Updated: 28/06/2023

Angel Investors are defined as affluent individuals who provide capital for a business start-up, usually in exchange for convertible debt or ownership equity. Often, they are found among an entrepreneur's family and friends. The funds they provide may be a one-time investment to help the business get off the ground or an ongoing injection to support and carry the company through its difficult early stages. These types of investments are risky and usually, do not represent more than 10% of their portfolio.

What is an Angel Investor?

Angel Investors are often retired entrepreneurs or executives, who partake in angel investing for reasons beyond monetary return. They may want to keep abreast of current developments in a particular business arena, mentoring the next generation of entrepreneurs, and making use of their experience and networks on a less than full-time basis. Angel investors provide feedback, advice, and contacts in addition to funds. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital, as well as to provide advice to their portfolio companies.

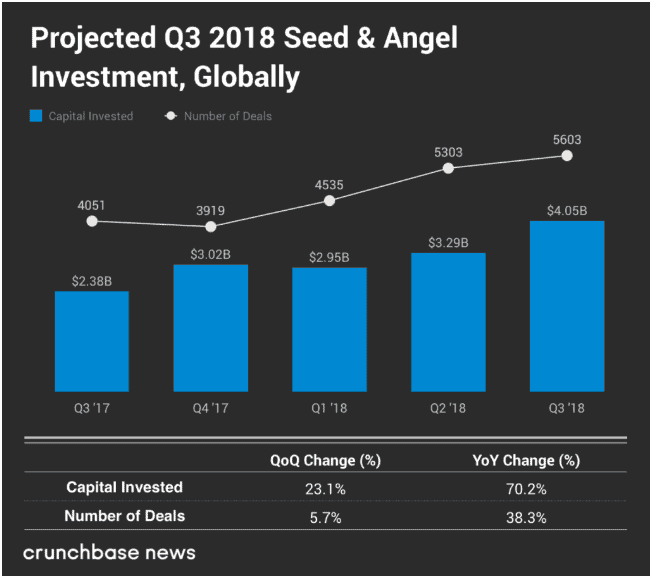

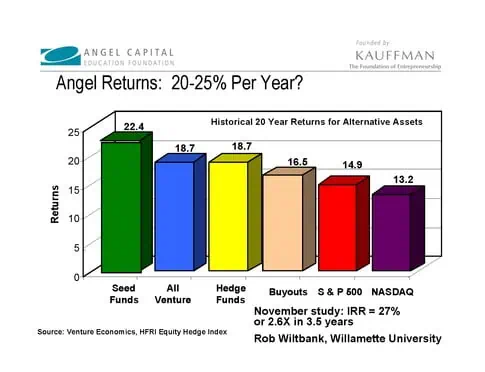

Angel investing has soared globally, especially the last 5-10 years due to the growing technology startups that had generated great returns. Individuals are seeking alternative returns that are better than traditional investment vehicles such as stocks and bond.

But unlike most other types of investors, many angels are not motivated solely by profit. Particularly if the angel investors are a current or former entrepreneur, he or she may be motivated as much by the process and the enjoyment of helping a young business succeed as by the money he or she stands to gain, and are therefore more likely to be persuaded by an entrepreneur's drive to succeed, persistence and mental discipline.

Main Categories of Angel Investors

Core

Core Angel Investors are individuals with extensive business experience who have operated and owned successful businesses. They are committed to their job of angel investing and continue to be involved with high-risk investments despite their losses. They possess a diversified portfolio that encompasses all industries, including public and private equity and real estate. They serve as valuable mentors and advisors to their invested companies.

High-Tech

High-tech angel investors may have less experience than core angels but invest significantly in the latest trends of modern technology. Their investments primarily depend on the value of their other high-tech holdings, which can vary considerably. Many high-tech angel investors enjoy the risk of their deals as well as the exhilaration of bringing novel technology to the marketplace but some may prefer not to be actively involved in their invested companies.

Return On Investment (ROI)

ROI angel investors are primarily concerned with the financial reward of high-risk investments, hence the ROI. Their motivation behind investing is their perception of what other angels’ gross income may be. ROI angels tend to stay away from investing when market performance is poor and emerge once the market shows stability and improvement. They view each of their investments as another company added to their diversified portfolio and rarely become actively involved in the invested companies.

There are different types of angel investors within the three categories, depending on the intentions and value propositions that the entrepreneur or angel investor is seeking; They may be affiliated and non-affiliated. The former is someone who has some sort of contact with you or your business but is not necessarily related to or acquainted with you while the latter has no connection with either you or your business.

Types of Angel Investors

- Entrepreneurial Angels – They own and operate their own successful businesses. Their steady flow of income allows them to make higher-risk investments and provide a larger amount of capital. They tend to make adequately-sized investments anywhere from $200,000 to $500,000 and are known for investing more money into the same company as the business progresses. They enjoy the personal fulfillment of assisting entrepreneurs to launch a successful start-up and rarely take an active role in managing a company.

- Enthusiast Angels – Enthusiast angels are business persons who have been independently wealthy. They often invest small amounts of capital (between $10,000 to a few hundred thousand dollars) in several different enterprises and view investing as a mere hobby. They also do not take an active role in management.

- Professional Angels – They are professionally employed (i.e. Accountant, Engineer, Lawyer, etc.) and would invest in companies in their related field. They would usually invest in several companies at the same time, and their capital contributions range anywhere from $25,000 to $200,000 per investment. They may also provide services to their invested company (legal, accounting or financial).

- Head Angels – They are angel leaders who bring together and advocate other angel investors to a specific deal. They enjoy being the first in a deal and leading others to an investment opportunity.

- Mentor Angels – They serve as mentors to their invested companies. To them, providing insights and mentoring entrepreneurs to help them achieve success is more valuable than monetary rewards.

- Venture Capitalists/Angel Investors – Some venture capital firms may have strict rules when it comes to independent investing. But sometimes an investment may be so appealing a venture capitalist partner may decide to privately invest. VC partners may even decide to co-invest in an attractive investment alongside their firm’s financing. VC partners can also independently fund early-stage investments, only to have their firm finance the company during later stages of development.

- Will Work-For-Equity Angels – They are service providers who intend to exchange their services for a percentage of shares in the company. When a young company takes advantage of this type of service, they often save money in the long run.

- Technology Angels – These types of investors are primarily concerned with developing technologies rather than building a diversified portfolio of companies. They are also known to assist entrepreneurs to license these inventions.

The process of angel investing is not easy, same goes with being an angel investor. Entrepreneurs may be able to raise the desired capital for their venture but may not be compatible with their investors or the investors have unrealistic expectations of them. To avoid this discrepancy, entrepreneurs are strongly encouraged to learn about the different types of angel investors before they go about recruiting one as it will help sort through and choose a well-matched angel investor for them. It can make the difference between establishing a strong foundation for a company or a failing venture.

Common Questions About Angel Investors

How Much Do Angel Investors Invest?

Granted that it differs among cases, regions, or countries, it's safe to say that the typical angel investors would invest at least RM10,000 while the average angel investors would invest around RM100,000. The maximum really depends on the angel investor. Usually RM200,000 all the way to RM1,000,000. The numbers may have changed over time, but it's a good rule of thumb nonetheless.

What Percentage Do Angel Investors Want?

Angel Investors would typically take 10-25% equity in return. Angel investors would take no more than 20-25% as it gives founders the right incentive and alignment with the founder to help grow the business in the right direction. If it is more than 25% this breaks the angel investors definition of being a good angel investor.

How Is An Angel Investors Definition Different From A Venture Capitalist by Definition?

The key difference is whose money they use to invest. Venture capitalists generally use money pooled from investment companies, large corporations, and pension funds to invest. While angel investors use their own money. They are required to have a minimum net worth of $1 million and an annual income of at least $200,000 to be considered an accredited investor.

Angel Investors Network

Angel Investors in Malaysia tend to be more private about their identity. Therefore, at NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd), we represent them on the front before most Startups get to meet them. We ensure that startups and investors are both ready and have a good match before the introduction. We would advise startups on how to approach investors so they can be prepared to pitch their business. This would help avoid all sorts of unnecessary situations where the deal would fall apart.

NEXEA's angel investors are focused on building value for the Startups. They have guided startup founders during really tough times – many of the startups almost failed due to reasons like poor cash flow management and unsustainable strategies. Our angel investors/mentors create values through sharing their years of experience to help guide startups in avoiding common pitfalls and drive performance results, not to mention at some cases, introducing relevant industry players or even opening doors to potential partners. Find out more about our angel investors at NEXEA Angel Investors Network.

Conclusion

Angel investors are individuals who provide crucial financial backing, expertise, and networking opportunities to early-stage startups. These investors are typically experienced entrepreneurs or high-net-worth individuals who invest their own capital in exchange for an ownership stake in the company. They play a vital role in supporting innovative ideas, fueling growth, and guiding entrepreneurs through the early stages of their ventures. The involvement of angel investors is instrumental in propelling startups towards success by providing not only financial resources but also mentorship and valuable industry connections.

Sources

Definition of Angel Investors

Main Categories of Angel Investors

Venture Capital

Size of Angel Investments

Updated: 20/12/2022

Most people have considered starting their own business at one point in their life, be it the food and beverage industry to starting a multimillion-dollar business. But no matter what their ideas are, all of them have one thing in common: They need capital to get their business started. For this to happen, startup companies have to find an investor who is willing to invest in their business. If they are in luck, they might find an angel investor for themselves!

Definition of Angel Investors

Angel investors are wealthy individuals who invest in small businesses or entrepreneurs in exchange for a share of the company's ownership. They are frequently found among an entrepreneur's friends and family. They may provide a one-time investment to help a company get off the ground or a continuous injection to support and carry the company through its early stages.

Usually, an angel investor funds startup companies with their own capital and they possess high assets which can be over a million dollars, has an annual income of over $200,000 or a joint income with their spouse exceeding $300,000.

Understanding Angel Investors

The investments they invest in are high-risk investments that typically account for less than 10% of an angel investor's total portfolio. Most of them have extra cash and are seeking a greater rate of return than standard investment possibilities can offer.

They are more interested in assisting businesses in their early stages than in making a profit from the company. They are essentially the polar opposite of venture capital firms. They have a lot of expertise because they've invested in a lot of businesses. They may share their knowledge with you and perhaps stop you from making costly blunders.

Informal investors, angel funders, private investors, seed investors, and business angels are all terms used to describe angel investors. Some of them pool their funds through online crowdfunding platforms or by forming angel investor networks.

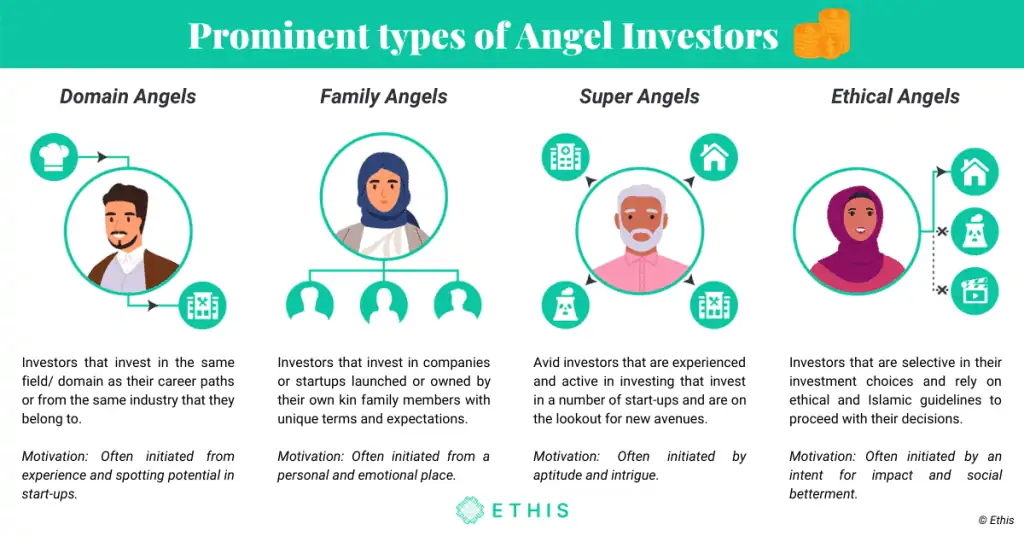

Types of Angel Investors

Though angel investors and venture capital firms may appear to be similar, they differ in several ways: their investment process is faster, they are more flexible than Venture Capital (VC), they support smaller companies than VCs and frequently approach them online and directly. As it grows in popularity, many sorts of investors emerge, each with its own strategy and motives for investing.

What to Know When Looking for an Angel Investor

Unfortunately, many entrepreneurs' primary aim is to secure financing as fast as possible, and in their rush, they frequently ink a deal with the first investor that comes along.

Keep in mind that your investor relationship is a long-term commitment. Consider your investment to be a spouse: you"ll be together for a long time and will share assets. As a result, you'll need to locate someone who won't abandon you if things go wrong. You need someone who will support you and your company through good times and bad.

Here are some tips for you when looking for an investor:

Be proactive

Despite their amusing name, angel investors do not fall from the sky. You must approach people, and you must do so in a way that is particular to them. Successful entrepreneurs have no patience for people who are shy. In order to get your startup an angel investor, you need to get out there and talk to people, inspiring them to believe in your company as much as you do.

Be prepared

In order to do the above, you need to do some research on the possible investor and discover at least a few basic information about them. What have they been investing their money into? What criteria do they use to evaluate possible investment opportunities? Your objective should be to hook them fast. You should consider every pitch to be an all-in gambit. You either immediately thrill them or they never want to hear from you again.

Creating a brief elevator pitch for your first encounter is a wonderful method to do this. In essence, this is a short version of your presentation which is meant to get their attention right away. Your pitch should be no more than 150 words and no more than 30 seconds, but it should also identify the precise problem that your solution solves.

Never appear unprepared, or worse, uninterested in your own project, or just plain lazy.

Network, Network, Network

In order to discover angel investors, you must first get to know the investor you are interested in, which requires immersing yourself in your local business and social communities. Concentrate on business owners, as they are the people who may be or become angel investors, or who know someone who is.

Join commercial and trade associations and attend meetings on a regular basis. Joining civic and community groups is also a good way to meet new people. Participate in trade shows and events. Make your face and name known by meeting as many people as possible.

Be personal

You'll want to be as personable as possible when seeking angel investors. Find things you have in common, such as friends or interests, and utilise your shared experience to your advantage.

Make use of the connection services on the internet

You might be able to connect with an angel investor through a website that matches entrepreneurs with angel investors. At the very least, you'll be able to get your company idea in front of a larger audience.

In NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd), the angel investors are all seasoned business owners and/or C-level executives who can contribute more than just funding for your firm. We also give guidance and assistance through industry professionals and mentors. The NEXEA Investors/Mentors look for investment possibilities in technology firms that can demonstrate revenue and future development prospects.

Advantages and Disadvantages of Angel Investing

Angel investors are always seeking for methods to make more money with their money than they would if they put it in the stock market. However, it's important to remember that angel investors' motivations are usually more than just financial.

They might want to mentor a new generation of entrepreneurs, work in a specific field, or use their expertise and abilities in a different way. There are some advantages and disadvantages of having an angel investor for your startup company:

| Advantages Of Angel Investing | Disadvantages Of Angel Investing |

| No obligation. Business owners aren't obligated to repay the angel backer if the firm fails. | Less control. Companies that engage with angel investors may have to give up some of their company's stock. |

| An angel investor is also an entrepreneur. Angel investors frequently have a wealth of business expertise and experience. | Inexperienced angel investor. You may end up with an unskilled angel investor that provides bad advice. |

| More money down the line. When angels invest in a firm, they are frequently in it for the long haul. | Expectations are higher. Angel investors are in it to generate money, they anticipate a significant return on their investment. |

Some of the advantages of angel investing is that there is no obligation. Because they haven't asked for a new line of credit, and most angel investment includes stock transactions, business owners aren't obligated to repay the angel backer if the firm fails.

An angel investor is also an entrepreneur. Angel investors frequently have a wealth of business expertise and experience. They can provide insights and advice for startup companies because they most likely have been in your shoes before. They made the mistakes for you, so you don't have to.

More money down the line. When angels invest in a firm, they are frequently in it for the long haul. They frequently make another cash injection later on as the company progresses.

Some disadvantages of angel investing is there is less control. Companies that engage with angel investors may be required to give up some of their company's stock. While this is usually a small sum, angel investors may decide they want a larger say incorporate choices.

Inexperienced angel investor. One major disadvantage of an angel investor is that you may end up with an unskilled angel investor that provides bad advice or hounds business owners for status updates. This is especially true for new angel investors who put substantial sums of money into a firm.

Expectation are higher. Within five to six years, angel investors frequently expect a big return on their investment, which is equal to ten times their initial investment. Before taking moeny from business angels, you must establish whether your firm can develop at the rate that an angel investor anticipates and set growth goals.

How Angel Investing Works

Angel investors typically invest their own money, rather than managing funds for others, and invest at the seed or angel funding stage, which is the early stage of a company's development. They often invest after the initial round of funding, which may come from the founders themselves, friends, and family, or bank financing, and before a company requires a larger investment from a venture capital firm. The goal of angel investing is to provide capital to help a company grow at a critical stage of development and potentially generate a return on investment.

The angel investing process works:

- Connection: Angel investors connect with startups or small businesses through various channels such as word of mouth, industry events, referrals, online forums, or local events.

- Due Diligence: If there is mutual interest, the angel investor will conduct due diligence on the company by talking to the founders, reviewing business documents, and assessing the industry.

- Term Sheet: After a verbal agreement is reached, a term sheet or contract is drawn up outlining the investment terms, equity percentages, investor rights and protections, governance, and exit strategy.

- Closing: Once the contract is finalized and signed, the deal is officially closed and the investment funds are released for the company's use.

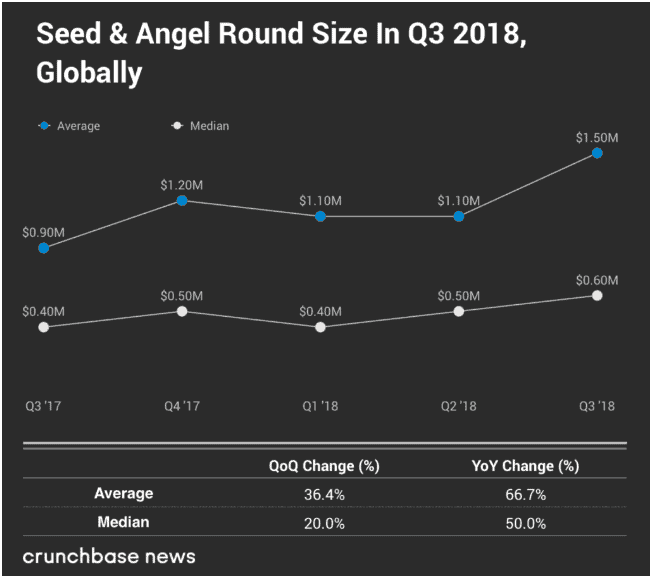

The contribution amount for angel investing can vary widely, with funding levels ranging from as low as $5,000 to as high as $150,000. Sometimes angel investors form a syndicate and can provide funding up to $1 million for select companies.

It is also common for angel investors to not acquire more than a 25% stake in a company. This is because experienced angel investors understand that the founders of the company should hold the majority stake in order to maintain a strong incentive to make the company successful.

Final Thought

Finding an angel investor is not a simple task. Even though there are its pros and cons, it all ends up in how much effort you put to find an angel investor for your company.

With the hard work you put in, we assure you that the work will be well worth it when you discover an angel investor who is eager to invest in your firm. Besides just providing funds for your company, an angel investor's advice and expertise can be very important in moulding your company's success.

References

How To Master Angel Investment In 5 Simple Steps

What Every Angel Investor Wants You to Know

Updated 20/7/2022

While inspiration and emotion are constantly present in the field of innovation and startups, most investors would want to think of themselves as rational beings. However, it's well acknowledged that they, too, are human - and business angels are no exception. Hence, some psychological factors may be influencing business investments.

We all know the simple stuff that goes into funding decisions: financials, competition, team, unique selling proposition, the risk versus reward calculations, portfolio diversity and so forth. But what about the less tangible factors that might tip the scales either way?

To respond, this article is a quick rundown of some of the factors that might impact all types of investors, including angel investments.

What Is An Angel Investor

Before we understand the psychological factors influencing business angel investors, here is a short introduction of who they are.

Angel Investors (also known as a private investor, seed investor, or angel funder) is a wealthy individual who invests in small businesses or entrepreneurs in exchange for a share of the company's ownership. Angel investors are individuals that aim to invest at the early stages of startups. These are high-risk funding that typically account for less than 10% of an angel investor's total portfolio.

Most angel investors have extra cash and are looking for a higher rate of return than standard investment possibilities can offer. Angel investors provide more advantageous conditions compared to other lenders since they usually invest in the entrepreneur launching the business rather than the profitability of the business. Angel investors are more interested in assisting startups in their early stages than in making a profit from the company.

Below is a video that further explains what is an angel investor.

Angel Investor Traits

There are many individual angel investors to choose from, but how do you know if the one you've approached is a good business angel? Working with business angels is a once-in-a-lifetime opportunity since they bring so much more to the table than just initial money.

They bring their expertise, strong connections, talents, and experience to the table, which may aid you in your desire to develop your business immensely. And it is already a significant accomplishment for the company. Here are a few distinguishing features of good angel investors that set them apart from the competition in the angel investing market.

Trustworthy

Finding a trustworthy angel investor is crucial since you don't want someone who subsequently uses the privileged information against you and your business, causing troubles for you and your company. Angel investing is more of a two-way street; both the angel investor and the entrepreneur must be trustworthy and dependable. Find a business angel that can help you not just with money, but also with advice and knowledge.

A smart business angel would not only invest in your company but also in you and your team. These are the angels who put a premium on establishing connections with other investors and organisations. They are also looking forward to working with you in the future.

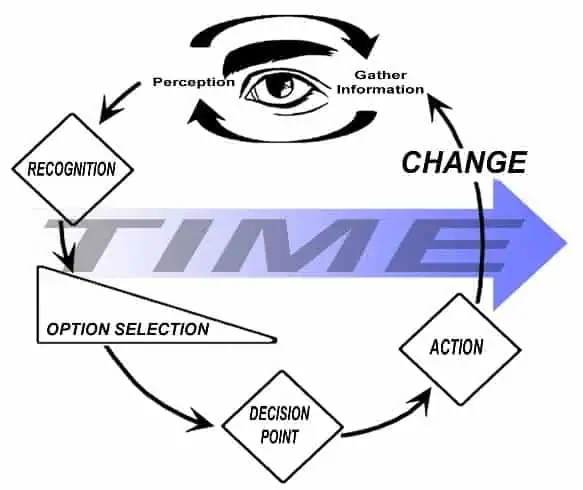

Ability To Make Sound Decisions

When it comes to making a decision, seasoned business angels don't hesitate to get down to the nitty-gritty details. They have a keen eye for talent, and if they perceive promise in you and your concept, they will act quickly to invest in your business. The greatest angel investors make decisions based on the current scenario and provide their judgement right away, rather than putting the entrepreneur through a nerve-wracking wait just to turn him down later.

Not only does this slow down the fundraising process, but it also takes time. Look for an angel whose primary purpose is to assist you in launching your firm and making it successful, rather than anticipating a cut of the profits from your growth.

Supports And Challenge The Entrepreneurs

If you have an angel investor who is also a successful entrepreneur, consider yourself lucky since they have seen it all. Such investors are well-versed in what it takes to build a successful business as well as the obstacles that your firm will face in its early stages. They are familiar with the highs and lows that a new business endeavour must experience in the corporate sector before achieving success.

These are the investors who will push and challenge you every step of the way, as well as offer you advice, when necessary, to help you grow as an entrepreneur during the process of building a successful business. Good business angels are people who are enthusiastic supporters of entrepreneurs, eager to roll up their sleeves or pick up the phone to assist them in difficult times.

Factors Influencing Business Angel Investments

Angel investors, individuals who invest in high-risk enterprises without the help of professional portfolio advisors, are an essential source of early-stage entrepreneurial funding. An angel must decide how much time to spend on due diligence, how much money to contribute, and how much post-investment involvement with entrepreneurs while offering fundings.

They may be particularly influenced by behavioural issues because they are individual investors. Psychologists have discovered that inevitable psychological, cognitive, and emotional biases can affect and influence every person's judgement. Having said that, below are some psychological characteristics that are linked to an investor's financial decision.

Market Size

Angel investors are often interested in solutions that address important issues for broad target markets. When it comes to investment, venture capitalists look for market qualities such as high growth and low competition.

When pitching to investors, your brand will have a stronger competitive advantage if it has a larger and more consistent consumer base. A larger and more consistent customer base will demonstrate that your business has a significant impact on its target market.

If everything else is equal, targeting a huge market is the most effective method to pique investors' interest. Investors will have little reservations about passing on a funding that will struggle to develop beyond a million dollars in the future; yet, an opportunity that elegantly addresses a billion-dollar market will be carefully considered by even the most cautious investor.

Founder of 500 Startups, Dave McClure says “Market size matters because most investors want to know that you’ve got a big business. Bigger is generally better.”

If an investor is familiar with your sector, they are likely to be aware of at least a few competitors for your company, and if they aren't, they may rapidly learn about them. They'll want proof that you have a strong competitive edge that the competitors can't simply overcome before they invest in you.

Reputation

Investing in a company is dangerous financially and in terms of the angel's professional reputation. A positive public image is beneficial to investors since it aids deal flow and making a bad move might tarnish that image. It is debatable how much impact making the wrong funding will have on future business and how much of it is just about pride.

Clearly, one's environment has an impact on one's beliefs: Americans are more optimistic about failure than Europeans, viewing it as a learning opportunity. Investors in America are less concerned about appearing to make a mistake. Most business angels, however, consider reputation to some extent when making an investment decision.

Income Level

You must invest your money in order to receive returns and pursue an increase in your wealth. The quantity of money an investor can invest in startups and businesses is determined by our income levels. It may also have an effect on our level of risk tolerance.

Investors who have a large pool of income are more likely to take risks and make substantial investments than those who have a smaller pool of income. Having a greater income stream can undoubtedly bring up new investment opportunities and patterns.

Founders' Capabilities

An important pointer to consider for investors before investing is the nature of the founders and their capabilities. For business founders, having a passion for their startup is relatively easy to come by. They have faith in the product or service they desire to offer. They believe it is a step forward from previous items or a novel approach to an old problem—in other words, the better mousetrap. But how passionate are they? Are they willing to keep going despite being told “No” over and over?

The decision to invest by investors may be affected by the following capabilities:

- Founders that are more focused on the execution of a startup idea instead of the idea itself.

- Founders who have conducted their market research and understand the needs of the customer to prepare their MVP.

- Hungry to learn and cooperate are skills that investors look for in founders. This guarantees that the founders are dedicated to push their business should things get tough.

Angel investors place a higher value on “investor fit” than venture capital fund managers. Because angel investors typically take a more hands-on approach to the businesses they invest in, they place a high value on “chemistry” between themselves and the founder.

Company Profits

Understanding your risk tolerance level will assist you in managing the risk and anxiety associated with the investment. Risk tolerance is frequently influenced by our risk perception. In this case, investors look in-depth at company profitability and cash flows.

Investors will look for certain key performance indicators in a company's financial accounts before investing. These essential KPIs will be scrutinized by investors, so work with your controller services to track and enhance them. Financial statements for a business are similar to a report card that shows how well your company is doing.

Conclusion

Investment is often guided or influenced by plenty of other factors apart from the aforementioned one. Aspects like family history, personal profile, financial obligations, and others also tend to affect your investment choices. These aforementioned factors do tend to influence the choices, but it’s still in the hands of the investor to build a solid investment portfolio based on the need and profile of the investor.

Angel investors bring a specific attitude to the table before ever looking at a single company pitch deck. As a result, what's going on in the investment sector can lead to different judgments at any particular time.

Therefore, understanding the psychological factors influencing angel investors' decision-making process will be able to help you to tell the difference and secure funding from the right business angel who will assist you in all your endeavours to make your new company a great success.

References

Factors Influencing Business Angel Investments

Psychological Factors Influencing Business Angel Investments

Last updated on 25th March 2022

Angel investing has evolved into a major source of fuel for the national economy, jobs, and new innovation, in addition to being trendy and highly profitable. Angel investors have become a primary source of finance for entrepreneurs, and for many firms, a necessary component of their survival. What is the relationship between angels and networking? What makes this form of fundraising unique?

What is an Angel Investor?

An angel investor (also known as a private investor, seed investor, or angel funder) is a wealthy individual who offers financial support to small businesses or entrepreneurs in return for owning stock in the firm. Angel investors are frequently found among an entrepreneur's relatives and friends. Angel investors' cash may be a one-time investment to assist the firm get off the ground, or they may be a continuous infusion to support and sustain the company through its challenging early phases.

How To Be An Angel Investor?

An Angel Investor (also known as a private investor, seed investor, or angel backer) is a wealthy individual who invests in small businesses or entrepreneurs in exchange for a share of the company's ownership. Angel investors are frequently discovered among an entrepreneur's friends and relatives. Angel investors are basically anyone who has extra money to invest in a business or firm, and there is a tax advantage for angel investors in Malaysia.

Criteria For Angel Investor

In general, an angel investor is a high-net-worth individual who invests in a startup firm in exchange for a piece of the company's ownership. An angel investor must meet the following criteria:

- Have at least 5 years of domain knowledge or managerial experience

- Either a high-net-worth individual or a high-earning individual

- High net Worth Individual - A person with a total wealth or net personal assets of RM 3 million or more in foreign currency; or

- High-Income Earner - A gross annual income of not less than RM 180,000.00 in the preceding twelve (12) months; or a gross annual income of RM 250,000.00 in the preceding twelve (12) months jointly with one's spouse

What Is An Angel Investor Network?

An angel investor network is a collection of angel investors that have banded together to make larger investments, work more efficiently, and offer mutual support. Angel networks and angel groups are two terms for the same thing. Members of the angel network gather to hear presentations from entrepreneurs, then examine the ideas and make investment decisions.

Angel networks frequently partner with other similar organisations to make investments. Most angel networks concentrate their efforts in areas where some of their members have prior experience or knowledge, though they are usually open to investing in other areas as well. The most prevalent sectors of investment for angel networks, according to the Angel Capital Association, are software, medical devices, telecommunications, and manufacturing.

Benefits of Angel Investor Network

Angel investing is becoming more popular as an asset class, and many accredited investors want to learn more about how they may become involved. Start with a local l angel group to find an answer to this question. Working alongside like-minded angels is the best approach to simplify the difficulties of angel investing.

There are numerous options for investment, including investing on their own or informally with friends using online portals for accredited investors and collaborating with local startup accelerators. While angel groups are more traditional than cloud investment, they do provide excellent returns, especially when compared to an individual angel investor.

Flexible Participation

Angel Investor Network recognise that members have varying levels of commitment and interests, and they invite investors to participate in the organization in the way that best suits them. Members can participate in events such as pitch competitors, screening meetings, due diligence sessions, educational and networking opportunities and so forth.

Most clubs have limited or no investment restrictions and each member has complete discretion over whether or not to invest. Every group is a little different, so make sure you know what to anticipate before you join. If members are mutually supportive and engaged with the group, groupings become more beneficial to them in the long run.

Deal Flow And Due Diligence Source

Hundreds of applications are reviewed by most angel groups each year, with applicants coming from online applications, conferences, pitch competitions, syndicate partners, and personal relationships. Each year, invitations are sent to 20–30 companies to formally pitch the groups' members. Groups typically undertake due diligence on 25 per cent to 50 per cent of the proposals provided. As a result, every month, an angel group is likely to evaluate at least one investment possibility.

Follow-up meetings with founders, calling customers, doing personal reference checks, and negotiating or reviewing contracts are all examples of due diligence tasks. Unless one angel investor can devote full-time to sourcing, vetting, and assessing investment prospects, the advantage of enlisting the help of a group far surpasses the difficulty of going it alone.

Finding A Good Match For Your Money

One of the risks of making independent angel investments is not knowing whether the entrepreneur will be able to raise more funds. Writing that check is a leap of faith in and of itself; doing so without knowing whether or not additional capital will be pooled with yours can be unsettling.

Investing with a group of angel investors can assist to mitigate this risk. Transparency in a startup's investment by the entire group provides some assurance that there is sufficient cash for a sustainable runway.

Access To Investing Resources And Tools

Angel groups frequently give members a variety of tools and services to help them manage deal flow and track investment activities more effectively. Many of these instruments can be purchased individually, but without a bigger group to compare them to, they can be pricey and ineffective.

Many angel clubs also allow members to fund funds through a special purpose vehicle (SPV), which allows them to invest less than $25,000 in any individual project. This is a terrific alternative for people who want to establish a portfolio of investments by participating in a variety of deals with smaller check quantities.

Knowledge and experience are gathered.

The sharing of collective expertise among members is one of the most valuable effects of bringing together multiple angel investors into one organisation. Angel investors frequently prefer to invest in industries with which they understand. It makes sense; angel investing is hazardous enough, and backing businesses in new areas can be intimidating.

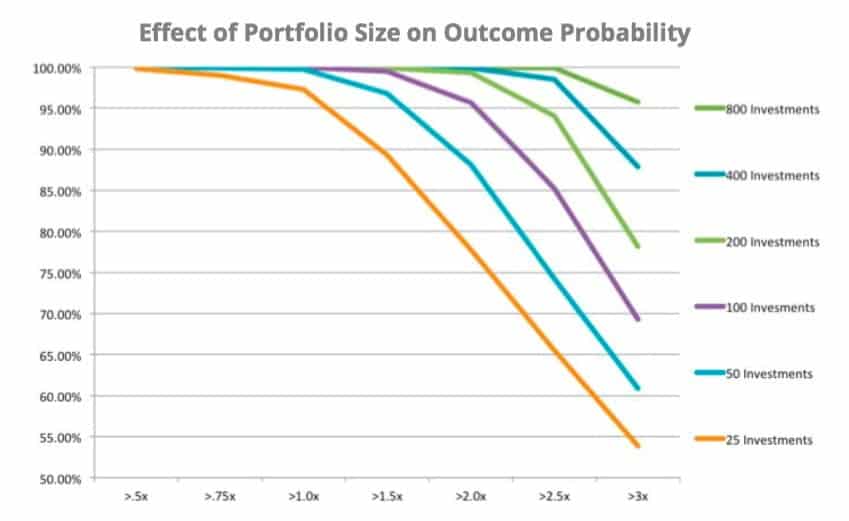

However, statistics suggest that diversifying an investor's portfolio is the best approach to maximise their chances of making a profit. Individuals can obtain exposure to topics they might not consider on their own by combining investors from various backgrounds into one group. Members benefit from having access to other members' perspectives, which are frequently provided by professionals from the same industries as those presented by startups.

Angel group settings are a terrific way for people to learn more about angel investing, in addition to exchanging knowledge about specific investment prospects. A simple internet search will turn up a slew of articles on the subject, which is a wonderful place to start. However, one of the best ways for novice investors in the area to get their feet wet is to dive into the process alongside experienced angels.

NEXEA's Angel Investment Network

NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd) is Malaysia's leading Angel Investment Network, with a focus on Southeast Asian business. Because of our proven track record and multiple high-growth firms in our portfolio, NEXEA has a large network of angel investors who fund and coach startups. At NEXEA Angel Investment Network, we worked with investors and businesses in a unique approach.

We do not make money until our investors do, and even then, it is only a portion of their profit. NEXEA is motivated to drastically improve return rates by investing in only the best firms and only hiring the best mentors (successful CEOs, entrepreneurs, and C-Suite Executives) to guide the startups.

NEXEA reviews over 1000 companies each year to ensure that we present investors with 3-10 high-quality investments each year. The selected companies are screened using a proprietary startup principles methodology. Our due diligence procedure, background checks, and investment committees must all be passed by each startup.

NEXEA's Angel Investor Network provide several advantages. We assist our investors by handling the legal parts of startup investments, such as your Term Sheet, Due Diligence, and other legal matters and offers startup support that no other angel groups can match. Because of our understanding of the industry, we are able to advise startups on technology and business tasks.

Our angel investor network allows our investors to invest in many firms with the same amount of money, lowering their startup investment risks significantly. To assist new investors in the group, we encourage our investors to share their investment and business experiences with one another improving their investment's success rate.

In Closing

Participating in an organized angel investor network gives several time-saving and experiential benefits, whether you are exploring a hobby or wanting to devote many hours each week to angel investment. It is also a wonderful place for seasoned angel investors to share their knowledge with newcomers to the field.

Give the group setting a try if you have been walking the route alone or have considered getting into angel investing. It is possible that you might actually enjoy it.

Reference

What Is A Angel Investor Network

Benefits of Angel Investor Network

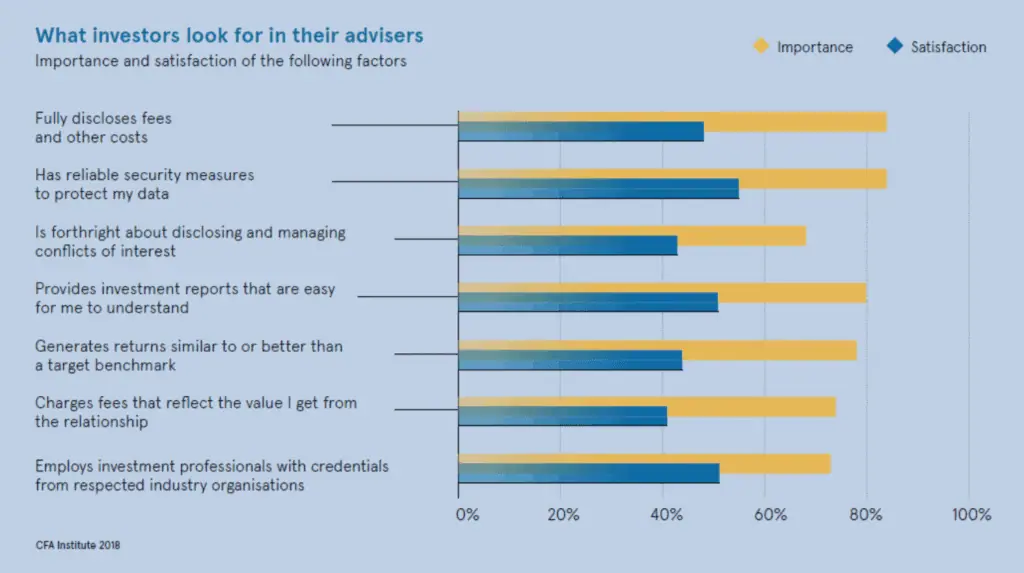

What are investor's looking for? This article will be looking upon some of the important concepts and areas that what are investors looking for, in terms of a business as a whole, entrepreneur characteristics and personalities as well as business plans and financial records and statements. Investors thought process may be conducted prior to investment or during the businesses pitch for investment. Have a read below!

What Are Investor's Looking For?

What are investor's looking for? Let's divide this question into further sub-categories so it becomes easy for us to understand. Prior to making any investments, it is fundamental that an investor goes through the process of thorough research and due diligence to understand what they are investing in and what is the return that they are receiving.

Attitudes and approach to investing are being dramatically changed by the minute because of the ever-growing business environment. An investor in one geographical region will not have the same requirements as another. Investor's goals and expectations also vary from their age and demographic.

Investor Characteristics By Geographical Region

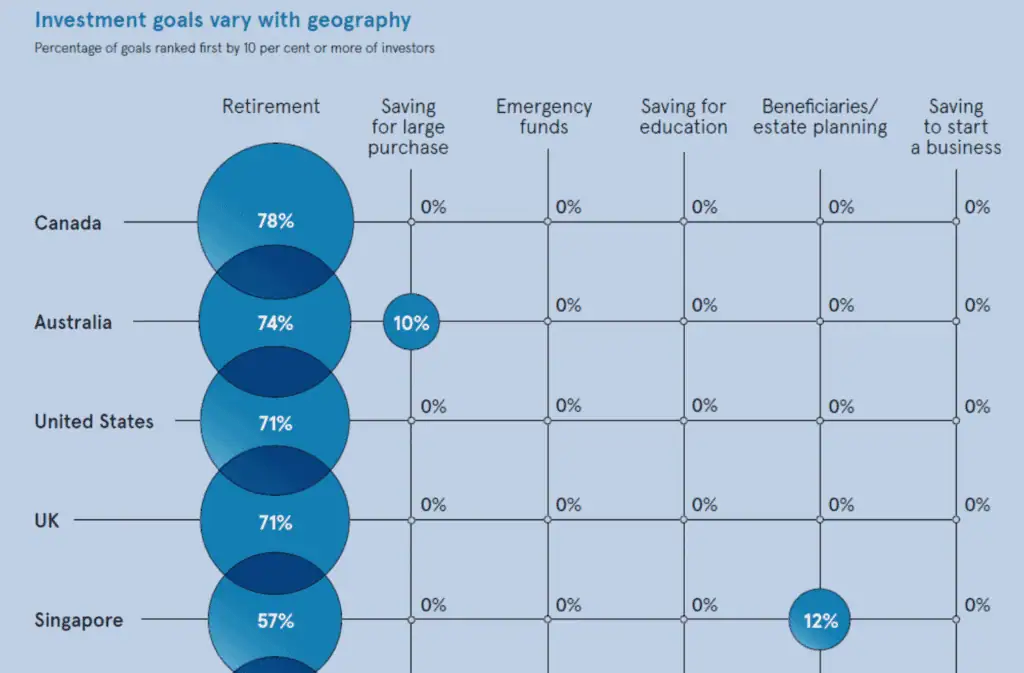

According to a survey by Visual Capitalist, to analyse the reasons why most investors prefer to invest their money and how does it differ from one country to another. A handful of countries chosen made Canada stand at the top at 78% where the majority of investors are investing their money for the reason to save for retirement, followed by Australia at 74%, United States and the United Kingdom at 71% and Singapore at 57% respectively. Whereas, 12% of Singaporean investor also spends their investments in estate planning and beneficiaries.

Other countries showed different trends as shown below. Majority of Chinese investors, for example, chose to spend their investments towards beneficiaries and estate purchases rather than saving for retirement in comparison to North America and Europe. French population saved 26% of their investments for the purpose of needing it for emergency funds whereas UAE saw a trend of 31% savings towards starting their own businesses.

Not surprisingly, as investors get older, their goals shift away from making immediate big-ticket purchases and holding riskier investments for a higher rate of return. Later on in life, goals are more focused on retirement and maximising wealth.

What Are Investor's Looking For In Entrepreneurs?

What are investor's looking for in terms of entrepreneurial skills, personality, work ethos, ability to work in a team and the list goes on. There's always a clicking moment that happens between an investor and a founder that plays into the investment decision. Sometimes it's easy to identify - an affinity based on a common background, such as shared work or educational experiences -- or perhaps a co-investor that's mutually known and trusted.

In other cases, it might be harder to put a finger on, such as likeability of the entrepreneur, or merely an instinct or impression that the investor develops, good or bad, either way, the investor is going to be asking a lot of tough questions and requiring in-depth detail.

What are investor's looking for in an entrepreneurs business skills and personality traits? Initially, you might think that all investors make their decisions based on the business plan, but there’s another set of factors just as important to most investors, and it’s all in the entrepreneurs' personality.

-

Humility. What are investor's looking for in humble founders? Entrepreneurs need to be grounded with humility for several reasons. They need to be willing to listen to outside opinions. As an entrepreneur, you aren’t going to know everything, and you’re going to make mistakes. Being humble enough to listen to outside insights is imperative to improve the business. This is important because this characteristic will allow entrepreneurs to be able to listen to investors and be able to positively take constructive criticism.

What are investor's looking for in humble entrepreneurs? Humble entrepreneurs understand that mistakes and pitfalls will occur, and their ideas won’t become successful overnight. This humility leads to greater long-term thinking and more rational responses in a crisis.

-

Passion. What are investor's looking for when it comes to being passionate about the business? When founders of businesses are passionate about the goals the company is pursuing, that passion often motivates other team members in the company to be passionate and therefore more members and so on. Not only that, but when you are out meeting potential investors, that passion will show and being able to get your vision across with this enthusiasm will have a lasting effect.

A perfect example of a passionate entrepreneur and leader is automobile giant Henry Ford. What many don’t know is that Ford Motor Company was in fact Henry Ford’s third attempt at making a car manufacturing company. In the face of failure, Ford was determined that nothing would stop him and he would achieve his dream and solve the problem that there were no reasonably priced mass-produced cars available — this is when the Model T was made and it was so successful that more than 15 million Model Ts were sold during its years of production (1908 to 1927).

- Being Opportunistic. What are investor's looking for in an opportunistic entrepreneur? Being opportunistic is a huge trait to have for any entrepreneur. It’s not about taking unnecessary risks or moving into territories, sectors or markets you have no experience in. Instead, it’s about being able to locate and capitalise on opportunities that come available in the marketplaces you know. Sometimes the opportunities will be outside of those, and whether you look to try and take advantage of these or not is down to a separate trait: your willingness and ability to adapt.

What Are Investor's Looking For In A Startup Business?

Startups need to know how to attract investors if they want to get funded by them. In this section, there is a discussion of the key items investors look for when making an investment decision, particularly for startups.

-

Market Size. Most investors are looking for a business opportunity with growth potential. This is where most investors will start. How big is the addressable market that your company is looking to serve? If it's a market with existing solutions, be prepared to spend a lot of time explaining to the investors how your solution is different from your peers. If it's a new, emerging market, the focus will be on how big the market is expected to get and what's driving its growth. Be sure to be able to target the exact question, what are investor's looking for from your market analysis and research.

If the product is not new but a new entrant to an existing market, the same issues hold. However, it is assumed that any market share you attain is coming from some other competitor; thus, your competitive advantage must be demonstrable to the investor(s).

-

Passion Amongst Founders Team. Having a passion for their startup is pretty easy to come by for business founders. Most startups exist today because of the passion to be creative and doing what their owners enjoy to pursue as a profession. They believe in the product/service they want to provide. They are confident that it is an improvement over existing products or is a new way to address an old problem.

However, while most investors want and appreciate passionate entrepreneurs, they are also looking for someone willing to invest their own money as well as funding from them. This is to be able to divide and diversify the risks involved due to the unstable nature of the business environment. As a founder of your startup, you will have to raise the initial capital yourself. You can do this from your own savings, borrowings, family, friends, etc. But you must be willing to demonstrate you believe in product/service enough to invest your own money. You will have to get the business off the ground on your own.

Personal investment is not only limited and restricted to monetary investment, investor's want to see a significant degree of effort in investment. This isn’t exclusive to personal capital. They want to see your blood, sweat, and tears poured into the business because if you won’t invest, they never will.

-

Product/Service Differentiation and Competitive Advantage. What are investor's looking for in terms of your product/service's unique selling point? This is going to be a critical issue for investors. What makes your product/service unique? There has to be something about your product that sets it apart. If you have a never before seen product and you’re the first to the market, that maybe it. However, most startups are entering existing marketplaces.

-

Momentum and Traction. An important way to reduce the risk in an investment opportunity is to show investors that you're not just all talk but have already begun taking action to build the business. This may include pilot testing the market with your product/service or creation of prototypes. Demonstrating that the market is already engaging with your product and providing useful feedback will set your startup apart from many others that are still in the thought process phase.

What are investor's looking for in terms of traction and what does it mean to them? To any startup or investor, momentum or traction could be defined in any number of ways but the key component here is to exhibit some degree of progress. Month-over-month organic growth, continuous revenue growth, increased user numbers, staffing expansion, technology development, etc. all constitute progression.

What Are Investor's Looking For In A Business Plan?

Most potential funders wish to see a business plan as a first step in deciding whether or not to invest. What are investor's looking for exactly in a business plan that decides whether they are willing to invest or step back?

What Are Investor's Looking For In Financial Statements?

There are key performance indicators that investors will want to see in a company's financial statements before they will invest. Financial statements are financial records of a company's working consisting of many components, so which components to be precise, are investor's looking for?

- Net Profit. What are investor's looking for in net profit to be exact? Financial statements will reveal a company's net profit, the net profit is the money that a business has left over after paying all expenses. "Are you making money?" is often the first question asked. As many business owners do not often have a clear understanding of their net profit, this is a good place to start to be able to explain to investors what your figures mean.

- Sales. If you establish a track record of sales before seeking investment, investors don't take on the risk of not knowing the answer to that question. Investors also care about sales growth.

- Cash Flow. Investors view of cash in the bank as a sign that you can deal with unexpected problems and capitalize on new opportunities. Free cash flow, the amount of cash that's left after you meet your expenses each period, is a sign of sustainable operations. If you have both, investors won't have to worry that you could go under at any time.

- Margins. What are investor's looking for in margins you might wonder? Sales are meaningless if you aren't making money. Investors also want to see your profit margins both overall and at the individual product level. They'll also compare your margins against industry standards and their other available investment opportunities. Higher margins generally lead to a better return for investors. If you have low margins, you'll need to demonstrate a plan for improving them. For early-stage businesses, demonstrating how economies of scale will reduce costs as you grow is usually the answer.

-

Debt. What are investor's looking for in the debt section? Debt scares investors for two reasons. One is simply that if you go out of business, debt holders get their money back before equity holders have a chance to claim what's left. The second, and more important, is that debt payments eat up your cash. High debt payments can hinder your ability to meet payroll and other expenses during slow periods. They may also mean you have less cash available to help you handle a sudden surge in orders or an emergency equipment replacement.

One of the most common debt measures is the quick debt ratio—current assets (excluding inventory) divided by current liabilities. A quick ratio of 1 indicates that you can exactly meet your obligations, and the higher it is above that, the more flexibility you have.

Creating A Successful Pitch Deck for Investors

What are investor's looking for in a pitch deck and how can you create the ideal pitch deck to present? Summarised below are 3 key elements of creating a successful pitch deck to meet the requirements of what are investor's looking for from an entrepreneurs pitch:

- Knowledge of Industry. You will likely be asked technical questions in your pitch, for example, those concerning the logistics of your industry, the science behind your product, or the current research surrounding the problem you are trying to solve. Answering these questions with confidence shows your expertise and that you have thoroughly researched the current market. Even if you are breaking into a new market that you don’t have any first-hand experience in, it’s worth mentioning how you have addressed that problem.

- Marketing Campaign. What are investor's looking for in terms of how you plan on marketing and promoting your product/service to reach out to the targeted audience? Your marketing strategy hinges on who your target audience is and where they are most likely to see and respond to your message. If you are not confident in your ability to devise a marketing strategy, then you should consult with a marketing expert before your pitch to get some additional insights. If you keep these areas in mind when preparing for your pitch, you are sure to impress your potential investors and hopefully get that much-needed funding for your business.

- Financials and Projections. This section is about what are investor's looking for in your financial projections and predictions? Putting together a set of thoughtful projections on both the revenue and cost sides enhances your credibility with potential investors. You must also be able to demonstrate an appreciation of the capital you are raising and how you intend to deploy it to meet milestones that will be critical for future fundraising. While your audience may feel projections are premature in assessing the business, they will appreciate that you understand financial metrics and how to “operate” a business.

For more detailed guidance, see our insights on creating successful Pitch Decks and important components required with examples.

Looking For Investors In Malaysia

Are you looking for investors in Malaysia for your startup? NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd)'s Angel Investor Network

Concluding Thoughts

"Most people think that to become rich, it’s enough to be talented and capable. But in fact, the world is full of such people, and most of them are poor. What they are missing is financial intelligence, a comprehensive aptitude for financial subjects like accounting, investing and so forth. This lack of training in financial intelligence is a problem not only for today’s youth but also for highly educated adults, many of whom make poor decisions with their money"

Rich Dad, Poor Dad by Robert T. Kiyosaki

References

How Investment Goals Vary by Country and Age

What is an Angel Investor? This article is your ultimate guide to angel investors, who are they, what is the angel investor funding process as well as the most commonly asked questions regarding Angel Investors.

Who Are Angel Investors?

Angel investors are individuals who are providers of funds and/or capital for a business start-up normally in its early stages of the business, usually in exchange for convertible debt or ownership equity. Since angel investors are very often individuals that have been at executive positions at large firms, they can often provide useful advice and introductions to the entrepreneur based on their own experiences, in addition to the funds.

A Harvard report provided information on how angel-funded start-ups had a higher chance of survival, likely up to four years more in comparison to non-angel invested firms.

Alejandro Cremades, the author of "The Art of Startup Fundraising: Pitching Investors, Negotiating the Deal and Everything Else Entrepreneurs Need to Know", states that angel investing has not only become trendy and highly profitable, but it has also emerged into being a powerful source of fuel for the national economy, jobs and new innovation.

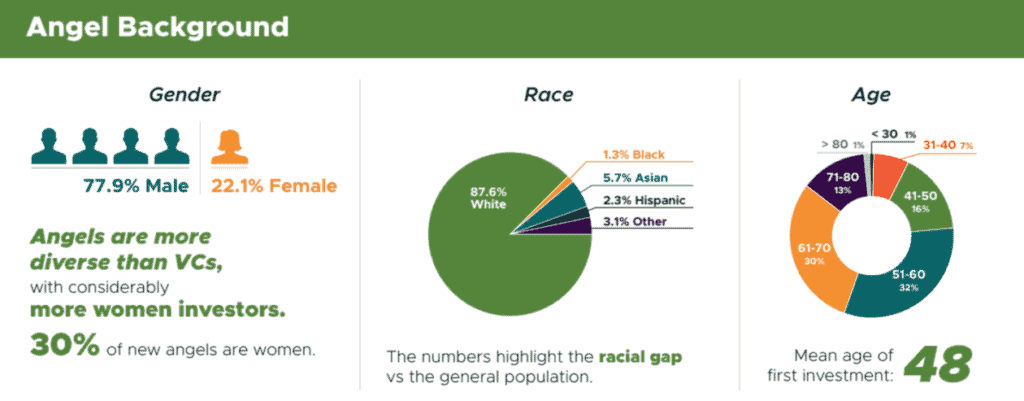

Taking a peek into the world of angel investors, using the United States as an example, GeekWire Statistics reveals that Angels are more diverse than venture capitalists and the majority are women with the number increasing by the minute. However, the statistics will differ in every country.

How Does Angel Investing Work?

This is a step-by-step process and not something that reaps success overnight. New startup businesses or individual entrepreneurs often seek out for angel investors to pitch in capital to their business in return for a stake in the company they invest in. It's not just limited to the capital, their experience and knowledge in the industry hold immense value as well.

To put this timeline into perspective, Amazon CEO Jeff Bezos himself benefited from 22 "angels" that supported his startup, Amazon in the 1990s when it was a struggling online bookselling service. Many of Amazon’s initial investments came from Bezos’ family and friends, an input of $50,000 secured 1% of the company. Today, those shares are worth more than $8.5 billion. That investment saw a 17-million-per cent gain 25 years later! However, this is just an example and this does not mean that your angel-funded business will take decades to be successful too!

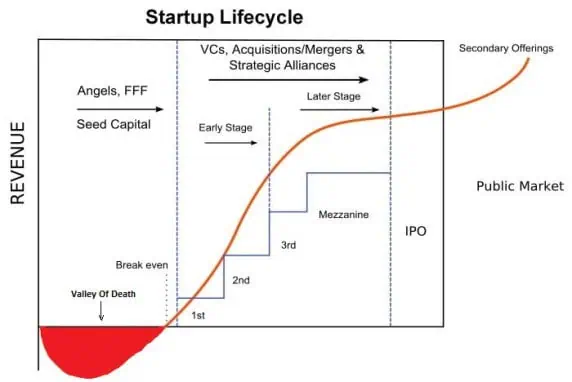

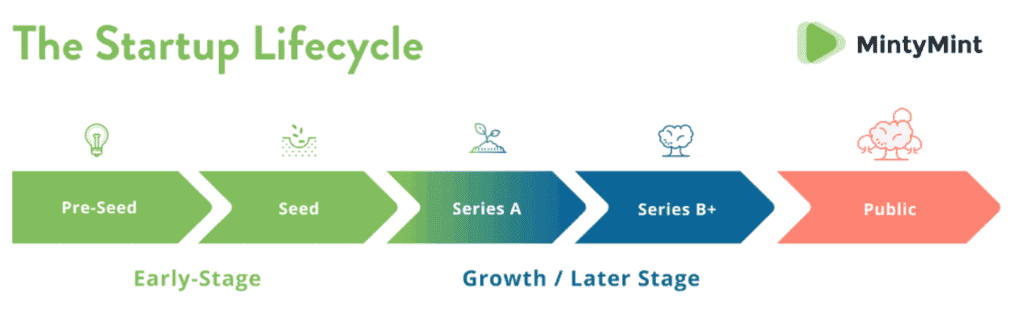

According to MintyMint, angel investors enter the lifecycle of a startup in these early stages where they are in need of guidance and capital the most.

Let's start with the most basic question: Why and when do you need an Angel Investor? This type of investment is targeted to those entrepreneurs in need of business expertise and financing for their startup. Usually, a method of recommendation and referrals also allows investors and entrepreneurs to meet together. Entrepreneurs are usually provided with the angel investor's profile and vice versa. Both parties will have their own series of requirements; a checklist of expectations.

The screening process for entrepreneurs will include their requirement in terms of investor skill and capacity of capital input whereas for investors, they need to look out for any "red flags" within the business and how attractive is the investment opportunity based on the input of time, money and attention.

What is an Angel Investor expecting from your pitch? Pitches like this can turn out to be quite stressful for the entrepreneurs because of a lot of reasons: they are time-sensitive and they need to be able to fit all information regarding their business in that time slot for the angels, the environment may also have a stressful impact on the entrepreneurs pitching and often sometimes leads them to forget their numbers. Amongst all, it is of utmost importance to remain transparent with the investors and provide them with all the key figures.

Once both parties have agreed upon working together before the angel investor funding process begins, there are some angels that might prefer to invest straight after a pitch but the majority are interested in a little due diligence at first. This may include going through scenario building or a certain checklist of things to be approved by the angel. Before ending the due diligence process, it is at this point that both parties sit down together and agree on their deal terms, goals that are mutually accepted and beneficial as well as the deal structure and meeting notes that are to be shared with the diligence report once it is complete.

Once all the legal implications are completed, a closing date is assigned, documents are signed. The process is a lot more time consuming and further technicalities are involved. Described above is a brief summary for quick understanding!

As a summary, Neil Patel, New York's best selling author, and renowned online marketer, having helped renowned companies like Zappos, Amazon, Viacom, Airbnb and the list goes on; explain in detail what angel investing is all about. He simplifies what is an angel investor in the short video below:

"But how are Angel Investors any different than Venture Capitalists?"

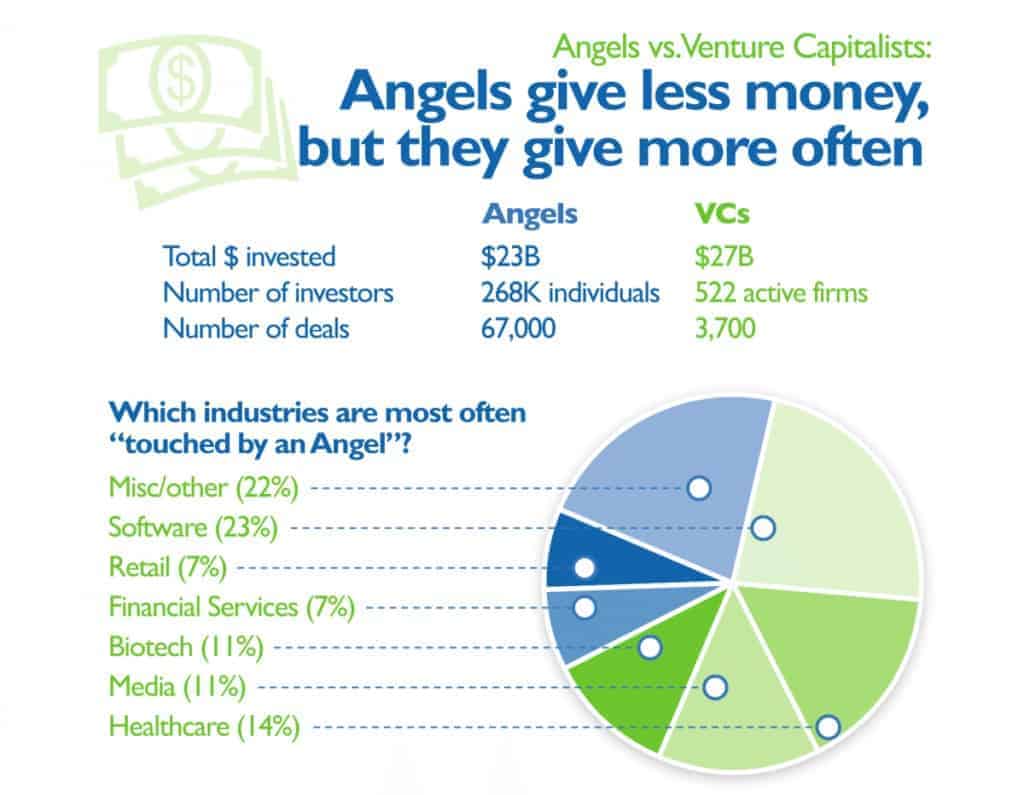

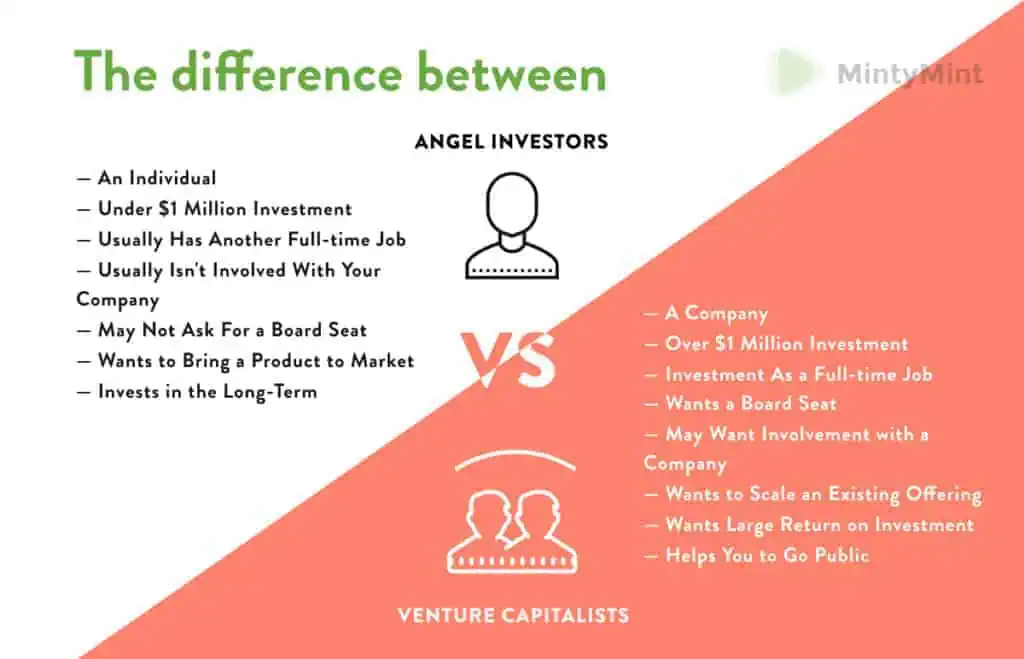

What is an angel investor and a venture capitalist? Many people often confuse the two and fail to notice the differences between the two entities. Here is just a brief outline to clear out any confusions you may have regarding the difference in both. Angel investors are individuals willing to spend their own money whereas venture capitalists (VCs) come from a venture capital company. Angel investors have limited funds and prefer the investment amount under a limit whereas venture capitalists prefer a large number of investments.

Most angel investors prefer investing at the start-up stage of a business in comparison to VCs that prefer entering the business when they see a potential to progress further. A few further characteristics are detailed in the diagram above detailing what is an angel investor and how is it different from a venture capitalist.

What are the Top Qualities to Look for in an Angel Investor?

What is an angel investor's ideal qualities? Angels step in as saviours for budding entrepreneurs to help them kick start their business. Therefore, it is important, for an entrepreneur, to know and understand the characteristics and qualities to look for in a potential angel investor. This debate can be divided into three sub-sections:

Personality of Angels

What is an angel investor's ideal personality? Finding a trustworthy angel for your business is crucial because you do not want to provide your private and confidential information to someone who will later use that privileged information against you. What is an angel investor's personality trait that is suitable for your business? It is important for angels and entrepreneurs to build a relationship on mutual trust and reliability, not only for monetary assistance and protection but for guidance and knowledge as well. They must have good decision-making skills and the ability to remain calm under pressure. They have a quick eye for talent (based on their years of experience, of course!) and potential in your business and give you the verdict straight away whether they see potential in your business idea or now.

Patience is truly a virtue, a patient angel understands the business environment and dynamics and that profits do not start rolling out overnight. They possess the ability to see through the bigger picture and focus on the long-term operation and not be afraid of whatever challenges that may come their way. An angel should not only be in it for the profits but also enjoy nurturing, mentoring and have the thrill to deal with challenging situations alongside the entrepreneurs.

Investment Decision Skills

What is an angel investor's preferred decision-making skills? Seasoned business angels rely heavily upon due diligence before making any commitments or signing contracts. What is an angel investor's focus when it comes to investment decisions? They prefer getting into the 'nitty-gritty' details to prevent any risk of fraud, scams or other unfavourable circumstances. Angels also need to possess great networking skills, they will help bring on board more individuals if they are well-connected in the industry.

Angel investors will follow the principle of diversity and know that not all business models are the same therefore they won't yield the same results upon investment. When investing in multiple businesses, they understand that no two ventures are going to work on the same dynamics.

Coaching and Support from an Angel

What is an angel investor's ideal coaching attitude? Secondly, it is also important to note that what is an angel investor's top mentoring skills that you should keep track of? Along with having the aim to make money, angels should also be relationship builders for successful business partnership and understanding. They also need to have great mentoring skills as the majority of their time will be spent engaging with the entrepreneurs and coaching them and their teams on how to make it big in the corporate world.

Other than their monetary input, angels also need to be willing to remain actively involved in the venture in terms of advice and their knowledge on brand management, networking, product and service strategies.

Where Do I Find an Angel Investor in Malaysia?

What is an angel investor's role in Malaysia? Every country will have their own means to approach an angel investor usually through an angel investor directory. But, if you are reading this article and in need of an angel investor, you came to the right place.

Visit the NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd) Investors Network and submit your application for approval to get funded!

"How Do I Become an Angel Investor in Malaysia?"

What is an Angel Investor's registration process if any? It is not required that you register yourself as an Angel Investor, you can still be an angel investor without registration. However, according to the Malaysian Business Angel Network (MBAN), if you are to register yourself as an accredited angel investor in the country, you would then be eligible to enjoy a tax benefit amounting to RM 500, 000 under the Angel Tax Incentive Programme.

For registration purposes, you are to meet the following requirements:

- Either A High Net Worth Individual (Total Wealth Or Net Personal Assets Of RM 3 Million And Above Or Its Equivalent In Foreign Currencies)

- A High Income Earner (Gross Total Annual Income Of Not Less Than RM 180,000 In The Preceding 12 Months; Or RM 250,000 Jointly With One’s Spouse)

- Tax Resident In Malaysia

On the flip side, if you are a startup seeking an angel investor, according to MBAN, your startup is to fulfil the following requirements:

- Company Has To Be Minimum 51% of Malaysian Citizen Ownership

- Company’s Core Business Must Be Technology Related

- Been In Operation For Three (3) Years Or Less

- Cumulative Revenue Of Less Than RM 5 Million

On A Parting Note

What is an angel investor? Hopefully, this article would've helped to increase your knowledge about angel investors. Angel investors are playing a more and more important role in financing many new businesses, even though in comparison to other sources of financing, they individually invest relatively small amounts of capital in the early stages of enterprise development.

Visit the NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd) Investors and take advantage of the most experienced network of investors and Startup Mentors in Malaysia.

References

How Angel Investors And Angel Groups Work

How Does Angel Investing Work?

How to create an effective pitch deck: A data-driven analysis of what makes successful slides

Jeff Bezos told what may be the best startup investment story ever

Startup Funding 101: investment rounds and sources

Angel investment networks have not just become trendy and highly lucrative, they have become a major source of growth, innovation, and jobs for the national economy.

For startup founders, these angel networks became an indispensable part of their existence. How do these angel networks operate? How do they provide funds? How can startup founders approach these angel investors in Malaysia?

Angel investors or business angels are commonly wealthy individuals who provide capital for startups. The injection of money can help with turning an idea into an actual company and lay the foundation for the company to offer its products or services.

Not only do these individuals provide capital, most often they also invest their knowledge and expertise to support startup's growth.

Support outside of providing capital is one of the aspects that sets angel investors apart from other more traditional investors. Other investors tend to limit their involvement in providing capital in return for a share in the startup.

Angel investors or networks commonly have a much closer relationship with the startups they have invested in. They monitor the startup and it's progress attentively and provide advice when needed. These angel investors become a sort of mentor or guide for the startups.

As angel investors are mostly individuals who have held executive positions at large corporations or have successfully ran their own companies, gaining mentors through angel investors can be just as valuable as the invested capital for novice entrepreneurs.

Why startups require angel investors

Fast-growing small firms often need aid overcoming funding gaps to sustain their growth. Angel investors can help resolve this issue. Furthermore, angel investors can support startups by sharing contacts and networks to secure additional capital. The fact that angel investors mostly invest locally is an added positive to the local market as a whole.

Business angels usually fill in the gap between family and friends, and larger more formal entities such as VC's. Some of these angels purely seek profit while others seek more meaningful investments.

For instance, some angels will only invest in startups that are active in specific industries or serve a certain cause. These industries could range anywhere from sustainable agriculture to education and tech startups. Since angel investors are very often individuals that have held executive positions at large corporations

Another reason startups would seek out angel investment networks would be for the fact that angel investors can provide debt-free financing.

In the case of a bank, even when they agree to provide a startup with funds, they will likely restrict the quantity you are allowed to borrow, as the bank will be much more risk-averse than the average angel investor. Contrarily angel investors will not shy away from investing larger sums if they feel the startup has a lot of potential.

Unlike loans and different forms of credit financing, angel investor funding is usually a much cheaper option when looking for seed-stage capital.

Startups are not tied to monthly payments on the capital plus the interest, instead, with angel funding, a portion of the company profits will be given to the investor relative to the investment made. The share of ownership for the angel investor usually starts at about 10%, however, the share could increase with consecutive funding in the startup.

Furthermore, unlike a loan, invested capital does not have to be paid back in the event of a business failure.

Angel investor networks in Malaysia

There are many angel investors in Malaysia open to funding startups at any given time. There are also many 'dormant' investors who have the capital but find it difficult to look for suitable startups to invest in. In such cases, angel investment networks provide the solution by linking startups to so-called dormant investors. Naturally, non-dormant investors are also involved in these business angel networks.

Angel Investor networks in Malaysia invest varying amounts as compared to Venture Capital – and recently groups of angel investors have been putting down investments as large as early-stage VC investment sizes. Angel Investor networks in Malaysia could invest anywhere between RM50k to RM2m or more, where early-stage VC investments could start at RM500k to RM1m.

Angel investment networks

Business angels are more often joining forces to form and participate in angel networks. In fact, the entire startup and angel investor ecosystem in Malaysia has gone through a considerable expansion in the last 10 years.

During the last 10 years, many business angels have gotten involved with business angel networks. The main reason for this is to get access to the best deals as this is much harder when working alone. Unless you already have a big name in the angel investor and VC industry, joining an angel group could be considered essential to gain success.

There are different reasons for these angel investment networks to form and operate, such as:

- Getting access to a continuous stream of offers and opportunities

- Lessen the risk in investments

- Broaden the range of investments

- Improve the ability to perform due diligence

- Ability to make more substantial and meaningful investments

- Gain more control over the potential success of startups

These angel networks can provide individual investors with more confidence which often leads to startups receiving better deals as well.

Most business angel networks tend to establish themselves within certain geographic regions. In the case of Malaysia, most of these networks would focus either exclusively on Malaysian startups or more broadly on ASEAN startups. Some of these groups focus will only invest in certain industries, mostly tech, while others have a wider range of industries they are willing to invest in.

Where to find angel investors in Malaysia

Malaysian angel investors often shy away from public appearance. Therefore they may be hard to find and approach by startups. Angel Investors in Malaysia are usually found in angel Investment Groups or Networks. Finding the right business angel network can be very valuable for both startups and investors.

An example of an angel investment network is NEXEA. NEXEA ensures that both the startups and investors are a good fit before the introduction takes place.

At NEXEA startups receive advice and knowledge on what and how investors think prior to making the introduction. This will help startups in preparing their presentations for potential investors. Furthermore, it will also reduce the risk of a potential altercation taking place where the deal would not go through.

Generally, finding angel investors in Malaysia can be done in various ways, for example:

- By networking

- Personally introducing oneself

- Joining pitch night events

- Through local coworking spaces

- By finding and approaching accelerators

- Locally through Meetup events

- Angel investor associations

Malaysian Business Angel Network

Another place to look for angel investors in Malaysia would be the Malaysian Business Angel Network (MBAN). The Malaysian Business Angel Network is the official trade association and governing body for angel investors and angel investment networks in Malaysia. The main objective for the company is to support the angel investors and startup environment as a whole.

Finding the right angel investment networks for your fundraising needs

Angel investors as individuals can have a very wide range of unique characters and perspectives. Hence, finding a business angel network can be very valuable when it comes to gaining consistency and structure in investments. Furthermore, the fundraising procedure for startups can be more organized and simple.