Updated: 28/06/2023

Angel Investors are defined as affluent individuals who provide capital for a business start-up, usually in exchange for convertible debt or ownership equity. Often, they are found among an entrepreneur's family and friends. The funds they provide may be a one-time investment to help the business get off the ground or an ongoing injection to support and carry the company through its difficult early stages. These types of investments are risky and usually, do not represent more than 10% of their portfolio.

What is an Angel Investor?

Angel Investors are often retired entrepreneurs or executives, who partake in angel investing for reasons beyond monetary return. They may want to keep abreast of current developments in a particular business arena, mentoring the next generation of entrepreneurs, and making use of their experience and networks on a less than full-time basis. Angel investors provide feedback, advice, and contacts in addition to funds. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital, as well as to provide advice to their portfolio companies.

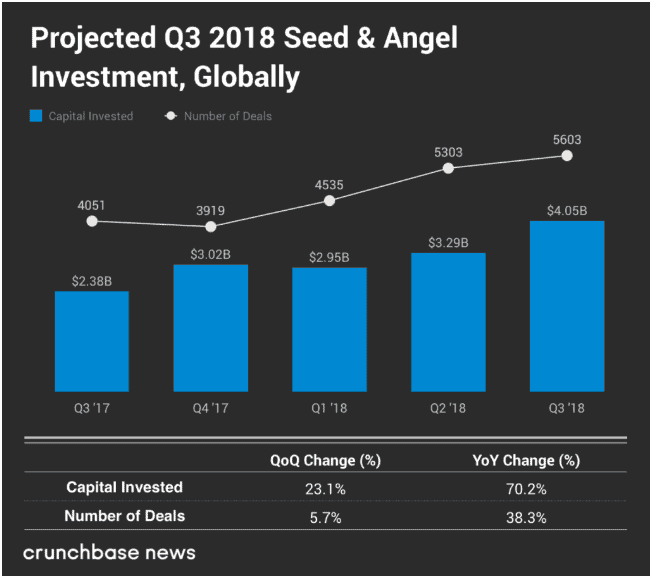

Angel investing has soared globally, especially the last 5-10 years due to the growing technology startups that had generated great returns. Individuals are seeking alternative returns that are better than traditional investment vehicles such as stocks and bond.

But unlike most other types of investors, many angels are not motivated solely by profit. Particularly if the angel investors are a current or former entrepreneur, he or she may be motivated as much by the process and the enjoyment of helping a young business succeed as by the money he or she stands to gain, and are therefore more likely to be persuaded by an entrepreneur's drive to succeed, persistence and mental discipline.

Main Categories of Angel Investors

Core

Core Angel Investors are individuals with extensive business experience who have operated and owned successful businesses. They are committed to their job of angel investing and continue to be involved with high-risk investments despite their losses. They possess a diversified portfolio that encompasses all industries, including public and private equity and real estate. They serve as valuable mentors and advisors to their invested companies.

High-Tech

High-tech angel investors may have less experience than core angels but invest significantly in the latest trends of modern technology. Their investments primarily depend on the value of their other high-tech holdings, which can vary considerably. Many high-tech angel investors enjoy the risk of their deals as well as the exhilaration of bringing novel technology to the marketplace but some may prefer not to be actively involved in their invested companies.

Return On Investment (ROI)

ROI angel investors are primarily concerned with the financial reward of high-risk investments, hence the ROI. Their motivation behind investing is their perception of what other angels’ gross income may be. ROI angels tend to stay away from investing when market performance is poor and emerge once the market shows stability and improvement. They view each of their investments as another company added to their diversified portfolio and rarely become actively involved in the invested companies.

There are different types of angel investors within the three categories, depending on the intentions and value propositions that the entrepreneur or angel investor is seeking; They may be affiliated and non-affiliated. The former is someone who has some sort of contact with you or your business but is not necessarily related to or acquainted with you while the latter has no connection with either you or your business.

Types of Angel Investors

- Entrepreneurial Angels – They own and operate their own successful businesses. Their steady flow of income allows them to make higher-risk investments and provide a larger amount of capital. They tend to make adequately-sized investments anywhere from $200,000 to $500,000 and are known for investing more money into the same company as the business progresses. They enjoy the personal fulfillment of assisting entrepreneurs to launch a successful start-up and rarely take an active role in managing a company.

- Enthusiast Angels – Enthusiast angels are business persons who have been independently wealthy. They often invest small amounts of capital (between $10,000 to a few hundred thousand dollars) in several different enterprises and view investing as a mere hobby. They also do not take an active role in management.

- Professional Angels – They are professionally employed (i.e. Accountant, Engineer, Lawyer, etc.) and would invest in companies in their related field. They would usually invest in several companies at the same time, and their capital contributions range anywhere from $25,000 to $200,000 per investment. They may also provide services to their invested company (legal, accounting or financial).

- Head Angels – They are angel leaders who bring together and advocate other angel investors to a specific deal. They enjoy being the first in a deal and leading others to an investment opportunity.

- Mentor Angels – They serve as mentors to their invested companies. To them, providing insights and mentoring entrepreneurs to help them achieve success is more valuable than monetary rewards.

- Venture Capitalists/Angel Investors – Some venture capital firms may have strict rules when it comes to independent investing. But sometimes an investment may be so appealing a venture capitalist partner may decide to privately invest. VC partners may even decide to co-invest in an attractive investment alongside their firm’s financing. VC partners can also independently fund early-stage investments, only to have their firm finance the company during later stages of development.

- Will Work-For-Equity Angels – They are service providers who intend to exchange their services for a percentage of shares in the company. When a young company takes advantage of this type of service, they often save money in the long run.

- Technology Angels – These types of investors are primarily concerned with developing technologies rather than building a diversified portfolio of companies. They are also known to assist entrepreneurs to license these inventions.

The process of angel investing is not easy, same goes with being an angel investor. Entrepreneurs may be able to raise the desired capital for their venture but may not be compatible with their investors or the investors have unrealistic expectations of them. To avoid this discrepancy, entrepreneurs are strongly encouraged to learn about the different types of angel investors before they go about recruiting one as it will help sort through and choose a well-matched angel investor for them. It can make the difference between establishing a strong foundation for a company or a failing venture.

Common Questions About Angel Investors

How Much Do Angel Investors Invest?

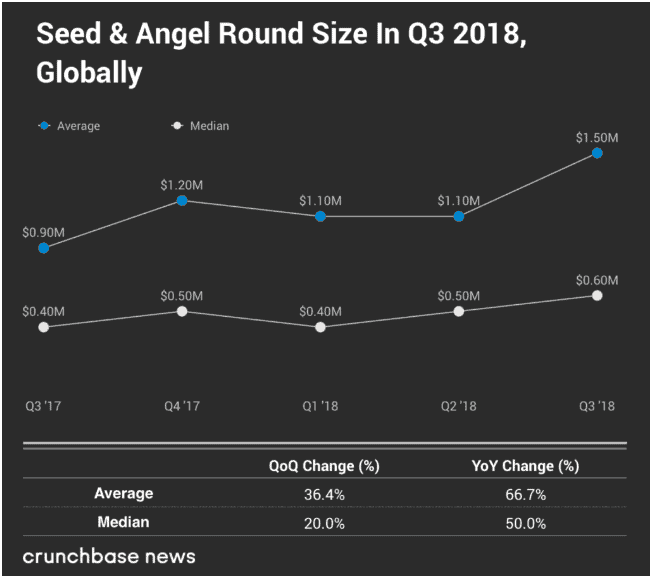

Granted that it differs among cases, regions, or countries, it's safe to say that the typical angel investors would invest at least RM10,000 while the average angel investors would invest around RM100,000. The maximum really depends on the angel investor. Usually RM200,000 all the way to RM1,000,000. The numbers may have changed over time, but it's a good rule of thumb nonetheless.

What Percentage Do Angel Investors Want?

Angel Investors would typically take 10-25% equity in return. Angel investors would take no more than 20-25% as it gives founders the right incentive and alignment with the founder to help grow the business in the right direction. If it is more than 25% this breaks the angel investors definition of being a good angel investor.

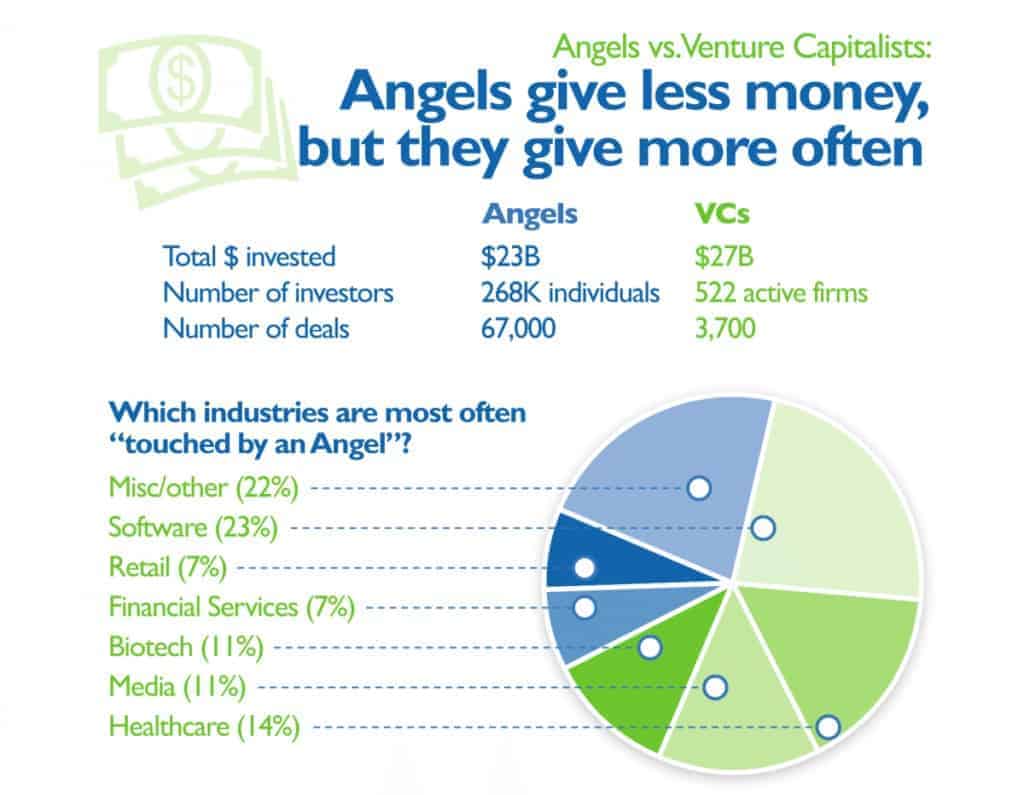

How Is An Angel Investors Definition Different From A Venture Capitalist by Definition?

The key difference is whose money they use to invest. Venture capitalists generally use money pooled from investment companies, large corporations, and pension funds to invest. While angel investors use their own money. They are required to have a minimum net worth of $1 million and an annual income of at least $200,000 to be considered an accredited investor.

Angel Investors Network

Angel Investors in Malaysia tend to be more private about their identity. Therefore, at NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd), we represent them on the front before most Startups get to meet them. We ensure that startups and investors are both ready and have a good match before the introduction. We would advise startups on how to approach investors so they can be prepared to pitch their business. This would help avoid all sorts of unnecessary situations where the deal would fall apart.

NEXEA's angel investors are focused on building value for the Startups. They have guided startup founders during really tough times – many of the startups almost failed due to reasons like poor cash flow management and unsustainable strategies. Our angel investors/mentors create values through sharing their years of experience to help guide startups in avoiding common pitfalls and drive performance results, not to mention at some cases, introducing relevant industry players or even opening doors to potential partners. Find out more about our angel investors at NEXEA Angel Investors Network.

Conclusion

Angel investors are individuals who provide crucial financial backing, expertise, and networking opportunities to early-stage startups. These investors are typically experienced entrepreneurs or high-net-worth individuals who invest their own capital in exchange for an ownership stake in the company. They play a vital role in supporting innovative ideas, fueling growth, and guiding entrepreneurs through the early stages of their ventures. The involvement of angel investors is instrumental in propelling startups towards success by providing not only financial resources but also mentorship and valuable industry connections.

Sources

Definition of Angel Investors

Main Categories of Angel Investors

Venture Capital

Size of Angel Investments