A startup with a wonderful business idea is attempting to launch its operations. From humble beginnings, the firm has shown the quality of its concept and goods, constantly developing thanks to the generosity of friends and family, as well as the founders' personal financial resources. As time passes, its client base expands, and the company's activities and goals broaden.

Before long, the firm had climbed through the ranks of its rivals to become highly valued, allowing for future development to include more offices, staff, and possibly an Initial Public Offering (IPO).

If the early phases of the hypothetical firm described above appear too good to be true, they usually are. While a very small percentage of lucky firms grow according to the strategy outlined above, the vast majority of successful startups have made several efforts to seek funds through rounds of external investment. These fundraising rounds allow outside investors to contribute funds to a developing firm in return for equity, or a portion of the company's ownership.

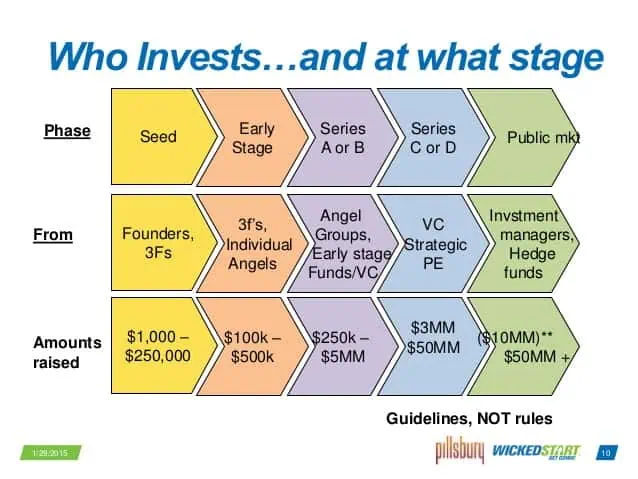

Depending on the business and the degree of interest among possible investors, several sorts of fundraising rounds are available to companies. It is not commonplace for firms to receive "seed" capital or angel investor money at the onset. These financing rounds can then be followed by Series A, B, and C funding rounds, as well as extra efforts to raise funds if necessary.

What is Series A Funding?

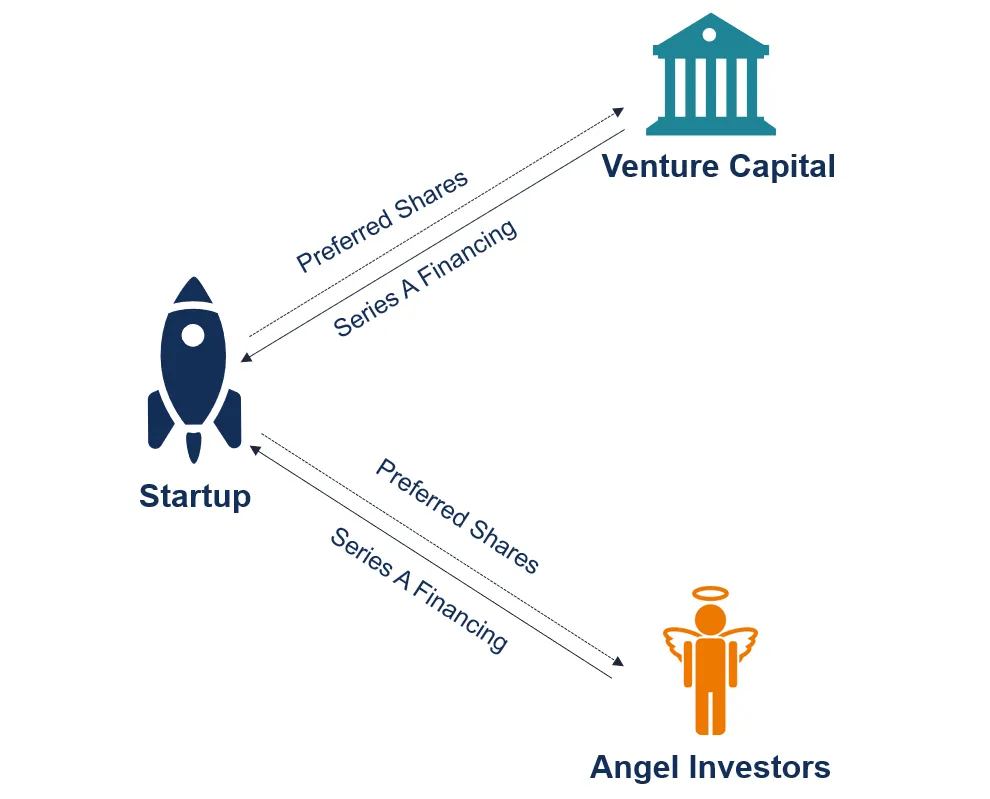

Series A funding is a stage in a startup's capital-raising process. The series A round is essentially the second step of startup funding and the first level of venture capital financing.

Series A financing, like seed financing, is a kind of equity-based financing. This means that a corporation raises the necessary funds from investors by selling its shares. However, most series A funding includes anti-dilution measures. Startups typically issue preferred shares, which do not provide their owners voting rights.

Concurrently, it is fairly typical for firms to issue convertible preferred shares. These shares give investors the opportunity to convert their preferred shares into common stock at a later date. It is worth noting that the rewards to investors from series A financing are lower than the returns from seed fundraising.

Objectives of Series A Funding

Series A funding is largely utilised to secure a company's continuing growth. The series A round's shared aims include fulfilling product development milestones and acquiring fresh talent. At this stage of development, a firm plans to expand its operations in order to attract additional investors to future rounds of financing.

The largest investors in the Series A round are venture capital companies. They are often firms that specialise in early-stage investments. The basic norm is that money is granted to businesses that have already generated revenue but are still in the pre-profit stage.

How Series A Funding Works?

In contrast to seed money, the series A investment follows a strictly formal approach. Venture capitalist, who represents the majority of investors in this round of financing, are willing to complete the due diligence and valuation procedure before making an investment decision. As a result, these processes kick off every significant series A fundraising.

The valuation of a business is a critical component of series A funding. Companies seeking series A money, as opposed to firms in the seed stage, can disclose more information that may be utilised to make educated investment decisions.

The objectives of series valuation fundraising include identifying and assessing a company's development with its initial funding, as well as the effectiveness of its management team. Furthermore, the valuation process indicates how successfully a firm and its management utilise present resources to generate future earnings. Venture capitalists will only invest in a firm when the due diligence and valuation processes have been completed.

How to Get Series A Funding?

Founders or CEOs must select the correct investors since their selection will have an influence on the success of their companies. Consider your potential investors to be partners. You undoubtedly want the collaboration to run as smoothly as possible. Don't spend your time pitching to investors that aren't a good fit for your business. Find investors whose interests and beliefs are compatible with yours.

Sizing up the investing market is a smart place to begin. You must determine who the active and inactive investors are. After that, you may begin looking for active investors that are interested in the industry you work in. This will allow you to locate and connect with Series A investors much more quickly.

It is critical to understand the various methods for obtaining Series A funding. Depending on your needs, you can obtain this cash from the following investors:

Venture Capitalist

Private-sector investors are referred to as venture capitalists. They are involved with fast-expanding industries, such as medical and technology firms. A venture capitalist investment typically runs between $7 and $10 million. Most venture capital firms play an important role in the development of new businesses. It should be noted that these companies typically have an exit strategy in place where they liquidate their assets once specific conditions are met.

Angel Investors

Angel investors, like venture capitalists, are considered to be members of the private sector. They are, however, individuals rather than commercial companies.

Single angel investment might vary between $25,000 and $100,000. They often invest with the anticipation of a significant return on investment. These investors may take on a more active role in a fledgling firm and even request a seat on the board of directors.

Crowdfunding

Crowdfunding is quite different from private investors. It may provide the general public with an investing opportunity. It is a hands-off investing strategy in terms of corporate operations.

The founder presents his or her concept or product and then invites others from all around the world to give money. Although crowdfunding is often a grassroots technique, several businesses may raise millions in a single month.

Other Ways to Get Series A Funding

Receiving Series A money is already a significant achievement for a young firm. This fund gives a firm two years to build a team and a product and begin executing its go-to-market plans. In addition to the many methods of obtaining Series A capital discussed above, the following items will also be beneficial:

Join an accelerator

An accelerator programme is used by around one-third of startup firms that seek finance. In reality, these accelerators account for 10% of all Series A funding. Keep in mind that the company team is the most important element considered for entry into the top accelerators.

Leveraging the network

When a startup seeks Series A capital, its network is critical. While you may join a top-tier accelerator to increase your statistical chances of receiving Series A investment, these groups only accept 2% of applications.

Startups that are sponsored without going via accelerators typically prosper as a result of early networking. They accomplished so, for example, with important investors, such as venture capital (VC) from leading venture capital companies or angel investors.

Expanding and nurturing the network

Before approaching these investors, it is a good idea to continue leveraging and growing your micro-VC and angel connection. A founder can accept as many new meetings as they can manage. Your startup's chances can be greatly improved by cultivating and developing a real connection prior to Series A investment.

Tips on Getting Series A Funding

After learning everything there is to know about Series A fundraising, it should be abundantly evident that obtaining Series A capital is not easy, but it is also not impossible. You must have a well-planned strategy in place to guarantee that you are properly prepared. Here are some tips for you:

Parameter of Evaluation

As a founder, you should be aware of all the criteria that venture capitalists use to evaluate a firm. Typically, VCs look for idea validation, traction, customer acquisition, the finished product, the team, and the management system. Aside from that, VCs consider the stage of your firm, market sector, location, and target equity.

Think about the potential team

Unlike in the seed stage, investors are more concerned with the business's ability to scale. Even if you have a core staff in place, have a strategy for hiring and increasing your team in the future years.

Find a lead investor

Invest significant work in locating a lead investor who compliments your business. Advice will become as precious as money as you advance in your career. The primary investor should be knowledgeable and have contacts in your industry.

Focus on the close

Even once VCs agree to invest in your firm, the legal procedure is time-consuming. The paperwork might take anything from 3 to 6 months to complete. To speed the procedure, you must be prepared with a lawyer and the necessary papers.

Terms of the deal

It is critical to have the transaction conditions correct and in accordance with your business objectives. Even though you are eager to get the first round of venture investment, keep in mind that sealing the deal is not the primary goal.

Pay close attention to the parameters of this round, since they will serve as the foundation for any subsequent rounds of funding.

Differences Between Series A and Seed Round

While it is necessary to know how to get introductions, pitch VCs and set conditions, there is another component of the fundraising process that is just as critical: Knowing the many types of fundraising choices.

Surprisingly, deciding between a seed round and a series A is not always easy. While both are regarded as stepping stones on the patch to Initial Public Offerings (IPOs) success, it is critical to grasp the differences between the two sources of investment.

| Seed Round | Series A |

| Designed to provide startups with the funding they need to lay the groundwork for a successful business | The ownership requirements of much larger funds leave less negotiating room to bring on knowledgeable investors. |

| They will have more time to perfect their business idea and connect with key business associates | With larger partners and more cash, the company is able to scale faster |

| Has a lower dilution and greater cash for the future rounds and have more freedom to pivot and change course in response to market conditions | Within the community, there is an increase in renown, prestige, and name recognition |

Conclusion

Series A funding is a startup company's first big round of venture capital investment. With this type of investment, you have a higher chance of maintaining your business's development and success.

While many firms receive investment on a daily basis, you must understand that many investors will say no.

You must begin learning from that experience and analyse what went wrong. Continue to make modifications until you are able to get Series A finance in accordance with your company objectives.

References

All About Series A funding and How To Get It

Series A, B, C Funding: How It Works