Updated: 21/12/2022

This article will be your startup funding guide to Series A, B and C rounds. It will break down the need for why businesses raise these funding rounds and how they work. The figures regarding estimates of funding amount raised for each rounds will vary and valuations for companies are subject to change over time. This article is for a mere understanding on the way Series A, B and C rounds work.

Before You Pitch For Series A, You'll Need These

Different funding rounds allow entrepreneurs to scale their business at different stages. But your company must be mature enough to qualify for each funding round. A sustainable business model is one of the core factors investors will look at. However, it is important to know that before you start looking for funding options, you need to know what you require before you pitch for A round.

- Metrics. Understand the specific, quantifiable and historic performance metrics that align with the standard in your vertical and with Series A investor expectations. For example, if yours is a SaaS model, investors will expect to see the trailing year and current KPIs, including churn rate, Monthly Recurring Revenue (MRR), Committed Monthly Recurring Revenue (CMRR), Customer lifetime value (CLTV) and so on. These are all indicators of core business growth and provide a means to predict near-term trends and potential.

- Your Team. Series A investors expect you to have recruited the core functional team required to scale your company. This might include senior managers for areas such as tech/R&D, finance, operations, product development, and sales and marketing.

Types of Series Funding

There are other types of funding rounds available to startups, depending upon the industry and the level of interest among potential investors. It's not uncommon for startups to engage in what is known as "seed" funding or angel investor funding at the outset. Next, these funding rounds can be followed by A, B and C funding rounds, and additional efforts to earn capital.

Series A

Series A financing (as known by other names: Series A round or Series A funding) is one of the stages in the startup's capital-raising process. Essentially, the Series A round is the second stage of startup financing and the first stage of venture capital financing.

Series A financing is primarily used to ensure the continuous growth of a company. The common goals in the Series A round include reaching milestones in product development and attracting new talent. In this stage of development, a company intends to continue the growth of its business to attract more investors to future rounds of financing.

According to Investopedia, typically, between $2 million and $15 million raised in A round, although due to high tech industry valuations, or unicorns, this sum has risen on average. As of 2020, the average Series A funding is $15.6 million.

Series A financing follows a strictly formal approach. Venture capitalists that are representing the majority of investors in this round of financing are looking forward to completing the due diligence and valuation process before making an investment decision. In Series A funding, investors are not just looking for great ideas. Rather, they are looking for companies with great ideas as well as a strong strategy for turning that idea into a successful, money-making business.

The valuation of a startup is an essential part of Series A financing. Unlike startups that are still in the seed stage, businesses that are looking to secure Series A capital are able to provide more information that can be used to make informed investment decisions.

The goals of valuation in Series A fundraising include the identification and assessment of progress made by a company using its seed capital, as well as understanding how efficient is the management team. Additionally, the valuation process demonstrates how well a company and its management use the available resources to earn profits in the future. Only when the due diligence and valuation processes are completed will venture capitalists invest in a company.

Average Series A funding amount in 2021 from the U.S. Funding Data, the mean Series A funding round has grown steadily over the years and is currently at around $18.7 million, of April 3, 2021. Investment activity has increased up significantly in Q1, 2021. For example, for the week ending March 13th 2021, there were at least 23 Series A deals, yielding over half a billion dollars in venture funding in the U.S. itself.

According to Embroker, there are no distinguishing factors for when a company is ready to raise its Series A. For SaaS companies, many investors look to annual recurring revenue (ARR) as their north star metric to determine when a company is ready to raise. Some investors argue that when a company passes $1 million in ARR they’re ready for their Series A.

Series B

If you’ve already raised your Series A and will require more capital to reach your goals for growth, Series B is your next milestone. After seed capital and Series A, Series B is the next step. Series B round is also a form of equity-based financing. In other words, investors provide capital to a company in exchange for the latter’s preferred shares.

The majority of the deals include anti-dilution provisions like in the Series A round. This means that a company usually sells preferred shares that do not provide its holders with voting rights. However, the shares often come with a convertibility option (i.e., the holders of the preferred shares can convert their shares into common stock at a future date).

Series B financing is appropriate for companies that are ready for their development stage. They are companies that generate stable revenues, as well as earn some profits. According to Investopedia, in a Series B round, the average anticipated capital raised is $33 million. Series B companies are well-established, and their valuations reflect this; most Series B companies are valued between $30 million and $60 million, with an average of $58 million.

Series C

When a company raises a Series C, it has previously gone through a few rounds of fundraising, and past term sheets are met with new term sheets, which can have repercussions. Companies seek series C financing for further expansion to reinforce their existing success. Following a series C round, a company aims to scale up its operations and continue its growth. The proceeds from this financing round are most commonly used for entering new markets, research and development, or acquisitions of other companies.

This level of investment attracts a special influx of investors, including private equity, hedge funds, and late-stage venture capitalists.

This round of funding frequently draws new investors. Large financial institutions, such as investment banks and hedge funds, are willing to engage in the series C round, unlike the earlier stages of fundraising, where most investors are venture capitalists and angel investors. This can be explained by the fact that the investment carries a reduced risk because the company is already established.

According to Investopedia, companies are typically valued at around $118 million at this point, while some companies undergoing Series C investment may be valued significantly more. In addition, rather than relying on assumptions for future success, these appraisals are increasingly based on hard evidence. Companies seeking Series C capital should have a solid client base, revenue streams, and a track record of success.

Why Do Businesses Need Funding?

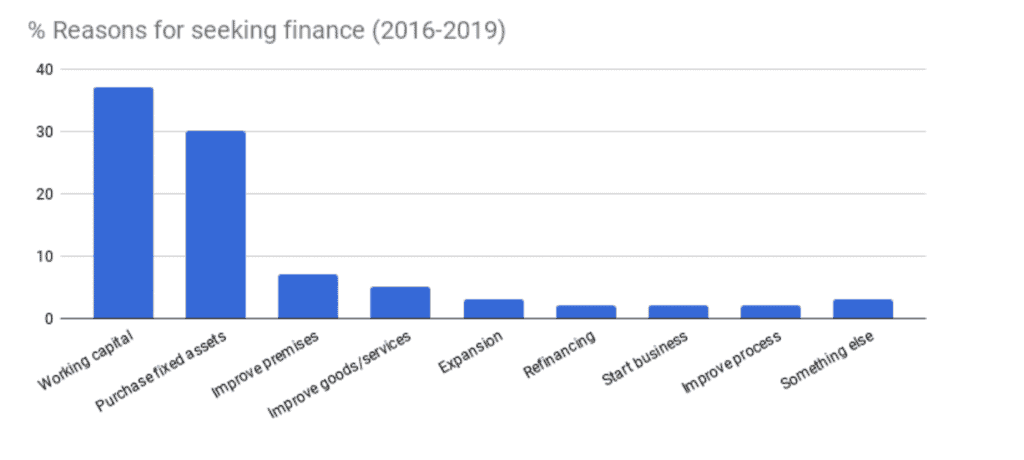

There is no one answer to this question but many. This section will be summarising the top 2 reasons why a business takes the step to acquire funding

Working Capital

Sufficient working capital is a key aspect of any company’s financial health, and not having enough working capital can have a serious impact on your business's future. Many businesses choose to apply for external funding to create enough working capital to enable them to fulfil their growth ambitions. Data collected from British Business Bank Survey in 2019 claims working capital is the number one reason businesses seek financing.

Working capital funding can also allow your company to take advantage of new opportunities that arise, investing in new products or services to enable you to expand. Working capital loans can provide a useful ‘cushion’ for your company should you need a bit of extra cash.

Growth

Funds raised by startups can be used in growth, sales and marketing strategies as well. Funding raised by startups goes into all kinds of growth prospects; some startups may choose to spend this on their marketing and promotional strategies, others may use this for research and development for an advancement in their technological capabilities. Depending on the scale of the startup or the business, it is important that they use this at the optimal level and balance for growth of the business in order to increase sales.

Finding Investors at Each Level of Funding

One of the main benefits of getting an investment from a venture capitalist or angel investor is their connections and industry knowledge. They can provide valuable guidance and advice on expanding into new markets, and can also open doors to new sources of funding.

Join A Startup Incubator

Joining a startup incubator can provide valuable resources and support for early-stage startups, including mentorship, training, networking opportunities, and access to funding. It can be a great way for entrepreneurs to gain valuable experience and connections in the startup world.

Know The Major Players

Researching active startup investors and understanding their investment preferences can be beneficial for entrepreneurs looking to secure funding. Knowing which investors are most active in your field can help you identify potential partners and tailor your pitch to align with their interests. Additionally, researching the types of projects they have invested in the past can give you an idea of the types of startups they are looking to fund. Some investors may focus on specific industries or stages of development, such as seed funding or later-stage funding. It's also important to know the stage of your business and match it with the investors. It's also important to note that building relationships with investors can be a long-term process, so it's essential to be persistent and keep them updated on your progress. Networking and building relationships with industry professionals can also be a great way to get introduced to potential investors.

Use your professional network

Once you have secured seed or A-round funding from an investor, they will likely be interested in helping you raise additional funding in later rounds. As part-owners of the company, investors want to see the value of their equity grow, and they may be able to help you raise additional funds by connecting you with other investors in their network. These investors may include venture capital firms, angel investors, or other high net worth individuals. They can also help you by leveraging their industry connections and resources to help your business grow and increase in valuation. It's important to keep your investors updated on your progress and communicate your fundraising goals with them, so they can help you reach them.

Conclusion

As you can see, there are a lot of factors to think about when navigating the VC world. It's critical to remember that these VCs work full-time negotiating transactions, and the entrepreneur is likely the newcomer to the table. It is also important to understand the stage your business is at and what type of funding is the most suitable for your type of startup or business.