Regardless of how brilliant your business idea is, one critical component of startup success is your ability to get adequate capital to launch and expand the company. While many people fund their new businesses with their own money or by borrowing from family or friends, there are alternative choices. However, business entrepreneurs must recognise that getting startup finance is never straightforward and always takes longer than expected.

What is Startup Financing?

Startup financing is money that early-stage businesses apply for and subsequently utilise to launch a product or expand their firm. Startup financing can take several forms, some of which are non-dilutive and some are dilutive.

Non-dilutive funding refers to any sort of funding that does not need the exchange of ownership equity for the money. A loan, for example, is non-dilutive in the sense that it does not compel you to give up an ownership stake.

On the other hand, the dilutive funding options, such as angel investors or venture capitalist (VC) are still kinds of startup finance, but they need ownership stock in exchange for the money. An investor, for example, will almost certainly demand equity in the form of stocks or partial ownership.

5 Reasons Why You Need Startup Financing

In today's world, having a fantastic concept and a strong desire to achieve is just not enough. If you're an entrepreneur trying to build and scale your firm, you might want to consider funding your venture.

According to surveys, one of the most prevalent causes for small business failure is a lack of cash. Apple, Google, and Amazon, on the other hand, all began as modest businesses and developed into commercial behemoths owing to finance.

Obtaining funds for future business expansion is not a "piece of cake." Companies at the beginning phase, on the other hand, now have numerous options for obtaining the money they require. Some of the more recent options include venture capital, angel investing, and crowdfunding. Startup accelerator programmes might also provide assistance for startup companies.

Today, the adage "time is money" is more true than ever, particularly in the technological sector. An entrepreneur with an idea usually requires funding to move on quickly.

So, if you're an entrepreneur who's serious about starting a firm, here are five major reasons why you should seek startup financing:

Build your startup idea on a solid base

Developing an early concept into a real product sometimes needs more money and a larger crew. It implies that in order to bring your vision to life, you'll need to hire more people, attract experts in the sector, invest in manufacturing expenditures, and keep operations operating smoothly during the development period.

Capture as much of the market in as little time as possible

When you have a game-changing concept that is highly received in the market, you will most likely want to grab as much of the market as possible. You will need to enhance your marketing and sales efforts to compete in the market with other powerful businesses. Again, this is only possible if you have a lot of money.

Get additional value from angel investors

The primary motive for reaching out to angel investors is, of course, to obtain cash. However, they might provide more than simply money. They can assist you in obtaining transactions with other firms with whom they have relationships. After all, your market success is in their best interests as well.

Attract the attention of the market and the future investors by having business funding

If your startup receives money from venture capital or another business form, it indicates that it is well-positioned for the future. Funding raises your profile and draws the market's interest. It provides value to your company and demonstrates to prospective partners, consumers, and future investors that you are worth considering.

Types of Startup Financing

When you're a new company looking for funding, the number of options can be overwhelming. Here are some types of startup financing for your reference:

Small business loan

A small business loan is a loan created specifically for small enterprises. In order to receive a loan, you may be required to put up collateral or have a good personal and corporate credit score. However, you will almost certainly have cheaper interest rates than you would on a personal loan. Some small business bank loans have significantly softer credit history criteria, offering people with a freshly created credit score a chance.

You can also consider microloans. A microloan, unlike a bank loan, is provided by an individual. This means that no credit score is likely to be required, although interest rates may vary. The SBA.gov website has a loan finder that can assist you in locating a microloan or a more standard small business loan.

Crowdfunding

Crowdfunding is a method of fundraising in which a firm receives money from a large number of people. In certain circumstances, investors pay money in exchange for the early delivery of a product or service.

When it comes to fundraising possibilities, crowdfunding is less risky. However, a failed campaign may cost you time as well as money. The worst-case scenario is if you successfully raise funds but fail to deliver the promised product or service. This might do irreversible harm to your brand, costing you more than money.

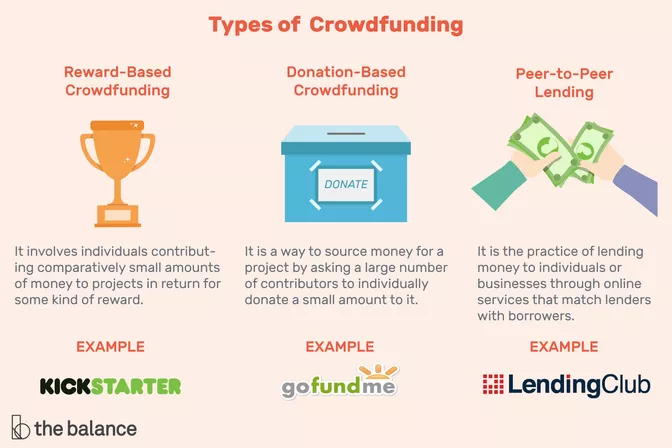

Some types of crowdfunding are reward-based crowdfunding, donation-based crowdfunding and peer-to-peer lending.

Small Business Grants

Small business grants, like loans, provide you with a flat sum of cash to use for your company's purposes. This type of grant, on the other hand, does not have to be returned, unlike a business loan. Because of this, there is no interest, no credit need, and no danger. However, this implies that grants are quite competitive.

It takes a lot of effort to get a small company grant since you'll have to apply for a number of them. However, the reward is high, and, once again, there is no risk on your side other than lost time.

Venture Capital Firms

A venture capital firm invests in promising businesses, providing them with the capital they require to expand and reach a larger market. In contrast to the previously listed startup funding sources, a venture capitalist (VC) often needs stock in your firm in exchange for the money granted. This implies that your firm will either have to offer the VC some stock or the VC will anticipate a dividend or return on investment (ROI) in the future.

If you don't mind owning a portion of your revenues to someone else or having choices made by an outside group, a venture capital firm can give significant money in a pinch. To find this type of funding, look into venture capital businesses that invest in your sector. Before reaching out, make sure you have a business strategy and a minimum viable product (MVP).

Angel Investors

An angel investor will lend you money in exchange for a percentage of your company's stock or partial ownership. Make sure you have a business strategy and a pitch deck ready before looking for an angel investor. This will make your company appear more professional and demonstrate to the investor that you're serious about what you're doing. Then, conduct research on angel investors in your field and begin pitching.

Line of Credit

A line of credit, such as a company credit card, is a sort of finance that can be used for a variety of purposes. The interest rate will vary based on your credit score. When you have a line of credit, you'll pay interest on any outstanding debt from a given payment period, just like you do on any unpaid portion of your credit card balance.

A line of credit might be especially helpful if you negotiate for longer payment terms. With long payment terms, you may have 60 or more days to pay off a sum before interest is charged. This permits you to keep a more stable cash flow. To get a line of credit, check around for a financial institution that provides a credit card with the features you want.

Here is a video for you to further understand the different types of startup financing for your startup company:

Conclusion

Startup funding is an essential component of the startup process. Regardless of the funding method you pick, startup finance is critical for any startup firm attempting to get off the ground. Consider your company's requirements and the choices you're willing to make. Then, check over the alternatives listed above and decide which path is best for you and your business.

References

Five Reasons Why Your Startup Needs Fundin

Startup Financing: 5 Key Funding Options For Your Company

What is startup financing and how can you qualify?

VC Funding for Your Startup

NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd) provides Venture Capital funding for Startups from idea stages to pre-series A-stages. We fund Startups in any industry, as long as there is a tech element to ensure your Startup is scalable. Find out more: