What are some of the obstacles that young entrepreneurs encounter when starting a business? Some may argue that the products or services offered are not attractive enough or that the market the business is in is not large enough. Though, most entrepreneurs find that the lack of funds to be the root of their problem. With sufficient funds, much can be achieved, businesses can allocate the funds to marketing, product development and many more which can improve their situation. The question is, where can young entrepreneurs find these funds?

In order for start-ups to accelerate and sustain their growth, most entrepreneurs resolve to receive funds from investment rounds. If you are a first-time founder with a company that is still in the proof-of-concept stage or doesn't yet have enough income to support growth or development, you might be able to raise pre-seed investment from interested investors to help you get started.

What Is A Pre-Seed Funding?

Pre-seed funding is referred to as a "friends and family" round by many entrepreneurs and investors. While organisations may seek venture financing, especially if they have prior experience founding businesses and have established ties with investors, this is the first money you muster. You're effectively asking someone to take a huge risk and hand up a portion of their assets to fund your project if you don't have any investors. And most of the time, it's simply a notion.

This will frequently take the form of a convertible note, which is simply a debt that changes into equity (generally around the time of the next funding round).

- You are regarded a work-in-progress, yet you have something to show for it. Right now, you are probabaly working on even the most basic version of your product, or you have got something that works but is incredibly bare-bones

- You've spotted a lucrative market opportunity. Some will be far more noticeable than others.

- Your first few hires are about to be made. You've undoubtedly recognised that getting your product off the ground will require some additional assistance. Engineers or anyone with operating experience might be able to help. In either case, persuading someone to quit a secure position for a complete gamble will cost you money.

- Your expenses are beginning to mount. If you're working on a technically hard project, you may find yourself with a sizable bill.

Your term sheets are probably tidy and uncomplicated in this situation. You might be raising tens of thousands of dollars, sometimes from an early-stage startup accelerator programme and you are primarily aiming to get a run rate of at least a few months to build out your product and demonstrate that you have discovered some product-market fit.

When And How To Raise Pre-Seed Funding

By the time a firm is ready to secure pre-seed capital, it has usually built proofs-of-concept or prototypes in order to sway investors, and this stage of preparation is critical.

The timing and method of obtaining pre-seed funds are essential to the startup's success. Because companies at this stage lack real traction or a completely functional prototype, it's critical to persuade investors of the company's long-term ambition and ability to scale. It could take longer than expected.

However, because time is of the essence, a time frame is still essential for fundraising. Furthermore, if companies take too long to get off the ground, they may fail. As a result, the focus must be on completing the fundraising process within a set time frame and keeping investors on their toes when it comes to making the final decision.

While timing is important, companies cannot overlook the successes and failures along the way to pre-seed investment.

- Startups must have a clear understanding of their financial and business objectives. This comprises the required amount, the business's overall cost, and an estimate of how much it can earn in the future. They must also allocate monies prior to receiving them to the appropriate resources for their activities.

- It is critical to complete all paperwork ahead of time for pre-seed investment so that there is no delay if investors opt to invest.

- Before making the pitch, do extensive research on the pre-seed investor ecosystem and the top investors.

- Startups require all legal and regulatory documentation, including partnership agreements, incorporation papers, and relevant certificates.

- The next step is to create a pitch deck and finalise a business plan, as cash might come from unexpected places at this stage, and even spontaneous calls can result in a fundraising round.

How Much Pre-Seed Funding Should You Raise?

One of the most difficult issues in this area is persuading pre-seed investors to invest in firms that have little or no momentum at this level. So, how much money to raise at the pre-seed stage is determined by how much pressure founders want to put on their startup.

As a result, anyone urging founders to raise "as much money as you can" may not be entirely correct. The following are some of the reasons why startups should be cautious about the amount of cash they receive.

- If a startup raises too much money at this stage, the terms of the investment will automatically increase, and more diligence will be necessary. Investors are also likely to seek more control in order to ensure that their money is not misused

- If a firm receives more capital than it need, investors will modify the caluation upward to compensate. This can place a strain on companies because if things go wrong and they need to raise money again, their valuation will be declined, which can harm their reputation and business, as well as future rounds.

- Overfunding can also contribute to slackness and irresponsible spending. Raising more money than needed could disrupt the company's operation, which involves hiring more people, implementing new systems, and expanding total requirements.

So, before deciding the amount that you should raise, consider the factors below beforehand.

The Next Big Thing

The size of the pre-seed investment will determine the next step for the company, such as hiring more people, developing a new product, or growing sales in specific channels. Milestones differ from one company to the next, and they also fluctuate depending on the model utilised in the same industry. It could be the creation of a prototype for hardware or devices or the demonstration of a platform or services' proof of concept. It can also be linked to customer acquisition or testing to validate a product or value proposition in the market.

Planning milestones is critical since investors may want to know the significance of each one for the startup in order to determine whether the company has the correct leadership and direction. Furthermore, because the best time to raise cash is just before or shortly after a major milestone is reached, it is critical to keep track of how close or far they are.

How Do You Pick Milestones

Without a doubt, the ultimate goal is to reach the critical milestone that will attract investors. Pre-seed investors are typically mindful of the risk and uncertainty that comes with investing in startups or business strategies. As a result, this group of investors seeks substantiation, which has the power to validate business model assumptions and the startup's value proposition. As a result, it is critical to guarantee that the target milestones will aid in the achievement of the overall goal. If it fails to fulfil the goals, it is critical to set a new goal. But, at the same time, these milestones must be reasonable and feasible, as overselling concepts to investors is a waste of time.

How To Determine The Amount Of Funding

Prepare a detailed proposal that includes the responsibility areas, resources, and expenditures needed to fulfil the plans and meet the deadlines. This can assist startups in determining the amount of pre-seed funding they require. Because there is always room for uncertainty and unknowns. It is wise to budget for this extra spending. This money might also be used to cover any additional costs incurred as a result of a change in plans or strategy. Long-term planning guarantees that the financing amount chosen covers expenses until the next funding round. Otherwise, getting the next round of money would be extremely difficult. Aside from accounting for unforeseen costs, it's usually a good idea to leave some wiggle room in the plan's timeline. It's best to be ready for it ahead of time.

Investors' Perspectives

Some entrepreneurs may have the funds to bootstrap their businesses in their early phases, while others may not. In the case of the latter, it is always better to contact family or friends first. Before addressing pre-seed investors or corporations, this should be the first step.

Even if you're bootstrapping, keep in mind that momentum is everything. If a firm is unable to execute its plan using the founders' or original employees' finances, raising funding from outside sources may be negative since the milestones will not be significant enough to persuade investors to take the risk.

How To Get Pre-Seed Funding

There is no one-size-fits-all criterion for whether a company is ready to raise a pre-seed round, but there are several indicators that may show that this is the right decision.

- Have a MVP (minimal viable product) that is gaining traction

- Can show that our product is a good fit for the market

- Have a solid founding team with suitable experience and background

- Have stared the process of getting customers to use you product or service

- Your company has started to make money

- Need money to finish your prototype

- You are all set to make key hires

After determining if you need to raise money for your product development and accelerate your company's growth, it is now time to determine the best investors to approach.

Choose The Most Appropriate Investors To Approach

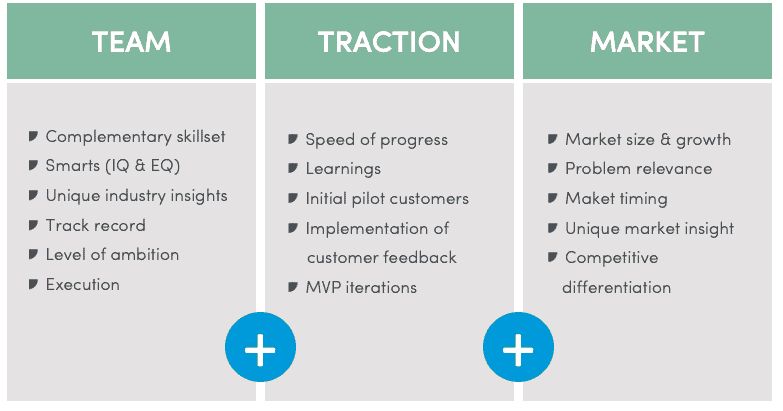

Most firms don't have much sales data to substantiate their business model during the pre-seed investment stage, these investors are putting their faith in the founding team when they invest at this level. You will need to find investors and funds that are primarily interested in pre-seed investment for companies. These investors and funds will be willing to take a chance and make judgments based on conviction and future potential rather than sales figures and income.

Pre-seed funding investors can be divided into three categories:

Angel Investors

These are individuals who make relatively small investments. Angel investors, however, can frequently provide pre-seed funding rapidly because they are the only ones who make decisions. If they were also a part of your company's angel round, they are already invested in the success of your venture.

Accelerator or Incubator Programmes

These programmes are similar to a crash course in starting a business. Early-stage companies are given access to an entrepreneurial community full of helpful training, networking opportunities, free or discounted resources, and exposure to top-tier Venture Capital for future funding rounds, in addition to raising initial pre-seed capital in exchange for equity. Founders must complete the application procedure and, if accepted, follow the instructions to finish the 'course.'

Pre-Seed And Seed Investment Venture Capital Funds

These funds are made up of a number of limited partners. Venture Capital funds can make greater pre-seed investments, but they also have a longer decision-making process.

How To Attract Attention From Pre-Seed Investors

If your business is already making money and developing traction, you will have a much better chance of getting pre-seed capital. Even if you don't yet have a working product or service, here are a few characteristics that can help you persuade investors.

- An Introduction. The greatest way to connect with a possible investor is through someone they trust, prefereably an entrepreneur they have previously invested in.

- An Entrepreneurial Personality. A startup's founder personality is very important during this early stage. Investors will be looking to see whether you are a go-getter and if you have left a high paying career and taken risks to pursue your passion.

- A Qualified Co-Founder. Building a team is a founder's first obligation, thus pitching to investors as a solo founder will drastically diminish your chances of securing funding. This is especially difficult if you want to develop a product but have a business background and don't have a technical co-founder who can put your ideas into action. It is not easy to fund a co-founder, therefore start seeking as soon as possible.

- Relevant Experience. Having an outstanding background in your field, for example, being a product manager at a prominet software firm or having a computer science degree will persuade investors to take you seriously if you aren't yet established as a startup founder.

What To Include In Your Pre-Seed Funding Pitch Deck

After you have identified the correct investors and gotten their attention, it is now time to create a pitch deck to seek investment. Apart from giving a normal pitch, company owners and promoters should have a pitch prepared for unplanned encounters with investors. Here are some topics that must be included in your pitch deck.

- Problem. This should be the first slide in the deck that should highlight the gaps in the market that your company is aiming to fill and how you plan to solve the problem.

- Solutions. Highlighting the key qualities of a product or service and illustrating how it will address the problem. Startups must have a clear understanding as to where their product/services fit in the market

- Value Proposition. Intoduce the unique value proposition gradually, explaining why the product or service being pitched will fit in the market and what value it adds to clients or consumers

- Product/Service: Describe the product/service in depth, including photographs, videos, and a detailed explanation. A section on competitors allows you to see how your product or service compares to others on the market.

- Traction. To prove or indicate traction, the startup must show monthly growth, a minimum viable product, or whatever it has accomplished thus far.

- Team. Investors want to know who is on the team beyond the leadership and founders, thus this is one of the most important slides in a pitch deck. Personnel and resouces are in charge of carrying out the plan, thus emphasising them during pre-seed rounds is critical.

- Targeted Amount Of Funding. Startups must use all available startegies to determine an amount that will assist them to reach their objectives, goals, and milestones. Giving a clear justification for the amount, as well as directing any possible investment to the areas where it would be spent, goes a long way. A detailed schedule for spending this cash should help persuade investors of the pitch's meticulous planning.

Difference Between Pre-Seed Funding And Seed Funding

One of the first things, you are probably wondering about after developing your first product is how you are going to get it out the door while you are just getting started. To acquire that initial push of early adopters, you might wish to pay for promotion and marketing. You may require as much assistance as possible from contractors or an entire team. Or, depending on how difficult it is to build out a product, you may have to quit your job to focus on it full time. All this is expensive, and money is not going to appear out of nowhere, you will most likely turn to fundraisers on a regular basis. As a result, you are faced with a dilemma, are you a pre-seed or a seed-stage company?

| Pre-Seed Funding | Seed Funding |

| To validate the startup idea and construct a prototype, a pre-seed fund is required | Used to get the business up and running and produce the minimum viable product |

| A pre-institutional capital received from friends, relatives, and business incubators | Comes from a variety of sources, including venture capitalists, angel investors, and startup accelerators |

| To acquire a pre-seed fund, you don't require any revenue traction | To receive seed funding at the time of pitching, you are required a revenue traction |

| The completion of the prototype, hiring staff, building the minimal viable product are all critical goals to fulfil with the pre-seed funding | In order to be eligible for a seed-stage fund, a company must have established a minimum viable product |

Conclusion

There is no denying that pre-seed investment has risen in popularity in recent years as the number of entrepreneurs has increased. Pre-seed investment can be the make-or-break moment for every startup due to its relevance in early-stage product and service development.

That is why, rather than merely getting startup funding, it is critical to evaluate the variables that will help entrepreneurs set expectations for investors in future rounds and build a long-term partnership.