity that a company must give up to secure investment because venture capitalists are taking a high risk.

At this stage, the most common investors are:

- Startup owner

- Family and friends

- Angel investors

- Early venture capital

The Series A Stage

The initial round of venture capital financing is commonly referred to as Series A. Businesses have typically finished their business plan by this point and have a pitch deck focusing on product-market fit. Businesses are improving their products, growing their clientele, increasing their marketing and advertising, and demonstrating a consistent stream of income.

Next things to do:

- Perfecting the product and/or service.

- Increase the workforce.

- Conduct any additional research that is required to support the launch.

- Raise the funds required to carry out the plan and attract new investors.

A great strategy will be required to produce long-term profits in the Series A round. You must clearly show how you intend to sustainably monetize your product, regardless of how many enthusiastic users you have.

Angel investors and traditional venture capital firms provide the majority of the Series A funding. However, corporate venture capital funds and family offices are funding options in your industry. In order to lessen the risk of a failed investment, most investors are drawn to startups with strong business plans and executives who have the skills to implement them.

At this stage, the most common investors are:

- Accelerators

- Super angel investors

- Venture capitalists

- Corporate venture capital funds

- Family offices

The Series B Stage

At this stage, the businesses are prepared to grow. The operations for actual product manufacturing, marketing, and sales are supported by venture capital at this stage. This stage will require a larger capital than the previous stage in order to expand. Series B funding is distinct from Series A funding. Investors in Series B want to see actual performance as well as proof of a minimum viable product (MVP) or service in order to support future fundraising, as opposed to Series A investors who will assess your potential. Investors are reassured by performance metrics that you and your team can succeed on a larger scale.

Series B funding is typically provided by venture capitalists, corporate venture capitalists, and family offices that specialize in financing well-established startups. They provide the capital required to expand markets and form operational teams such as marketing, sales, and customer service. Series B funding can be used to:

- Grow operations

- Meet customer demands

- Expand new markets

- Compete more effectively

At this stage, the most common investors are:

- Venture capitalists

- Corporate venture capital funds

- Family offices

- Late-stage venture capitalists

The Expansion Stage (Series C and Beyond)

The Series C funding stage is typically reached after a company has achieved a certain level of success and is looking to continue growing through additional funding. This funding can be used to develop new products, expand into new markets, and potentially acquire other startups. On a fast trajectory, it usually takes 2-3 years to get to this stage and companies at this stage are typically generating exponential growth and consistent profitability.

Companies must have a solid customer base, a steady revenue stream, a track record of growth, and a desire to expand globally in order to qualify for Series C funding.

Investors are typically more willing to invest at the Series C stage and beyond because the company has achieved a certain level of success and proven its viability as a business. This reduced the risk and makes the investment more attractive to investors, who may be more hesitant to invest in earlier stages where the risk is higher.

Investors at this stage may include hedge funds, investment banks, private equity firms, and other non-traditional venture capital firms, in addition to traditional venture capital firms. These investors may see the potential for a good return on their investment due to the company's proven track record and continued growth potential.

At this stage, the most common investors are:

- Late-stage venture capitalists

- Private equity firms

- Hedge funds

- Banks

- Corporate venture capital funds

- Family offices

The Mezzanine Stage

The last phase of venture capital, also known as the mezzanine stage or pre-public stage, marks the transition of a company to a liquidity event, such as an initial public offering (IPO) or acquisition. At this stage, the company is considered a mature, viable business and requires funding to support significant events.

When a company reaches the mezzanine level, it is regarded as fully operational and profitable. Many of the original investors who have supported the company reach this point may decide to sell their shares and recoup a sizeable profit from their initial investment.

This opens the door for late-stage investors to come in and potentially gain from an initial public offering (IPO) or sale. The mezzanine stage is often referred to as the bridge stage because it bridges the gap between the company's earlier stages of growth and its eventual exit.

The Initial Public Offering (IPO)

An initial public offering (IPO) is a way for a private company to be publicly traded by offering its corporate shares on the open market. This can be an effective way for a growing startup or a long-established company to generate funds and reward earlier investors, including the founders and team.

To go public, a company needs to form an external public offering team of underwriters, lawyers, certified public accountants, and SEC experts; compile all of its financial performance information and project future operations; have a third party audit its financial statements and provide an opinion on the market value of the initial public offering; and file a prospectus with the SEC and determine a specific date for going public.

Going public can be a complex process that requires careful planning and attention to detail. It is important for companies to work with experienced professionals to ensure that all necessary steps are followed and the process goes smoothly.

Going public, or conducting an initial public offering (IPO), can bring a number of benefits to a company. One of the main benefits is the ability to raise significant capital through the sale of shares to the public. This capital can be used to fund expansion, pay off debts or investors, and provide additional resources for the company.

Going public can also make it easier for a company to engage in mergers and acquisitions, as it can use its publicly traded shares as currency to acquire other companies. Additionally, public stock can be an attractive form of executive compensation and employee benefit, as it provides employees with an ownership stake in the company.

However, it is important to note that going public is not the only option for a company looking to raise capital. Special Purpose Acquisition Companies (SPACs) are another option that allows a company to remain private while raising capital through the sale of shares. SPACs may offer more price certainty and provide a clearer idea of who the investors will be, which can be useful for companies weighing the value of short-term investors who are looking for a return versus long-term investors who are supporting the growth over time.

Venture capital (VC) is an important source of funding for startups, as it provides the capital needed to grow and scale the business. Venture Capitals are typically willing to invest in early-stage companies with high growth potential and are looking for a return on their investment through the company's future success.

To attract Venture Capital investment, startups need to have a solid business plan and a clear vision for the future. Venture Capital will also be looking for a team with the necessary skills and experience to execute the plan, as well as a product or service that addresses a real need in the market.

In addition, Venture Capital will be looking for startups that have a competitive advantage, whether it's through a unique technology, a strong customer base, or a patented product. It's also important for startups to have a clear plan for how they will generate revenue and achieve profitability.

Finally, Venture Capital will be looking for a strong management team that has the ability to adapt to changing market conditions and make strategic decisions that drive the company's growth.

Conclusion

The five stages of venture capital represent the progression of a company from its earliest stages of development through to later stages of growth and expansion. These stages provide a framework for understanding how a company can secure the funding it needs to develop and grow its business.

At the pre-seed and seed stages, companies are focused on developing a proof of concept or a prototype, building a team, and establishing a customer base. Early-stage funding is used to help a company grow and scale its business, and expansion-stage funding is used to accelerate growth and expand into new markets. Later-stage funding is used to maintain growth and prepare for an exit, such as through an IPO or acquisition.

Overall, the five stages of venture capital represent the journey that a company takes as it moves from an idea or prototype to a fully-fledged business. By securing funding at each stage, a company can gain the resources and support it needs to develop and grow its business, and ultimately achieve success.

References

Five Stages of Capital Funding

Explanation of Five Stages of Venture Capital

More About Stages of Venture Capital

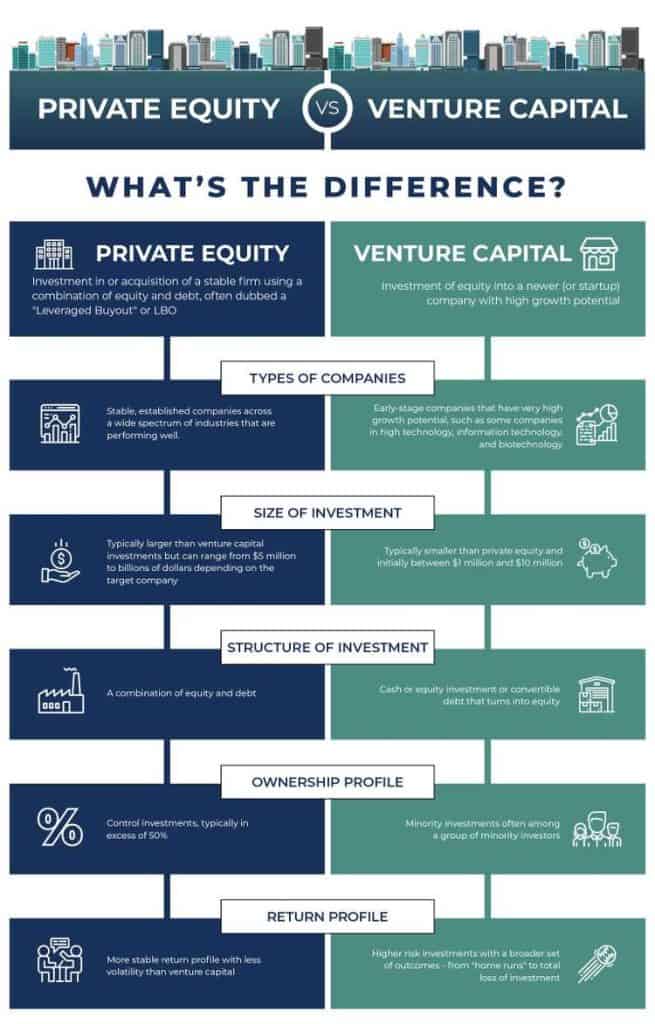

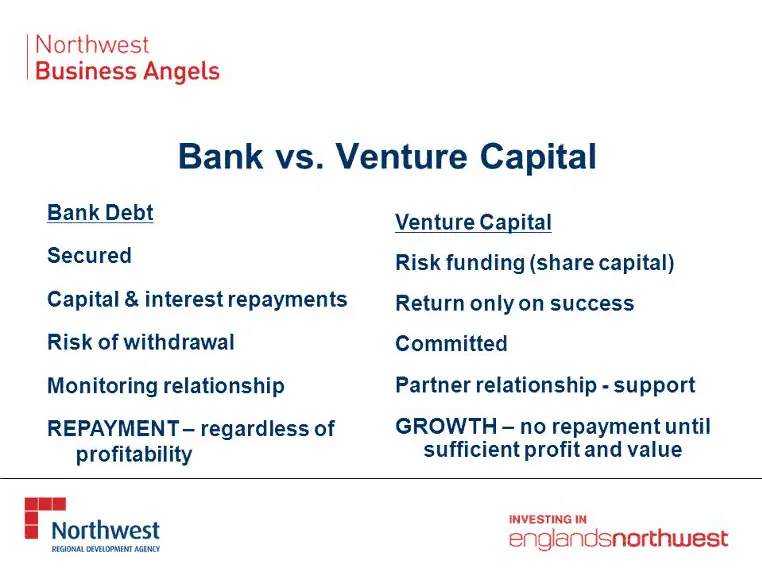

Private equity and venture capital are similar in that they are both types of equity financing where firms invest in companies and exit by selling their investments in equity financing, such as through Initial Public Offerings (IPOs). However, there are significant differences in the types of companies they invest in, the amount of money they commit, and the percentage of equity they claim. Private equity firms typically invest in established companies with larger sums of money and take controlling stakes, while venture capital firms typically invest in early-stage high-growth companies with smaller sums of money and take minority stakes.

Private Equity

Private equity is a form of investment capital that is provided by high-net-worth individuals and firms to private companies, or public companies that are taken private and delisted from public stock exchanges. The investors in private equity buy shares or gain control of the company with the goal of growing the company and ultimately removing them from stock exchanges and making them private. Private equity firms often provide not only capital, but also strategic and operational expertise to the companies they invest in.

Large institutional investors such as pension funds, endowments, insurance companies, and sovereign wealth funds are among the major players in the private equity industry. They invest large sums of money into private equity funds, which are managed by private equity firms. These firms then use the capital from these institutional investors to acquire stakes in private companies or control of public companies with the goal of growing the companies and plan to take the company private and delist it from the stock exchanges. Additionally, there are also large private equity firms funded by a group of accredited investors, which are wealthy individuals or institutions that meet certain financial and investment criteria set by the government. These accredited investors also participate in private equity investments through these large private equity firms.

Private equity firms often target companies that are under performing or facing financial stress and poor management. The goal is to acquire these companies, restructure their debt, and make improvements to the company's operations and management. Private equity firms have the resources and expertise to make significant changes to a company and turn it around. This can include consolidating operations, streamlining the business, and cutting costs. Private equity firm's long-term investment horizon and capital resources enable them to make these big changes that may not be possible for publicly traded companies that are subject to the pressures of meeting quarterly earnings expectations.

Venture Capital

Venture capital is a form of financing that is provided to startup companies and small businesses that have the potential for significant growth and high returns, particularly those that are innovative or are creating new market opportunities. It is typically provided by wealthy individuals, investment banks, and specialized venture capital funds. The funding can be in the form of financial capital, but it can also include technical or managerial expertise. The investors are taking on a higher level of risk compared to traditional investments. If the company does perform well, the potential for above-average returns exists. The trade-off is that there is a risk of losing the invested capital if the company does not meet its potential. Venture capital funding is a popular option for newer companies or those with a short operating history, as it can provide the necessary capital to grow and expand, especially if they do not have access to other forms of funding such as capital markets or bank loans. However, the downside for the company is that the venture capital investors will often obtain equity in the company, giving them a voice in company decisions and a risk if the company may not deliver on its potential.

Venture capitalists offer more than just financial funding for new companies. They can provide valuable resources and connections for startups. They have valuable experience gained from participating in board meetings for their investments, which can become a valuable resource for companies to lean on. Additionally, venture capitalists can become a driving force for sales and fundraising campaigns, as they have a vested interest in the success of the investment. They also have powerful connections to senior professionals with specialist skills, which can assist startups in launching and expanding their business operations and access the expertise they need to grow and succeed.

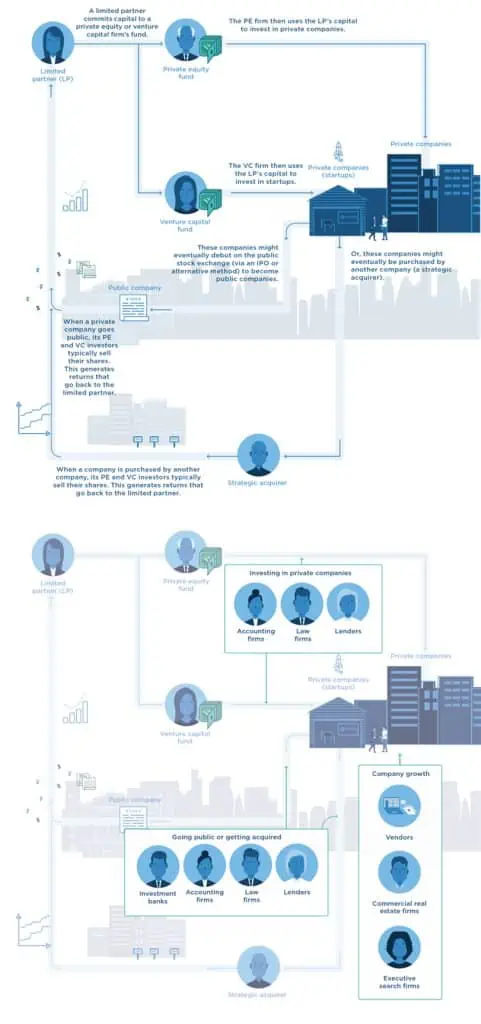

The Similarities: Private Equity vs Venture Capital

Private equity (PE) and venture capital (VC) firms have some similarities in their operations. They both gather funds from accredited investors who are known as limited partners (LPs), and they both invest in privately-owned companies. The main objective of both PE and VC firms is to enhance the value of the businesses they invest in, and they do so with the goal of selling them or their equity stake (ownership) in them for a return on investment. Additionally, both PE and VC firms typically provide more than just capital to their portfolio companies, they also provide strategic and operational support to help the companies grow and succeed.

The Differences: Private Equity vs Venture Capital

Company Types

Private equity firms typically focus on investing in mature, established companies that have a proven track record and generate steady cash flow or may be underperforming and work to improve their operations and financial performance. They often acquire these companies through leveraged buyouts, which involve borrowing a significant amount of money to purchase the company, and then using the company's assets and cash flow to pay off the debt. Private equity firms typically invest in a wide range of industries, including healthcare, construction, transportation, energy, and many others.

Venture capital firms, on the other hand, focus on investing in early-stage companies that have high growth potential, but also high risk. These companies are often in the technology or innovation sectors, such as biotechnology, software, and cleantech. Venture capital firms typically provide funding for research and development, product development, and marketing, and they may also provide strategic and operational support. The goal of venture capital investments is to generate high returns through equity appreciation, as these companies grow and eventually go public or get acquired.

Stage

Private equity firms tend to focus on buying established, mature companies that are facing operational or financial challenges, with the goal of improving the company's performance and increasing its value. Private equity firms often use leverage, such as debt financing, to acquire companies, and then use the company's assets and cash flow to pay off the debt.

On the other hand, venture capital firms typically invest in early-stage companies that have high growth potential but are not yet profitable. They provide funding for research and development, product development, and marketing, and also provide strategic and operational support. The goal of venture capital firms is to achieve a high return on investment by investing in companies that have the potential to become successful and profitable in the future.

Deal Size

According to PitchBook, a data provider of private market deals, around 25% of private equity deals in the US are between $25 million and $100 million. Private equity firms typically invest large sums of money in companies, often in the hundreds of millions or even billions of dollars in a single company because they are investing in already established companies. This allows them to make significant changes to the company and improve its value.

Venture capital deals, on the other hand, tend to be smaller in size, with many being less than $10 million in Series A rounds. However, subsequent funding rounds, such as Series B or Series C, can be much larger. This is because venture capital firms typically invest in early-stage companies that have not yet reached profitability, and therefore require smaller amounts of funding to get started. Furthermore, they are investing in startups with a high degree of uncertainty, they prefer to spread their risk by investing in multiple companies.

It is worth noting that there are some anomalies and exceptions to these general trends, and some private equity deals can be smaller and some venture capital deals can be larger. Additionally, the size of the deal does not always correlate with the success of the company or the returns of the investor.

Percentage Acquire

Private equity firms typically acquire 100% ownership of the companies they invest in and have complete control over the operations and decision-making of the company. This allows them to implement changes and improvements to increase the company's value.

On the other hand, venture capitalists typically take minority stakes in companies, often in the form of equity, usually less than 50%, which allows them to spread their risk and invest in multiple companies and they do not exert control over the management or direction of the company. Instead, they provide funding, strategic guidance, and resources to help the company grow. They often work closely with the company's management team, but they do not assume operational control. Venture capitalists usually invest in early-stage companies that have not yet reached profitability, and therefore, they will typically split shares with founders, angel investors and other venture capitalists or private partners involved in the startup.

Risk

Private equity firms typically invest in more mature companies that have already established a track record of profitability. They tend to make fewer investments and at a larger scale, investing significant amounts of capital in each acquisition. This means that each investment is more expensive and carries a higher risk. If one of these companies fails, it can have a significant impact on the overall performance of the fund. This is why private equity firms are more selective in their investments, focusing on companies that have a low probability of failure.

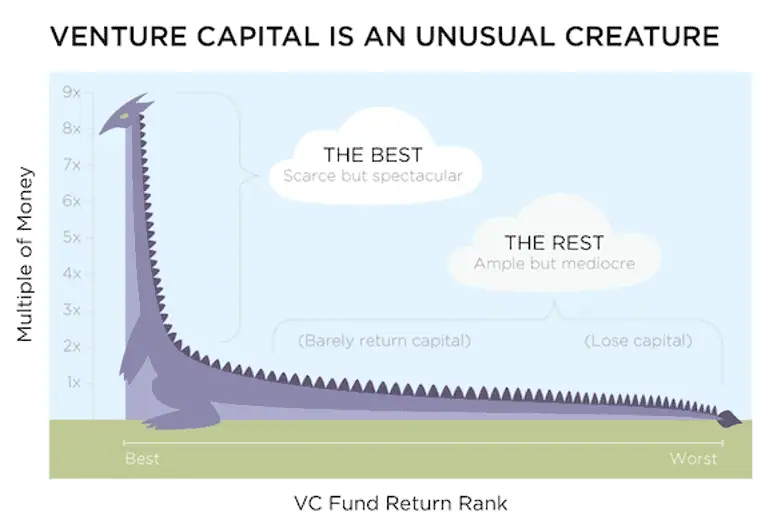

On the other hand, venture capitalists typically invest in early-stage companies that are not yet profitable, and they expect that the majority of companies they back will eventually fail. However, they invest small amounts in many companies, with the hope that at least one will be a hit and generate a high return on investment (ROI). This allows them to spread the risk and mitigate the impact of any failures.

Structure

Private equity firms often fund their acquisitions with a combination of cash and debt. They will usually take out loans to finance the purchase of a company, and then use the cash flow generated by the acquired company to pay off the debt over time. This allows them to invest in more expensive and larger scale acquisitions, while spreading the risk over a longer period of time. However, this also means that private equity firms are more heavily leveraged than venture capitalists, and they are exposed to more risk if the companies they acquire do not perform well.

On the other hand, venture capital funds are typically composed of cash from investors, which is then used to invest in startups and early-stage companies. The goal is to generate a high return on investment (ROI) through equity appreciation as the companies grow and eventually go public or get acquired.

Value Returns

Both private equity and venture capital aim for a return on investment of around 20% in the form of an internal rate of return (IRR). However, it is important to note that the returns generated by these two types of investment strategies can be quite different. Venture capital returns are heavily dependent on the success of the top companies in their portfolio, while private equity firms can generate returns from a variety of companies, some of which may not be as well-known.

Private equity firms, returns are more likely to come from improving the financial performance of the companies they acquire, rather than from financial engineering techniques like leverage. In other words, private equity firms are increasingly focused on growing the companies they invest in, rather than just cutting costs and increasing debt. This shift in focus is driven by the fact that firms are using more of their own money to make acquisitions, which puts more pressure on them to generate strong returns through operational improvements.

Operational

Private equity firms have traditionally been known for their "strip and flip" approach, where they would acquire companies, dismantle and restructure them, and then sell them for a profit. However, this approach has evolved over time, with private equity firms now focusing more on enhancing and expanding the companies they acquire to make them more valuable when they are sold.

On the other hand, venture capitalists tend to be more closely involved with the companies they invest in, and often provide not only financial support but also strategic and operational guidance. The level of involvement by venture capitalists depends on the preferences of the business owner.

Work

The work at private equity firms is similar to that of investment banking, which typically involves performing company valuations, analyzing financial statements, and coordinating with lawyers, bankers, and accountants. In this sense, private equity work is more focused on the financial and quantitative aspects of the business.

On the other hand, venture capital is often considered a more relationship-driven process, which means that venture capitalists spend more time building relationships with potential and existing portfolio companies, and less time on financial analysis. This can include activities such as making phone calls, attending networking events, and evaluating business plans. Some people may find the relationship-driven aspect of venture capital more enjoyable compared to the financial analysis required in private equity, while others may prefer the opposite.

Salary

The median salary for private equity and venture capital associates is around $150,000, with variable bonuses. However, this is not the only factor to consider when evaluating the potential for big returns. While private equity tends to have a higher potential for returns, it is also a more competitive field, with a longer and more rigorous hiring process. On the other hand, venture capital is considered riskier, as the returns are heavily dependent on the success of the top companies in the portfolio. However, the potential for outsized returns exists, as a small investment in a company could turn into significant wealth. It's worth noting that this is not a common occurrence, and not every venture capitalist will achieve these types of returns.

Culture

The atmosphere in venture capital firms is often considered more relaxed compared to private equity firms. This is partly due to the diversity of backgrounds found in venture capital, with many people coming from technology and other non-finance backgrounds. In contrast, private equity tends to attract individuals with a pure finance background, and the work culture can be more formal and hierarchical.

In terms of work schedule, venture capital firms tend to operate within a normal workweek schedule, while private equity firms may demand long, unsociable hours and little time away from work. This can be challenging for some people, as it can require a significant amount of time and dedication.

Additionally, private equity firms often involve a power struggle as there is a significant amount of money at stake. The competitive work culture can be intense and even hostile at times, as individuals are determined to succeed and make it to the top.

Exit

When you've grown tired of the fast-paced and financially focused nature of private equity or venture capital, there are various other paths you can take.

The options provided are ways for private equity professionals to transition into different roles or industries. Moving into hedge funds allows for the potential to generate a higher return on investment in a shorter time frame. Switching to venture capital offers the opportunity to be involved in the early stages of promising start-ups, despite the higher risk. Joining a corporate company can take the form of taking on a leadership role or advisory position within a portfolio company.

The options provided are ways for venture capitalists to exit their investment in a company and generate a return on their investment. An Initial Public Offering (IPO) is when a private company offers shares of stock to the public for the first time, allowing venture capitalists to sell their shares to underwriters and investors. A merger or acquisition (M&A) is when two companies combine their resources and operations, and it also provides an opportunity for venture capitalists to earn returns from the acquiring company. A share buyback occurs when a company repurchases its own shares from shareholders, which can be a feasible exit route for venture capitalists in larger companies.

Working Together

Private equity (PE) and venture capital (VC) firms can work together in various ways, as capital flows through the private markets. One way they can work together is by participating in financial transactions, where capital is transferred from one entity to another. During these transactions, professionals such as investment bankers and lawyers provide advice or execute the deal, which then initiates a growth or transition phase for the companies involved. Another way PE and VC can work together is through co-investment, where a PE firm and a VC firm invest in the same company together, providing more capital and expertise to help the company grow.

Conclusion: Private equity vs Venture Capital

Private equity firms typically invest in established companies that are in need of growth capital, restructuring, or a change of ownership. These firms typically invest larger sums of money, often in the hundreds of millions of dollars, and often take controlling stakes in the companies they invest in. They also have a longer-term investment horizon, holding their investments for several years before exiting through a sale or initial public offering (IPO).

Venture capital firms, on the other hand, typically invest in early-stage companies with high growth potential. They invest smaller sums of money, often in the millions of dollars, and take minority stakes in the companies they invest in. They also have a shorter-term investment horizon, often exiting their investments within a few years through a sale or initial public offering (IPO).

In summary, Private equity firms invest in established companies and have a longer-term investment horizon while Venture Capital firms invest in early-stage companies with high growth potential and have a shorter-term investment horizon.

References

Definition: Private Equity vs Venture Capital

More about Private Equity vs Venture Capital

Updated: 17/1/2023

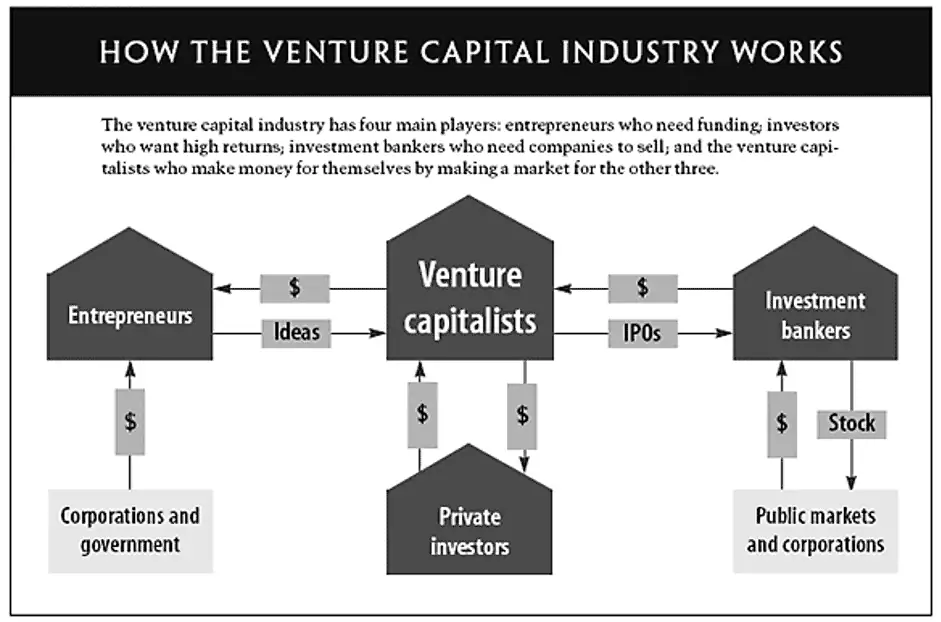

Venture capital can be considered as a subset of private equity and a form of financing that primarily provides funds and financing from investors to start-up companies and small businesses that are believed that have high long-term growth potential.

These companies at early stages and emerging ones that have been deemed to have high growth potential or have demonstrated high growth are the ones that have access to a pool of funds and investors. Understanding how Venture Capital works can significantly benefit you, whether or not you are an entrepreneur or not.

What is Venture Capital?

Venture capital is a type of private equity financing provided by venture capital firms or funds to startups, early-stage, and emerging companies with high growth potential. The investors, known as venture capitalists, provide capital in exchange for equity ownership in the companies they invest in. The goal is to achieve a significant return on investment through the successful growth and eventual exit of the company, typically through an acquisition or initial public offering.

How is “High Growth Potential” Quantified in Venture Capital?

This high growth is measured by a myriad of performance indicators which include the number of employees, man force of the company, annual revenue as well as the businesses' general scope of operations.

Some of the more common growth metrics that investors use to measure potential include revenue, customer acquisition cost (CAC), customer retention rate (CRR) and operational efficiency.

Revenue

In the business world where cash is king, if a business is not profitable then the business is considered not viable. As a metric, revenue is simple, measured by the total sales within a given time frame. This varies from business to business e.g. if the product is a subscription-based service, this number is more meaningful if calculated monthly or perhaps a seasonal business would have profits skewed within certain time periods.

Customer Acquisition Cost

Customer acquisition cost (CAC) measures the costs to the business of bringing in new customers and is calculated by taking total sales for a particular time period take away marketing expenses. To ascribe meaning to this number this needs to be cross-referenced with Customer Lifetime Value (LTV) which explains how much revenue the business is bringing in over the time they remain a customer.

The monitoring and retaining of customers is essential for the longevity of the business given that it costs substantially more to attract new customers than to just resell to or maintain an existing customer base.

Operational efficiency measures the ratio between selling, general and administrative expenses and the business’ sales figures and is important as it points out whether or not the costs of running the business are comfortably on par with the revenue being brought in. Related financial ratios may be used here including the gross profit margins, liquidity margins as well as burn rate.

Are Ratios Reliable?

From an investors point of view, the primary purpose of using these growth ratios is to not only see and measure how the company is performing but also to pinpoint which companies are being undervalued.

For example, how venture capital works is that a company with high earnings per share is considered more profitable, likely leading investors to pay more for the company whilst consistent increases in return on equity ratio indicates that the company has been steadily and consistently increasing in value and successfully translating that value increases into profits for investors.

What’s In It For the Investor?

Venture capital firms or funds invest in these early high growth stage companies in exchange for equity or an ownership stake and they are willing to take on the risk of financing risky start-ups in the hope that some of the firms they support will become successful.

But because start-ups face high uncertainty, VC investments typically have high rates of failure. Despite this riskiness, the potential for above-average returns is an incentive and an attractive payoff for potential investors.

Within the last decades, for new companies or ventures that have had a short and limited operating history, how venture capital works is that venture capital funding is increasingly becoming a popular and even expected and essential source for raising capital, especially because a challenge of emerging companies is primarily the lack of access to capital markets, traditional lending institutions such as bank loans and other debt instruments.

It has evolved from a niche activity that has its inception post World War II during an economic and financial boom into a sophisticated industry with multiple players that play an important role in spurring innovation, entrepreneurship as well as shaping the future of the financial landscape and methods of capital raising.

For more information on Angel Investors, please click here.

The Four Stages of Funding

Seed Funding: What is it and How Does It Work?

How venture capital works is that the typical venture capital investments occur after an initial seed funding round. Seed funding, also known as seed money and seed capital, represents a form of securities offering in which an investor invests capital in a start-up company in exchange for an equity stake or convertible note stake within the company.

Much of the seed capital that is raised by the company typically arises from sources close to its founders including family, friends and other acquaintances but can also include seed venture capital funds, angel funding as well as more recently with the rise of social media, crowdfunding.

How venture capital works is that obtaining seed funding is the first four of the funding stages that are required for a start-up to become an established business.

Why Pursue Seed Funding?

Usually, how venture capital works is that seed funding goes towards a beginning to develop an idea for a business or new product and generally only covers the costs of creating a proposal but can also go towards paying for preliminary operations such as market research and product development. Investors can be founders themselves, pursuing with their savings and/or loans.

How is Seed Capital different from Venture Capital?

Seed capital is distinguished from venture capital in a way that venture capital investments tend to come from institutional investors and it significantly involves more money and is at arm’s length transactions.

Venture capital contracts also generally involve much more complexity in their contracts as well as the corporate structure accompanying the investment.

Besides, how venture capital works is that seed funding also involves an even higher rate of risk in comparison to a venture capital investment since the investor will be unable to view or evaluate any existing projects for funding, which is the reason why the investments made during the seed stage are generally lower but for similar levels of stake within the company.

For more information on seed funding, please click here.

What is the Goal of a Company Seeking Seed Funding?

The primary goal at this point for the company is to attract further financing. Professional angel investors sometimes provide seed money either through a loan or in return for equity in the future company. How venture capital works is that it allows for flexibility of funding, be it seed or angel.

Who Are The Typical Seed and Angel Investors?

The primary goal at this point for the company is to attract further financing. Professional angel investors sometimes provide seed money either through a loan or in return for equity in the future company.

Series A Funding

Following early stages in seed financing, the company would look for expansion funding which would help smaller-scale companies expand significantly in terms of growth. This is known as Series A funding which is when the company (usually still in the pre-revenue stage) will open itself up to further investments.

Series A is much more significant that the funding procured through angel investors, with funds of more than $10 million being procured. This occurs after the business has developed a track record (an established user base, consistent revenue figures or some other key performance indicators). Opportunities may then be taken to scale the product across different markets.

What is Required to Achieve Series A funding?

Within this round of funding, it is essential to have a plan for developing a business model that will guarantee long term profit. The business will publicise itself as being open to Series A investors and will also need to provide an appropriate valuation.

Within Series A funding, investors are not just looking for great business ideas but rather they are looking for strong strategies for turning that businesses' core idea into a successful, profitable and money-making business. At this stage, it is common for investors to take part in a somewhat more political process.

With a significant departure from the participative mentality take on by the time the company reaches series A funding, it is common for a few venture capital firms to lead the pack and a single investor will typically serve as the anchor.

Series B Funding

Following Series A funding comes series B funding and at this stage, the company has already been developed through Series A but now needs to expand further.

A company that is attempting to acquire Series B funding will have already proven itself at the market with high active users and user activity but will need to establish itself to truly begin growing revenue. Hence why Series B funding is centred around the goal of taking the businesses to the next level, past the development stage. Investors help start-ups get thereby expanding market reach.

What is the Aim of Series B funding?

Considering that companies that have gone through seed and already have substantial user bases have already proven their worth, Series B funding is primarily used to grow the company so that it can meet the increasing levels of demand. Series B is similar to Series A in terms of key players in that it is often led by the same investors as Series A. The difference with Series B is the addition of a new wave of other venture capital firms that also specialise in alter stage investing.

Series C Funding

Companies that make it to Series C funding sessions are already acknowledged to be fairly successful and is reserved for businesses that are interesting in upscaling and businesses that are interested in expanding into new markets.

It is sought by companies that have already become successful and are looking toward expanding this success through methods such as the development of new products, expansion into new markets or even the acquisition of other companies.

What is Series C Funding used for?

Beyond this, Series C funding may also be sought after by companies that are experiencing short term challenges that need to be addressed.

Within Series C rounds, investors inject capital into the meat of successful businesses to receive a significant return on their investment and the funding in this stage is generally focused upon scaling the company in a way to ensure the growth of the company be as quick and successful as possible. Series C is significantly different compared to A and B because of the mechanisms involved in scaling a business.

For example, a possible way to scaling a company would be an acquisition. Merger and acquisitions are significantly more complicated processes and indicate a shift in the direction of the business away from the start-up stage and mindset. Similarly, as the operation gets increasingly less risky, the company is also capable of attracting bigger investors.

Groups such as hedge funds, investment banks in addition to private equity firms and large secondary market groups that come into play as the business is looking more and more profitable as the company has already proven itself to be a successful business model. These new investors approach the business expecting to invest significant sums of money into these companies that are already thriving as a means of helping to secure their own position as business leaders within the market.

Therefore, it can be said that Series C investors are significantly more self-interested as compared to seed-stage or A and B investors, given the exponentially lowered rate of risk associated with an already thriving company and business model.

More commonly, a company will end its external equity funding with Series C although some companies can go onto Series D and E rounds of funding as well. For the most part, however, companies that have already gained upwards of hundreds of millions of dollar worth of funding through Series C are prepared to continue to develop on a global scale.

In fact, the majority of companies that are going through and raising Series C funding use this as a means of helping boost their company valuation in anticipation of IPO. Most go onto seeking series D funding as the goals the company set out during earlier stages likely had not been completed yet.

Hierarchical Structure in a Venture Capital Firm

A typical venture capital firm is organised in a dual model as a limited partnership managing legally independent venture capital funds, with venture capitalists serving as general partners and their investors are limited partners.

Most venture capital firms are organised as management companies responsible for managing several pools of capital with each representing a legally separate limited partnership. How venture capital works is that Limited Partners cannot participate in the active management of venture capital funds if their liability is to be limited to the number of their commitments.

Why do Investors Work with VCs?

From the perspective of an investor, how venture capital works is that there are two main alternatives to invest in venture capital besides investing in venture capital funds: through direct investments in private companies or the outsourcing of selection of venture capital funds through investing in funds of funds.

Direct investments in private companies require more capital to achieve similar diversification as investing in venture capital funds.

Direct investments also pose another unique challenge as direct investments within venture capital usually require a different skill set which limits partners in venture capital funds typically lack.

Investors will need to realise that there will be an additional layer of management fees and expenses involved but institutional investors will thereby reduce the costs to the investors of the selection and management of their investments in different venture capital funds. It has been shown that within the world of how venture capital works are that the compensation of venture capitalists plays a critical role in aligning their interests with those of the limited partners.

An Analysts Role in a VC

The most junior level within a VC are analysts whose main responsibilities involve attending conferences to scout deals that might be within the investment strategy of the fund that the venture capital firm is investing out of. Analysts are not able to make decisions and are primarily concerned with conducting market research and studying competitors.

Associates Role in a VC

Next up on the ladder are associates and tend to be people with a financial background with good networking skills. Associates too do not make decisions within a firm but can make recommendations to those in charge.

Principals Role in a VC

Following associates is the role of principals who can make decisions when it comes to investments but have a lesser influence on the execution of the overall strategy of the firm.

Managing Partners role in a VC

The most senior people within the venture capital firm are partners who could either be general or managing. The difference in title varies depending on whether or not the painter has an influence on investment decisions or may also have an influence upon operational decisions.

In addition to investments, partners are also responsible for and will be held accountable for raising capital for the funds that the firm will be investing with.

Venture Partners Role in a VC

Venture partners are not involved in the day to day operations nor the investment decisions of the firm however they have a strategic role within the firm, mainly involving bringing new deal flow that they will then refer to other partners within the firm.

Venture partners are usually compensated using carry interest (a percentage of returns that funds make once they cash out of investment opportunities).

Investors of VC firms are called Limited Partners (LPs) who are institutional or individual investors that have invested capital in the funds of the VC firms that they are investing off of. How venture capital works is that LPs include endowments, corporate pension funds, sovereign wealth funds, wealthy families, and funds of funds.

Other Activities Performed by Venture Capital Firms

Fundraising as detailed above is the first activity that all new venture capital firms have to perform. How venture capital works is that successful venture capital investors usually do not manage only a single venture capital fund, but they also engage in fundraising activities to establish a venture capital fund but they engage in fundraising activities to establish a new venture capital fund some three to five years after the start of their previous fund.

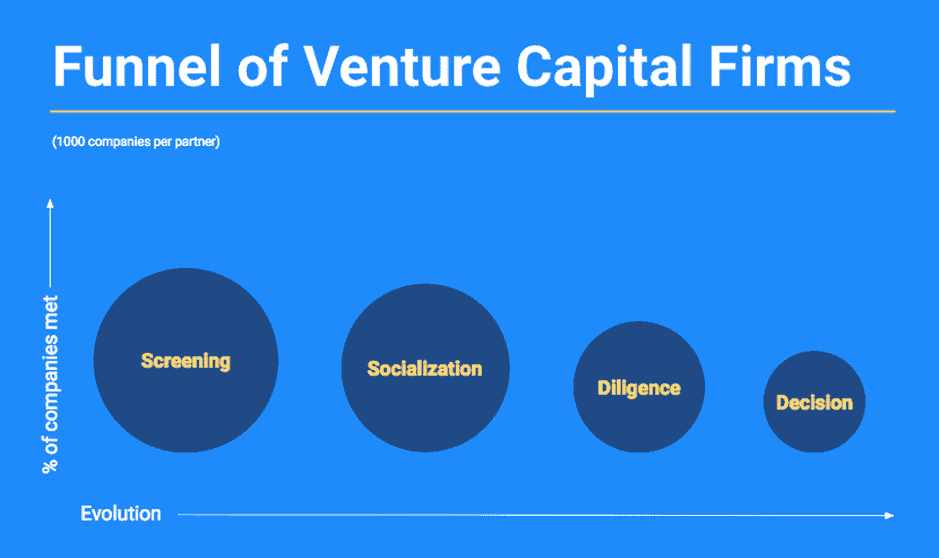

The activities of a VC firm: Deals

Another challenge for a venture capital firm is to secure an adequate flow of high-quality business proposals to evaluate. How venture capital works is that the firms match venture capital investors with entrepreneurs can present some difficulties given market information asymmetries.

How venture capital works and from a venture capital fund’s perspective, it is essential to have access to the best propositions which may be problematic for newly established firms given that entrepreneurs would prefer to team up with investors with already strong reputations.

Besides, rather than generating their own deal flows, how venture capital works is that funds may attract investments proposals through their already existing network of co-investors or educate partners, making funds fairly isolationist and probably difficult to gain access to.

Are deals and collaboration in a VC world biased?

As a result, how venture capital works is that being able to general a high-quality level of deal flow may also depend on being able to enter syndication networks. Research has suggested the high likelihood of venture capital investors only being willing to collaborate with other investors whom they are familiar with through prior investments given that this provides more information about their specific capabilities and reliability, thus reducing the risk of hidden information and information asymmetry.

In addition to these duties, how venture capital works is that firms also must perform extensive checking and due diligence activities are given that VC investors are typically extremely selective. While large venture capital funds may receive hundreds of investment proposals annually, they eventually may invest in a portfolio of only 15-25 companies over a five year period as many investment proposals will in all likelihood not receive more than a few minutes of the attention of venture capital investors.

The activities of a VC firm: due diligence

Quick screenings whether or not a certain investment proposal would fit the spirit of a certain firm given that some investors specialise in certain investment stages, certain industries or certain geographic regions.

How venture capital works is that proposals that pass the initial screening are then subjected to in-depth due diligence tests before an investment decision can be made.

However, research has shown that investment decisions are clouded by local bias. Venture capital investors are known to exhibit preferences for investment in companies within the local home market because this eases information transfer.

This benefits the identification of investment targets, the evaluation of the ventures and then post-investment monitoring and the subsequent addition of value.

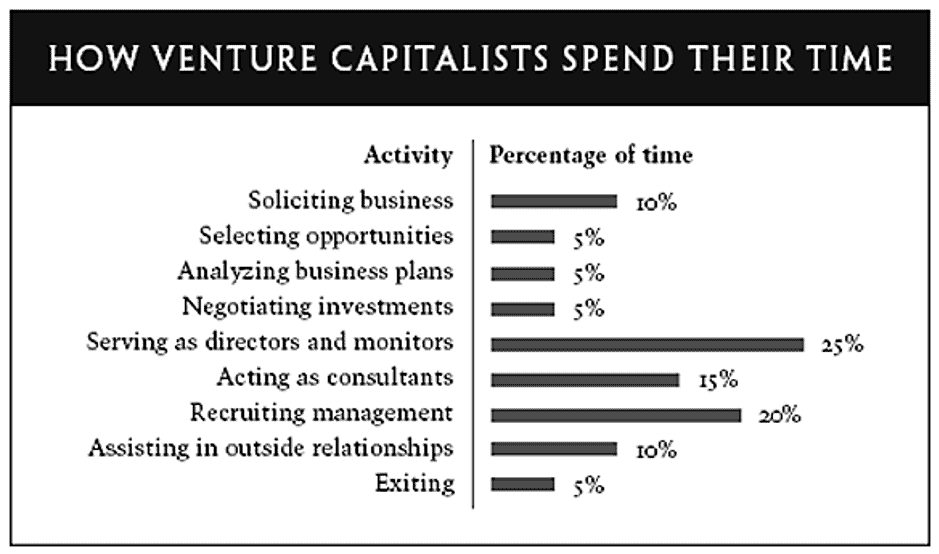

To reduce hidden action problems after investment, investors are strongly engaged with their portfolio companies usually with monitoring, assisting as well as certifying their portfolio companies. It has been shown that venture capital investors spend over half their time on monitoring and assisting their portfolio companies.

How investors in VCs lessen risk

Investors often require board seats which are linked with other powers such as veto rights as well as contractual provisions which allow them to directly influence the behaviour of their invested entrepreneurs. How venture capital works are that it is essential to have different prongs governing investments.

How venture capital works are that boards of directors in venture capital-backed companies are smaller and thus more involved in strategy formation and evaluation as opposed to boards where members do not have large ownership stakes.

In addition to this, the primary strategies used by investors include time, stage and sector diversification plus prorated investing over time as well as the number of investments within a portfolio.

Risk Mitigation: Time Diversification

The majority of VC funds are committed over a three to five year period. How venture capital works are that by being committed over a longer period of time and spreading out the commitments, a fund gets time diversity and also theoretically this has a soothing effect on the macrocycles that impacts a business.

Risk Mitigation: Stage Diversification

Certain VCs are specific and have early vs late-stage investing approaches to augment the risks posed by certain investments in certain stages. The goal here is to also smooth out irregularities that may occur during the course of the investments in the portfolio.

Risk Mitigation: Sector Diversification

Historically, VC firms have broad sector diversification, investing from software to life sciences within the same fund. This spreads out the macro and environmental risk associated with certain industries to compensate for others.

Risk Mitigation: Prorated Investment

Many VC firms reserve the right to invest their “pro-rata” ownership within future rounds, which then allows them to maintain their % ownership within the company.

Risk Mitigation: Number of Investments

There is conventional wisdom within the VC industry that each fund ought to have 25-30 companies within the fund to spread out and diversify. How venture capital works is that this spreading out of risk and mitigation of putting all your eggs in one basket will ensure higher certainty of returns in the future.

References

https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#5a62b3991b14

https://visible.vc/blog/startup-funding-stages/. Accessed 28 Sept 2020

https://www.startups.com/library/expert-advice/how-venture-capital-works

In this article, we will learn about the early stage of venture capital, which include pre-seed, seed, and series A funding and preparation for an investor pitch. The early-stage challenge, opportunities, and risks are then discussed. Understanding these will help you to further grow your business.

Early Stage Company

The term "Early Stage" refers to something that has only recently begun to happen or develop. In other words, it typically includes a tested prototype or service model as well as a business plan. Early-stage companies may not be profitable but some businesses may have breakeven.

Early-stage companies have not yet matured in the process but have only a newly developed business model that addresses at least one market pain point. This is also why they are called the startup phase which is phase one. They will focus solely on finalizing the products and services. At this stage, they will be collecting market data to assist them in making the final decision.

The funding also called seed funding or seeding will be the next step in developing the business before moving on to the next stage of growth. The process of funding involved gaining early-stage venture capital needed to further develop the business.

Series A funding is the next round of funding for an early-stage startup. The step demonstrates the startup's promising growth potential and accomplishments in the process of becoming a well-established business. This step allows the startup to secure a large amount of venture capital funding for the development of the business, as many investors consider series A funding to be the first stage of venture capital financing.

It should be noted that as an early-stage startup, significant effort must be expended to proof to investors that their business model will generate a Return on Investment (ROI), as investing in early-stage companies is risky.

The growth stage comes after the early stage. It is when a company has gotten off the ground and is working to increase its market share. The growth stage is in commercial operation and has solid customer traction. They are generating revenue and expanding rapidly. Companies are still working to become profitable at this stage.

6 Startup Venture Capital Funding Stages

Here is a breakdown of the six stages involved in the process of becoming an established company:

Pre-Seed Stage

At this stage, the business model is being developed and research is being gathered to support their requests to investors.

Seed or Startup Stage

Filling in details of the business model to increase its credibility.

Series A Funding

There is a sign of positive business growth.

Growth Stage

The stage contains the final version of the product or services currently being developed in the market.

Maturing Stage

The number of customers is increasing, including new and returning customers as well as increased sales.

Expansion or Exit Stage