Updated on 25 October 2023

To understand the concept of equity crowdfunding, let us quickly go over what crowdfunding is. Crowdfunding is one of the methods to raise capital for a project or venture from a large number of people who each contribute a relatively small amount, typically via the internet.

Visit our insights page to learn more about crowdfunding.

What Is Equity Crowdfunding (ECF)?

Equity Crowdfunding is a method for Startups and Small & Medium Enterprises (SMEs) or Businesses to raise funds via the general public, a.k.a. Retail Investors. Retail Investors develop operational strategies for the company using their extensive experience in operational management. He designs and implements training processes to ensure a high level of efficiency in the workshops for deals on ECF platforms to Invest in businesses in exchange for Equity.

These businesses are generally high risk, high return investment alternatives to other Investment instruments like Stocks, Bonds, Mutual Funds or Trust Funds, or even Fixed Deposits. Startups generally have a 25% yearly average return, however, it also comes with a high risk of >90% mortality rate.

Of course, the 25% return is after even the failures of those startups, as the successful Startups are able to provide more than 5X or if you are lucky, more than 30X returns on your investment.

Startup Investment is a numbers and skills game - the numbers being you have to invest in enough Startups (we generally assume >20) and the skills being able to spot the right Startups to invest in.

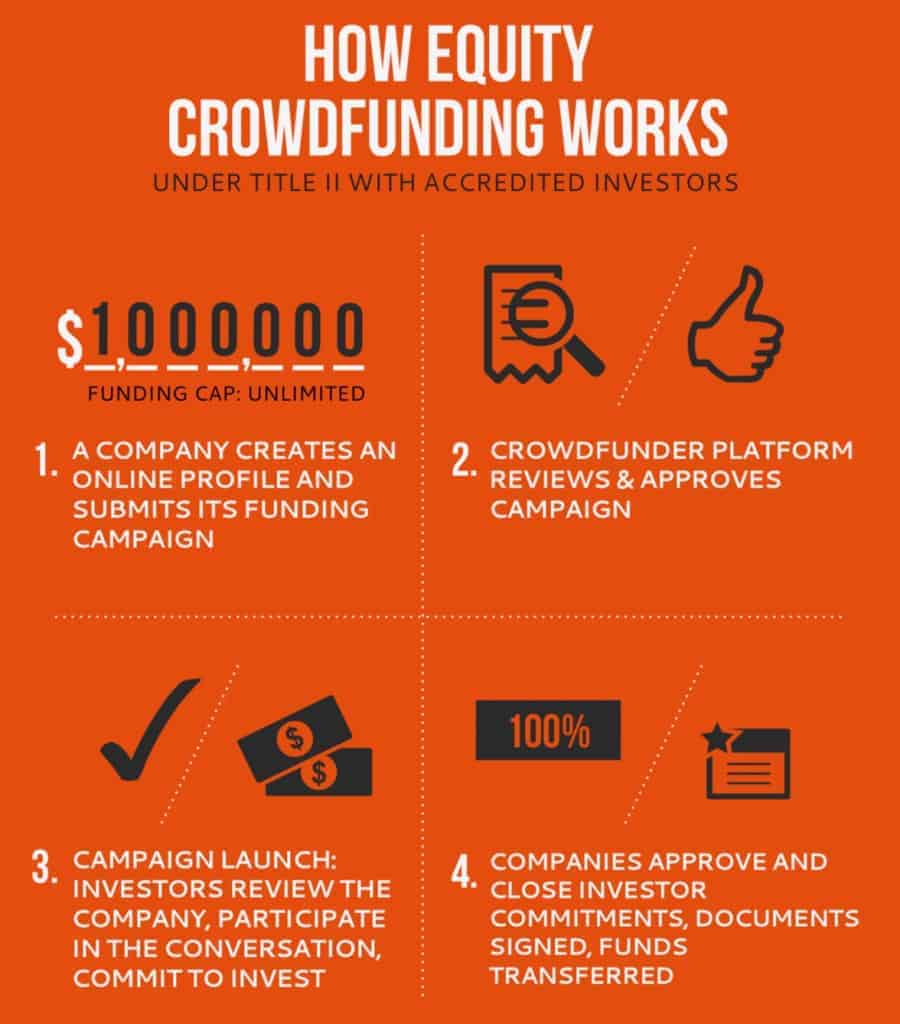

How Does Equity Crowdfunding Work?

Equity crowdfunding is a superior option for generating larger sums than rewards-based crowdfunding. Because of the high sums at stake, equity crowdfunding platforms, also known as portals, are controlled by the government. There are limits to how much money can be generated, invested, and how often it can be used.

Choose A Platform

Begin by deciding whether you want to use a rewards or equity-based model. Find out how long campaigns can run on different platforms. That might be crucial. What is the maximum amount you can raise? Also, figure out who is going to view it. Different categories of backers may be attracted to different platforms.

Obtain Platform Acceptance

Fill out the online forms and supply any necessary documentation. The platforms must verify your legitimacy. If you want to use equity crowdfunded, you may need an offer document or prospectus. This outlines the investment' specifics, as well as any required risk warnings and investor cooling-off periods.

Make Your Case

You will have a space to make your pitch after the platform has accepted you. Describe your project or concept, why you are looking for money, and how much you would like to raise. If the platform is based on rewards, make a list of what backers will receive. If you are using an equity-based platform, you will need to specify the equity stake as well as the share price, if one can be calculated.

End Of Campaign

Some social crowdfunding sites allow you to get all of the funds generated during the campaign. Others require you to establish a goal and only receive money if you achieve it.

For Startups, here's what you can expect when raising funds via Equity Crowdfunding

- Prepare to go public (or semi-public). Your business will now have shareholders from the outside. Having a good shareholders agreement will help in the future.

- Be prepared to show your numbers on the platform. Members of the platform can view the information to evaluate your company. This is to help them make a decision for investment purposes. So, the numbers should look good!

- The Securities Commission of Malaysia has allowed ECF operators to charge a certain percentage (%) on the amount raised. For example, if you raise RM3m, the ECF operator will charge 7% (RM210k) as their fee. This goes to pay for their operational costs in running the ECF platform. This is standard in the ECF industry.

- Prepare to publicise the offering. Having a media strategy is important to get a maximum benefit from ECF funding publicity.

- Prepare your FFF (Friends, Family & Fools). Letting them know before you go live is important to help you boost your initial fundraiser. This will help you get the rest of your money. If a deal is only 5% funded for the first 2 weeks, that is not a good sign. Feel free to include current shareholders.

- Prepare a fundraising video. This is important to engage and to educate your target investors on why they should invest in your company. It is important to help them understand your business so that they feel comfortable to invest in your company.

Some equity crowdfunding platforms also charge other fees to cover costs such as due diligence before approving Startups to be able to list on the platform for fundraising. This is to ensure the quality of deals on their platforms.

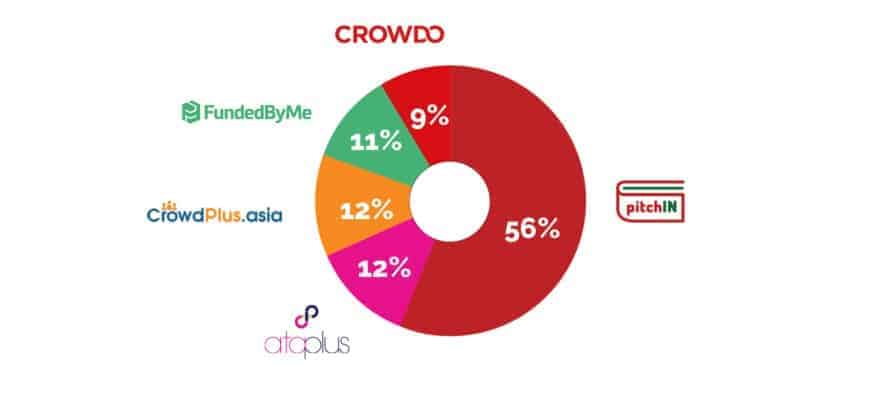

Who is the Top Crowdfunding Platform in Malaysia?

The Track Record of Equity Crowdfunding in Malaysia in a year:

All the 6 ECF platforms raised Rm10M in a year of operations, helping the above 14 Startups to get funding. This is a great start for the ECF industry - something that we are very pleased to support. So how can we compare them? Do have a look below.

How Can We Compare the platforms of Equity Crowdfunding in Malaysia?

The answer, as always, is that it depends. Some platforms have their specialities and niches, or strengths;

- Propeller Crowd Plus - PCP has a track record of SME companies.

- PitchIn - PitchIn has a track record of various types of Startups to date.

- Funded By Me - FBM has a track record of deals with companies based in Penang.

- Ata Plus - AP has a track record of funding social enterprises.

- Crowdo - Crowdo has a track record of Startups and P2P Money Lending.

- Eureeca - Most of their track record is from the Middle East & the UK.

If you were to look at all of them, they all have their strengths and track records. It is up to Startup Founders to decide how they would like to benefit from raising funds from an ECF platform. We encourage Startups to talk to all the ECF operators to learn about what intangibles they can provide other than just the money.

Sometimes, they offer connections to the right Investors, or even extra media coverage, or other forms of help.

We have created tables below to summarise all the necessary information for equity crowdfunding platforms and any fees and regulations that may occur. These tables are with regards to Malaysia only.

| Crowdfunding Platform | Fee and Other Charges |

| ATA Plus | Signing up as a member is free. As a member, you enjoy free access to all deals and make an investment(s) with no additional cost or fees. All required government levies or taxes will be charged accordingly when an investment is concluded. |

| Crowdo | Basic fees charged to an Issuer are processing fees, onboarding fees and an administrative fee which is charged as a % of the funds raised. |

| CrowdPlus.asia | No fee is charged to investors. The fee is charged to companies that successfully raised their minimum targeted amount within the offer period. A fee of 7% is charged on the total amount raised in a successful fundraising campaign and no fee is charged in the event of an unsuccessful campaign. In addition to that, it is important to note the cost associated with coaching, financial and legal due diligence, if required, is not refundable. |

| FundedByMe | There is no fee for becoming a member. When making an investment, a fee of 1.9% of the invested amount is applied to each investment. For entrepreneurs, FundedByMe charges a listing fee of EUR 2 900 to list your business post having successfully gone through the application process. They charge a platform fee of 8% (excl. VAT) on the amount you successfully raise. |

| Fundnel | Fundnel charges a 2% success-based fee of total funds raised from your deal. In certain cases, a monthly project retainer fee might be required to cover the costs of engagement of external professional parties. |

| Eureeca | You pay nothing to apply, and there are no upfront fees during introductory conversations. Eureeca takes a success fee of 7.25% of the amount raised. |

| pitchIN | Using pitchIN's service is free. However, if your project succeeds in raising the amount that you want, there will be a 5% fee to the funds raised. |

The table below is to identify any extra regulations implemented by these platforms:

| Crowdfunding Platform | Regulations |

| ATA Plus |

Sophisticated Investor: no restrictions Angel Investor: a maximum of RM 500,000 within a 12-month period Retail Investor: a maximum of RM 5,000 per issuer (Entrepreneur/Deal) with a total amount of not more than RM 50,000 within a 12-month period |

| Crowdo | For MYR denominated Equity Offer: an Sdn Bhd (private limited company) can raise up to 3m MYR during a 12-month span and cumulatively 5m MYR. A Venture Capital Fund can raise unlimited amounts of funds. |

| Crowdplus.asia | The minimum investment is RM500 and the maximum investment from an individual is subject to the investors' type. |

| FundedByMe | They also offer a number of additional services to further help build and market your campaign, these costs vary depending on the case. |

| Fundnel | Fundnel charges zero fees for accessing the platform as an investor; a success-based fee on the successful transaction is borne by the seller. Fundnel offers multiple funding structures: equity, convertibles, debt and revenue-sharing. |

| Eureeca | If your company has been approved, there is an application fee of $1,500. If the company passes this assessment, the company is eligible to list on the platform. If the campaign is not listed, $750 of the application fee is refundable. |

| PitchIN | There are also processing fees for MOL Pay and PayPal, our financial payment gateway partner, if the funding is successful. |

What Is Equity Crowdfunding in Malaysia an Alternative To (For Startups)?

Where else can startups find investments or funding (i.e. alternatives to equity crowdfunding in Malaysia)?

- Pre-Seed & Seed or Early Stage Venture Capital (VCs) typically from RM100k to 3M

- Angel Investor Networks or Groups (Not Individual Angel Investors) typically from RM50k to 1M

- Government Grants like the Cradle CIP 300 or TERAJU

- Government Funds like Cradle Seed Ventures or PlatCom Ventures or others.

Note that although there are alternatives, they can be combined as well, depending on a Startups Fund Raising Strategy.

Pros & Cons of Equity Crowd Funding (ECF)

Pros

- ECF is an easy way to get media attention. Having this as part of your media strategy will help.

- Engage your customers - why not get your best advocates to be a part of your business? Hopefully, they will join you in promoting it further.

- Transparency & Compliance - having a transparent & compliant business is important for long-term success. ECF is a step closer to that. Do expect to report regularly to your investors.

-

A Strong reach of Retail Investors - there are hundreds of investors on ECF platforms - all of which are potential investors! Be

prepared to hold annual general meetings. - ECF platforms act as your Investment Advisor - as there is someone to help you through the process.

Cons

- Equity crowdfunding is not for every business - the benefits of crowdfunding may not apply to B2B businesses, for example.

- Compliance requirements - be prepared to report to your investors, hold annual general meetings and administrative work along with that.

- Startups have to be ready to open up their financial numbers to the public - although this is available to members only.

- Startups need to be ready to have a larger than the usual number of investors or shareholders. Having additional partners in your business is something that all businesses should think about seriously.

- There are costs to equity crowdfunding. Other than fees, it takes time and effort to build up a crowdfunding campaign. Angel investment, for example, is completely free for Startups.

- There is a chance that the equity crowdfunding process may fail. This may not reflect well in the market. Your upfront fees may also no be refunded depending on the platform.

Equity Crowdfunding in Malaysia In The Year 2019

The 7 biggest platforms currently in the Malaysian market are Ata Plus, Crowdo, FundedByMe, Crowdplus.asia, Fundnel, Eureeca and PitchIN. Fundnel is the latest platform that was granted a license.

After it was introduced, 50 SME’s were funded with a collective amount of close to MYR 49 million. Close to 60% of all the investors who contributed to this amount are retail investors. This shows clearly that the general public is interested in this way of investing.

The biggest group of investors of equity crowdfunding in Malaysia is between 35-45-year old. They tend to be the people who have enough income to put some aside for investment. Also, they are in the generation where they still are to some extent familiar and comfortable with technology.

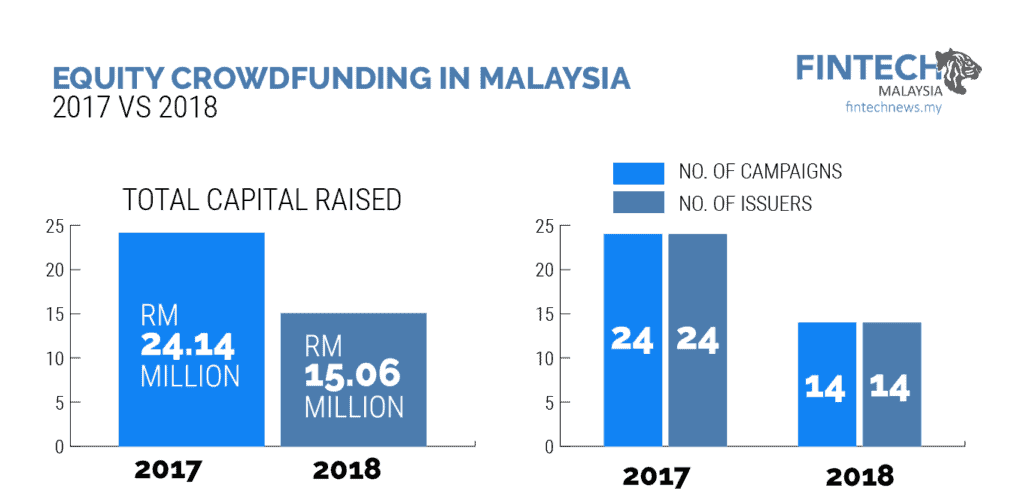

After 2017, we saw a decrease in the performance of this industry. The total amount that was raised dropped from 24 million to 15 million and the number of campaigns dropped from 22 to 14. PitchIN owned a 75% market share as they were the most active ones.

If we take a look at the cases carried out o PitchIN’s platform, we can highlight some of the most successful campaigns. Commerce.Asian Fundaztic and QEOS LED are good examples. They all clocked in at MYR 3 million. In the case of Fundaztic, it only took 38 minutes to close the round.

PitchIN continues to dominate the market. Currently, more than half of the funds are still raised through their platform.

Ata Plus is moving up since 2017. They made huge improvement regarding their market share. Together with crowdplus.asia they are lining up behind PitchIN.

Meanwhile, players like Eureeca have not seen any activity. Fundnel being the newest entrant have not had any campaigns at the time that the data was compiled.

Below is a video providing insights into Equity Crowdfunding by Securities Commission Malaysia.

The other players like Eureeca and Fundnel are showing no activity. Until now, Fundnel did not manage to obtain any market share.

More Resources:

To Conclude

Equity crowdfunding is raising capital from the crowd through the sale of securities (shares, convertible note, debt, revenue share, and more) in a private company (that is not listed on stock exchanges).

The key difference between a crowdfunding site like Kickstarter and equity crowdfunding is what is being sold. With Kickstarter campaigns, entrepreneurs raise capital through the presale of their product, often at a discount, or through tiers of various perks to attract their fans and potential customers.

According to FinTech Malaysia, below is the analysis of the total capital raised through equity crowdfunding in Malaysia.

With equity crowdfunding, companies sell securities, whether in the form of equity in the company, debt, revenue share, convertible note, and more. Equity crowdfunding gives investors skin in the game.

Companies with high scalability potential are suited to both VC funding and crowdfunding options. Such companies have highly innovative business models and typically work within the software, fintech, biotech, MedTech and gaming industries.

The reason for this is that both funding options allow them to raise capital quickly to achieve fast growth, and avoid the risk of being swallowed up or beaten by competitors with deeper pockets and more endurance.