Updated: 20/12/2022

Most people have considered starting their own business at one point in their life, be it the food and beverage industry to starting a multimillion-dollar business. But no matter what their ideas are, all of them have one thing in common: They need capital to get their business started. For this to happen, startup companies have to find an investor who is willing to invest in their business. If they are in luck, they might find an angel investor for themselves!

Definition of Angel Investors

Angel investors are wealthy individuals who invest in small businesses or entrepreneurs in exchange for a share of the company's ownership. They are frequently found among an entrepreneur's friends and family. They may provide a one-time investment to help a company get off the ground or a continuous injection to support and carry the company through its early stages.

Usually, an angel investor funds startup companies with their own capital and they possess high assets which can be over a million dollars, has an annual income of over $200,000 or a joint income with their spouse exceeding $300,000.

Understanding Angel Investors

The investments they invest in are high-risk investments that typically account for less than 10% of an angel investor's total portfolio. Most of them have extra cash and are seeking a greater rate of return than standard investment possibilities can offer.

They are more interested in assisting businesses in their early stages than in making a profit from the company. They are essentially the polar opposite of venture capital firms. They have a lot of expertise because they've invested in a lot of businesses. They may share their knowledge with you and perhaps stop you from making costly blunders.

Informal investors, angel funders, private investors, seed investors, and business angels are all terms used to describe angel investors. Some of them pool their funds through online crowdfunding platforms or by forming angel investor networks.

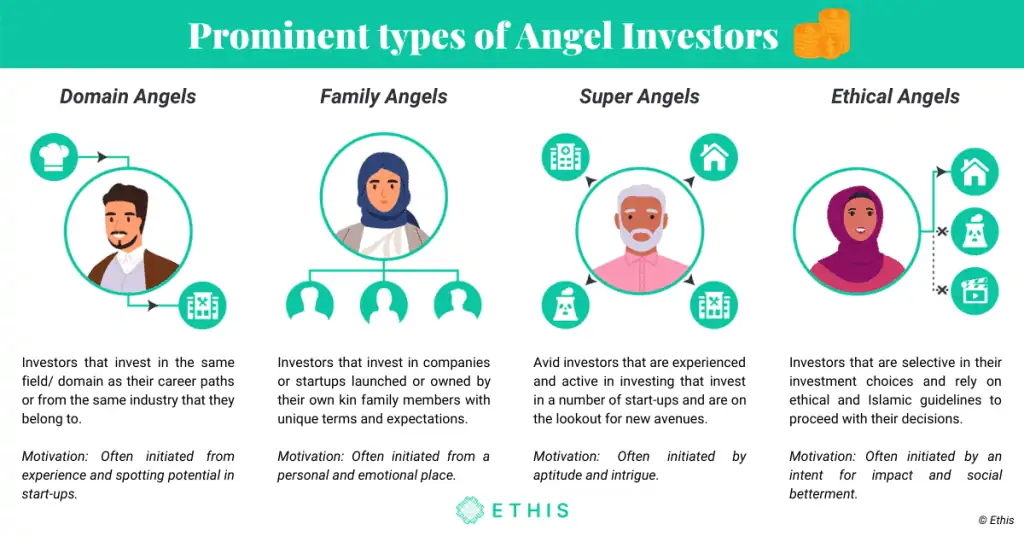

Types of Angel Investors

Though angel investors and venture capital firms may appear to be similar, they differ in several ways: their investment process is faster, they are more flexible than Venture Capital (VC), they support smaller companies than VCs and frequently approach them online and directly. As it grows in popularity, many sorts of investors emerge, each with its own strategy and motives for investing.

What to Know When Looking for an Angel Investor

Unfortunately, many entrepreneurs' primary aim is to secure financing as fast as possible, and in their rush, they frequently ink a deal with the first investor that comes along.

Keep in mind that your investor relationship is a long-term commitment. Consider your investment to be a spouse: you"ll be together for a long time and will share assets. As a result, you'll need to locate someone who won't abandon you if things go wrong. You need someone who will support you and your company through good times and bad.

Here are some tips for you when looking for an investor:

Be proactive

Despite their amusing name, angel investors do not fall from the sky. You must approach people, and you must do so in a way that is particular to them. Successful entrepreneurs have no patience for people who are shy. In order to get your startup an angel investor, you need to get out there and talk to people, inspiring them to believe in your company as much as you do.

Be prepared

In order to do the above, you need to do some research on the possible investor and discover at least a few basic information about them. What have they been investing their money into? What criteria do they use to evaluate possible investment opportunities? Your objective should be to hook them fast. You should consider every pitch to be an all-in gambit. You either immediately thrill them or they never want to hear from you again.

Creating a brief elevator pitch for your first encounter is a wonderful method to do this. In essence, this is a short version of your presentation which is meant to get their attention right away. Your pitch should be no more than 150 words and no more than 30 seconds, but it should also identify the precise problem that your solution solves.

Never appear unprepared, or worse, uninterested in your own project, or just plain lazy.

Network, Network, Network

In order to discover angel investors, you must first get to know the investor you are interested in, which requires immersing yourself in your local business and social communities. Concentrate on business owners, as they are the people who may be or become angel investors, or who know someone who is.

Join commercial and trade associations and attend meetings on a regular basis. Joining civic and community groups is also a good way to meet new people. Participate in trade shows and events. Make your face and name known by meeting as many people as possible.

Be personal

You'll want to be as personable as possible when seeking angel investors. Find things you have in common, such as friends or interests, and utilise your shared experience to your advantage.

Make use of the connection services on the internet

You might be able to connect with an angel investor through a website that matches entrepreneurs with angel investors. At the very least, you'll be able to get your company idea in front of a larger audience.

In NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd), the angel investors are all seasoned business owners and/or C-level executives who can contribute more than just funding for your firm. We also give guidance and assistance through industry professionals and mentors. The NEXEA Investors/Mentors look for investment possibilities in technology firms that can demonstrate revenue and future development prospects.

Advantages and Disadvantages of Angel Investing

Angel investors are always seeking for methods to make more money with their money than they would if they put it in the stock market. However, it's important to remember that angel investors' motivations are usually more than just financial.

They might want to mentor a new generation of entrepreneurs, work in a specific field, or use their expertise and abilities in a different way. There are some advantages and disadvantages of having an angel investor for your startup company:

| Advantages Of Angel Investing | Disadvantages Of Angel Investing |

| No obligation. Business owners aren't obligated to repay the angel backer if the firm fails. | Less control. Companies that engage with angel investors may have to give up some of their company's stock. |

| An angel investor is also an entrepreneur. Angel investors frequently have a wealth of business expertise and experience. | Inexperienced angel investor. You may end up with an unskilled angel investor that provides bad advice. |

| More money down the line. When angels invest in a firm, they are frequently in it for the long haul. | Expectations are higher. Angel investors are in it to generate money, they anticipate a significant return on their investment. |

Some of the advantages of angel investing is that there is no obligation. Because they haven't asked for a new line of credit, and most angel investment includes stock transactions, business owners aren't obligated to repay the angel backer if the firm fails.

An angel investor is also an entrepreneur. Angel investors frequently have a wealth of business expertise and experience. They can provide insights and advice for startup companies because they most likely have been in your shoes before. They made the mistakes for you, so you don't have to.

More money down the line. When angels invest in a firm, they are frequently in it for the long haul. They frequently make another cash injection later on as the company progresses.

Some disadvantages of angel investing is there is less control. Companies that engage with angel investors may be required to give up some of their company's stock. While this is usually a small sum, angel investors may decide they want a larger say incorporate choices.

Inexperienced angel investor. One major disadvantage of an angel investor is that you may end up with an unskilled angel investor that provides bad advice or hounds business owners for status updates. This is especially true for new angel investors who put substantial sums of money into a firm.

Expectation are higher. Within five to six years, angel investors frequently expect a big return on their investment, which is equal to ten times their initial investment. Before taking moeny from business angels, you must establish whether your firm can develop at the rate that an angel investor anticipates and set growth goals.

How Angel Investing Works

Angel investors typically invest their own money, rather than managing funds for others, and invest at the seed or angel funding stage, which is the early stage of a company's development. They often invest after the initial round of funding, which may come from the founders themselves, friends, and family, or bank financing, and before a company requires a larger investment from a venture capital firm. The goal of angel investing is to provide capital to help a company grow at a critical stage of development and potentially generate a return on investment.

The angel investing process works:

- Connection: Angel investors connect with startups or small businesses through various channels such as word of mouth, industry events, referrals, online forums, or local events.

- Due Diligence: If there is mutual interest, the angel investor will conduct due diligence on the company by talking to the founders, reviewing business documents, and assessing the industry.

- Term Sheet: After a verbal agreement is reached, a term sheet or contract is drawn up outlining the investment terms, equity percentages, investor rights and protections, governance, and exit strategy.

- Closing: Once the contract is finalized and signed, the deal is officially closed and the investment funds are released for the company's use.

The contribution amount for angel investing can vary widely, with funding levels ranging from as low as $5,000 to as high as $150,000. Sometimes angel investors form a syndicate and can provide funding up to $1 million for select companies.

It is also common for angel investors to not acquire more than a 25% stake in a company. This is because experienced angel investors understand that the founders of the company should hold the majority stake in order to maintain a strong incentive to make the company successful.

Final Thought

Finding an angel investor is not a simple task. Even though there are its pros and cons, it all ends up in how much effort you put to find an angel investor for your company.

With the hard work you put in, we assure you that the work will be well worth it when you discover an angel investor who is eager to invest in your firm. Besides just providing funds for your company, an angel investor's advice and expertise can be very important in moulding your company's success.