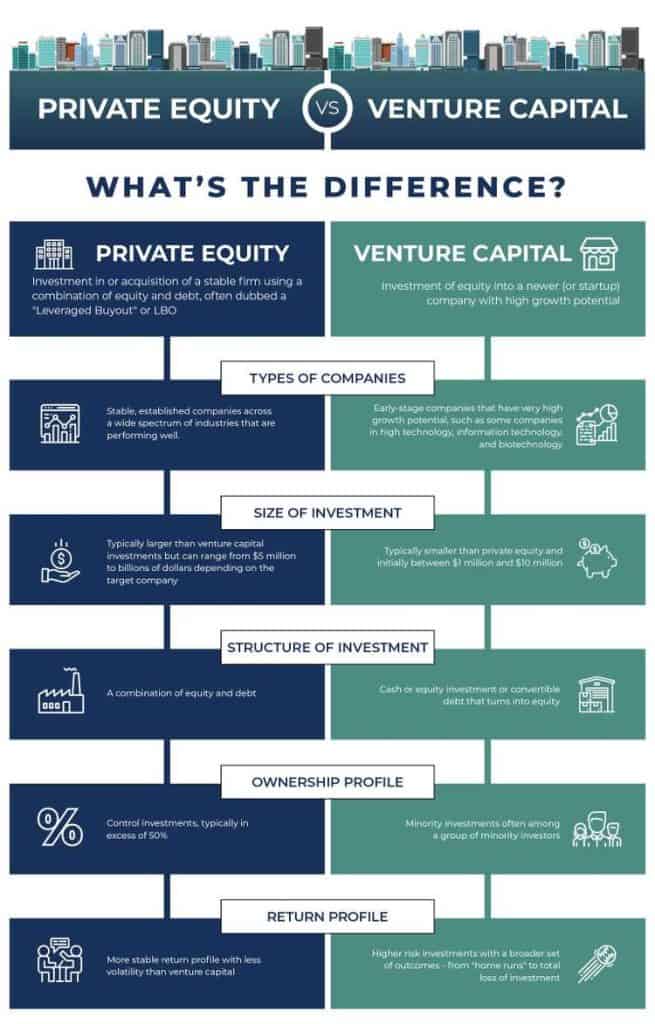

Private equity and venture capital are similar in that they are both types of equity financing where firms invest in companies and exit by selling their investments in equity financing, such as through Initial Public Offerings (IPOs). However, there are significant differences in the types of companies they invest in, the amount of money they commit, and the percentage of equity they claim. Private equity firms typically invest in established companies with larger sums of money and take controlling stakes, while venture capital firms typically invest in early-stage high-growth companies with smaller sums of money and take minority stakes.

Private Equity

Private equity is a form of investment capital that is provided by high-net-worth individuals and firms to private companies, or public companies that are taken private and delisted from public stock exchanges. The investors in private equity buy shares or gain control of the company with the goal of growing the company and ultimately removing them from stock exchanges and making them private. Private equity firms often provide not only capital, but also strategic and operational expertise to the companies they invest in.

Large institutional investors such as pension funds, endowments, insurance companies, and sovereign wealth funds are among the major players in the private equity industry. They invest large sums of money into private equity funds, which are managed by private equity firms. These firms then use the capital from these institutional investors to acquire stakes in private companies or control of public companies with the goal of growing the companies and plan to take the company private and delist it from the stock exchanges. Additionally, there are also large private equity firms funded by a group of accredited investors, which are wealthy individuals or institutions that meet certain financial and investment criteria set by the government. These accredited investors also participate in private equity investments through these large private equity firms.

Private equity firms often target companies that are under performing or facing financial stress and poor management. The goal is to acquire these companies, restructure their debt, and make improvements to the company's operations and management. Private equity firms have the resources and expertise to make significant changes to a company and turn it around. This can include consolidating operations, streamlining the business, and cutting costs. Private equity firm's long-term investment horizon and capital resources enable them to make these big changes that may not be possible for publicly traded companies that are subject to the pressures of meeting quarterly earnings expectations.

Venture Capital

Venture capital is a form of financing that is provided to startup companies and small businesses that have the potential for significant growth and high returns, particularly those that are innovative or are creating new market opportunities. It is typically provided by wealthy individuals, investment banks, and specialized venture capital funds. The funding can be in the form of financial capital, but it can also include technical or managerial expertise. The investors are taking on a higher level of risk compared to traditional investments. If the company does perform well, the potential for above-average returns exists. The trade-off is that there is a risk of losing the invested capital if the company does not meet its potential. Venture capital funding is a popular option for newer companies or those with a short operating history, as it can provide the necessary capital to grow and expand, especially if they do not have access to other forms of funding such as capital markets or bank loans. However, the downside for the company is that the venture capital investors will often obtain equity in the company, giving them a voice in company decisions and a risk if the company may not deliver on its potential.

Venture capitalists offer more than just financial funding for new companies. They can provide valuable resources and connections for startups. They have valuable experience gained from participating in board meetings for their investments, which can become a valuable resource for companies to lean on. Additionally, venture capitalists can become a driving force for sales and fundraising campaigns, as they have a vested interest in the success of the investment. They also have powerful connections to senior professionals with specialist skills, which can assist startups in launching and expanding their business operations and access the expertise they need to grow and succeed.

The Similarities: Private Equity vs Venture Capital

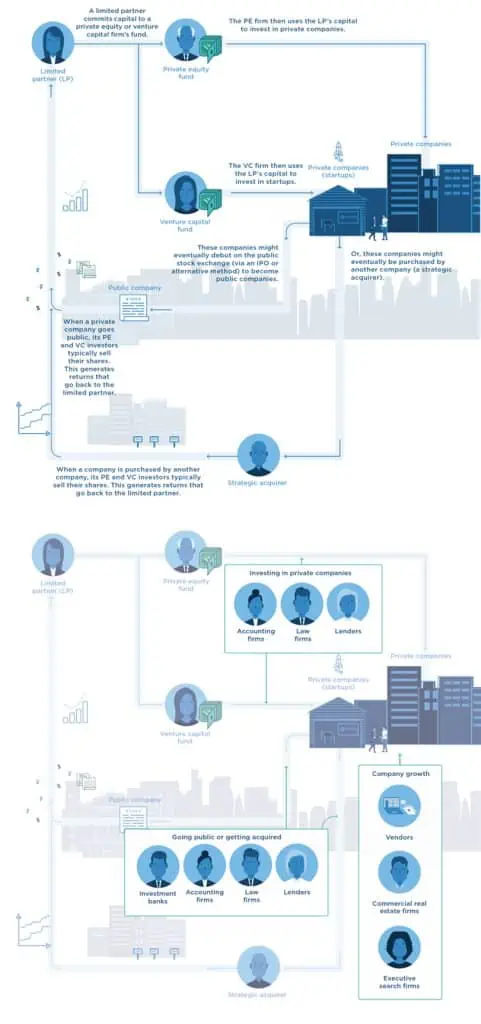

Private equity (PE) and venture capital (VC) firms have some similarities in their operations. They both gather funds from accredited investors who are known as limited partners (LPs), and they both invest in privately-owned companies. The main objective of both PE and VC firms is to enhance the value of the businesses they invest in, and they do so with the goal of selling them or their equity stake (ownership) in them for a return on investment. Additionally, both PE and VC firms typically provide more than just capital to their portfolio companies, they also provide strategic and operational support to help the companies grow and succeed.

The Differences: Private Equity vs Venture Capital

Company Types

Private equity firms typically focus on investing in mature, established companies that have a proven track record and generate steady cash flow or may be underperforming and work to improve their operations and financial performance. They often acquire these companies through leveraged buyouts, which involve borrowing a significant amount of money to purchase the company, and then using the company's assets and cash flow to pay off the debt. Private equity firms typically invest in a wide range of industries, including healthcare, construction, transportation, energy, and many others.

Venture capital firms, on the other hand, focus on investing in early-stage companies that have high growth potential, but also high risk. These companies are often in the technology or innovation sectors, such as biotechnology, software, and cleantech. Venture capital firms typically provide funding for research and development, product development, and marketing, and they may also provide strategic and operational support. The goal of venture capital investments is to generate high returns through equity appreciation, as these companies grow and eventually go public or get acquired.

Stage

Private equity firms tend to focus on buying established, mature companies that are facing operational or financial challenges, with the goal of improving the company's performance and increasing its value. Private equity firms often use leverage, such as debt financing, to acquire companies, and then use the company's assets and cash flow to pay off the debt.

On the other hand, venture capital firms typically invest in early-stage companies that have high growth potential but are not yet profitable. They provide funding for research and development, product development, and marketing, and also provide strategic and operational support. The goal of venture capital firms is to achieve a high return on investment by investing in companies that have the potential to become successful and profitable in the future.

Deal Size

According to PitchBook, a data provider of private market deals, around 25% of private equity deals in the US are between $25 million and $100 million. Private equity firms typically invest large sums of money in companies, often in the hundreds of millions or even billions of dollars in a single company because they are investing in already established companies. This allows them to make significant changes to the company and improve its value.

Venture capital deals, on the other hand, tend to be smaller in size, with many being less than $10 million in Series A rounds. However, subsequent funding rounds, such as Series B or Series C, can be much larger. This is because venture capital firms typically invest in early-stage companies that have not yet reached profitability, and therefore require smaller amounts of funding to get started. Furthermore, they are investing in startups with a high degree of uncertainty, they prefer to spread their risk by investing in multiple companies.

It is worth noting that there are some anomalies and exceptions to these general trends, and some private equity deals can be smaller and some venture capital deals can be larger. Additionally, the size of the deal does not always correlate with the success of the company or the returns of the investor.

Percentage Acquire

Private equity firms typically acquire 100% ownership of the companies they invest in and have complete control over the operations and decision-making of the company. This allows them to implement changes and improvements to increase the company's value.

On the other hand, venture capitalists typically take minority stakes in companies, often in the form of equity, usually less than 50%, which allows them to spread their risk and invest in multiple companies and they do not exert control over the management or direction of the company. Instead, they provide funding, strategic guidance, and resources to help the company grow. They often work closely with the company's management team, but they do not assume operational control. Venture capitalists usually invest in early-stage companies that have not yet reached profitability, and therefore, they will typically split shares with founders, angel investors and other venture capitalists or private partners involved in the startup.

Risk

Private equity firms typically invest in more mature companies that have already established a track record of profitability. They tend to make fewer investments and at a larger scale, investing significant amounts of capital in each acquisition. This means that each investment is more expensive and carries a higher risk. If one of these companies fails, it can have a significant impact on the overall performance of the fund. This is why private equity firms are more selective in their investments, focusing on companies that have a low probability of failure.

On the other hand, venture capitalists typically invest in early-stage companies that are not yet profitable, and they expect that the majority of companies they back will eventually fail. However, they invest small amounts in many companies, with the hope that at least one will be a hit and generate a high return on investment (ROI). This allows them to spread the risk and mitigate the impact of any failures.

Structure

Private equity firms often fund their acquisitions with a combination of cash and debt. They will usually take out loans to finance the purchase of a company, and then use the cash flow generated by the acquired company to pay off the debt over time. This allows them to invest in more expensive and larger scale acquisitions, while spreading the risk over a longer period of time. However, this also means that private equity firms are more heavily leveraged than venture capitalists, and they are exposed to more risk if the companies they acquire do not perform well.

On the other hand, venture capital funds are typically composed of cash from investors, which is then used to invest in startups and early-stage companies. The goal is to generate a high return on investment (ROI) through equity appreciation as the companies grow and eventually go public or get acquired.

Value Returns

Both private equity and venture capital aim for a return on investment of around 20% in the form of an internal rate of return (IRR). However, it is important to note that the returns generated by these two types of investment strategies can be quite different. Venture capital returns are heavily dependent on the success of the top companies in their portfolio, while private equity firms can generate returns from a variety of companies, some of which may not be as well-known.

Private equity firms, returns are more likely to come from improving the financial performance of the companies they acquire, rather than from financial engineering techniques like leverage. In other words, private equity firms are increasingly focused on growing the companies they invest in, rather than just cutting costs and increasing debt. This shift in focus is driven by the fact that firms are using more of their own money to make acquisitions, which puts more pressure on them to generate strong returns through operational improvements.

Operational

Private equity firms have traditionally been known for their "strip and flip" approach, where they would acquire companies, dismantle and restructure them, and then sell them for a profit. However, this approach has evolved over time, with private equity firms now focusing more on enhancing and expanding the companies they acquire to make them more valuable when they are sold.

On the other hand, venture capitalists tend to be more closely involved with the companies they invest in, and often provide not only financial support but also strategic and operational guidance. The level of involvement by venture capitalists depends on the preferences of the business owner.

Work

The work at private equity firms is similar to that of investment banking, which typically involves performing company valuations, analyzing financial statements, and coordinating with lawyers, bankers, and accountants. In this sense, private equity work is more focused on the financial and quantitative aspects of the business.

On the other hand, venture capital is often considered a more relationship-driven process, which means that venture capitalists spend more time building relationships with potential and existing portfolio companies, and less time on financial analysis. This can include activities such as making phone calls, attending networking events, and evaluating business plans. Some people may find the relationship-driven aspect of venture capital more enjoyable compared to the financial analysis required in private equity, while others may prefer the opposite.

Salary

The median salary for private equity and venture capital associates is around $150,000, with variable bonuses. However, this is not the only factor to consider when evaluating the potential for big returns. While private equity tends to have a higher potential for returns, it is also a more competitive field, with a longer and more rigorous hiring process. On the other hand, venture capital is considered riskier, as the returns are heavily dependent on the success of the top companies in the portfolio. However, the potential for outsized returns exists, as a small investment in a company could turn into significant wealth. It's worth noting that this is not a common occurrence, and not every venture capitalist will achieve these types of returns.

Culture

The atmosphere in venture capital firms is often considered more relaxed compared to private equity firms. This is partly due to the diversity of backgrounds found in venture capital, with many people coming from technology and other non-finance backgrounds. In contrast, private equity tends to attract individuals with a pure finance background, and the work culture can be more formal and hierarchical.

In terms of work schedule, venture capital firms tend to operate within a normal workweek schedule, while private equity firms may demand long, unsociable hours and little time away from work. This can be challenging for some people, as it can require a significant amount of time and dedication.

Additionally, private equity firms often involve a power struggle as there is a significant amount of money at stake. The competitive work culture can be intense and even hostile at times, as individuals are determined to succeed and make it to the top.

Exit

When you've grown tired of the fast-paced and financially focused nature of private equity or venture capital, there are various other paths you can take.

The options provided are ways for private equity professionals to transition into different roles or industries. Moving into hedge funds allows for the potential to generate a higher return on investment in a shorter time frame. Switching to venture capital offers the opportunity to be involved in the early stages of promising start-ups, despite the higher risk. Joining a corporate company can take the form of taking on a leadership role or advisory position within a portfolio company.

The options provided are ways for venture capitalists to exit their investment in a company and generate a return on their investment. An Initial Public Offering (IPO) is when a private company offers shares of stock to the public for the first time, allowing venture capitalists to sell their shares to underwriters and investors. A merger or acquisition (M&A) is when two companies combine their resources and operations, and it also provides an opportunity for venture capitalists to earn returns from the acquiring company. A share buyback occurs when a company repurchases its own shares from shareholders, which can be a feasible exit route for venture capitalists in larger companies.

Working Together

Private equity (PE) and venture capital (VC) firms can work together in various ways, as capital flows through the private markets. One way they can work together is by participating in financial transactions, where capital is transferred from one entity to another. During these transactions, professionals such as investment bankers and lawyers provide advice or execute the deal, which then initiates a growth or transition phase for the companies involved. Another way PE and VC can work together is through co-investment, where a PE firm and a VC firm invest in the same company together, providing more capital and expertise to help the company grow.

Conclusion: Private equity vs Venture Capital

Private equity firms typically invest in established companies that are in need of growth capital, restructuring, or a change of ownership. These firms typically invest larger sums of money, often in the hundreds of millions of dollars, and often take controlling stakes in the companies they invest in. They also have a longer-term investment horizon, holding their investments for several years before exiting through a sale or initial public offering (IPO).

Venture capital firms, on the other hand, typically invest in early-stage companies with high growth potential. They invest smaller sums of money, often in the millions of dollars, and take minority stakes in the companies they invest in. They also have a shorter-term investment horizon, often exiting their investments within a few years through a sale or initial public offering (IPO).

In summary, Private equity firms invest in established companies and have a longer-term investment horizon while Venture Capital firms invest in early-stage companies with high growth potential and have a shorter-term investment horizon.