Updated 20/7/2022

While inspiration and emotion are constantly present in the field of innovation and startups, most investors would want to think of themselves as rational beings. However, it's well acknowledged that they, too, are human - and business angels are no exception. Hence, some psychological factors may be influencing business investments.

We all know the simple stuff that goes into funding decisions: financials, competition, team, unique selling proposition, the risk versus reward calculations, portfolio diversity and so forth. But what about the less tangible factors that might tip the scales either way?

To respond, this article is a quick rundown of some of the factors that might impact all types of investors, including angel investments.

What Is An Angel Investor

Before we understand the psychological factors influencing business angel investors, here is a short introduction of who they are.

Angel Investors (also known as a private investor, seed investor, or angel funder) is a wealthy individual who invests in small businesses or entrepreneurs in exchange for a share of the company's ownership. Angel investors are individuals that aim to invest at the early stages of startups. These are high-risk funding that typically account for less than 10% of an angel investor's total portfolio.

Most angel investors have extra cash and are looking for a higher rate of return than standard investment possibilities can offer. Angel investors provide more advantageous conditions compared to other lenders since they usually invest in the entrepreneur launching the business rather than the profitability of the business. Angel investors are more interested in assisting startups in their early stages than in making a profit from the company.

Below is a video that further explains what is an angel investor.

Angel Investor Traits

There are many individual angel investors to choose from, but how do you know if the one you've approached is a good business angel? Working with business angels is a once-in-a-lifetime opportunity since they bring so much more to the table than just initial money.

They bring their expertise, strong connections, talents, and experience to the table, which may aid you in your desire to develop your business immensely. And it is already a significant accomplishment for the company. Here are a few distinguishing features of good angel investors that set them apart from the competition in the angel investing market.

Trustworthy

Finding a trustworthy angel investor is crucial since you don't want someone who subsequently uses the privileged information against you and your business, causing troubles for you and your company. Angel investing is more of a two-way street; both the angel investor and the entrepreneur must be trustworthy and dependable. Find a business angel that can help you not just with money, but also with advice and knowledge.

A smart business angel would not only invest in your company but also in you and your team. These are the angels who put a premium on establishing connections with other investors and organisations. They are also looking forward to working with you in the future.

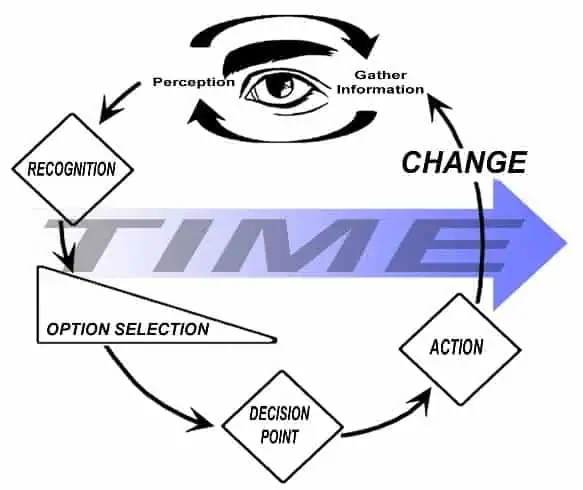

Ability To Make Sound Decisions

When it comes to making a decision, seasoned business angels don't hesitate to get down to the nitty-gritty details. They have a keen eye for talent, and if they perceive promise in you and your concept, they will act quickly to invest in your business. The greatest angel investors make decisions based on the current scenario and provide their judgement right away, rather than putting the entrepreneur through a nerve-wracking wait just to turn him down later.

Not only does this slow down the fundraising process, but it also takes time. Look for an angel whose primary purpose is to assist you in launching your firm and making it successful, rather than anticipating a cut of the profits from your growth.

Supports And Challenge The Entrepreneurs

If you have an angel investor who is also a successful entrepreneur, consider yourself lucky since they have seen it all. Such investors are well-versed in what it takes to build a successful business as well as the obstacles that your firm will face in its early stages. They are familiar with the highs and lows that a new business endeavour must experience in the corporate sector before achieving success.

These are the investors who will push and challenge you every step of the way, as well as offer you advice, when necessary, to help you grow as an entrepreneur during the process of building a successful business. Good business angels are people who are enthusiastic supporters of entrepreneurs, eager to roll up their sleeves or pick up the phone to assist them in difficult times.

Factors Influencing Business Angel Investments

Angel investors, individuals who invest in high-risk enterprises without the help of professional portfolio advisors, are an essential source of early-stage entrepreneurial funding. An angel must decide how much time to spend on due diligence, how much money to contribute, and how much post-investment involvement with entrepreneurs while offering fundings.

They may be particularly influenced by behavioural issues because they are individual investors. Psychologists have discovered that inevitable psychological, cognitive, and emotional biases can affect and influence every person's judgement. Having said that, below are some psychological characteristics that are linked to an investor's financial decision.

Market Size

Angel investors are often interested in solutions that address important issues for broad target markets. When it comes to investment, venture capitalists look for market qualities such as high growth and low competition.

When pitching to investors, your brand will have a stronger competitive advantage if it has a larger and more consistent consumer base. A larger and more consistent customer base will demonstrate that your business has a significant impact on its target market.

If everything else is equal, targeting a huge market is the most effective method to pique investors' interest. Investors will have little reservations about passing on a funding that will struggle to develop beyond a million dollars in the future; yet, an opportunity that elegantly addresses a billion-dollar market will be carefully considered by even the most cautious investor.

Founder of 500 Startups, Dave McClure says “Market size matters because most investors want to know that you’ve got a big business. Bigger is generally better.”

If an investor is familiar with your sector, they are likely to be aware of at least a few competitors for your company, and if they aren't, they may rapidly learn about them. They'll want proof that you have a strong competitive edge that the competitors can't simply overcome before they invest in you.

Reputation

Investing in a company is dangerous financially and in terms of the angel's professional reputation. A positive public image is beneficial to investors since it aids deal flow and making a bad move might tarnish that image. It is debatable how much impact making the wrong funding will have on future business and how much of it is just about pride.

Clearly, one's environment has an impact on one's beliefs: Americans are more optimistic about failure than Europeans, viewing it as a learning opportunity. Investors in America are less concerned about appearing to make a mistake. Most business angels, however, consider reputation to some extent when making an investment decision.

Income Level

You must invest your money in order to receive returns and pursue an increase in your wealth. The quantity of money an investor can invest in startups and businesses is determined by our income levels. It may also have an effect on our level of risk tolerance.

Investors who have a large pool of income are more likely to take risks and make substantial investments than those who have a smaller pool of income. Having a greater income stream can undoubtedly bring up new investment opportunities and patterns.

Founders' Capabilities

An important pointer to consider for investors before investing is the nature of the founders and their capabilities. For business founders, having a passion for their startup is relatively easy to come by. They have faith in the product or service they desire to offer. They believe it is a step forward from previous items or a novel approach to an old problem—in other words, the better mousetrap. But how passionate are they? Are they willing to keep going despite being told “No” over and over?

The decision to invest by investors may be affected by the following capabilities:

- Founders that are more focused on the execution of a startup idea instead of the idea itself.

- Founders who have conducted their market research and understand the needs of the customer to prepare their MVP.

- Hungry to learn and cooperate are skills that investors look for in founders. This guarantees that the founders are dedicated to push their business should things get tough.

Angel investors place a higher value on “investor fit” than venture capital fund managers. Because angel investors typically take a more hands-on approach to the businesses they invest in, they place a high value on “chemistry” between themselves and the founder.

Company Profits

Understanding your risk tolerance level will assist you in managing the risk and anxiety associated with the investment. Risk tolerance is frequently influenced by our risk perception. In this case, investors look in-depth at company profitability and cash flows.

Investors will look for certain key performance indicators in a company's financial accounts before investing. These essential KPIs will be scrutinized by investors, so work with your controller services to track and enhance them. Financial statements for a business are similar to a report card that shows how well your company is doing.

Conclusion

Investment is often guided or influenced by plenty of other factors apart from the aforementioned one. Aspects like family history, personal profile, financial obligations, and others also tend to affect your investment choices. These aforementioned factors do tend to influence the choices, but it’s still in the hands of the investor to build a solid investment portfolio based on the need and profile of the investor.

Angel investors bring a specific attitude to the table before ever looking at a single company pitch deck. As a result, what's going on in the investment sector can lead to different judgments at any particular time.

Therefore, understanding the psychological factors influencing angel investors' decision-making process will be able to help you to tell the difference and secure funding from the right business angel who will assist you in all your endeavours to make your new company a great success.

References

Factors Influencing Business Angel Investments

Psychological Factors Influencing Business Angel Investments