When a company issues more shares of stock, it can dilute the ownership percentages of existing stockholders. This means that each stockholder's ownership stake in the company becomes smaller as more people are added to the mix. Anti-dilution provisions are used to prevent this from happening to certain stockholders. These provisions are commonly applied when new investors buy stock at a lower price than earlier investors, and they work to minimize the dilutive effect of future stock issuances.

What is Anti-Dilution Provision?

Anti-dilution provisions are designed to protect investors from the potential dilution of their equity stake in a company when new shares are issued at a lower price than their original investment. They are typically associated with preferred shares and give investors the right to maintain their ownership percentage in a company even if new shares are issued at a lower price.

Anti-dilution provisions come in various forms, but they essentially work to maintain an investor's ownership percentage in a company, even when new shares are issued at a lower price than their original investment. This is achieved through adjustments to the conversion ratio of preferred shares or convertible securities, such as convertible preferred stock or convertible debt.

The conversion ratio of preferred shares refers to the number of shares into which each preferred share can be converted. When new shares are issued at a lower price, the conversion ratio is adjusted to give the investor more shares. This ensures that their ownership percentage in the company stays the same, despite the dilutive event. For convertible securities, the investor's conversion rate is adjusted to give them more shares, thereby maintaining the value of their investment. These adjustments can be essential for investors who want to safeguard their ownership stake in a company, particularly early investors who want to ensure that their investment is not unfairly diluted as the company grows and raises additional capital.

Anti-dilution provisions can be triggered by a variety of events, such as a new round of funding, a stock split, or a merger or acquisition. They can also be structured differently depending on the specific terms of the security, such as whether they are full-ratchet or weighted-average anti-dilution provisions.

This can be important for investors who have invested in a company at an early stage and want to ensure that their ownership stake is not diluted as the company grows and issues more shares. Anti-dilution provisions can help protect these investors by giving them the right to receive more shares in the event of a dilutive event.

When does Anti-Dilution Provision Used?

Anti-dilution provisions are commonly used in the issuance of convertible securities, particularly in venture capital investing, where multiple rounds of financing are often used.

By including anti-dilution provisions in their convertible stock offerings, companies can provide greater protection for their investors and help to ensure that their ownership stakes are not unfairly diluted. This can be particularly important for early-stage companies, where additional funding rounds are likely to occur, and the risk of dilution is higher.

Additionally, anti-dilution provisions can serve as an incentive for companies to maintain financial targets, as this can help prevent the securities' conversion price from being adjusted downward. This can be an important consideration for both investors and companies, as it can help to maintain the value of the investment and provide greater stability for the company's financial position.

Types of Anti-Dilution Provisions

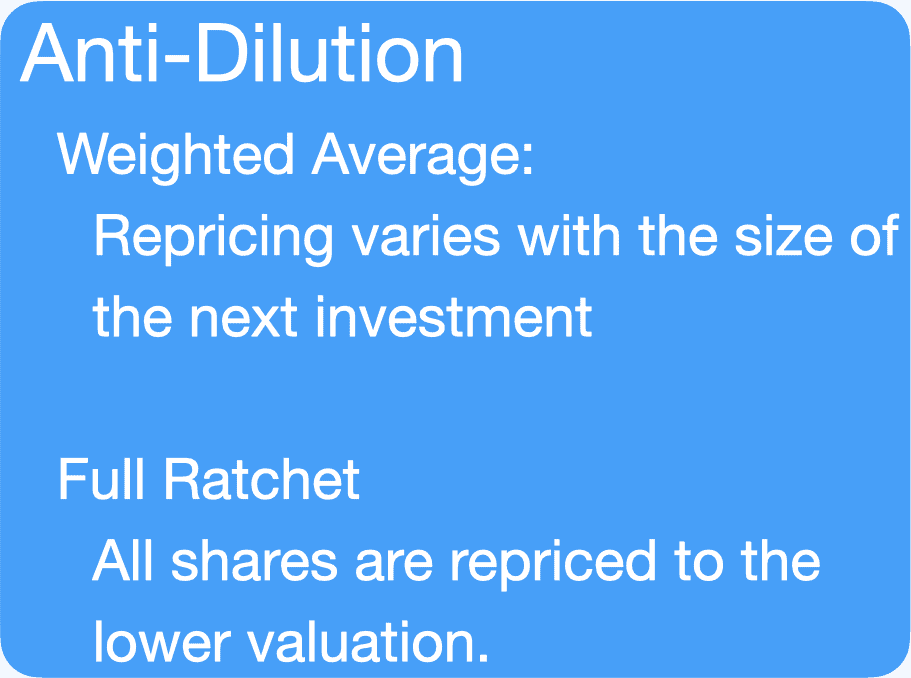

There are two main types of anti-dilution provisions: full ratchet and weighted average.

Full Ratchet

Full ratchet anti-dilution provisions are considered more aggressive. It allows the investor to adjust the conversion price of their preferred stock based on the price of the new shares issued in a dilutive event. In other words, it allows the investors to convert their securities at the lowest sale price available, which provides protection in the event that the new offering price is lower than their conversion price. If the investor's conversion price is adjusted downward to the price at which the new shares are issued, it can result in a significant increase in the number of shares the investor receives upon conversion.

For instance, if an investor holds preferred shares in Company ABC with a conversion price of $10 and a full ratchet anti-dilution provision, and Company ABC issues more shares at a conversion price of $5, the investor's original conversion price of $10 would be adjusted downward to $5. Consequently, the investor would be able to acquire twice as many shares at the same price. While full ratchet anti-dilution provisions can effectively safeguard investor interests, they can also be aggressive and potentially disadvantageous to the company's existing shareholders, as they can significantly increase the number of outstanding shares. Typically, companies use weighted average provisions instead of full ratchet provisions to balance investor protection and share value preservation.

Weighted Average

Weighted average anti-dilution provisions, on the other hand, are less aggressive and more commonly used. These provisions adjust the conversion price of the preferred stock based on a weighted average of the price at which the new shares are issued and the price at which the investor purchased their original shares. This means that the investor's conversion price is adjusted to reflect the average price of the new shares and the original investment price.

The formula for the new conversion price is:

New Conversion Price = O x (A + B) / (A + C)

Where O is the old conversion price, A is the shares outstanding before the new issue, B is the consideration received for the new issue, and C is the number of new shares issued.

For example, if a company issues 1,000 preferred shares at $5 per share in a first offering that are convertible at a 1:1 ratio and then issues another 1,000 shares at $3 per share in a new offering, the new conversion price under the weighted average method would be calculated as follows:

New Conversion Price = $5 x (2,000 + $3,000) / (2,000 + $5,000) = $3.57

This means that owners of the first issue of preferred shares would now have the option to convert their shares for $3.57 instead of the original $5. While the weighted average method still provides protection for investors, it is less drastic than the full ratchet method, which immediately adjusts the conversion price to the lowest sale price available.

The choice between full ratchet and weighted average anti-dilution provisions depends on a number of factors, including the stage of the company, the amount of funding required, and the terms of the preferred stock. Full ratchet provisions are generally more attractive to investors, as they provide greater protection against dilution, but they can be more detrimental to the company's existing shareholders. Weighted average provisions are more commonly used and can strike a better balance between protecting the investor and preserving the value of the company's existing shares.

Why is Anti-Dilution Provision Important?

Anti-dilution provisions are important because they protect the value of an investor's ownership in a company. When a company issues new shares at a lower price than the existing shares, it dilutes the value of the existing shares. Anti-dilution provisions adjust the conversion price of preferred shares to account for the dilution, which ensures that the investor's ownership percentage in the company remains the same. Without anti-dilution provisions, investors could suffer significant losses when a company issues new shares at a lower price. Anti-dilution provisions provide these investors a safety net and help maintain their ownership stake in the company.

These provisions are typically included in contracts that can be converted to common stock. While preferred stockholders do not have voting rights in a corporation, they gain such rights when they convert to common stock.

In preferred stock agreements that provide for conversion to common stock, a specific price is set for the conversion. For instance, if the conversion price were set at $1.00, 10 preferred shares would be converted to 10 common shares at that price. Anti-dilution provisions are intended to modify this price if the value of the shares suddenly declines as a result of issuing new shares at a lower price.

The conversion of preferred stock to common stock through anti-dilution provisions enables preferred stockholders to acquire common shares at a lower price than they would have otherwise. This conversion results in an increase in the number of common shares that they own compared to their original preferred shares.

Reasons to Consider Anti-Dilution

Anti-dilution provisions are worth considering for several reasons:

- Appealing to potential investors as they provide a safeguard against potential dilution of their investment

- Protect the equity of existing investors and make them more willing to invest further in the company

- Protect the value of the common stock if implemented effectively

Considerations for Negotiating Anti-Dilution

When negotiating anti-dilution protection, there are several key considerations to keep in mind:

- Anti-dilution provisions are negotiable, different parties involved in each financing round will have varying perspectives on what's right.

- Full-ratchet anti-dilution provisions are rare and can put off future investors who won't receive the same rights. Founders are also resistant to them because they could effectively reduce their ownership stakes.

- Future investors may negotiate away prior investors' anti-dilution protections, leading to disputes among investors that delay or derail the company's ability to raise future rounds.

- Investors may accept fewer protections to preserve the company's ability to raise money or avoid diluting founders and employees. Customizable anti-dilution protection provisions, such as "pay-to-play" terms, may be negotiated.

- Anti-dilution provisions are not typically found in convertible notes or SAFEs because those convert into preferred shares following a priced financing round. Additionally, the valuation cap or discount rate already serves as anti-dilution protection.

Conclusion

Anti-dilution provisions are an important tool for protecting investors' equity stake in a company, particularly early investors who want to maintain their ownership percentage as the company grows and raises additional capital. These provisions come in various forms and can be triggered by different events, but they work to adjust the conversion ratio of preferred shares or convertible securities to ensure that investors receive more shares and maintain their ownership percentage. While anti-dilution provisions can be complex and subject to negotiation, they are a valuable protection mechanism for investors who want to safeguard their investments and avoid unfair dilution.

References

Overview of Anti-Dilution Provisions

Definition of Anti-Dilution Provisions

Types of Anti-Dilution Provisions