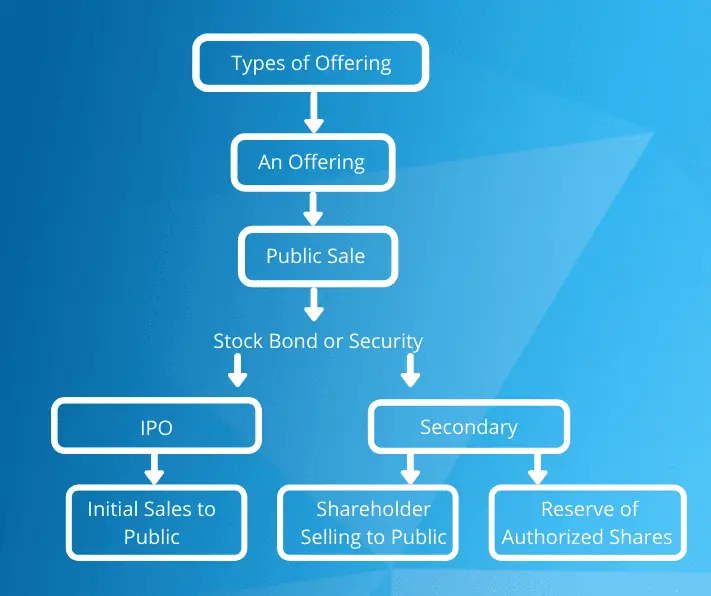

To provide some context before discussing secondary offerings of shares, let's review some fundamental concepts about primary and secondary markets. In the primary market, companies sell new shares for cash to investors, and the proceeds generated are typically utilized to finance company operations, make acquisitions, or pursue other business objectives. On the other hand, in the secondary market, investors trade previously issued shares of listed companies among themselves. The company itself does not issue any new shares or receive any additional funding due to these transactions.

The Definition of Secondary Offering

A secondary offering is when existing shareholders, such as insiders or institutional investors, sell their shares to the public on a secondary market, such as a stock exchange. The company previously issued these shares in an initial public offering (IPO) or another primary offering.

Unlike in an IPO, the proceeds from a secondary offering go to the selling shareholders rather than the company. The company does not receive any new capital from the sale of shares in a secondary offering. Still, it may benefit indirectly if the offering helps to increase demand for its shares and/or improves liquidity in the market.

Secondary offerings can have various motivations, such as allowing existing shareholders to monetize their investments, raising funds for the selling shareholders, or simply increasing the liquidity of the company's shares. The selling shareholders and underwriters who facilitate the offering typically agree upon the terms of a secondary offering, including the number of shares being offered, the price, and the timing.

Primary vs Secondary Offerings

Secondary offerings can take on different forms depending on how they are structured and what the company is trying to achieve.

A company issues new shares to investors in exchange for cash in a primary offering. This is typically done through an IPO, but it can also be done through a follow-on offering if the company needs additional capital to fund growth opportunities or repay debt.

In a secondary offering, on the other hand, the company does not issue new shares. Instead, existing shareholders sell their shares to other investors on the secondary market. This can include large institutional investors, retail investors, or even other companies.

However, there are different types of secondary offerings. For example, a non-dilutive secondary offering is one in which the company does not issue new shares but instead allows existing shareholders to sell their shares to other investors. This can be a good way for shareholders to monetize their investment in the company without diluting the value of their remaining shares. On the other hand, a dilutive secondary offering is one in which the company issues new shares and sells them to investors. This can dilute the value of existing shares, but it can also provide the company with additional capital to fund growth opportunities or repay debt.

The Work of Secondary Offerings

An initial public offering (IPO) is a process through which a private company becomes a publicly-traded company by offering its shares to the public for the first time. In an IPO, the company issues new shares of stock that are sold to institutional investors, individual investors, and other interested parties in the primary market. The primary purpose of an IPO is to raise capital for the company, which can use the proceeds for a variety of purposes, such as expanding its business, paying off debt, or making acquisitions. Going public can also increase the company's visibility and credibility, which can help attract new customers and business partners. The process of going public involves extensive regulatory requirements, including filing registration statements with the Securities and Exchange Commission (SEC), providing detailed financial and operational disclosures, and meeting certain corporate governance standards. The company typically hires investment banks and other financial advisors to help prepare for the IPO and to underwrite and sell the new shares of stock.

After an initial public offering (IPO), the company's shares become publicly traded, and investors can buy and sell the shares on the secondary market through a stock exchange, such as the New York Stock Exchange (NYSE) or the Nasdaq. Investors who hold shares of a company's stock can choose to sell their shares to other investors in what is known as a secondary offering. Unlike in an IPO, where the company issues new shares and receives the proceeds from the sale, in a secondary offering, the selling investors own the shares, and the proceeds from the sale go directly to them, not to the company. A secondary offering can be either dilutive or non-dilutive. In a non-dilutive offering, existing shareholders sell their shares to the public, and the company's outstanding shares do not increase. In a dilutive offering, the company issues new shares of stock, which can lead to a dilution of existing shareholders' ownership percentage in the company.

The price of a company's shares in a secondary offering is determined by market supply and demand and may not necessarily reflect the company's intrinsic value. Additionally, secondary offerings can impact a company's stock price, depending on factors such as the size of the offering, the price at which the shares are sold, and market conditions.

A company may perform a secondary follow-on offering. A follow-on offering is a type of secondary offering in which a company offers additional shares of stock to the public after the initial public offering (IPO). Follow-on offerings can be used to raise capital for various purposes, such as financing debt, making acquisitions, or funding research and development (R&D) initiatives. In some cases, follow-on offerings may be initiated by investors who wish to cash out of their holdings rather than by the company itself. This can happen when early investors or insiders who own a significant portion of the company's shares want to sell their holdings for liquidity reasons, such as diversifying their investments or raising cash for personal reasons. Follow-on offerings can also be used to refinance debt when interest rates are low. In this case, a company may issue new shares of stock and use the proceeds to pay off high-interest debt, which can help lower its overall cost of capital and improve its financial position. The terms of a follow-on offering, including the number of shares being offered, the offering price, and the use of proceeds, are typically agreed upon by the company's management and its underwriters, who facilitate the offering. The offering may also require regulatory approval from the Securities and Exchange Commission (SEC) and other relevant authorities.

Types of Secondary Offerings

There are two main types of secondary offerings: non-dilutive offerings and dilutive offerings:

Non-dilutive offerings

In a non-dilutive offering, the company does not issue new shares of stock. Instead, existing shareholders sell their shares to the public. This means that the number of outstanding shares remains the same, and the ownership percentage of each shareholder remains unchanged. Non-dilutive offerings can be used by companies to provide liquidity for existing shareholders or to raise capital without diluting the ownership of current shareholders.

Dilutive offerings

In a dilutive offering, the company issues new shares of stock, which can dilute the ownership percentage of existing shareholders. This is because the number of outstanding shares increases, which means that each existing shareholder owns a smaller percentage of the company. Companies can use dilutive offerings to raise capital for various purposes, such as financing acquisitions or expanding operations.

Dilutive offerings can have a negative impact on a company's stock price, at least in the short term, because they increase the number of outstanding shares, which can dilute earnings per share (EPS). However, if the offering is successful and the company uses the proceeds to generate growth, this can ultimately be positive for the company and its shareholders in the long run. Additionally, dilutive offerings may be subject to regulatory approvals and other requirements.

A company may use one of several methods to conduct a dilutive secondary offering. These methods include:

Private placement

Private placement refers to the sale of securities by a company to a select group of investors, such as institutional investors, accredited investors, or high-net-worth individuals, without conducting a public offering. Private placements are typically used by companies that are seeking to raise capital but do not want to go through the time-consuming and expensive process of a public offering.

Public Offering

A public offering is a type of securities issuance where a company offers new shares of its stock or other securities to the public. The process is typically managed by an investment bank or group of investment banks, which act as underwriters for the offering.

Unlike private placements, public offerings are open to retail investors, who can purchase company shares in the primary market. Public offerings can take different forms, including initial public offerings (IPOs), where a company first goes public, and follow-on offerings, where a company issues additional shares after already being public.

Toxic Financing

Toxic financing involves the issuance of securities, such as stocks or bonds that are structured in a way that is harmful to the company or its existing shareholders. It typically involves the issuance of securities at a steep discount to the market price, which is then sold to institutional investors who can quickly sell the securities at a profit. This process often results in a significant increase in the supply of shares, which puts downward pressure on the stock price.

The method chosen by the company will depend on factors such as the amount of capital needed, market conditions, and the company's relationship with investment banks and other investors.

Effects of Secondary Offerings

Secondary offerings can significantly impact investor sentiment and corporate stock prices, and the market's reaction can be unpredictable at times.

If a major shareholder sells a large number of shares, this can be seen as a sign of bad news, and investors may react negatively, causing the stock price to fall. However, in some cases, dilutive secondary offerings can positively impact a company's stock price if investors believe that the proceeds will be used to fund growth opportunities, such as debt repayment, acquisitions, or research and development.

The success of a secondary offering ultimately depends on the company's ability to use the funds raised to generate growth and create value for shareholders. If the company is successful in this regard, the stock price may eventually recover and even rise over time, despite the short-term dip that often occurs after a dilutive offering.

Overall, secondary offerings are an important tool for companies to raise capital. Still, they can also be a source of volatility for investors. Hence, it's important to carefully consider the potential risks and rewards before investing in a company that is planning a secondary offering.

Conclusion

Secondary offerings allow investors to buy and sell shares in companies that have already gone public. These offerings can be non-dilutive, where current shareholders sell their shares, or dilutive, where the company creates and places new shares onto the market. Dilutive offerings can sometimes negatively impact stock prices in the short term due to the dilution of existing shares, but can also provide much-needed capital to support a company's long-term growth. Ultimately, the success of a secondary offering depends on how effectively the company uses the proceeds.

References

The Definition of Secondary Offerings