This article talks about the Venture Capital Thailand ecosystem where it answers the basic questions of what is venture capital, why do companies require a venture capitalist to listing down venture capital companies in Thailand. Lastly, we provide several tips in helping you find the right venture capital firm for your company.

What is Venture Capital?

A venture capitalist or VC is an investor who either gives funding to startup ventures or supports small organisations that desire to expand but do not have access to equities markets. Venture capitalists are willing to invest in companies that fit in those criteria because they have the potential to earn a huge return on their investments if these companies end up being successful.

Some of the aspects that venture capitalists look for are strong management team, large potential market and a unique product or service with a strong competitive advantage. Also, they seek for opportunities that they are familiar with, and the opportunity to possess an enormous stake of the business so that they can influence its direction. Here at NEXEA, we are interested in tech start-ups as this is our expertise.

Why do companies require a Venture Capitalist?

You may be thinking, "Why do I need a VC? or What kind of value can a VC bring in to my business?" Well, it is true that not many Venture Capitalists are able to bring in much value. This is because they are too busy managing 10-20 companies per partner as well as managing their Limited Partners (investors).

Nevertheless, any VC is more than just providing funds. Since they will become part the owner of your business, they would want to see the company grow as well by providing any necessary help succeed a startup. At NEXEA, we offer to our invested startups ex-entrepreneurs who can guide young entrepreneurs with their business as well as provide some advice to avoid making the mistakes that they have made in the past.

For entrepreneurs and CEO of rapidly growing companies, most of them are inexperienced and they do not always know what to look out for. That is why a lot of startups need venture capitalist and in order to lessen the risk for a venture capitalist, it is important that startup founders are being connected to industry experts.

"You will need to do the due diligence in order to really understand if a VC is going to add value in addition to capital. This value can be introductions for potential partnerships, their network of other successful founders or the infrastructure the firm brings."

Venture Capital Thailand - Environment

Thailand is the second largest ASEAN economy with an expected GDP of 528 USD billion by the end of 2020. Having relatively skilled labor force as well as cheaper business and living costs in comparison to established venture capital ecosystem like Singapore, the Kingdom is in a transition from an industrial and export-oriented economy to a service and knowledge-based economy.

The Thai government has enforced their Thailand 4.0 strategy back in 2018 in order to encourage future growth industries ranging from next-generation automotive, food for the future to digital, developing highly skilled labour force as well as promoting innovation. With such a strategy, the government hopes that it will provide the economy with a comprehensive push towards digitalisation through its 20-year national Digital Economy Masterplan - boosting the ecosystem of venture capital Thailand even more.

Very Early Stage Investment Firms in Venture Capital Thailand (<US$1m)

- 500 TukTuks

- Alpha Founders Capital

- Ardent Capital

- BangkokVC

- Beacon Venture Capital

- Inspire Group (Inspire Ventures)

- InVent

- K2 Venture Capital

- Muangthai Capital

- SCB10X

- Sparx Ventures

- Stonelotus Capital

- TVCA

Later Stage Investment Firms in Venture Capital Thailand (>US$1m)

- AddVentures

- Galaxy Ventures

- InVent

- Krungsri Finnovate

- Quona Capital

- Reapra

- SCB10X

- The Quant Group

- Tracxn

- VNET Capital

Finding the right venture capital firm for your company

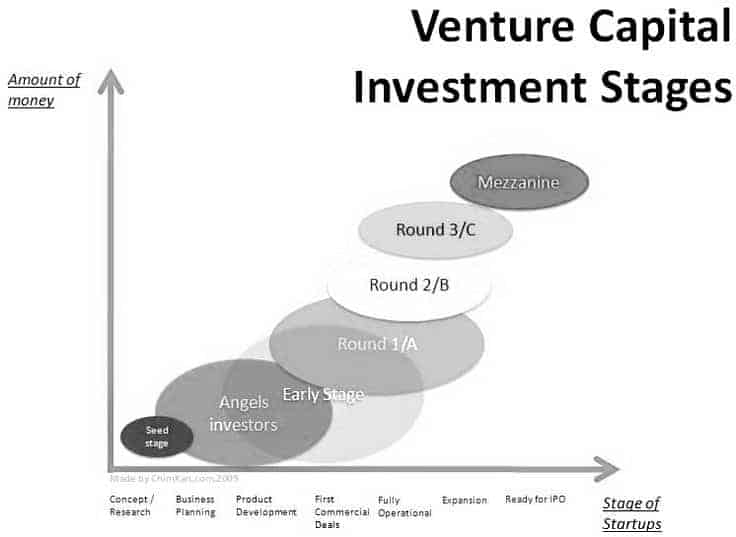

The first step to finding the right venture capital firm for your company is to know what stage your company is at right now. After figuring out the stage of your business, you can start applying to venture capital. Remember to prepare an informing pitch deck in order for you to have a higher chance of getting funded when pitching your company. Here are some examples of how a pitch deck should look like made by other successful companies.

Secondly, in order to find the best VCs, you should look out for their infrastructure and "speciality". It is best to find VCs that specialised in the industry that your company is in because you will then be provided with the best support tailored to your needs. Venture Capitalists like First Round Capital, Y Combinator or 500 Startups have a dedicated team of marketers, recruiters, experts and other necessary resources to bring into the company that they invest in. At NEXEA, we have dedicated lawyers, regional level CFOs, a lot of world-class CEOs that mentor and invest in startups as well as other supportive infrastructure in place.

Lastly, it is important to set some boundaries for yourself. If your company are one of those companies that are founded by multiple people, it is very important that there is a mutual understanding between each other on what you are willing to give away. Giving away is not only in terms of equity but in time as well. When a venture capitalist invests in your firm the whole working dynamic can change as you hopefully transition your company into a fast-growing firm.

Steps to finding the right venture capital firm

Besides that, here are some additional tips on how to find the right venture capital firm for your company. We've made it into several easy steps where you can easily implement through the list of companies in Venture Capital Thailand to see which ones fit well with your firm's needs.

-

Geography: The location of your startup should be in the region which the VC is operating in. At NEXEA, we invest in tech startups in the SEA region. However, for some programs, we prefer companies that are based in Malaysia as our HQ is located in Kuala Lumpur. Thus, do some research on the VC to know if your location is applicable to them.

-

Sector: Usually VC's only invest in companies that operate in fields of business where they have a lot of experience in. That goes to show why at NEXEA we invest in tech startups because we have a lot of expertise in tech-related companies. For us, a company which has a traditional business model would not be applicable.

-

Portfolio conflict: A VC will typically not invest in a company which is a direct competitor of a company in their portfolio. So before applying to a VC, you should find out about their portfolio and see if you can identify any direct competitors to your company.

-

Involvement: There are two types of VC firms. The first group are the VCs that are very involved. These type of VCs typically do not invest in a lot of companies as they do not have the time to be highly involved in all the companies that they invest in. The second group of VCs are the opposite where these firms are not very involved in the companies they invest in. This is usually due to the number of startups they invest in. They simply don't have the time to have a meeting with each startup every week.

At NEXEA, we are highly involved with each startup due to our startup mentor network. For a startup, it is essential to know from each founder whether they prefer a highly involved VC or less involved VC.

- Fund size: A startup has to know beforehand what series a VC invest in. It does not make sense to apply for a pre-seed startup while you are doing your A-series. Furthermore, if you plan beforehand that you want to do your B-series and A series with the same VC to ensure good collaboration, you should check whether or not they invest in both series.

Venture Capital Thailand Summary

The number of venture capital firms in Thailand has been growing rapidly which is reflected by the growing number of startups that are starting and growing in the region. For startups wanting a venture capital, it is crucial to first identify the stage of their company is as well as setting boundaries for the company in order to find the right expertise needed for the company.

We hope this article has provided you with a head start on what you should be looking for in a venture capitalist. Let us know in the comments section if there is anything else that you would like to know more about venture capital Thailand.

If you'd like to know more about venture capitalists in other Southeast Asian countries such as Malaysia, Vietnam, Indonesia, the Philippines and Singapore, check out the Southeast Asian Venture Capital article.

Learn More About NEXEA Venture Capital & How We Provide More Than Just Money

References:

- https://blog.edx.org/5-criteria-identify-right-venture-capitalists/

- https://www.inc.com/bubba-page/5-steps-to-finding-the-right-venture-capital-investor.html

- https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#1d3377831b14

This article talks about the Venture Capital Vietnam ecosystem where it answers the basic questions of what is venture capital, why do companies require a venture capitalist to listing down venture capital companies in Vietnam. Lastly, we provide several tips in helping you find the right venture capital firm for your company.

What is Venture Capital?

A venture capitalist or VC is an investor who either gives funding to startup ventures or supports small organisations that desire to expand but do not have access to equities markets. Venture capitalists are willing to invest in companies that fit in those criteria because they have the potential to earn a huge return on their investments if these companies end up being successful.

Some of the aspects that venture capitalists look for are strong management team, large potential market and a unique product or service with a strong competitive advantage. Also, they seek for opportunities that they are familiar with, and the opportunity to possess an enormous stake of the business so that they can influence its direction. Here at NEXEA, we are interested in tech start-ups as this is our expertise.

Why do companies require a Venture Capitalist?

You may be thinking, "Why do I need a VC? or What kind of value can a VC bring in to my business?" Well, it is true that not many Venture Capitalists are able to bring in much value. This is because they are too busy managing 10-20 companies per partner as well as managing their Limited Partners (investors).

Nevertheless, any VC is more than just providing funds. Since they will become part the owner of your business, they would want to see the company grow as well by providing any necessary help succeed a startup. At NEXEA, we offer to our invested startups ex-entrepreneurs who can guide young entrepreneurs with their business as well as provide some advice to avoid making the mistakes that they have made in the past.

For entrepreneurs and CEO of rapidly growing companies, most of them are inexperienced and they do not always know what to look out for. That is why a lot of startups need venture capitalist and in order to lessen the risk for a venture capitalist, it is important that startup founders are being connected to industry experts.

"You will need to do the due diligence in order to really understand if a VC is going to add value in addition to capital. This value can be introductions for potential partnerships, their network of other successful founders or the infrastructure the firm brings."

Venture Capital Vietnam - Environment

The ecosystem of Venture Capital Vietnam has been developing since 2004. With the new surge of Vietnamese companies from industries ranging from trucking to fintech and facial recognition has attracted an exponential number of venture capital money, making Vietnam one of Asia's youngest and fastest-growing economies. According to the World Bank, Vietnam's per capita GDP has increased tenfold over the past 30 years.

Currently, one of the big themes that Vietnamese and other Asian venture capitalists are attracted to is the regional expansion of Vietnam's growing companies as well as acquiring any business idea that revolves around young consumers or digital transformation. It is no surprise that Vietnam is pulling ahead of Thailand, its more developed regional neighbour at the rate that the country is growing.

Very Early Stage Investment Firms in Venture Capital Vietnam (<US$1m)

- CyberAgent Capital

- DFJ VinaCapital

- Dragon Capital

- FPT Ventures

- Mekong Capital

- Nova Founders

- Prosperous Vietnam Investment

- Ridge Venture

- VinaCapital Ventures

Later Stage Investment Firms in Venture Capital Vietnam (>US$1m)

- 500 Startups

- CyberAgent Capital

- Prosperous Vietnam Investment

- Vietnam Innovative Startups Accelerator

Finding the right venture capital firm for your company

The first step to finding the right venture capital Vietnam firm for your company is to know what stage your company is at right now. After figuring out the stage of your business, you can start applying to venture capital. Remember to prepare an informing pitch deck so that you have a higher chance of getting funded when pitching your company. Here are some examples of how a pitch deck should look like made by other successful companies.

Secondly, in order to find the best VCs, you should look out for their infrastructure and "speciality". It is best to find VCs that specialised in the industry that your company is in because you will then be provided with the best support tailored to your needs. Venture Capitalists like First Round Capital, Y Combinator or 500 Startups have a dedicated team of marketers, recruiters, experts and other necessary resources to bring into the company that they invest in. At NEXEA, we have dedicated lawyers, regional level CFOs, a lot of world-class CEOs that mentor and invest in startups as well as other supportive infrastructure in place.

Lastly, it is important to set some boundaries for yourself. If your company are one of those companies that are founded by multiple people, it is very important that there is a mutual understanding between each other on what you are willing to give away. Giving away is not only in terms of equity but in time as well. When a venture capitalist invests in your firm the whole working dynamic can change as you hopefully transition your company into a fast-growing firm.

Steps to finding the right venture capital firm

Besides that, here are some additional tips on how to find the right venture capital firm for your company. We've made it into several easy steps where you can easily implement through the list of companies in Venture Capital Vietnam to see which ones that fit well with your firm's needs.

-

Geography: The location of your startup should be in the region which the VC is operating in. At NEXEA, we invest in tech startups in the SEA region. However, for some programs, we prefer companies that are based in Malaysia as our HQ is located in Kuala Lumpur. Thus, do some research on the VC to know if your location is applicable to them.

-

Sector: Usually VC's only invest in companies that operate in fields of business where they have a lot of experience in. That goes to show why at NEXEA we invest in tech startups because we have a lot of expertise in tech-related companies. For us, a company which has a traditional business model would not be applicable.

-

Portfolio conflict: A VC will typically not invest in a company which is a direct competitor of a company in their portfolio. So before applying to a VC, you should find out about their portfolio and see if you can identify any direct competitors to your company.

-

Involvement: There are two types of VC firms. The first group are the VCs that are very involved. These type of VCs typically do not invest in a lot of companies as they do not have the time to be highly involved in all the companies that they invest in. The second group of VCs are the opposite where these firms are not very involved in the companies they invest in. This is usually due to the number of startups they invest in. They simply don't have the time to have a meeting with each startup every week.

At NEXEA, we are highly involved with each startup due to our startup mentor network. For a startup, it is essential to know from each founder whether they prefer a highly involved VC or less involved VC.

- Fund size: A startup has to know beforehand what series a VC invest in. It does not make sense to apply for a pre-seed startup while you are doing your A-series. Furthermore, if you plan beforehand that you want to do your B-series and A series with the same VC to ensure good collaboration, you should check whether or not they invest in both series.

Venture Capital Vietnam Summary

The number of venture capital firms in Vietnam has been growing rapidly which is reflected by the growing number of startups that are starting and growing in the region. For startups wanting a venture capital, it is crucial to first identify the stage of their company is as well as setting boundaries for the company in order to find the right expertise needed for the company.

We hope this article has provided you with a head start on what you should be looking for in a venture capitalist. Let us know in the comments section if there is anything else that you would like to know more about venture capital Vietnam.

If you'd like to know more about venture capitalists in other Southeast Asian countries such as Malaysia, Singapore, Thailand, Indonesia and the Philippines, check out the Southeast Asian Venture Capital article.

Learn More About NEXEA Venture Capital & How We Provide More Than Just Money

References:

- https://www.ft.com/content/cbe426bc-adc4-11e9-8030-530adfa879c2

- https://medium.com/datadriveninvestor/an-overview-of-the-venture-capital-industry-in-vietnam-1056a03a650

- https://e27.co/indonesia-singapore-vietnam-the-most-attractive-fintech-hubs-in-sea-study-20200907/

- https://blog.edx.org/5-criteria-identify-right-venture-capitalists/

- https://www.inc.com/bubba-page/5-steps-to-finding-the-right-venture-capital-investor.html

- https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#1d3377831b14

This article talks about the Venture Capital Singapore ecosystem where it answers the basic questions of what is venture capital, why do companies require a venture capitalist to listing down venture capital companies in Singapore. Lastly, we provide several tips in helping you find the right venture capital firm for your company.

What is Venture Capital?

A venture capitalist or VC is an investor who either gives funding to startup ventures or supports small organisations that desire to expand but do not have access to equities markets. Venture capitalists are willing to invest in companies that fit in those criteria because they have the potential to earn a huge return on their investments if these companies end up being successful.

Some of the aspects that venture capitalists look for are strong management team, large potential market and a unique product or service with a strong competitive advantage. Also, they seek for opportunities that they are familiar with, and the opportunity to possess an enormous stake of the business so that they can influence its direction. Here at NEXEA, we are interested in tech start-ups as this is our expertise.

Why do companies require a Venture Capitalist?

You may be thinking, "Why do I need a VC? or What kind of value can a VC bring in to my business?" Well, it is true that not many Venture Capitalists are able to bring in much value. This is because they are too busy managing 10-20 companies per partner as well as managing their Limited Partners (investors).

Nevertheless, any VC is more than just providing funds. Since they will become part the owner of your business, they would want to see the company grow as well by providing any necessary help succeed a startup. At NEXEA, we offer to our invested startups ex-entrepreneurs who can guide young entrepreneurs with their business as well as provide some advice to avoid making the mistakes that they have made in the past.

For entrepreneurs and CEO of rapidly growing companies, most of them are inexperienced and they do not always know what to look out for. That is why a lot of startups need venture capitalist and in order to lessen the risk for a venture capitalist, it is important that startup founders are being connected to industry experts.

"You will need to do the due diligence in order to really understand if a VC is going to add value in addition to capital. This value can be introductions for potential partnerships, their network of other successful founders or the infrastructure the firm brings."

Venture Capital Singapore - Environment

What is the environment like in venture capital Singapore? It is no secret that Singapore originates hundreds and thousands of new startups as a result of their government policies. This makes the venture capital landscape in Singapore is densely populated. Singapore is popular for being one of the largest tech hubs in Southeast Asia (SEA) in terms of VC investments.

According to a study by MDI ventures, Finc Capital and Dealroom.co, VC investments into the sector has grown seven-fold since 2015 and the value of all fintech startups in Singapore is currently US$108 billion in the year 2020. With that much said, Singapore is still one of the top Southeast Asian countries to have headquarters because of the standardised processes, high quality of human capital as well as the educated workforce in the region.

Very Early Stage Investment Firms in Venture Capital Singapore (<US$1m)

Later Stage Investment Firms in Venture Capital Singapore (>US$1m)

- AA Ventures

- Angel Central

- B Capital Group

- C31 / CapitaLand Limited

- Cento (ex-DMP)

- Coent Venture Partners

- DBS Ventures

- Expara

- Far East Ventures

- Farsight Capital

- Golden Equator

- Golden Gate Ventures

- Gree Ventures

- Innosight Ventures

- InseadAlum

- Insignia Ventures Partners

- Jungle Ventures

- KK Fund

- Life.SREDa

- Openspace Ventures (ex-NSI)

- Play Ventures

- Qualgro

- REAPRA (Shuhei Morofuji)

- SBI Ven Capital

- SC Ventures

- SEAVI ADVENT

- Seed Plus

- Segnel Ventures

- SequoiaCapital Singapore

- SG Innovate

- Singtel Innov8

- SPH Ventures

- Spiral Ventures

- SPRING Seeds

- ST Telemedia

- Tanglin Venture Partners

- The Mediapreneur

- Tin Men Capital

- TNB Ventures

- TNF Ventures

- UOB Venture Management

- Vertex Ventures

- Vickers Venture Partners

- VisVires New Protein

- Wavemaker Partners

Finding the right venture capital firm for your company

The first step to finding the right venture capital firm for your company is to know what stage your company is at right now. After figuring out the stage of your business, you can start applying to venture capital. Remember to prepare an informing pitch deck in order for you to have a higher chance of getting funded when pitching your company. Here are some examples of how a pitch deck should look like made by other successful companies.

Secondly, in order to find the best VCs, you should look out for their infrastructure and "speciality". It is best to find VCs that specialised in the industry that your company is in because you will then be provided with the best support tailored to your needs. Venture Capitalists like First Round Capital, Y Combinator or 500 Startups have a dedicated team of marketers, recruiters, experts and other necessary resources to bring into the company that they invest in. At NEXEA, we have dedicated lawyers, regional level CFOs, a lot of world-class CEOs that mentor and invest in startups as well as other supportive infrastructure in place.

Lastly, it is important to set some boundaries for yourself. If your company are one of those companies that are founded by multiple people, it is very important that there is a mutual understanding between each other on what you are willing to give away. Giving away is not only in terms of equity but in time as well. When a venture capitalist invests in your firm the whole working dynamic can change as you hopefully transition your company into a fast-growing firm.

Steps to finding the right venture capital firm

Besides that, here are some additional tips on how to find the right venture capital firm for your company. We've made it into several easy steps where you can easily implement through the list of companies in Venture Capital Singapore to see which ones fit well with your firm's needs.

-

Geography: The location of your startup should be in the region which the VC is operating in. At NEXEA, we invest in tech startups in the SEA region. However, for some programs, we prefer companies that are based in Malaysia as our HQ is located in Kuala Lumpur. Thus, do some research on the VC to know if your location is applicable to them.

-

Sector: Usually VC's only invest in companies that operate in fields of business where they have a lot of experience in. That goes to show why at NEXEA we invest in tech startups because we have a lot of expertise in tech-related companies. For us, a company which has a traditional business model would not be applicable.

-

Portfolio conflict: A VC will typically not invest in a company which is a direct competitor of a company in their portfolio. So before applying to a VC, you should find out about their portfolio and see if you can identify any direct competitors to your company.

-

Involvement: There are two types of VC firms. The first group are the VCs that are very involved. These type of VCs typically do not invest in a lot of companies as they do not have the time to be highly involved in all the companies that they invest in. The second group of VCs are the opposite where these firms are not very involved in the companies they invest in. This is usually due to the number of startups they invest in. They simply don't have the time to have a meeting with each startup every week.

At NEXEA, we are highly involved with each startup due to our startup mentor network. For a startup, it is essential to know from each founder whether they prefer a highly involved VC or less involved VC.

- Fund size: A startup has to know beforehand what series a VC invest in. It does not make sense to apply for a pre-seed startup while you are doing your A-series. Furthermore, if you plan beforehand that you want to do your B-series and A series with the same VC to ensure good collaboration, you should check whether or not they invest in both series.

Venture Capital Jobs Singapore

During the first nine months of 2019, there was a 25% increase in investments in early-stage deep tech start-ups, compared to the same period in 2018. Venture capital Singapore has an expanding job scope because of the past successes of startups. Investment is likely to remain high because of the government's efforts to promote Singapore as the region's innovation and start-up hub. Venture Capital Singapore investments climbed 36% year-on-year to hit SGD13.4 billion during the first nine months of 2019. Digital tech companies received 93.2% of the funds.

The venture capital Singapore industry not only offers full-time jobs but is also broadening its scope by hiring interns and trainees as well. A brief look into the job description for an intern at venture capital in Singapore would have the following guidelines: you will perform industry landscape evaluations and propose new investments targets, conduct due diligence and analysis of selected target companies and so on. Venture capital Singapore jobs in full-time contracts also includes jobs like investment managers, analysts, directors and so on.

Venture capital Singapore industry advertises their jobs on various platforms, the most popular one being LinkedIn with new updated listings every day. Followed by other platforms such as Glassdoor and Job Street Singapore to open the world of venture capital jobs Singapore to those interested.

Venture Capital Singapore Summary

Venture capital Singapore has been growing rapidly which is reflected by the growing number of firms and startups that are starting and growing in the region. For startups wanting a venture capital, it is crucial to first identify the stage of their company is as well as setting boundaries for the company in order to find the right expertise needed for the company. This is not just the rule for venture capital Singapore, but generically.

We hope this article has provided you with a head start on what you should be looking for in a venture capitalist, particularly in regards to venture capital Singapore. Let us know in the comments section if there is anything else that you would like to know more about venture capital Singapore.

If you'd like to know more about venture capitalists in other Southeast Asian countries such as Malaysia, Vietnam, Indonesia, Thailand and the Philippines, check out the Southeast Asian Venture Capital article.

Learn More About NEXEA Venture Capital & How We Provide More Than Just Money

References:

- https://e27.co/indonesia-singapore-vietnam-the-most-attractive-fintech-hubs-in-sea-study-20200907/

- https://blog.edx.org/5-criteria-identify-right-venture-capitalists/

- https://www.inc.com/bubba-page/5-steps-to-finding-the-right-venture-capital-investor.html

- https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#1d3377831b14

This article talks about the Venture Capital Philippines ecosystem where it answers the basic questions of what is venture capital, why do companies require a venture capitalist to listing down venture capital companies in Philippines. Lastly, we provide several tips in helping you find the right venture capital firm for your company.

What is Venture Capital?

A venture capitalist or VC is an investor who either gives funding to startup ventures or supports small organisations that desire to expand but do not have access to equities markets. Venture capitalists are willing to invest in companies that fit in those criteria because they have the potential to earn a huge return on their investments if these companies end up being successful.

Some of the aspects that venture capitalists look for are strong management team, large potential market and a unique product or service with a strong competitive advantage. Also, they seek for opportunities that they are familiar with, and the opportunity to possess an enormous stake of the business so that they can influence its direction. Here at NEXEA, we are interested in tech start-ups as this is our expertise.

Why do companies require a Venture Capitalist?

You may be thinking, "Why do I need a VC? or What kind of value can a VC bring in to my business?" Well, it is true that not many Venture Capitalists are able to bring in much value. This is because they are too busy managing 10-20 companies per partner as well as managing their Limited Partners (investors).

Nevertheless, any VC is more than just providing funds. Since they will become part the owner of your business, they would want to see the company grow as well by providing any necessary help succeed a startup. At NEXEA, we offer to our invested startups ex-entrepreneurs who can guide young entrepreneurs with their business as well as provide some advice to avoid making the mistakes that they have made in the past.

For entrepreneurs and CEO of rapidly growing companies, most of them are inexperienced and they do not always know what to look out for. That is why a lot of startups need venture capitalist and in order to lessen the risk for a venture capitalist, it is important that startup founders are being connected to industry experts.

"You will need to do the due diligence in order to really understand if a VC is going to add value in addition to capital. This value can be introductions for potential partnerships, their network of other successful founders or the infrastructure the firm brings."

Venture Capital Philippines - Environment

The ecosystem of venture capital Philippines has been growing steadily over the last three years. With the recent implementation of Innovative Startup Act or Republic Act 11337 as well as the Revised Corporation Code by the Philippine government, this shows the support of the local government towards promoting entrepreneurship.

Currently, the top successful startups are within the industries of financial technology (Fintech), e-commerce as well as medical and healthcare technology. As local regulatory are slowly changing (in-favour for entrepreneurs), the majority of venture capitalists is looking forward to the growth prospects of the Philippine startups.

Very Early Stage Investment Firms in Venture Capital Philippines (<US$1m)

- ATLUS Digital Capital

- First Asia Venture Capital

- Future Now Ventures

- GIDEON Venture Capital

- Gobi-Core Philippine Fund

- Kickstart Ventures

- Narra Venture Capital

Later Stage Investment Firms in Venture Capital Philippines (>US$1m)

- ATLUS Digital Capital

- GIDEON Venture Capital

- Kickstart Ventures

- Narra Venture Capital

- Venturecapital Holdings

Finding the right venture capital firm for your company

The first step to finding the right venture capital firm for your company is to know what stage your company is at right now. After figuring out the stage of your business, you can start applying to venture capital. Remember to prepare an informing pitch deck in order for you to have a higher chance of getting funded when pitching your company. Here are some examples of how a pitch deck should look like made by other successful companies.

Secondly, in order to find the best VCs, you should look out for their infrastructure and "speciality". It is best to find VCs that specialised in the industry that your company is in because you will then be provided with the best support tailored to your needs. Venture Capitalists like First Round Capital, Y Combinator or 500 Startups have a dedicated team of marketers, recruiters, experts and other necessary resources to bring into the company that they invest in. At NEXEA, we have dedicated lawyers, regional level CFOs, a lot of world-class CEOs that mentor and invest in startups as well as other supportive infrastructure in place.

Lastly, it is important to set some boundaries for yourself. If your company are one of those companies that are founded by multiple people, it is very important that there is a mutual understanding between each other on what you are willing to give away. Giving away is not only in terms of equity but in time as well. When a venture capitalist invests in your firm the whole working dynamic can change as you hopefully transition your company into a fast-growing firm.

Steps to finding the right venture capital firm

Besides that, here are some additional tips on how to find the right venture capital firm for your company. We've made it into several easy steps where you can easily implement through the list of companies in Venture Capital Philippines to see which ones that fit well with your firm's needs.

-

Geography: The location of your startup should be in the region which the VC is operating in. At NEXEA, we invest in tech startups in the SEA region. However, for some programs, we prefer companies that are based in Malaysia as our HQ is located in Kuala Lumpur. Thus, do some research on the VC to know if your location is applicable to them.

-

Sector: Usually VC's only invest in companies that operate in fields of business where they have a lot of experience in. That goes to show why at NEXEA we invest in tech startups because we have a lot of expertise in tech-related companies. For us, a company which has a traditional business model would not be applicable.

-

Portfolio conflict: A VC will typically not invest in a company which is a direct competitor of a company in their portfolio. So before applying to a VC, you should find out about their portfolio and see if you can identify any direct competitors to your company.

-

Involvement: There are two types of VC firms. The first group are the VCs that are very involved. These type of VCs typically do not invest in a lot of companies as they do not have the time to be highly involved in all the companies that they invest in. The second group of VCs are the opposite where these firms are not very involved in the companies they invest in. This is usually due to the number of startups they invest in. They simply don't have the time to have a meeting with each startup every week.

At NEXEA, we are highly involved with each startup due to our startup mentor network. For a startup, it is essential to know from each founder whether they prefer a highly involved VC or less involved VC.

- Fund size: A startup has to know beforehand what series a VC invest in. It does not make sense to apply for a pre-seed startup while you are doing your A-series. Furthermore, if you plan beforehand that you want to do your B-series and A series with the same VC to ensure good collaboration, you should check whether or not they invest in both series.

Venture Capital Philippines Summary

The Philippine venture capital ecosystem is slowly growing as more and more startups are expected to increase in the succeeding years. With that said, for startups wanting a venture capital, it is crucial to first identify the stage of their company is as well as setting boundaries for the company in order to find the right expertise needed for the company.

We hope this article has provided you with a head start on what you should be looking for in a venture capitalist. Let us know in the comments section if there is anything else that you would like to know more about venture capital Philippines.

If you'd like to know more about venture capitalists in other Southeast Asian countries such as Malaysia, Vietnam, Thailand, Indonesia and Singapore, check out the Southeast Asian Venture Capital article.

Learn More About NEXEA Venture Capital & How We Provide More Than Just Money

References:

- https://www.esquiremag.ph/money/industry/startups-in-the-philippines-a00304-20200225-lfrm

- https://blog.edx.org/5-criteria-identify-right-venture-capitalists/

- https://www.inc.com/bubba-page/5-steps-to-finding-the-right-venture-capital-investor.html

- https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#1d3377831b14

Southeast Asia Growing in Popularity

Southeast Asia came from far in its aim to be an attractive investment area. Over the past years the region experienced a strong economic growth. Since 2012, Southeast Asian startups were able to put in more money than the year before. In a market with over 600 million consumers together with the world's fastest growing internet market, Southeast Asia's time has come now.

The change affects startups and investors in this region positively. With the ecosystem maturing, larger capital is flowing in and out for both parties in this increasingly competitive market. More opportunities are arising for upstream, downstream and in previously untouched sectors due to the lack of capital and infrastructure. Venture capitalists are expanding their investment range and are situated in a more competitive environment in which they have to compete to get into deals. The region acknowledges nine unicorns with several others coming up. Those startups are increasingly raising bigger fund to keep their trendline in steady growth.

Chinese tech giants and Silicon Valley majors are currently in a battle with each other and with regional managers for a slice of this increasing market. No surprise, knowing that the internet economy's expectation of 2017 was to hit USD 50 billion and will exceed 200 billion by 2025

Globally, it is clear that Asia overtook Europe when it comes to Private Equity and Venture Capital. From 2016 to 2017, Asia saw a rise of around 13% while Europe has been steady for the past years. North America is the biggest player and takes the lions-share in this sector. Asia's fast-growing economy and advanced technical resources make the area more and more attractive to invest in.

High-growth sectors in Southeast Asia

There are some sectors that show quicker progression than others. Those are high-growth sectors and most of the time sensitive to technology. The following are some sectors which are perceived as attractive markets. Later in this report, you will find them validates by the unicorns resulting from this market.

Fintech

- More than half the adult population of ASEAN is unbanked and lack of access to financial services is acute in rural areas.

- In ASEAN, P2P lending is forecast by Allied Market Research to grow at a compound annual growth rate of 51.5 percent to 2022.

- The unmet electronic payment needs across four ASEAN markets: Indonesia, Philippines, Cambodia, and Myanmar is in total more than USD 180 billion

- In these four markets, the credit market currently serviced by the informal sector is worth approximately USD 80 billion.

E-commerce

- E-commerce sales of first-hand goods were estimated to have reached USD 10.9 billion in GMV in 2017, up from USD 5.5 billion in 2015, growing at a 41% CAGR.

- The overall regional e-commerce market is expected to hit USD 88 billion by 2025.

- With an average of 140 minutes per month per person spend on e-commerce platforms, SEA outperforms the US who spends on an average of 80 minutes per person.

Transport

- Transport demand in Asia had increased on average four times per country since in 1980 ride-hailing services in Southeast Asia were expected to have reached USD 5.1 billion in 2017, double the USD 2.5 billion market size in 2015.

- The overall ride-hailing market is projected to touch USD 20.1 billion in GMV by 2025.

- Two of the biggest unicorns in Southeast Asia are ride-hailing majors; Grab and Go-Jek

Other sectors

- Online travel; due to the growth in airline and accommodation industry

- Online media serviced; driven by online ads and gaming

PE/VC investments in Southeast Asia

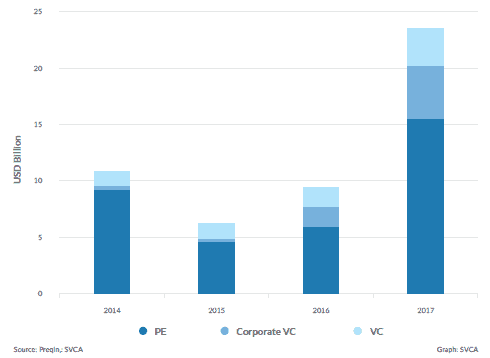

According to Preqin data, private equity and venture capital investments into SEA has nearly tripled its intensity to USD 23.5 billion in 2017, this growth has never been so high in four years. It was driven by a surge in corporate investment as leading companies across Asia co-invested in or led funding rounds for startups in this region. In the end, in seven of the top 10 deals in Southeast Asia for that year, corporate investors were part of it.

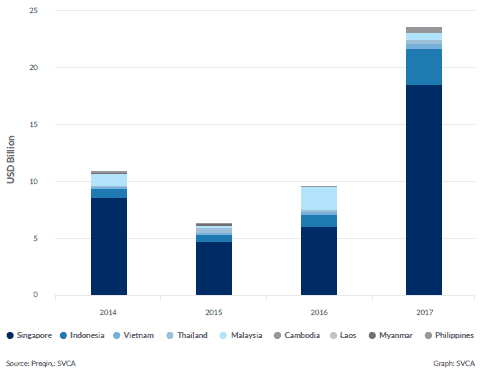

Singapore and Indonesia's role in PE/VC investments in Southeast Asia

The best areas within Southeast Asia for PE and VC investments are Singapore and Indonesia. Together they account for over 90% of the total deal value in 2017. The pro-business policies, tax treaties and a transparent regulatory regime make those countries interesting for fund managers and businesses seeking in SEA. As the fourth-largest economy in the world, Indonesia remains a key market, and significantly untapped at that, for businesses and investors alike. It is also home to four of the region's unicorns: Go-Jek, Tokopedia, Traveloka and Bukalapak.

Vietnam continues to show promise, with investments growing almost three times over the last two years to exceed USD 510 million in 2017.

Private Equity in focus

Private Equity deal value in Southeast Asia increased from USD 9.2 billion to 2014 USD 15.5 billion in 2017. The increasing PE interest to private transactions was the drive for the deal activity in this region. Such deals grew at 113% annually in three years. In one-year privatization deals involving PE firms grow 5.8%, led by the mega GLP deal.

Venture Capital in Focus

Statistics show that investments stood at 0.04% in 2014 and increased to 0.18% in 2016. This shows that the inflow of venture capital in Southeast Asia has been rising in the past years. This rise in investments led to a par with India when it comes to the proportion of GDP and is slowly pursuing China who is currently at 0.3% of GDP.

The amount of investments coming from VC's in Southeast Asia grew 4.8x from USD 1.7 to USD 8 billion (Preqin data). When it comes to seed and series A investments, the region saw an increase from USD 39.5 to 83.1 million. The largest gain was seen at series C and onwards. The investments had an increase from USD 738 million to 6.3 billion. Series A and subsequent financing rounds resulted in 79% of the VC investments for 2017.

Changes in the Southeast Asian sector

Unicorns launch IPO

A startup's exit path is relevant to investors. Still, Southeast Asia does not have relatively that much experiences with big exits. Looking at the fact that most startups right now are unprofitable and burning a lot of cash with the aim to grow, a public market listing is not likely. Yet two Asian unicorns announced their IPO in 2017 which gave the Asian sector hope. Sea Limited, formerly known as Garena, is a hosting platform for popular online games. The company raised USD 884 million in New York on initial public offering. Razer Ltd. is a leading marketer of computer and gaming equipment. The company raised around HKD 4.12 billion at the Hong Kong stock exchange on their IPO.

Larger money inflow

Startups are able to raise more money in their funding rounds nowadays. Unicorns are raising multibillion-dollar rounds. Some examples are Grab - USD 2.5 billion, which was recently followed by another USD 2 billion. Alibaba funded the e-commerce giant Lazada with USD 2 billion which resulted in a total investment of USD 4 billion.

When is The Best Time to Raise Funds for your Startup?

Reference list

MDEC, Southeast Asia 2018 Private Equity and Venture Capital Landscape Report

CB Insights, Venture Capital Funding Report Q3 2018, Available at https://www.cbinsights.com/research/report/venture-capital-q3-2018/

SVCA, Southeast Asia PE & VC: MAY 2018, Available at: https://www.svca.org.sg/editor/source/publication/research%20Publications/ southeast%20Asia%20PE%20%26%VC%20investments%20activity%20may%202018.pdf

Medium, Venture Capital in Asia: Landscape overview, available at: https://medium.com/@bluefuture/venture-capital-in-asia-lanscape-overview-1999ab168cc3

Learn more about venture capital

We will cover a list of Venture Capital Malaysia at the end of this article. I will also cover a few types of venture capital funding including Angel Investment, VC investment, PE investment and so on.

Venture capitalists have become more and more important in the start-up scene, as almost any major technology company launched in recent years has been financed by a VC company.

Aspiring entrepreneurs need to know what VC companies are looking for and how they can best be presented. Hire a good management team, learn how to pitch and show you understand the objectives of VC's exit strategies.

Securing funding is an important part of making your start-up dream come true.

Top Venture Capital in Malaysia

Below are the links to Venture Capital that invest into Malaysian companies by their investment stages. Venture Capital Malaysia List of VCs is to be updated regularly so that inactive venture capital in Malaysia are removed from this list.

Early Stage/ Idea Stage Venture Capital in Malaysia

Investments under RM1,000,000

- NEXEA – Funding from RM50,000 to RM2,000,000

- BizAngel – An Angel Investment group in Malaysia.

- Cradle Fund – We have a co-investment partnership with Cradle Fund.

Seed Stage Venture Capital in Malaysia

Investments above RM1,000,000

- Expara Ventures

- NEXEA – Funding from RM2,000,000 to RM5,000,000

- Netrove Partners

- TinkBig Venture

- Teak Capital + Intres (via the Axiata Digital Fund)

- 500 Startups

Later Stage Investment Venture Capital in Malaysia

Investments above RM2,000,000

- Cradle Seed Ventures Management Pte Ltd

- NEXEA – Funding from RM2,000,000 to RM5,000,000

- MavCap

- Jungle Ventures

- KK Fund

- Sequoia Capital

- Golden Gate Ventures

- Vertex Ventures

- SoftBank Capital

- IMJ Investment Partners (now Spiral Ventures)

- SPH Media Fund

- Asia Venture Group

- Incubate Fund

- Rebright Partners

Venture Capital Malaysia - How Does It Work?

Many venture capital firms in Malaysia either have funds or a holdings company. The funds range from small funds of a few million to billions. The smaller VCs are backed by family offices while the larger funds are typically funded by pension funds, insurance companies, foundations, fund-of-funds, and sovereign wealth funds. They are known as the Limited partners in a fund. General Partners are those managing the fund - but their business title is usually Venture Partner.

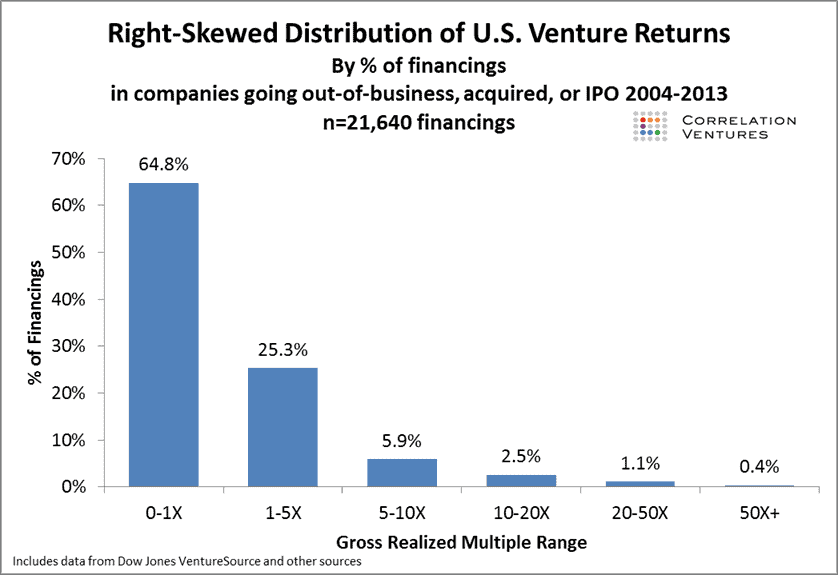

Venture Capital Funds in Malaysia require Startups that have the potential to grow at least 30X within 5-10 years to justify their investments. Below are the typical returns of Startups after 5-10 years. As you can see, those that return more than 30X will need to cover those that lose money (0-1X returns), plus give them enough returns to have at least 20-25% Internal Rate of Return (IRR). The data is from the US since the Malaysian market is just getting started.

To raise money from Venture Capital funds in Malaysia, there are a few key things to watch out for, like your Team, Financials, Traction (Results), Product, Market, and so on. All of these are detailed in our Startup Pitch Deck guide - which also helps Startups to understand how VCs think when they go through your Pitch deck. Do look below as we detail how to secure venture capital investment in the Malaysia & Southeast Asia context.

Understanding VCs: Venture capital companies are based on partnerships aimed solely at making a profitable exit.

VC deals are made throughout the world with the start-up boom. But how exactly does a VC company work?

Venture capital funds in Malaysia is usually structured as a private limited company and sometimes as a limited partnership. The majority of the capital of investment comes from the limited partners (LPs), whilst the General partners (GPs) of the Fund invest the capital on behalf of a limited partner in different projects.

General partners invest money in projects as well. Typical is that if a general partner raises a total of $100 million from limited partners for a particular project, the general partner is likely to raise an additional $1 million to $5 million to demonstrate the VC firm's trust in the project.

Ultimately, venture capital funds in Malaysia have one goal: to make a profitable exit if a funded start-up is either sold or published. A venture capital group will aim to repay its investors with a decent margin for their initial investments. The venture capitalist in Malaysia would naturally like, if possible, to make some money, usually about 20% of the final sale or public valuation, taken from their investors.

A venture capital firm pays for its expenses by retaining a management fee of approximately 2% annually for the entire amount of its original investment.

So, who are you talking to when you want to reach a risk capital venture?

General partners, managing directors and then partners are at the top of the hierarchy. These are the people who decide and define investment strategies. These are the people you want to talk to when you are ready to pitch your great idea.

How to secure venture capital investments in Malaysia

There are a few things to consider when looking to secure venture capital funding in Malaysia. Some Venture Capital firms only do certain stages of funding in different stages of the Startup Lifecycle. Some others only do specific industries - so watch out for those that only do one specific industry, e.g. Fintech Startups only. Some others have a list of Startups that they can invest into - and this depends on the Malaysian VC's mandate or agreement with their Limited Partners/Investors. Venture Capital Malaysia will explain below how to find the right VC alogn with other things to note.

The golden rule of real estate is location, location, location. For venture capitalists, however, it’s management, management, management.

A start-up’s success depends on having a flexible yet skilled management team. It doesn’t matter if the start-up has a great business plan. Realistically, the management team will have to revise that plan, changing directions to respond to market needs and pressures. They will always need to be ready to face unexpected challenges.

That’s why venture capitalist in Malaysia rarely invest in ideas alone. It’s a much safer bet to invest in a great team.

Most successful companies are founded on strong, balanced teams. In fact, when you look at Silicon Valley success stories, a pattern emerges: a successful company often springs from the combination of a visionary leader with a global perspective, a technician with the skills to turn the vision into reality, and a salesperson who can tailor a product to market expectations.

Computer graphic card pioneer 3Dfx was one such company. In the 1990s, the company’s founding trio included a visionary expert on polygonal mathematics, a professor from the Massachusetts Institute of Technology specializing in 3D mathematics, and a senior sales vice president with years of experience.

This is the sort of team a venture capitalist wants. If a company is missing a key position, it’s an indication that the management team might not be well-balanced. What’s more, venture capitalists also question a start-up that can’t attract at least one founder with a solid technical background.

In sum, if the management team doesn’t impress, a venture capitalist in Malaysia might feel the start-up isn’t yet ready for investment.

Check out some Malaysian Startups.

Find the Right Venture Capital in Malaysia by Stage

- Angel Round - usually an RM50k-RM500k round from angel investors or friends and family to go from idea to initial prototype. Many times, this is where Startups also go for Accelerator or Incubator programs.

- Seed Round - usually an RM500k - RM2M round from angel investors and a few early stage VC Firms in Malaysia to establish product-market fit with a series of initial customers

- Series A Round - usually an RM3M-RM10M round from VC Firms in Malaysia to grow the customer base and start to scale

- Series B Round - usually an RM15M+ round from later stage VC Firms in Malaysia to push towards becoming a market leader or expanding overseas

- After the Series B, companies will sometimes raise a Series C, D, E, etc., which can be a mix of both later-stage VC Firms in Malaysia as well as Private Equity firms (out of scope for this answer, but good to research the difference).

Other things to note about Malaysia VCs

Not all venture capitalist in Malaysia invest in everything. For example, many venture capitalists in Malaysia do not invest in e-commerce websites, property projects, Bitcoin mining projects, etc. because these projects rarely have the potential for a 30X return in 5-10 years.

The majority of VCs are looking for businesses that are somehow enhanced by IT - but not necessarily in the IT space. For example, Uber, Airbnb and Foodpanda are all IT-enhanced businesses in the industries of Transport, Accommodation and Logistics, which are in the past very traditional and slow growing businesses.

The IT solutions implemented give these businesses huge scalability in their business models to grow fast enough to give a 30X return within 5-10 years.

When is a good time to raise funds from Venture Capital in Malaysia?

Venture capital Malaysia aims to explain when the right time to raise venture capital. There are a few things to consider before raising from Malaysian venture capital.

This includes things like if it is time to trade ownership equity for capital investment. Should you work hard on becoming cash flow positive before raising money or at least have some revenue before raising money?

It definitely affects your valuation negatively if you have not validated revenues or if you have not become breakeven. Most Startups that approach us are not break-even yet but those that get invested have at least some sort of revenues proven. We work with many Startups that are not yet break-even but have some sort of revenues.

We support them with our network of successful business owners. We understand that taking off is hard, so we look to support Startups as much as we can.

We usually separate Startups with and without revenue, where those with revenue are considered Startups with some sort of Validation and can be valued as much as 4X higher due to the fact that they may have enough revenue to justify the valuation.

For example, some highly scalable startups with RM50k revenue a month can be valued at about 4X Revenues, which is:

50k*12*4=RM2.4M.

If they were to raise RM200k, that would be:

200k/2.4m = 8.3% equity dilution

At NEXEA, we never want to take more than 10-20% of the company because we want the founders to continue to be motivated in the case that more funds are raised later on.

Do you want to hold on to your company forever, or are you willing to let it go after some time and retire young? Does raising capital fit to the vision of the company and yourself, as the founder?

Some founders tend to want to own their business forever, and that is fine. Some others feel that by sharing the pie, the pie actually grows larger. One of the advice that we usually give is to think of the amount of money you need to retire young or to live the rest of your life without financial worries.

For example, if you think you need Rm10M to retire young and live the rest of your life financially free, then you only need to own 20% of a RM50M company by the time you exit. Venture capital funding can help you reach that goal.

To benefit the most from Venture Capitalist in Malaysia

To make the most of Venture Capital in Malaysia, you need to be ready for it. One of the things you will need to ensure is that you have your business plan tested and ready to be executed. One of the biggest mistakes we have seen is a Startup founder raising more than RM10m from Venture Capital and then spending it on the wrong things which brought little to no return to the value of the business. That is where testing/validation comes in to help you avoid mistakes like that.

For example, if you are an idea stage startup, you will want to ensure that there is a market, that your product is needed, and that people are willing to pay for it. Some Startups (even very large ones) have not done so, and are now paying the consequences in the form of down-rounds (valuation drops significantly), being avoided by VCs, or even having the CEO removed by their board members. It is always important to have the fundamentals of any business right so that you can build up your empire fast and steady. A great example of a Startup that validated well is Airbnb where there is a huge global demand, that people need cheaper accommodation, and that people are willing to pay for their fees. A huge factor for their success is that they are disrupting hotels that have traditionally been demanding high prices.

What will Venture Capital Funds in Malaysia typically ask from Startups?

Venture Capital Firms (VCs) in Malaysia look for a few key things in Startups. Of course, they give you money in exchange for your equity, or shares in your business. However, it also includes the Pitch Deck, asking amount, and usually Financials. If the deal starts to get serious, then they will start to do their due-diligence process, which can include calling up your suppliers and customers, checking your financials and accounting, and doing other forms of checks to ensure that they are not investing in something too risky.

The Term Sheet

Venture Capital Malaysia will try to explain the term sheet briefly for the main things to watch out for. The term sheet is an agreement where the VC in Malaysia and the Startup sign before the actual transaction. Startups need to negotiate and sign this upon both parties agreeing to the terms.

Investment Tip: Ensure that you write down the terms discussed and agreed upon so that they do not change by the time it is time to draft the actual term sheet. Do this in the order of importance to not-so-important, so that both parties can save time.

Going deeper, they may require things like Preferred Shares which have additional features and protection like a Liquidation Preference where they are guaranteed a certain return before the common shareholders get anything. Some Venture Capital in Malaysia also practices anti-dilution protection where in the event of a down-round (valuation goes down), they get protected from dilution of their equity. They can also have pro-rata rights and rights of refusal to invest further before an existing or new investor can, to maintain their equity percentage. Malaysian VCs can also ask for the right to be paid dividends, although dividends are usually not required by them. They would want Voting Rights and Board Seats to give them some control over the company in the case that there might be disagreements down the road.

The Pitch Deck

It does not occur to many Startups just how important the pitch deck is to Malaysian VCs. It is the reference point to most important aspects of your business. That is why it is important to understand how a VC in Malaysia thinks when they are looking through your pitch deck. Here is an example pitch deck that does just that.

For example, the Problem & Solution slides are important for venture capital fund managers to understand what problem you are solving, and why it is important to society. It seems that society highly rewards people who solve painful problems (by paying for your service), so this is one of the main things VCs look at when evaluating your business. The problem being solved must be painful enough for people to throw money to solve it. A good example is a food delivery service like RunningMan, where people are willing to pay extra for food to be delivered. It is not the most painful problem all the time, but when you are stuck in a meeting or just had a really tiring day, it makes a lot of sense. Or, it must evoke so much desire that they just end up needing to pay for it. A great example is Spotify, where it is so much more convenient to subscribe and get all the music in the world compared to buying albums or downloading music.

Venture Capitalists don't have time to attend lengthy presentations. Just make it quick!

Venture Capital people are busy. Don't waste the precious time they grant you to secure the financing they need. Have all your materials ready to make a good impression before you meet.

Know that long multi-page business plans are gone for a long time. Investors want to see snappy, concise plans with clear objectives. Entrepreneurs must show that they can launch their ideas on the market and quickly analyse the results – and be prepared to make big changes if necessary.

Today, the VCs deal with a tonne of communications, email or otherwise. They therefore prefer newsletters that deal with major issues in a few words.

You should have an understanding of the financial requirements of your start-up, the talents of your management team, your current development stage and future objectives. The executive summary of your business plan – one or two pages, topics – should cover these key subjects.

You may provide other support documents, such as the so-called investor slide deck, once you are at the door. This is a set of ten slides that address the most important issues for your startup like your competition or your company value proposition.

You also need a financial model to demonstrate your project's viability. Your model should provide financial data for three to five years covering issues, e.g. projected revenue, significant costs and net results. All this should be organised clearly in a table.

A good model accurately describes the factors that determine the profitability of your company. Don't skimp at the details! Don't skimp! For example, you have to consider how many customers you serve if you open a restaurant, fluctuating the price of raw materials, potentially increasing rent costs, etc.

Ask Me Anything

Let me know if you have any further questions. Let me know in the comments below what worries you and I will try to give you a good answer on how Venture Capital in Malaysia works for Startups. Venture Capital Malaysia is a side product Nexea aimed to help educate young Startups on venture capital.

Get Investments from a Leading Venture Capital Firm in Malaysia

If you want to raise funds, feel free to contact us here: Venture Capital - we have one of the fastest deal times and we cover early stage venture capital for Startups in Malaysia. NEXEA adds value like no other VC - because we are also a hybrid Angel Investment Fund. Our Angel Investors who are actual high net worth individuals, businessmen and ex-entrepreneurs are here to mentor and connect you with their networks.