During this pandemic breakout age, the global economy has faced a major challenge, making it difficult for many businesses to thrive. Inflation is happening now being driven by supply chain concerns caused by the epidemic and the war in Ukraine. At the same time, the Federal Reserve's response to inflation, and rising interest rates, is sure to have a negative impact on demand.

According to the global economic situation, a recession has finally come. Among those who have mentioned the economic downturn are notable economists, CEOs of various industries, large banks, and former Fed officials. Seventy-five percent of Fortune 500 CEOs have indicated that growth would begin to decline by the end of 2023.

What Is A Recession?

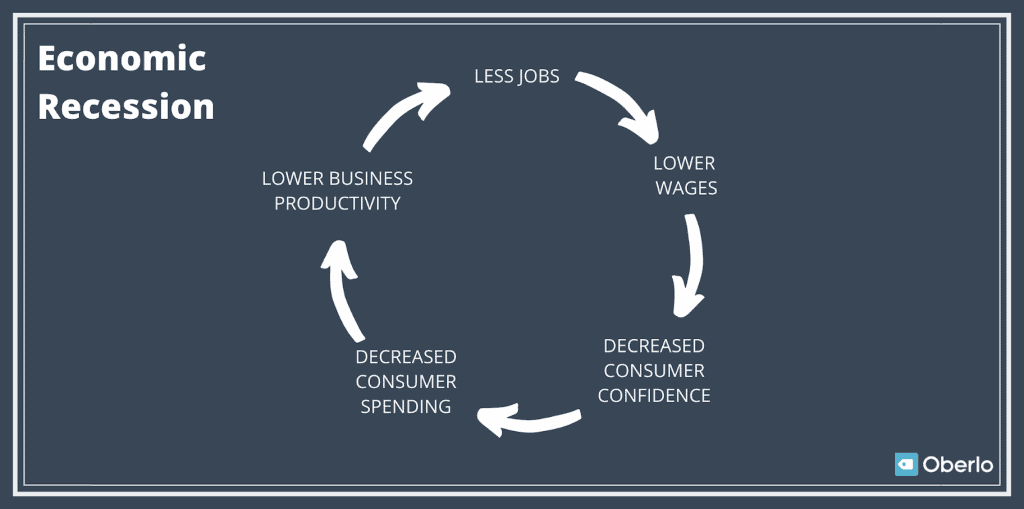

A recession is defined as a dramatic drop in economic activity that lasts months or even years. A recession is declared when a country's economy sees negative GDP, rising unemployment, declining retail sales, and contracting measures of income and manufacturing over a protracted period of time. Recessions are seen as an inescapable component of the economic cycle or the regular cycle of expansion and contraction in a country's economy.

In 1974, economist Julius Shiskin proposed a few guidelines for defining a recession: The most popular was two-quarters of falling GDP in a row. According to Shiskin, a healthy economy increases over time, hence two-quarters of slowing growth signals major underlying issues. This definition of a recession became generally known over time.

What Causes Recessions?

A recession can begin in a variety of ways, ranging from a rapid economic shock to the consequences of uncontrolled inflation. These are some of the primary causes of a recession:

An Unexpected Economic Shock

An economic shock is a circumstance that occurs unexpectedly and causes significant financial loss. OPEC shut off the supply of oil to the United States without warning in the 1970s, triggering a downturn and long queues at petrol stations. A more recent example of a sudden economic shock is the public health crisis - the coronavirus outbreak, which caused a shutdown of economies globally.

Excessive Debt

When people or corporations cause excessive debt, the cost of servicing the debt can escalate to the point where they are unable to pay their expenses. Increasing debt defaults and bankruptcies would capsize the economy. The mid-aughts housing bubble, which led to the Great Recession, is a great example of excessive debt triggering an economic crisis.

Asset Bubbles

When investment decisions are influenced by emotions, poor economic consequences are not far behind. Irrational exuberance inflates the stock market or real estate bubbles, and when the bubbles burst, panic selling can crash the market, producing a recession.

High Inflation

Inflation is defined as a consistent rising trend in prices over time. Inflation isn't always a negative thing, but it may be harmful. Inflation is controlled by central banks raising interest rates, and higher interest rates limit economic activity. In the 1970s, the United States had a persistent problem with out-of-control inflation. To break the cycle, the Federal Reserve increased interest rates swiftly, resulting in a downturn.

High Deflation

While runaway inflation can create an economic downturn, deflation can be even worse. Deflation is when prices decline over time, which causes wages to contract. which further depresses prices. When a deflationary feedback loop gets out of hand, people and business stop spending, which undermines the economy. Central banks and economists have few options to address the fundamental causes of deflation. Japan's troubles with deflation for the duration of the 1990s resulted in a severe downturn.

Technological Change

New technologies boost productivity and benefit the economy in the long run, although there may be a time of adjustment to technical achievements. Throughout the 19th century, there were waves of labour-saving technical advancements. The Industrial Revolution turned entire professions obsolete, resulting in recessions and difficult times. Some economists are concerned that artificial intelligence and robotics will create recessions by eliminating entire employment categories.

What Is Business Cycle?

The business cycle shows how an economy cycles between periods of growth and recession. When an economic expansion begins, the economy experiences healthy, long-term growth. Lenders gradually make it easier and less expensive to take on debt, encouraging people and corporations to take on debt. Irrational excitement begins to overtake asset prices.

Recession VS Depression

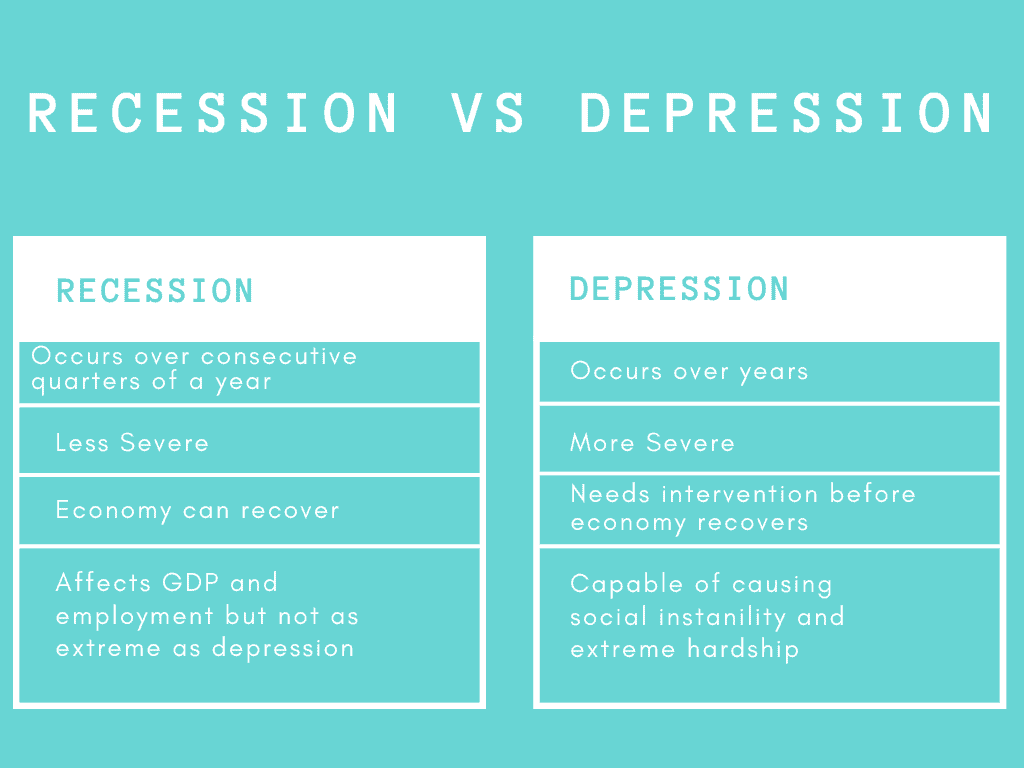

Although recessions and depressions have similar roots, the total impact of depression is far worse. There are more job losses, more unemployment, and sharper GDP drops. Most importantly, a downturn lasts longer—years rather than months—and it takes longer for the economy to recover.

The Impacts of The Recession on Business

Many recession consequences affect both large and small businesses. The following are the most common challenges that businesses of all sizes encounter during an economic crisis.

Sales Are Declining

Nothing affects a business more than when the register stops ringing or orders slow to a trickle during a recession. During an economic downturn, aggregate demand falls, resulting in a loss in sales for the majority of enterprises.

Cyclical industries including manufacturing and energy tend to experience particularly sharp declines. Companies with significant fixed expenditures, such as merchants and technology suppliers, incur disproportionate losses when sales fall.

Manufacturers may face overstocking, requiring them to reduce output until demand returns. The decline in consumer demand reduces the projected returns on investment for advertising and marketing expenses, causing budget cuts. This might result in income declines for media businesses that publish, broadcast, or sell advertisements online.

Credit Impairment And Bankruptcy

One of the first impacts of the recession on businesses is the tightening of credit conditions. Faced with an uncertain severity and duration of a downturn, lenders become more selective in the risks they are ready to underwrite.

A recession can cause a company's accounts receivable to balloon as liquidity concerns affect customers and companies up and down the supply chain. Customers that owe the firm money may be sluggish to make payments or fail to make them at all. As a result, the corporation may be obliged to slow its own payments.

While major corporations may be able to refinance their debt at a cheaper interest rate when the Federal Reserve reduces the federal funds rate in reaction to the downturn, most firms are saddled with fixed debt service obligations that must be fulfilled even as sales and profits fall. This is why, during previous recessions, business bankruptcies increased dramatically.

Employee Layoffs and Benefit Reductions

Small and large enterprises may undertake layoffs to cut costs if they require lesser personnel to satisfy lower demand for their products and services. Productivity per employee may rise, but morale may decrease as workloads rise and compensation increases slow or stop in the face of increasing layoffs.

Wages are sticky, which means that workers are hesitant to accept wage cutbacks even if layoffs are the most likely option. However, in a very lengthy and deep recession, labour and management may negotiate the cost concessions needed to rescue the firm and maintain employment, such as salary and benefit cuts. If the company is a manufacturer, it may be required to liquidate operations and move out underperforming products, resulting in large layoffs.

How To Save Your Company's Budget In The Crash Of A Recession?

Among those who have mentioned the recession are famous economists, CEOs of various industries, large banks, and former Fed officials. Seventy-five percent of Fortune 500 CEOs have indicated that growth would begin to decline by the end of 2023. During an economic recession, up to 17% of businesses fail, either declaring bankruptcy, being purchased, or going private.

Utilize Marketing Strategies In Several Channels

It is critical to track the organization's marketing channels and monitor key performance indicators (KPIs). The idea is to emphasize the most effective marketing channels for attracting and retaining the right kind of clients. Businesses should have realistic marketing expenditures in order to have a strong internet presence. At the same time, it might be the perfect opportunity to gain new clients as your competitors fade into obscurity.

Reduce Unnecessary Running Costs

It might be difficult to reduce some expenditures while maintaining the same level of service quality. Begin with the most costly and useless charges. Here are some costly areas of expenditure management where you may immediately reduce money without disrupting business operations.

First of all, subscribe to cheaper SaaS subscription packages if you don't require all of the things you're currently paying for. Some subscriptions you may discover you do not require. Secondly, apply remote work culture and reduce office hidden costs such as utility and rent costs. Furthermore, you should renegotiate contracts made with suppliers. If you've done good business with them for a long period, they'll willingly negotiate. They will want to keep you far more than you realize during a looming recession.

Apply Delegate And Automate Mechanisms

In times of economic crisis, company executives must be prepared to make difficult decisions. As a leader, you must evaluate which roles may be performed by workers, merged, or automated. Some functions can be automated to help save costs.

Some of the roles that can be automated include automated data entry employing AI-powered document comprehension technology can result in a 70% decrease in processing expenses. In addition, chatbots are becoming a more feasible option for routing inbound client answers to the appropriate resources or people.

Focus On The Primary Tasks And Limit The Number of additional projects

We know that expanding a business requires investment in new assets, products, and activities. However, a company might cut off their efforts in new assets during a recession. Consider new projects or initiatives carefully; they normally need a significant investment, and it's not worth starting unless you plan to complete them entirely. As a result, keeping an eye on expenses and controlling the company's expansion is important to survive during a recession.

In Conclusion

Recessions happen periodically, interrupting the global economic growth that prevails most of the time. Recession is a big challenge to businesses of all sizes and types to respond to a sudden drop in demand while cutting costs targeted toward expansion. As a founder, you should prepare a great defence strategy for your company in the scenario of a recession.

Appropriate fiscal management is the most effective instrument for dealing with an economic downturn. Remember that a financial statement is the easiest and most relevant way to manage a business. These financial documents might reveal places where money is being wasted. From there, you can begin to take action right away, keeping some of the tactics mentioned above, to ensure that your business is ready when the recession hits.

References

Understanding What Is A Recession?

Understanding The Factors That Cause Recession

How To Save Your Company's Budget In The Crash Of A Recession?