Investing in Southeast Asia can reward long-term investors looking for growth opportunities in emerging markets. However, finding quality and undervalued companies in this region is complex. Many challenges and risks are involved, such as political instability, currency fluctuations, corruption, and lack of transparency.

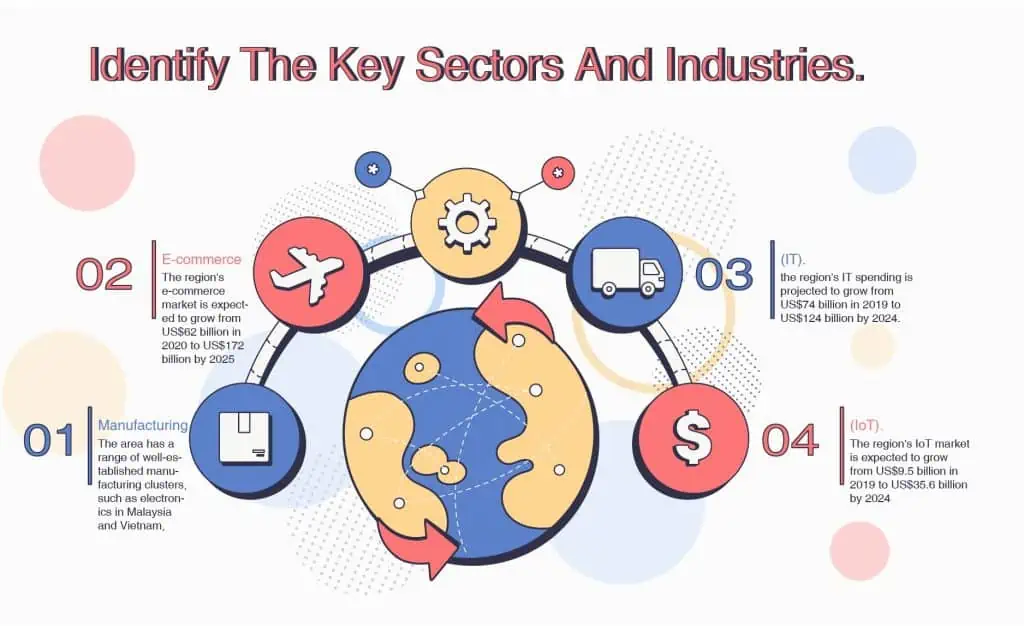

Identify the key sectors and industries.

Suppose you are looking for investment opportunities in Southeast Asia's fast-growing and diverse region. In that case, you might consider some quality and undervalued companies operating in critical sectors and industries that drive growth and innovation in the region, such as manufacturing, e-commerce, IT, IoT, and life sciences.

Manufacturing

Manufacturing is one of the most essential sectors in Southeast Asia, accounting for a large share of the region's GDP and exports. The area has a range of well-established manufacturing clusters, such as electronics in Malaysia and Vietnam, automobiles and packaged foods in Thailand, machinery and petrochemicals in Indonesia, and semiconductors, biopharmaceuticals, and aerospace components in Singapore. These clusters benefit from the region's large and growing market, extensive manufacturing base, new trade pact (the Regional Comprehensive Economic Partnership), and access to next-generation Industry 4.0 technologies. Some of the quality and undervalued companies in this sector include ARB Berhad, a Malaysian IT and IoT solutions and services company that ranked 72nd on the 2020 Asia Pacific Technology Fast 500 list, and vKirirom Pte. Ltd., a Singaporean software company that provides cloud-based solutions for education institutions.

E-commerce

E-commerce is another booming sector in Southeast Asia, as more consumers shop online for convenience, variety, and affordability. The region's e-commerce market is expected to grow from US$62 billion in 2020 to US$172 billion by 2025, according to a report by Google, Temasek, and Bain & Company. The region has several e-commerce platforms that cater to different segments and needs of online shoppers, such as Lazada, Shopee, Tokopedia, Bukalapak, Zalora, and Qoo10. Some quality and undervalued companies in this sector include PT Tokopedia, an Indonesian technology company specialising in e-commerce and ranked 94th on the 2020 Asia Pacific Technology Fast 500 list, and Involve Asia Technologies Sdn Bhd. This Malaysian media company connects e-commerce merchants with online publishers.

Information Technology(IT).

IT is another key sector in Southeast Asia, as more businesses adopt digital technologies to enhance their productivity, efficiency, and competitiveness. According to IDC, the region's IT spending is projected to grow from US$74 billion in 2019 to US$124 billion by 2024. The region has a vibrant IT ecosystem includes software developers, hardware manufacturers, cloud service providers, data analytics firms, cybersecurity experts, and digital transformation consultants. Some quality and undervalued companies in this sector include Blue Wireless Pte. Ltd. This Singaporean communications company provides wireless broadband solutions for enterprises across Asia Pacific and Africa, Cresco Data Pte. Ltd., a Singaporean software company that provides data automation and integration solutions for e-commerce businesses, Ivy Mobile Technologies Pte Ltd., a Singaporean software company that develops mobile applications for various industries, and PatSnap Pte. Ltd. This Singaporean software company provides intellectual property analytics and management solutions.

Internet of Things(IoT).

IoT is another emerging sector in Southeast Asia, as more devices and objects are connected to the internet to collect and exchange data. The region's IoT market is expected to grow from US$9.5 billion in 2019 to US$35.6 billion by 2024, according to Frost & Sullivan. The region has a solid potential to leverage IoT for various applications such as smart cities, manufacturing, agriculture, healthcare, transportation, and energy. Some of the quality and undervalued companies in this sector include Terminus Technologies.

Research the Leading Companies.

One of the most important skills for investors is to identify quality and undervalued companies that can generate consistent returns in the long term. In this article, we will share some tips on how to find such companies in Malaysia and Southeast Asia, a region with high growth potential and diverse opportunities.

Research the leading companies.

Research the leading companies you want to invest in each sector and their competitive advantages, such as market share, technology, customer base, and profitability. For example, in the e-commerce sector, you may want to look at companies like Shopee, Lazada, and Tokopedia, which have strong brand recognition, user loyalty, and network effects. In the banking sector, you may want to look at companies like Maybank, DBS, and CIMB, which have large customer deposits, digital innovation, and regional presence.

Analyze the financial performance.

You can use various metrics and ratios to assess the quality and undervalued aspects of the companies, such as earnings growth, return on equity, dividend yield, price-to-earnings ratio, and price-to-book ratio. You can also compare these metrics with their peers and industry averages to understand their relative value.

Evaluate the prospects and risks.

You can use various sources of information to gather insights and opinions on the companies, such as annual reports, analyst reports, news articles, podcasts, and forums. You can also consider the macroeconomic factors and trends that may affect the companies, such as interest rates, inflation, currency fluctuations, consumer behaviour, and regulations.

Following these steps, you can find quality and undervalued companies to invest in in Malaysia and Southeast Asia. However, you should also do your due diligence and research before making investment decisions. Investing involves risks and uncertainties; you should be prepared for possible outcomes.

Evaluate each company's financial performance and valuation.

Clear investment objective and strategy.

What are your investment goals, risk tolerance, time horizon, and preferred sectors or industries? This will help you narrow your search and focus on the most relevant companies for your portfolio.

Some market research and analysis.

What are the macroeconomic trends, political risks, regulatory environment, and competitive landscape in Malaysia and Southeast Asia? How do these factors affect different sectors and industries' growth prospects and profitability? You can use various sources of information, such as news articles, reports, databases, and websites, to get a comprehensive overview of the market conditions and opportunities.

Screen and select potential companies based on your investment criteria

You can use various tools and platforms, such as stock screeners, financial websites, and online investors, to filter and sort companies based on various parameters, such as market capitalization, sector, industry, dividend yield, growth rate, etc. You can also use qualitative factors, such as management quality, competitive advantage, brand recognition, customer loyalty, etc., to assess each company's potential.

Using multiple metrics to evaluate.

Evaluate each company's financial performance and valuation using revenue growth, earnings per share, return on equity, price-to-earnings ratio, and market capitalization. These metrics will help you measure how well the company generates income and creates value for its shareholders. You can compare these metrics with the industry averages and historical trends to determine if the company is overvalued or undervalued. You can also use other valuation methods, such as discounted cash flow analysis, relative valuation, or intrinsic value estimation, to estimate the fair value of each company.

Investment decision based on your analysis and judgment.

You should consider both the potential returns and risks of each investment opportunity. You should also diversify your portfolio across different sectors, industries, countries, and regions to reduce exposure to specific risks and enhance your overall performance. You should also monitor your portfolio regularly and adjust your strategy based on your investments' changing market conditions and performance.

Compare the valuation of each company.

One of the most important skills for investors is identifying quality and undervalued companies in the market they want to invest in. Quality companies have substantial competitive advantages, consistent profitability, high returns on capital, and good growth prospects. Undervalued companies trade below their intrinsic value, meaning the market has not fully recognized their potential.

One way to find quality and undervalued companies in Malaysia and Southeast Asia is to compare the valuation of each company with its peers and the industry average, looking for signs of undervaluation or overvaluation. Valuation estimates a company is worth based on its financial performance and future prospects. There are various valuation methods and metrics that can be used, such as price-to-earnings ratio (P/E), price-to-book value ratio (P/B), price-to-sales ratio (P/S), price-to-cash flow ratio (P/CF), dividend yield, earnings growth rate, return on equity (ROE), and free cash flow yield.

By comparing the valuation of each company with its peers and the industry average, investors can get a sense of whether a company is cheap or expensive relative to its competitors and the market. For example, suppose a company has a lower P/E ratio than its peers and the industry average. In that case, it may indicate that the company is undervalued, which generates more earnings per share than the market is willing to pay. Conversely, suppose a company has a higher P/E ratio than its peers and the industry average. In that case, it may indicate that the company is overvalued, generating less earnings per share than the market expects.

However, valuation is not an exact science. Many factors can affect the valuation of a company, such as its growth prospects, competitive position, risk profile, capital structure, accounting policies, and market sentiment. Therefore, investors should not rely solely on valuation metrics to make investment decisions but also consider other aspects of a company's business model, strategy, financial performance, and future outlook. Additionally, investors should be aware of the limitations and assumptions of each valuation method and metric and use them with caution and common sense.

Conduct due diligence

Company's management team

You want to look for leaders with relevant experience, vision, and integrity and align with shareholders' interests. You can check their backgrounds, track records, reputations, and incentives. You can also assess their communication, strategic thinking, and decision-making abilities.

Evaluate the company's business model.

You want to understand how the company creates value for its customers, suppliers, partners, and shareholders. You can analyze its products or services, target markets, competitive advantages, revenue streams, cost structure, and profitability. You can also examine its innovation capabilities, customer loyalty, and market share.

Examine the company's growth strategy.

The third step is to You want to see how the company plans to expand its business in the future, both organically and inorganically. You can review its goals, objectives, milestones, and action plans. You can also consider its opportunities and threats in the external environment, such as industry trends, customer preferences, regulatory changes, and competitive forces.

Identify the company's risks and challenges.

You want to know the potential pitfalls and uncertainties that could affect the company's performance and valuation. You can evaluate its financial health, operational efficiency, risk management practices, and contingency plans. You can also monitor its performance indicators, such as revenue growth, earnings per share, return on equity, and free cash flow.

Estimate the company's intrinsic value.

You want to compare the company's current market price with its fair value based on future cash flows. You can use various valuation methods, such as discounted cash flow analysis, multiples analysis, dividend discount model, or residual income model. You can also adjust your valuation for different scenarios and assumptions.

Invest in companies that have strong fundamentals.

Quality companies have strong fundamentals, such as solid balance sheets, competitive advantages, loyal customers, and proactive management. These companies can withstand market fluctuations and deliver sustainable growth and profitability over time. Undervalued companies have an attractive valuation, meaning their current share price does not reflect their true worth or future potential. These companies are often overlooked or misunderstood by the market, creating a margin of safety for investors who can recognize their value.

To find quality and undervalued companies in Malaysia and Southeast Asia, we need to adopt a bottom-up approach, focusing on each company's characteristics and performance rather than the macroeconomic factors or industry trends. This requires us to do thorough research and analysis of the company's financial statements, business model, competitive landscape, growth prospects, risks, and valuation. We also need to monitor the company's news and developments regularly and be alert for any changes affecting its outlook.

Some of the criteria that we can use to screen for quality and undervalued companies are:

Return on equity (ROE).

This measures how efficiently a company uses its shareholders' equity to generate profits. A high ROE indicates that the company has a strong competitive edge and can reinvest its earnings to grow its business. We can look for companies with an ROE of at least 15% or higher than their industry average.

Earnings growth.

This measures how fast a company's earnings are increasing over time. A high earnings growth indicates that the company has a high growth potential and can increase its market share and profitability. We can look for companies with an earnings growth of at least 10% or higher than their industry average.

Price-to-earnings ratio (P/E).

This measures how much investors will pay for each unit of a company's earnings. A low P/E indicates that the company is undervalued or has a low expectation from the market. We can look for companies with a P/E of less than 15 or lower than their industry average.

Dividend yield.

This measures how much a company pays out in dividends relative to its share price. A high dividend yield indicates that the company rewards its shareholders with consistent and generous payouts. We can look for companies with a dividend yield of at least 3% or higher than their industry average.

Conclusion

In conclusion, finding quality and undervalued companies to invest in Southeast Asia can reward long-term investors. However, it requires careful research, patience, and discipline to avoid falling into value traps or missing out on growth opportunities. Some metrics that can help investors identify undervalued companies are the price-to-earnings ratio, price-to-book ratio, and price/earnings-growth ratio. These metrics can help compare companies across different industries and markets and reveal their intrinsic value relative to their current price. By applying these metrics, investors can build a diversified portfolio of value stocks with strong fundamentals, attractive valuations, and potential for future growth.

Reference

Opportunities for companies in Southeast Asia to reimagine