Venture capital is a type of financing for startup companies that have the potential to grow. In order to grow, companies require a certain amount of investment. Venture capital firms acquire equity or ownership shares of the business in return of the investment.

When businesses are starting from scratch, they typically have limited or no funding at all. This is when investors come in and lend money to emerging startup businesses that have the potential for long-term growth. Entrepreneurs with little or no operating history can now obtain capital to launch their businesses thanks to venture capitalists and investors. Venture capital investments are considered high-risk investments, but they also have the potential for a high return. Investors take the risk of investing in venture capital in exchange for an equity stake with potentially large returns if the businesses succeed.

Venture capitalists and other investors take into account:

- The potential growth

- The strength of the management group

- The innovation of the products or services

It is undeniable that a startup may suffer a loss; venture capital firms can typically absorb several losses; however, this must be accompanied by investment in a runway success to continue generating returns for investors.

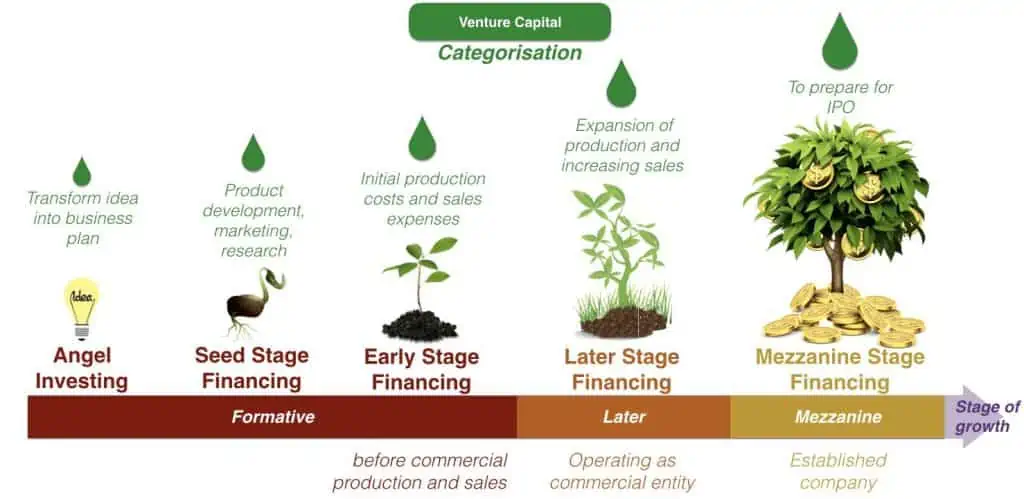

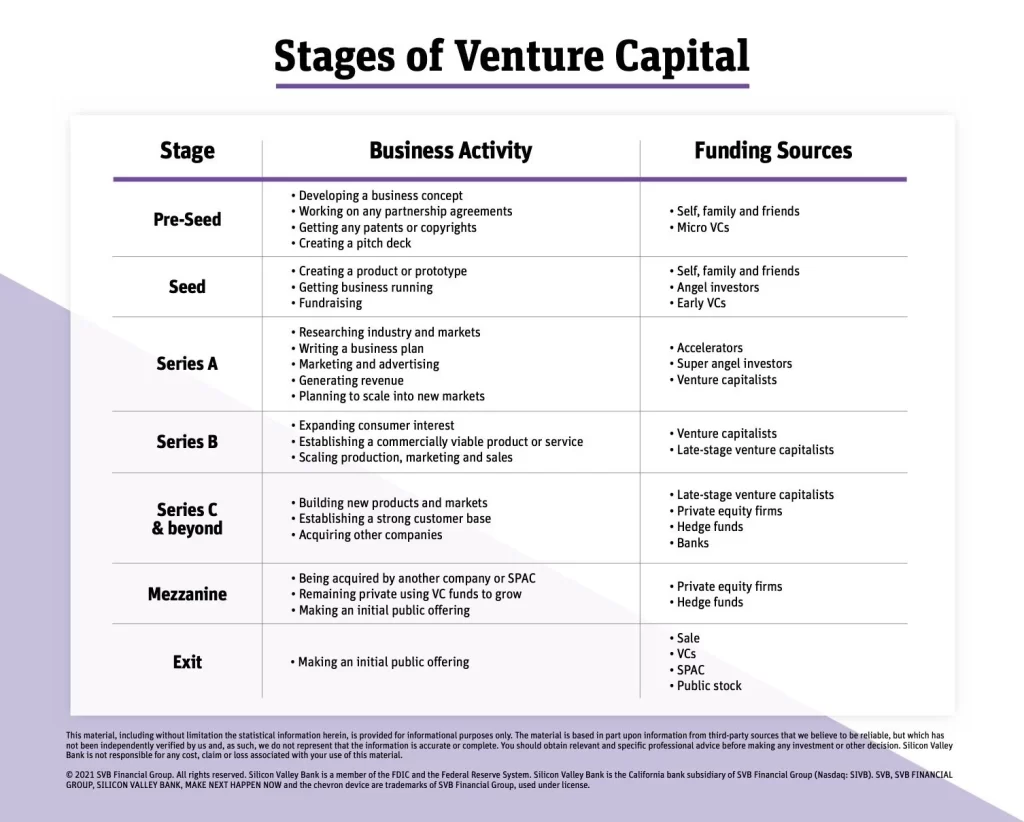

5 Stages of Venture Capital

Venture capital has five main stages, plus two transitions that take place before and after Venture Capital funding.

The Pre-Seed Stage

The stage before obtaining venture capital funding is known as pre-seed or bootstrapping. The pre-seed stage is when the company is formed and a product or service prototype is evaluated to determine the concept's marketability. At this stage, it is not possible to apply for funding to venture capital in exchange for equity. Therefore, the funding will rely on personal resources and contacts to establish the business.

Many business owners seek advice from founders who have gone through similar situations during the pre-seed stage. A successful business typically starts with an established business model and strategy guided by the founders. A partnership agreement, copyrights, or any other legal matter that is essential to the success of the businesses should be worked out at this time. These problems may become insurmountable in the future, causing investors to withdraw their investment from a business with unresolved legal issues.

At this stage, the most common investors are:

- Startup founder

- Friends and family

- Early-stage investors (Micro VCs)

The Seed Stage

Now that the businesses have some experience, the business can show that it has the potential to grow and flourish. To convince venture capital that the idea has a workable investment opportunity, a presentation must be created to pitch the idea to investors. The majority of the modest funds that are raised during the seed stage are used for particular tasks like:

- Market research

- Business plan development

- Setting up the management team

- Product development

The target is to raise enough capital to demonstrate to future investors that the businesses have the capacity to grow and scale.

In order to help you establish credibility, seed-stage venture capitalists frequently participate in pitching concurrently with other investment rounds. A representative from the venture capital firm will most likely join the board to oversee operations and ensure everything goes as planned.

This is the most expensive stage of funding in terms of equity that a company must give up to secure investment because venture capitalists are taking a high risk.

At this stage, the most common investors are:

- Startup owner

- Family and friends

- Angel investors

- Early venture capital

The Series A Stage

The initial round of venture capital financing is commonly referred to as Series A. Businesses have typically finished their business plan by this point and have a pitch deck focusing on product-market fit. Businesses are improving their products, growing their clientele, increasing their marketing and advertising, and demonstrating a consistent stream of income.

Next things to do:

- Perfecting the product and/or service.

- Increase the workforce.

- Conduct any additional research that is required to support the launch.

- Raise the funds required to carry out the plan and attract new investors.

A great strategy will be required to produce long-term profits in the Series A round. You must clearly show how you intend to sustainably monetize your product, regardless of how many enthusiastic users you have.

Angel investors and traditional venture capital firms provide the majority of the Series A funding. However, corporate venture capital funds and family offices are funding options in your industry. In order to lessen the risk of a failed investment, most investors are drawn to startups with strong business plans and executives who have the skills to implement them.

At this stage, the most common investors are:

- Accelerators

- Super angel investors

- Venture capitalists

- Corporate venture capital funds

- Family offices

The Series B Stage

At this stage, the businesses are prepared to grow. The operations for actual product manufacturing, marketing, and sales are supported by venture capital at this stage. This stage will require a larger capital than the previous stage in order to expand. Series B funding is distinct from Series A funding. Investors in Series B want to see actual performance as well as proof of a minimum viable product (MVP) or service in order to support future fundraising, as opposed to Series A investors who will assess your potential. Investors are reassured by performance metrics that you and your team can succeed on a larger scale.

Series B funding is typically provided by venture capitalists, corporate venture capitalists, and family offices that specialize in financing well-established startups. They provide the capital required to expand markets and form operational teams such as marketing, sales, and customer service. Series B funding can be used to:

- Grow operations

- Meet customer demands

- Expand new markets

- Compete more effectively

At this stage, the most common investors are:

- Venture capitalists

- Corporate venture capital funds

- Family offices

- Late-stage venture capitalists

The Expansion Stage (Series C and Beyond)

The Series C funding stage is typically reached after a company has achieved a certain level of success and is looking to continue growing through additional funding. This funding can be used to develop new products, expand into new markets, and potentially acquire other startups. On a fast trajectory, it usually takes 2-3 years to get to this stage and companies at this stage are typically generating exponential growth and consistent profitability.

Companies must have a solid customer base, a steady revenue stream, a track record of growth, and a desire to expand globally in order to qualify for Series C funding.

Investors are typically more willing to invest at the Series C stage and beyond because the company has achieved a certain level of success and proven its viability as a business. This reduced the risk and makes the investment more attractive to investors, who may be more hesitant to invest in earlier stages where the risk is higher.

Investors at this stage may include hedge funds, investment banks, private equity firms, and other non-traditional venture capital firms, in addition to traditional venture capital firms. These investors may see the potential for a good return on their investment due to the company's proven track record and continued growth potential.

At this stage, the most common investors are:

- Late-stage venture capitalists

- Private equity firms

- Hedge funds

- Banks

- Corporate venture capital funds

- Family offices

The Mezzanine Stage

The last phase of venture capital, also known as the mezzanine stage or pre-public stage, marks the transition of a company to a liquidity event, such as an initial public offering (IPO) or acquisition. At this stage, the company is considered a mature, viable business and requires funding to support significant events.

When a company reaches the mezzanine level, it is regarded as fully operational and profitable. Many of the original investors who have supported the company reach this point may decide to sell their shares and recoup a sizeable profit from their initial investment.

This opens the door for late-stage investors to come in and potentially gain from an initial public offering (IPO) or sale. The mezzanine stage is often referred to as the bridge stage because it bridges the gap between the company's earlier stages of growth and its eventual exit.

The Initial Public Offering (IPO)

An initial public offering (IPO) is a way for a private company to be publicly traded by offering its corporate shares on the open market. This can be an effective way for a growing startup or a long-established company to generate funds and reward earlier investors, including the founders and team.

To go public, a company needs to form an external public offering team of underwriters, lawyers, certified public accountants, and SEC experts; compile all of its financial performance information and project future operations; have a third party audit its financial statements and provide an opinion on the market value of the initial public offering; and file a prospectus with the SEC and determine a specific date for going public.

Going public can be a complex process that requires careful planning and attention to detail. It is important for companies to work with experienced professionals to ensure that all necessary steps are followed and the process goes smoothly.

Going public, or conducting an initial public offering (IPO), can bring a number of benefits to a company. One of the main benefits is the ability to raise significant capital through the sale of shares to the public. This capital can be used to fund expansion, pay off debts or investors, and provide additional resources for the company.

Going public can also make it easier for a company to engage in mergers and acquisitions, as it can use its publicly traded shares as currency to acquire other companies. Additionally, public stock can be an attractive form of executive compensation and employee benefit, as it provides employees with an ownership stake in the company.

However, it is important to note that going public is not the only option for a company looking to raise capital. Special Purpose Acquisition Companies (SPACs) are another option that allows a company to remain private while raising capital through the sale of shares. SPACs may offer more price certainty and provide a clearer idea of who the investors will be, which can be useful for companies weighing the value of short-term investors who are looking for a return versus long-term investors who are supporting the growth over time.

Venture capital (VC) is an important source of funding for startups, as it provides the capital needed to grow and scale the business. Venture Capitals are typically willing to invest in early-stage companies with high growth potential and are looking for a return on their investment through the company's future success.

To attract Venture Capital investment, startups need to have a solid business plan and a clear vision for the future. Venture Capital will also be looking for a team with the necessary skills and experience to execute the plan, as well as a product or service that addresses a real need in the market.

In addition, Venture Capital will be looking for startups that have a competitive advantage, whether it's through a unique technology, a strong customer base, or a patented product. It's also important for startups to have a clear plan for how they will generate revenue and achieve profitability.

Finally, Venture Capital will be looking for a strong management team that has the ability to adapt to changing market conditions and make strategic decisions that drive the company's growth.

Conclusion

The five stages of venture capital represent the progression of a company from its earliest stages of development through to later stages of growth and expansion. These stages provide a framework for understanding how a company can secure the funding it needs to develop and grow its business.

At the pre-seed and seed stages, companies are focused on developing a proof of concept or a prototype, building a team, and establishing a customer base. Early-stage funding is used to help a company grow and scale its business, and expansion-stage funding is used to accelerate growth and expand into new markets. Later-stage funding is used to maintain growth and prepare for an exit, such as through an IPO or acquisition.

Overall, the five stages of venture capital represent the journey that a company takes as it moves from an idea or prototype to a fully-fledged business. By securing funding at each stage, a company can gain the resources and support it needs to develop and grow its business, and ultimately achieve success.

References

Five Stages of Capital Funding