Updated: 17/1/2023

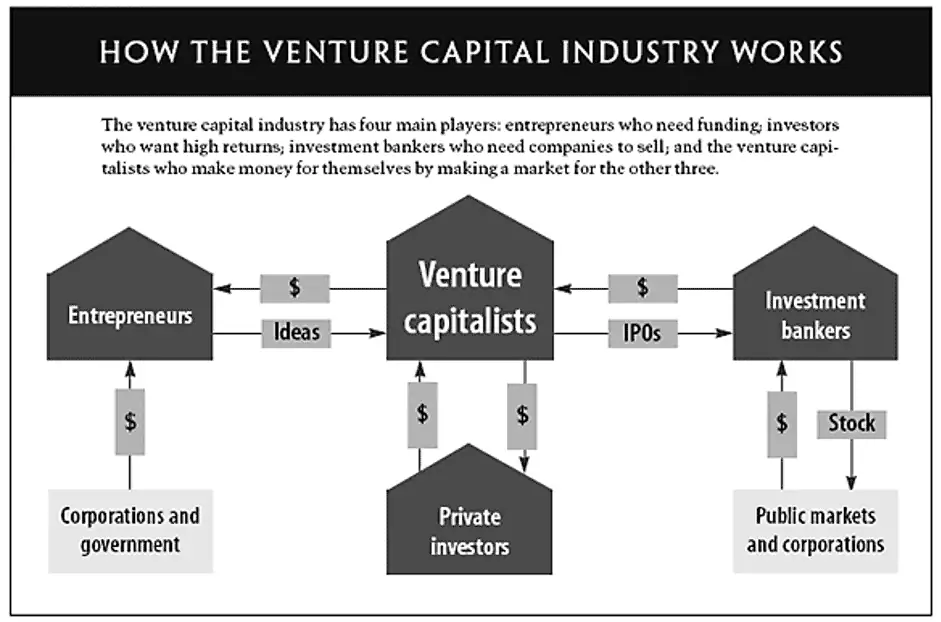

Venture capital can be considered as a subset of private equity and a form of financing that primarily provides funds and financing from investors to start-up companies and small businesses that are believed that have high long-term growth potential.

These companies at early stages and emerging ones that have been deemed to have high growth potential or have demonstrated high growth are the ones that have access to a pool of funds and investors. Understanding how Venture Capital works can significantly benefit you, whether or not you are an entrepreneur or not.

What is Venture Capital?

Venture capital is a type of private equity financing provided by venture capital firms or funds to startups, early-stage, and emerging companies with high growth potential. The investors, known as venture capitalists, provide capital in exchange for equity ownership in the companies they invest in. The goal is to achieve a significant return on investment through the successful growth and eventual exit of the company, typically through an acquisition or initial public offering.

How is “High Growth Potential” Quantified in Venture Capital?

This high growth is measured by a myriad of performance indicators which include the number of employees, man force of the company, annual revenue as well as the businesses' general scope of operations.

Some of the more common growth metrics that investors use to measure potential include revenue, customer acquisition cost (CAC), customer retention rate (CRR) and operational efficiency.

Revenue

In the business world where cash is king, if a business is not profitable then the business is considered not viable. As a metric, revenue is simple, measured by the total sales within a given time frame. This varies from business to business e.g. if the product is a subscription-based service, this number is more meaningful if calculated monthly or perhaps a seasonal business would have profits skewed within certain time periods.

Customer Acquisition Cost

Customer acquisition cost (CAC) measures the costs to the business of bringing in new customers and is calculated by taking total sales for a particular time period take away marketing expenses. To ascribe meaning to this number this needs to be cross-referenced with Customer Lifetime Value (LTV) which explains how much revenue the business is bringing in over the time they remain a customer.

The monitoring and retaining of customers is essential for the longevity of the business given that it costs substantially more to attract new customers than to just resell to or maintain an existing customer base.

Operational efficiency measures the ratio between selling, general and administrative expenses and the business’ sales figures and is important as it points out whether or not the costs of running the business are comfortably on par with the revenue being brought in. Related financial ratios may be used here including the gross profit margins, liquidity margins as well as burn rate.

Are Ratios Reliable?

From an investors point of view, the primary purpose of using these growth ratios is to not only see and measure how the company is performing but also to pinpoint which companies are being undervalued.

For example, how venture capital works is that a company with high earnings per share is considered more profitable, likely leading investors to pay more for the company whilst consistent increases in return on equity ratio indicates that the company has been steadily and consistently increasing in value and successfully translating that value increases into profits for investors.

What’s In It For the Investor?

Venture capital firms or funds invest in these early high growth stage companies in exchange for equity or an ownership stake and they are willing to take on the risk of financing risky start-ups in the hope that some of the firms they support will become successful.

But because start-ups face high uncertainty, VC investments typically have high rates of failure. Despite this riskiness, the potential for above-average returns is an incentive and an attractive payoff for potential investors.

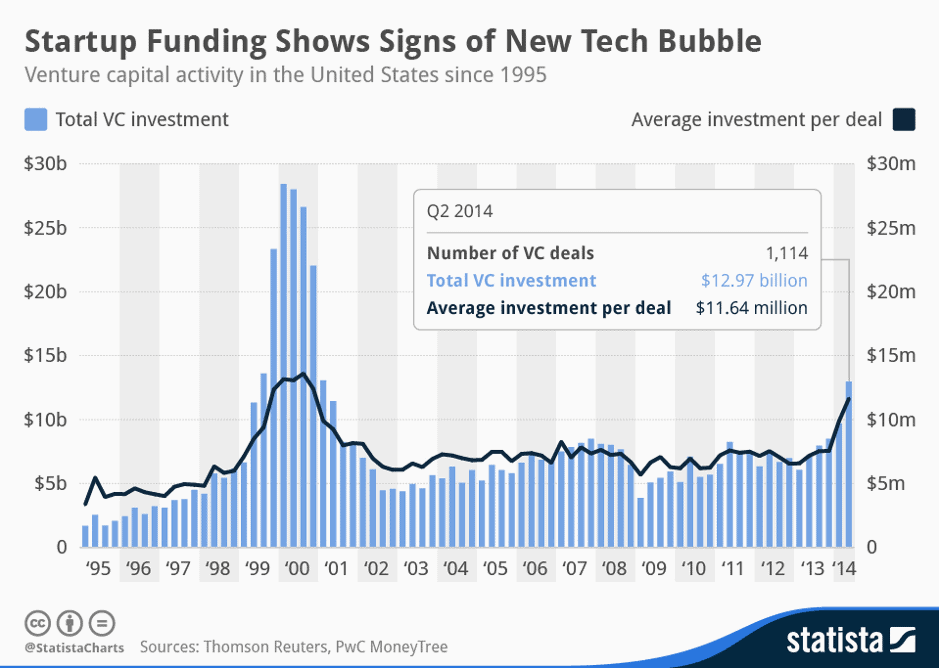

Within the last decades, for new companies or ventures that have had a short and limited operating history, how venture capital works is that venture capital funding is increasingly becoming a popular and even expected and essential source for raising capital, especially because a challenge of emerging companies is primarily the lack of access to capital markets, traditional lending institutions such as bank loans and other debt instruments.

It has evolved from a niche activity that has its inception post World War II during an economic and financial boom into a sophisticated industry with multiple players that play an important role in spurring innovation, entrepreneurship as well as shaping the future of the financial landscape and methods of capital raising.

For more information on Angel Investors, please click here.

The Four Stages of Funding

Seed Funding: What is it and How Does It Work?

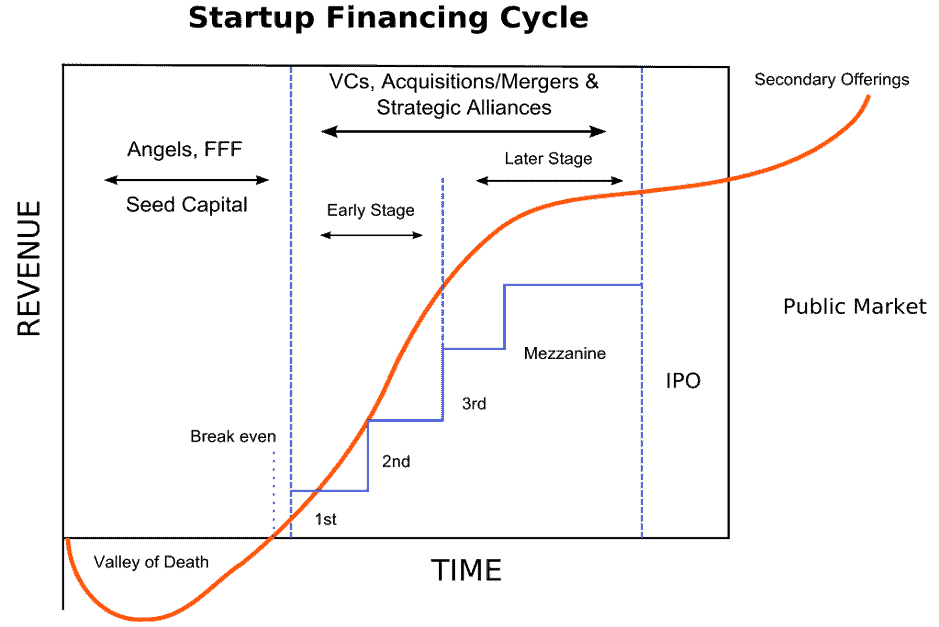

How venture capital works is that the typical venture capital investments occur after an initial seed funding round. Seed funding, also known as seed money and seed capital, represents a form of securities offering in which an investor invests capital in a start-up company in exchange for an equity stake or convertible note stake within the company.

Much of the seed capital that is raised by the company typically arises from sources close to its founders including family, friends and other acquaintances but can also include seed venture capital funds, angel funding as well as more recently with the rise of social media, crowdfunding.

How venture capital works is that obtaining seed funding is the first four of the funding stages that are required for a start-up to become an established business.

Why Pursue Seed Funding?

Usually, how venture capital works is that seed funding goes towards a beginning to develop an idea for a business or new product and generally only covers the costs of creating a proposal but can also go towards paying for preliminary operations such as market research and product development. Investors can be founders themselves, pursuing with their savings and/or loans.

How is Seed Capital different from Venture Capital?

Seed capital is distinguished from venture capital in a way that venture capital investments tend to come from institutional investors and it significantly involves more money and is at arm’s length transactions.

Venture capital contracts also generally involve much more complexity in their contracts as well as the corporate structure accompanying the investment.

Besides, how venture capital works is that seed funding also involves an even higher rate of risk in comparison to a venture capital investment since the investor will be unable to view or evaluate any existing projects for funding, which is the reason why the investments made during the seed stage are generally lower but for similar levels of stake within the company.

For more information on seed funding, please click here.

What is the Goal of a Company Seeking Seed Funding?

The primary goal at this point for the company is to attract further financing. Professional angel investors sometimes provide seed money either through a loan or in return for equity in the future company. How venture capital works is that it allows for flexibility of funding, be it seed or angel.

Who Are The Typical Seed and Angel Investors?

The primary goal at this point for the company is to attract further financing. Professional angel investors sometimes provide seed money either through a loan or in return for equity in the future company.

Series A Funding

Following early stages in seed financing, the company would look for expansion funding which would help smaller-scale companies expand significantly in terms of growth. This is known as Series A funding which is when the company (usually still in the pre-revenue stage) will open itself up to further investments.

Series A is much more significant that the funding procured through angel investors, with funds of more than $10 million being procured. This occurs after the business has developed a track record (an established user base, consistent revenue figures or some other key performance indicators). Opportunities may then be taken to scale the product across different markets.

What is Required to Achieve Series A funding?

Within this round of funding, it is essential to have a plan for developing a business model that will guarantee long term profit. The business will publicise itself as being open to Series A investors and will also need to provide an appropriate valuation.

Within Series A funding, investors are not just looking for great business ideas but rather they are looking for strong strategies for turning that businesses' core idea into a successful, profitable and money-making business. At this stage, it is common for investors to take part in a somewhat more political process.

With a significant departure from the participative mentality take on by the time the company reaches series A funding, it is common for a few venture capital firms to lead the pack and a single investor will typically serve as the anchor.

Series B Funding

Following Series A funding comes series B funding and at this stage, the company has already been developed through Series A but now needs to expand further.

A company that is attempting to acquire Series B funding will have already proven itself at the market with high active users and user activity but will need to establish itself to truly begin growing revenue. Hence why Series B funding is centred around the goal of taking the businesses to the next level, past the development stage. Investors help start-ups get thereby expanding market reach.

What is the Aim of Series B funding?

Considering that companies that have gone through seed and already have substantial user bases have already proven their worth, Series B funding is primarily used to grow the company so that it can meet the increasing levels of demand. Series B is similar to Series A in terms of key players in that it is often led by the same investors as Series A. The difference with Series B is the addition of a new wave of other venture capital firms that also specialise in alter stage investing.

Series C Funding

Companies that make it to Series C funding sessions are already acknowledged to be fairly successful and is reserved for businesses that are interesting in upscaling and businesses that are interested in expanding into new markets.

It is sought by companies that have already become successful and are looking toward expanding this success through methods such as the development of new products, expansion into new markets or even the acquisition of other companies.

What is Series C Funding used for?

Beyond this, Series C funding may also be sought after by companies that are experiencing short term challenges that need to be addressed.

Within Series C rounds, investors inject capital into the meat of successful businesses to receive a significant return on their investment and the funding in this stage is generally focused upon scaling the company in a way to ensure the growth of the company be as quick and successful as possible. Series C is significantly different compared to A and B because of the mechanisms involved in scaling a business.

For example, a possible way to scaling a company would be an acquisition. Merger and acquisitions are significantly more complicated processes and indicate a shift in the direction of the business away from the start-up stage and mindset. Similarly, as the operation gets increasingly less risky, the company is also capable of attracting bigger investors.

Groups such as hedge funds, investment banks in addition to private equity firms and large secondary market groups that come into play as the business is looking more and more profitable as the company has already proven itself to be a successful business model. These new investors approach the business expecting to invest significant sums of money into these companies that are already thriving as a means of helping to secure their own position as business leaders within the market.

Therefore, it can be said that Series C investors are significantly more self-interested as compared to seed-stage or A and B investors, given the exponentially lowered rate of risk associated with an already thriving company and business model.

More commonly, a company will end its external equity funding with Series C although some companies can go onto Series D and E rounds of funding as well. For the most part, however, companies that have already gained upwards of hundreds of millions of dollar worth of funding through Series C are prepared to continue to develop on a global scale.

In fact, the majority of companies that are going through and raising Series C funding use this as a means of helping boost their company valuation in anticipation of IPO. Most go onto seeking series D funding as the goals the company set out during earlier stages likely had not been completed yet.

Hierarchical Structure in a Venture Capital Firm

A typical venture capital firm is organised in a dual model as a limited partnership managing legally independent venture capital funds, with venture capitalists serving as general partners and their investors are limited partners.

Most venture capital firms are organised as management companies responsible for managing several pools of capital with each representing a legally separate limited partnership. How venture capital works is that Limited Partners cannot participate in the active management of venture capital funds if their liability is to be limited to the number of their commitments.

Why do Investors Work with VCs?

From the perspective of an investor, how venture capital works is that there are two main alternatives to invest in venture capital besides investing in venture capital funds: through direct investments in private companies or the outsourcing of selection of venture capital funds through investing in funds of funds.

Direct investments in private companies require more capital to achieve similar diversification as investing in venture capital funds.

Direct investments also pose another unique challenge as direct investments within venture capital usually require a different skill set which limits partners in venture capital funds typically lack.

Investors will need to realise that there will be an additional layer of management fees and expenses involved but institutional investors will thereby reduce the costs to the investors of the selection and management of their investments in different venture capital funds. It has been shown that within the world of how venture capital works are that the compensation of venture capitalists plays a critical role in aligning their interests with those of the limited partners.

An Analysts Role in a VC

The most junior level within a VC are analysts whose main responsibilities involve attending conferences to scout deals that might be within the investment strategy of the fund that the venture capital firm is investing out of. Analysts are not able to make decisions and are primarily concerned with conducting market research and studying competitors.

Associates Role in a VC

Next up on the ladder are associates and tend to be people with a financial background with good networking skills. Associates too do not make decisions within a firm but can make recommendations to those in charge.

Principals Role in a VC

Following associates is the role of principals who can make decisions when it comes to investments but have a lesser influence on the execution of the overall strategy of the firm.

Managing Partners role in a VC

The most senior people within the venture capital firm are partners who could either be general or managing. The difference in title varies depending on whether or not the painter has an influence on investment decisions or may also have an influence upon operational decisions.

In addition to investments, partners are also responsible for and will be held accountable for raising capital for the funds that the firm will be investing with.

Venture Partners Role in a VC

Venture partners are not involved in the day to day operations nor the investment decisions of the firm however they have a strategic role within the firm, mainly involving bringing new deal flow that they will then refer to other partners within the firm.

Venture partners are usually compensated using carry interest (a percentage of returns that funds make once they cash out of investment opportunities).

Investors of VC firms are called Limited Partners (LPs) who are institutional or individual investors that have invested capital in the funds of the VC firms that they are investing off of. How venture capital works is that LPs include endowments, corporate pension funds, sovereign wealth funds, wealthy families, and funds of funds.

Other Activities Performed by Venture Capital Firms

Fundraising as detailed above is the first activity that all new venture capital firms have to perform. How venture capital works is that successful venture capital investors usually do not manage only a single venture capital fund, but they also engage in fundraising activities to establish a venture capital fund but they engage in fundraising activities to establish a new venture capital fund some three to five years after the start of their previous fund.

The activities of a VC firm: Deals

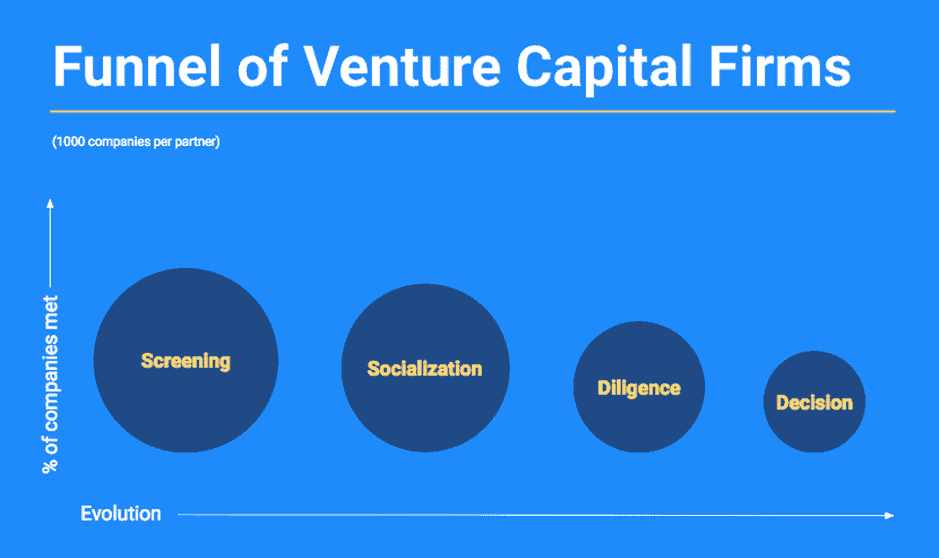

Another challenge for a venture capital firm is to secure an adequate flow of high-quality business proposals to evaluate. How venture capital works is that the firms match venture capital investors with entrepreneurs can present some difficulties given market information asymmetries.

How venture capital works and from a venture capital fund’s perspective, it is essential to have access to the best propositions which may be problematic for newly established firms given that entrepreneurs would prefer to team up with investors with already strong reputations.

Besides, rather than generating their own deal flows, how venture capital works is that funds may attract investments proposals through their already existing network of co-investors or educate partners, making funds fairly isolationist and probably difficult to gain access to.

Are deals and collaboration in a VC world biased?

As a result, how venture capital works is that being able to general a high-quality level of deal flow may also depend on being able to enter syndication networks. Research has suggested the high likelihood of venture capital investors only being willing to collaborate with other investors whom they are familiar with through prior investments given that this provides more information about their specific capabilities and reliability, thus reducing the risk of hidden information and information asymmetry.

In addition to these duties, how venture capital works is that firms also must perform extensive checking and due diligence activities are given that VC investors are typically extremely selective. While large venture capital funds may receive hundreds of investment proposals annually, they eventually may invest in a portfolio of only 15-25 companies over a five year period as many investment proposals will in all likelihood not receive more than a few minutes of the attention of venture capital investors.

The activities of a VC firm: due diligence

Quick screenings whether or not a certain investment proposal would fit the spirit of a certain firm given that some investors specialise in certain investment stages, certain industries or certain geographic regions.

How venture capital works is that proposals that pass the initial screening are then subjected to in-depth due diligence tests before an investment decision can be made.

However, research has shown that investment decisions are clouded by local bias. Venture capital investors are known to exhibit preferences for investment in companies within the local home market because this eases information transfer.

This benefits the identification of investment targets, the evaluation of the ventures and then post-investment monitoring and the subsequent addition of value.

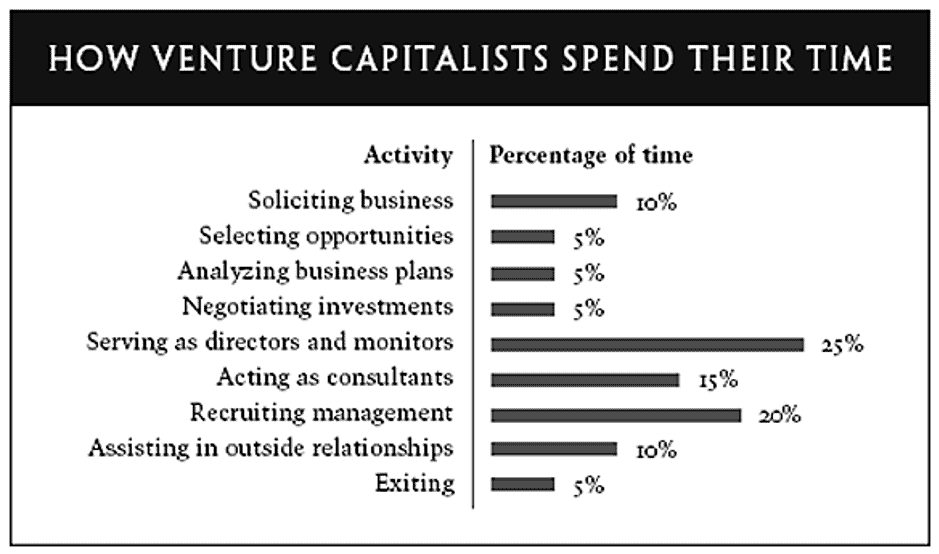

To reduce hidden action problems after investment, investors are strongly engaged with their portfolio companies usually with monitoring, assisting as well as certifying their portfolio companies. It has been shown that venture capital investors spend over half their time on monitoring and assisting their portfolio companies.

How investors in VCs lessen risk

Investors often require board seats which are linked with other powers such as veto rights as well as contractual provisions which allow them to directly influence the behaviour of their invested entrepreneurs. How venture capital works are that it is essential to have different prongs governing investments.

How venture capital works are that boards of directors in venture capital-backed companies are smaller and thus more involved in strategy formation and evaluation as opposed to boards where members do not have large ownership stakes.

In addition to this, the primary strategies used by investors include time, stage and sector diversification plus prorated investing over time as well as the number of investments within a portfolio.

Risk Mitigation: Time Diversification

The majority of VC funds are committed over a three to five year period. How venture capital works are that by being committed over a longer period of time and spreading out the commitments, a fund gets time diversity and also theoretically this has a soothing effect on the macrocycles that impacts a business.

Risk Mitigation: Stage Diversification

Certain VCs are specific and have early vs late-stage investing approaches to augment the risks posed by certain investments in certain stages. The goal here is to also smooth out irregularities that may occur during the course of the investments in the portfolio.

Risk Mitigation: Sector Diversification

Historically, VC firms have broad sector diversification, investing from software to life sciences within the same fund. This spreads out the macro and environmental risk associated with certain industries to compensate for others.

Risk Mitigation: Prorated Investment

Many VC firms reserve the right to invest their “pro-rata” ownership within future rounds, which then allows them to maintain their % ownership within the company.

Risk Mitigation: Number of Investments

There is conventional wisdom within the VC industry that each fund ought to have 25-30 companies within the fund to spread out and diversify. How venture capital works is that this spreading out of risk and mitigation of putting all your eggs in one basket will ensure higher certainty of returns in the future.

References

https://www.forbes.com/sites/alejandrocremades/2018/08/02/how-venture-capital-works/#5a62b3991b14

https://visible.vc/blog/startup-funding-stages/. Accessed 28 Sept 2020

https://www.startups.com/library/expert-advice/how-venture-capital-works