Dilution affects both the founders and financial leaders of a company as well as the individual shareholders who own stock in the company. Therefore, it is necessary for all parties to understand the impact of dilution, as it can have a significant effect on the value of their shares and their ownership stake in the company.

Founders and financial leaders need to carefully consider the impact of any new share issuances or stock option grants, as these can dilute the ownership percentage of existing shareholders. They need to balance the need for additional funding with the potential impact on existing shareholders and may need to consider anti-dilution measures to mitigate the effects of dilution.

Individual investors should also be aware of dilution, as it can affect the value of their shares and their ownership stake in the company. When a company issues new shares or grants stock options, the value of existing shares may decrease as the ownership percentage is diluted. Investors should be aware of this risk and take steps to manage it, such as closely monitoring the company's financial performance and growth plans and considering the potential impact of any new share issuances or stock option grants.

What Is Dilution?

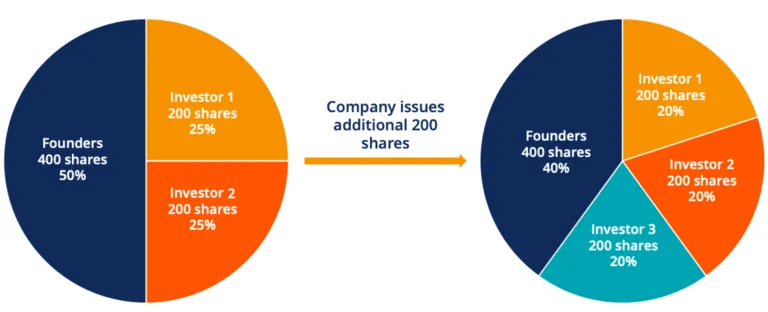

Dilution refers to the reduction of a shareholder's ownership percentage in a company. This can happen when a company issues additional shares of stock after its initial public offering (IPO), which can be sold to new investors or offered to existing shareholders as part of a stock option or equity incentive program. When new shares are issued, the existing shares represent a smaller percentage of the company's total ownership, diluting their value. The new shares can be issued for various reasons, such as to secure a partnership, award an employee, or raise money. Common stock is typically issued in these situations, which awards voting rights to the shareholder.

Before issuing new stock, companies typically carefully evaluate the potential dilution effect on their current shareholders. This is because the issuance of new shares can cause the value of existing shares to decrease as the ownership percentage is diluted. Companies also consider issuing preferred stock instead of common stock in cases where they want to raise equity financing without giving up voting rights.

The companies also need to carefully evaluate the potential impact on the broader market as the issuance of new shares can send a message to public investors that may cause an immediate drop in share value. This drop in value could prompt some investors to sell their shares, further depressing the company's stock price. Therefore, it is necessary for companies to consider the potential dilution effect on their current shareholders and the broader market and to make a well-informed decision before issuing new shares.

How Dilution Works?

When a company goes public through an IPO, it issues a certain number of shares to the public, and these shares become available for trading on a stock exchange. The number of shares issued in the IPO becomes the "float" of the company.

If the company later decides to issue additional shares through a secondary offering or as part of an equity incentive program, the total number of outstanding shares increases, which can dilute the ownership percentage of existing shareholders. The new shares can be sold to new investors or offered to existing shareholders, but in either case, the existing shareholders' ownership stake will represent a smaller percentage of the total number of outstanding shares.

For example, if a company has 1,000 shares outstanding and a shareholder owns 100 shares, they have a 10% ownership stake in the company. If the company issues 500 more shares, the total number of outstanding shares increases to 1,500, and the shareholder's 100 shares now represent only a 6.7% ownership stake in the company.

Dilution can significantly impact a shareholder's voting rights, dividends, and the overall value of their investment. To mitigate the effects of dilution, some companies offer anti-dilution protections to existing shareholders, such as the right to purchase additional shares at a discounted price or to receive additional shares to maintain their ownership percentage.

The Cause of Dilution

Dilution is not synonymous with market loss, even though the effect can look similar. Market loss is typically caused by factors such as decreased revenues, poor sales, or other industry-related issues that affect the company's financial performance. On the other hand, stock dilution is caused by an intentional action taken by the company, such as issuing new shares, that can affect the 409A valuation of common shares. In addition to issuing new shares, other factors that may cause stock dilution to include options converted to common shares, creating and offering new shares, equity compensation, and merger and acquisitions. These actions can dilute existing shareholders' ownership percentage and may affect their investment's overall value. As such, investors need to monitor the potential dilution effect of any corporate actions that may affect their holdings.

Stock options do not give the holder equity in the company until they are exercised. When an option is exercised, it is converted into common shares, which increases the total number of shares the company has issued, resulting in dilution. This dilution can cause a decline in share prices, which can be more significant for larger blocks of stock than smaller options.

For stock options to be granted, the company's board of directors must approve the issuance of the common stock needed for conversion. This means that the company is aware of the potential for dilution and can prepare for it. However, common shareholders typically do not have the same level of knowledge and often find out about the dilution after the fact.

Stock options can be a useful tool for attracting and retaining employees, but they also have the potential to cause dilution for existing shareholders. Companies need to carefully manage the potential impact of stock options on their capital structure and communicate any dilution risks to their investors.

When a company wants to raise money or expand, it may choose to create and offer new shares to the public. The issuance of new shares can also be used to reward employees, although this is typically done through stock options rather than actual shares. The value of the stock options is typically recorded as compensation based on the fair market value of the option.

However, when new shares are issued publicly, their value is subject to fluctuations in the stock market, which could result in an immediate increase or decrease in the stock's value. To mitigate any negative impact on the share price, many companies will precede the issuance of new stock with an internal promotional campaign or a press release explaining their motivation for issuing new shares. This can help investors understand the company's plans and potentially reduce any negative impact on the stock price.

Equity Compensation with A Vesting Schedule

Startups often use equity as a form of compensation for their new employees, but this equity comes with a vesting schedule that requires the employee to stay with the company for a specified period. At the end of the vesting period, the employee is given the awarded stock, which has the same impact on dilution as an option. Most startups have a four-year vesting period, with the first year usually being a "falling off the cliff" year where no equity is vested. However, these equity awards typically have no real-world value until the startup is public or sold. Before that, the potential value of the equity was based on the company's valuation. Although it can still be diluted when new stock is issued, this is only a theoretical projection and not actual cash value.

Mergers and Acquisitions

Mergers and acquisitions (M&A) are a common strategy businesses use to achieve growth and expansion. In a merger, two companies of roughly equal size come together to form a new company. In an acquisition, one company purchases another company, which becomes a subsidiary of the acquiring company. M&A can provide a range of benefits to companies, such as increased market share, access to new markets and customers, cost savings through economies of scale, and diversification of products or services. However, M&A can also be risky and expensive, and not all mergers and acquisitions are successful.

In the context of stock, when a company acquires another company, it may pay for the acquired company's stock in cash, stock, or a combination of both. The acquiring company may offer a premium to the market price of the acquired company's stock to entice shareholders to sell their shares.

However, acquiring a company's stock can dilute the shares of common shareholders, reducing their ownership percentage in the company. To mitigate this, some companies may conduct a share buyback before making an acquisition deal, which reduces the number of outstanding shares and increases the ownership percentage of remaining shareholders.

The Effect of Dilution

Dilution can significantly impact the value of a portfolio, the share price, and the earnings per share (EPS) of the company.

When a company issues new shares, it increases the number of shares outstanding, which can dilute the ownership percentage of existing shareholders. This, in turn, can reduce the value of a portfolio that holds shares of the company. For example, if a portfolio holds 100 shares of a company and the company issues 100 additional shares, the portfolio's ownership percentage is reduced by half, which can lead to a decline in the value of the portfolio.

In addition to affecting the value of a portfolio, dilution can also affect the company's share price. When new shares are issued, the supply of shares in the market increases, which can put downward pressure on the share price. This is because the company's value is now divided among a larger number of shares, which can reduce the perceived value of each individual share.

Dilution can also affect the company's earnings per share (EPS). EPS is a key financial metric that indicates the amount of profit attributable to each outstanding share of the company. When new shares are issued, the total amount of earnings is divided among a larger number of shares, which can reduce the EPS. This can be a concern for investors, as a decline in EPS can indicate lower profitability and future growth potential for the company.

Dilution is a common practice in the business world, but it is important to understand the specific circumstances and potential risks and benefits before investing in a company.

Is Dilution Good or Bad?

Share dilution is not always a bad thing. In fact, there are scenarios where it can benefit the company and its shareholders.

Share dilution can be positive when a company issues new shares to raise capital for growth and expansion. By selling new shares, the company can generate cash that can be used to invest in new products or services, acquire other companies, or expand into new markets. This can increase revenues and profits, benefiting shareholders through higher stock prices and dividends.

Another scenario where share dilution can be positive is when employees exercise stock options. This can indicate that employees are optimistic about the company's prospects and believe that the stock price will continue to rise in the future. Additionally, stock options can be a valuable tool for attracting and retaining talented employees, which can benefit the company and its shareholders in the long run.

However, there are also scenarios where share dilution can be a cause for concern. One such scenario is when a company issues new shares to pay for debt or to finance ongoing operations. This can indicate that the company is struggling to generate cash from its core business activities, which can be a red flag for investors. Additionally, excessive share dilution can significantly reduce the ownership percentage of existing shareholders, which can reduce their influence over the company's decision-making and future profits.

Overall, it is important for investors to understand the specific circumstances surrounding share dilution and to evaluate its potential impact on the company and its shareholders. While share dilution is not always bad, investors need to be aware of the potential risks and benefits before making investment decisions.

Conclusion

Dilution is a process that involves issuing new stock shares, which can significantly impact the value of a portfolio, the share price, and the earnings per share (EPS) of a company. While dilution can be a targeted strategy with specific end goals, such as raising capital for growth and expansion or incentivizing employees through stock options, it can also be a cause for concern when it indicates financial difficulties or excessive dilution. Investors need to understand dilution's circumstances and evaluate its potential impact on a company before making investment decisions. Dilution is a common practice in the business world, and investors should carefully consider the potential risks and benefits before deciding to invest in a company.