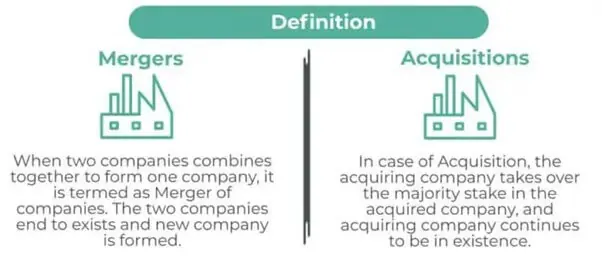

Mergers and acquisitions are frequently misunderstood concepts in the business sphere, as they are often used interchangeably despite having distinct meanings. A merger involves consolidating two independent entities to establish a new, collaborative organization. Conversely, an acquisition involves the purchase of one company by another. Companies may undertake mergers and acquisitions to broaden their market reach or increase their market share, with the ultimate aim of generating value for their shareholders.

Mergers

A merger is a type of corporate transaction in which two or more companies combine their businesses to form a new, larger company. In a merger, the companies pool their resources and assets to create a new entity, with shareholders of both companies receiving shares in the new entity. Unlike an acquisition, a merger is a friendly transaction, meaning that the companies involved agree to the terms of the deal and work together to ensure a successful integration. This can include combining management teams, streamlining operations, and eliminating redundancies. A merger does not require cash to complete. It can dilute the power of each individual company, as control is shared between the merged entities. However, mergers can also offer benefits such as increased scale, synergies, and diversification of assets and capabilities. Mergers can be a strategic move for companies looking to grow and strengthen their market position.

Friendly mergers of equals can be rare in practice, as it can be difficult to find two companies with compatible cultures, values, and management styles that are willing to give up some level of control to create a new entity. However, such mergers can still occur, particularly in industries where consolidation is occurring or where there are few opportunities for organic growth. When two companies decide to merge as equals, the process typically involves extensive negotiations to determine the terms of the deal, including the ownership structure of the new entity, the composition of the board of directors, and the allocation of responsibilities and decision-making authority. In a merger of equals, the stocks of both companies are surrendered, and new stocks are issued under the name of the new business identity. This can help to ensure that the new entity is perceived as a unified organization and can also help to facilitate the integration process. Friendly mergers of equals can be complex and challenging, but they can also offer significant benefits to both companies, including increased scale, expanded customer base, and greater market power.

Mergers are often pursued to achieve strategic goals such as reducing costs, expanding into new markets, and boosting revenue and profits. By combining resources, expertise, and customer bases, merged companies can often achieve these objectives more effectively than they could on their own. Mergers can be voluntary, with both companies agreeing to the transaction in order to pursue shared goals, or they can be initiated by one company seeking to acquire another. In some cases, mergers may involve companies of roughly the same size and scope, while in other cases, one company may be significantly larger than the other.

In addition, mergers can also offer other advantages, such as access to new technologies or intellectual property, increased bargaining power with suppliers or customers, and the ability to leverage economies of scale. However, mergers can also be risky and complex transactions, requiring careful planning and execution to ensure success. Challenges can include integrating different corporate cultures and systems, managing employee and stakeholder expectations, and dealing with regulatory requirements and potential antitrust concerns. As a result, companies considering a merger should carefully evaluate the potential benefits and risks and seek expert advice to help navigate the process.

Acquisitions

An acquisition, also known as a takeover, is a process by which one company purchases another company. The purchasing company, known as the acquirer, buys the smaller company, known as the target company, and assumes control of its operations and assets. In most cases, the target company is absorbed into the acquirer's existing business operations, and its assets become part of the larger company. This includes intellectual property, physical assets, employees, and customer lists. While the target company may cease to exist as a separate entity after the acquisition, its shareholders may still benefit from the transaction. In some cases, they may receive a premium on their shares or be given shares in the acquiring company as part of the deal.

The acquisition can have a negative connotation, while the merger is often seen as a more neutral or positive term. However, it's worth noting that there is no hard and fast rule about which term to use in any given situation. Sometimes, an acquisition may be referred to as a merger because it involves two companies coming together somehow, even if one company is clearly taking over the other.

An acquisition involves one company taking over all of the operational management decisions of another company is not always the case. In some cases, the target company may retain some degree of autonomy or independence even after the acquisition, especially if it is a subsidiary of the acquiring company rather than being fully integrated into its operations.

Acquisitions can require large amounts of cash, but there are also other ways that companies can finance acquisitions, such as by issuing stock or taking on debt. And while the acquiring company may have more power in the transaction, it's important to remember that both parties have to agree to the terms of the deal in order for it to go through.

Companies may engage in acquisitions for a variety of reasons. One common reason for an acquisition is to purchase a supplier and improve economies of scale. By acquiring a supplier, a company can often achieve greater efficiencies in its supply chain, which can lower costs per unit as production increases. This can help the company to be more competitive in the marketplace. Another reason for an acquisition is to improve market share. By acquiring a competitor or a company in a related market, a company can often expand its customer base and increase its market share. This can be especially beneficial in industries with high entry barriers, as it can be difficult for new companies to gain a foothold in the market. Acquisitions can also be used to obtain new product lines or technologies. By acquiring a company that has expertise in a particular area, a company can save years of capital investment costs and research and development. This can help the company to bring new products or technologies to market more quickly and gain a competitive advantage.

Acquisitions can be complex and involve a range of financial, legal, and operational considerations. Companies need to carefully consider the potential benefits and risks of an acquisition before proceeding. They may need to seek expert advice and guidance to ensure a successful outcome.

Mergers and Acquisitions

Mergers and acquisitions (M&A) are corporate restructuring activities that combine two or more companies or their major business assets. M&A can take various forms, such as acquisitions, mergers, asset purchases, tender offers, and hostile takeovers. M&A can provide several benefits to companies, such as gaining access to new markets or technologies, achieving economies of scale, reducing competition, and increasing shareholder value. However, M&A also involves significant risks, including high transaction costs, cultural clashes, regulatory hurdles, and integration challenges.

Financial institutions often have specialized divisions that focus on M&A activities. These divisions may provide advice and support to companies that are considering M&A transactions, help them negotiate deals, and provide financing for the transactions.

Types of Mergers and Acquisitions

There are several types of transactions that fall under the category of Mergers and Acquisitions (M&A).

Mergers

When two companies decide to merge, the boards of directors from both companies must agree to the combination and obtain approval from their respective shareholders. An example of a merger occurred in 1998 when Compaq absorbed the Digital Equipment Corporation. Later in 2002, Compaq merged with Hewlett-Packard, resulting in a new ticker symbol (HPQ) that combined the pre-merger symbols of both companies (CPQ and HWP).

Acquisitions

Acquisitions involve one company obtaining a majority stake in another company without changing the name or structure of the acquired firm. An example of this is the acquisition of John Hancock Financial Services by Manulife Financial Corporation in 2004, where both companies retained their original names and organizational structures.

Consolidation

Consolidation involves combining the core businesses of two companies and abandoning their previous corporate structures to create a new entity. Shareholders from both companies must approve the consolidation and receive common equity shares in the newly formed company. An illustration of consolidation is the 1998 merger between Citicorp and Travelers Insurance Group, which led to the creation of Citigroup.

Tender Offers

A tender offer involves one company offering to purchase the outstanding stock of another company at a predetermined price, which may differ from the market price. This offer is communicated directly to the target company's shareholders, bypassing its management and board of directors. An instance of a tender offer happened in 2008 when Johnson & Johnson offered to acquire Omrix Biopharmaceuticals for $438 million. Omrix agreed to the offer, and the transaction was completed by the end of December 2008.

Acquisition of Assets

In an asset acquisition, a company acquires specific assets from another company. This type of acquisition requires the approval of the company's shareholders from which the assets are being acquired. Asset acquisitions are often seen during bankruptcy cases, where different companies bid for specific assets of the bankrupt company, which are then liquidated once the assets are transferred to the acquiring companies.

Management Acquisitions

A management acquisition, which is also referred to as a management-led buyout (MBO), happens when a group of executives from a company purchases a controlling interest in another company, resulting in it becoming privately owned. Typically, these executives will team up with a financier or former corporate officers to provide financial backing for the acquisition. MBOs are often funded primarily through borrowing, and the approval of most shareholders is required. One illustration of a management acquisition is the 2013 acquisition of Dell Corporation by its founder, Michael Dell.

Valuation of Mergers and Acquisitions

During an M&A transaction, both the seller and the buyer conduct a valuation process. The buyer seeks to purchase the target at the lowest possible price, while the seller aims for the highest possible price.

Valuation is a crucial aspect of M&A, as it helps both parties to determine the final transaction price. The following are the commonly used valuation methods to value the target:

Price-to-Earnings Ratio (P/E Ratio)

The P/E ratio is often used to determine the offer price for a target company. The acquiring company will typically look at the P/E ratios of other companies within the same industry to determine what a fair P/E ratio would be for the target company.

Enterprise-Value-to-Sales Ratio (EV/Sales)

The enterprise value to sales ratio compares a company's enterprise value (which includes the market value of its equity plus its debt and other liabilities) to its annual sales revenue. The EV/sales ratio is calculated by dividing a company's enterprise value by its annual sales revenue. This helps the acquiring company to understand what multiples are considered reasonable in that industry and to compare the target company's multiple to its peers.

Discounted Cash Flow (DCF)

This method estimates the future cash flows that the target company is expected to generate and discounts them to their present value. The sum of the discounted cash flows represents the estimated value of the target.

Comparable Company Analysis (CCA)

This method compares the target company to similar publicly-traded companies to determine its value. The target's financial ratios, such as the price-to-earnings ratio, are compared to those of its peers to arrive at a valuation.

Asset-Based Valuation

This method calculates the target company's net asset value by subtracting its liabilities from its assets. This valuation method is commonly used when the target company's assets are the primary source of value, such as in real estate or manufacturing industries.

Replacement Cost

The replacement cost method is a valuation approach that is based on the cost of replacing the assets of a company, rather than on the company's earnings or sales. This method involves estimating the cost of acquiring or building the same assets from scratch and then using that cost as a benchmark for determining the company's value.

However, the replacement cost method is not often used in practice, as it has some limitations. Firstly, it does not take into account the value of intangible assets such as brand reputation, intellectual property, and customer relationships, which can be significant in many industries. Secondly, it assumes that the cost of acquiring or building the same assets is the same as the value of those assets, which may not always be the case.

Benefits of Mergers and Acquisitions

M&A deals can offer a variety of benefits for the companies involved, including:

Economies of Scale

By combining their resources, companies can achieve greater production, marketing, and distribution efficiencies, and reduce costs.

Mergers and acquisitions can enable companies to increase their market share by expanding their customer base and geographic reach, leading to increased revenues and profits.

Enhanced Capabilities

By acquiring complementary businesses, companies can expand their product lines or service offerings, gain access to new technologies or intellectual property, and improve their competitive position in the marketplace.

Improved Financial Resources

By joining forces, companies can pool their financial resources, which may enable them to make strategic investments, develop new products or services, and pursue growth opportunities that would not be possible on their own.

Reduced Labor Costs

By eliminating redundancies and consolidating operations, companies can reduce their labor costs, which can improve their profitability and competitiveness.

Improved Labor Talent

By bringing together employees from two different companies, M&A deals can create a more diverse and talented workforce, which can aid in growth and development.

Overall, M&A deals can provide a range of benefits for the companies involved and their customers, employees, and other stakeholders.

Potential Drawbacks of Mergers and Acquisitions

While mergers and acquisitions can offer many benefits, there are also potential disadvantages or risks that companies should be aware of, including:

High Costs

Mergers and acquisitions can be expensive, especially if the target company is unwilling to be acquired. The costs associated with legal fees, due diligence, and integration can be significant and may not be recouped if the deal does not generate the expected benefits.

Integration Challenges

Bringing two companies together can be complex and time-consuming and may require significant technological, system, and personnel investments. Integration challenges can lead to disruptions in business operations and may cause delays in realizing the expected benefits of the deal.

Cultural Differences

Differences in corporate culture and management styles can make it difficult to integrate two companies and may lead to conflicts and reduced employee morale.

Regulatory Challenges

Mergers and acquisitions may face regulatory hurdles, particularly if the companies involved are in highly regulated industries such as healthcare or finance. Regulatory challenges can delay or even prevent the completion of the deal.

Negative Reaction from Stakeholders

The announcement of a merger or acquisition can lead to a negative reaction from shareholders, employees, customers, and other stakeholders, resulting in a decline in stock price and reputational damage.

While mergers and acquisitions can offer many benefits, they also carry significant risks and challenges. Companies considering M&A deals should conduct careful due diligence, develop a solid integration plan, and be prepared to address potential challenges and risks.

Conclusion

Mergers and acquisitions can also have different implications for the companies involved.

In a merger, the two companies typically agree to join forces as equals, with both companies bringing their assets, liabilities, and ownership structures to the new entity. This can result in a more diverse and complementary set of products, services, or markets and potential cost savings through economies of scale. However, mergers can also be complex and challenging to integrate the two entities and their cultures.

In an acquisition, one company usually takes control of the other company by purchasing its assets or shares. This can allow the acquiring company to gain access to new technologies, products, or markets or to eliminate competition. However, acquisitions can also be expensive and risky, especially if the acquired company has significant liabilities or cultural differences from the acquiring company.

Overall, mergers and acquisitions can be powerful tools for companies to grow and create value, but they require careful planning, execution, and communication to be successful.

References

Definition of Mergers and Acquisitions

Types and The Valuation of Mergers and Acquisitions