Updated: 28/06/2023

Stories abound of startup companies all around the globe, making it big and, in turn, making their investors extremely wealthy, this often makes one wonder how to invest in startups? Investing in a company at the very beginning of its lifecycle can prove to be very profitable. Often with great risk, comes great reward.

If you had invested just $10,000 in Amazon, Dell, Apple, or Microsoft, when they went IPO, you’d be a million dollars richer just from that investment according to the IPO Playbook.

What is a Startup?

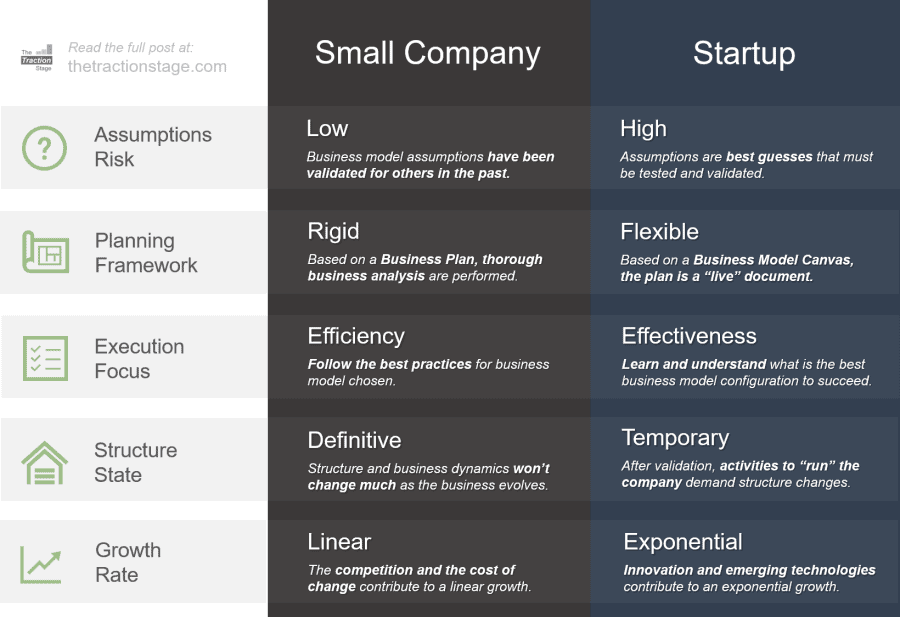

Let us quickly run over the basics on how to invest in startups, starting with understanding the definition of a ‘startup’. A startup refers to a company in the first stages of operations. Startups are founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. These companies generally start with high costs and limited revenue, which is why they look for capital from a variety of sources.

Understanding the components, nature and the business model of a startup before you decide to invest your money and time is important. There are a few special considerations that you need to consider when it comes to startups, this will make you decide when and how to invest in startups.

Location

Startups must decide whether their business is conducted online, in an office or home office, or in a store. The location depends on the product or service being offered. For example, a technology startup selling virtual reality hardware may need a physical storefront to give customers a face-to-face demonstration of the product’s complex features.

In your decision to how to invest in startups, this is important for you to know where the startup plans to operate and what exactly will you be investing your money and time into. Whether it will be based offline or on an online-based platform.

Funding

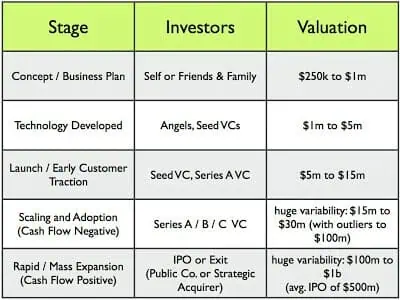

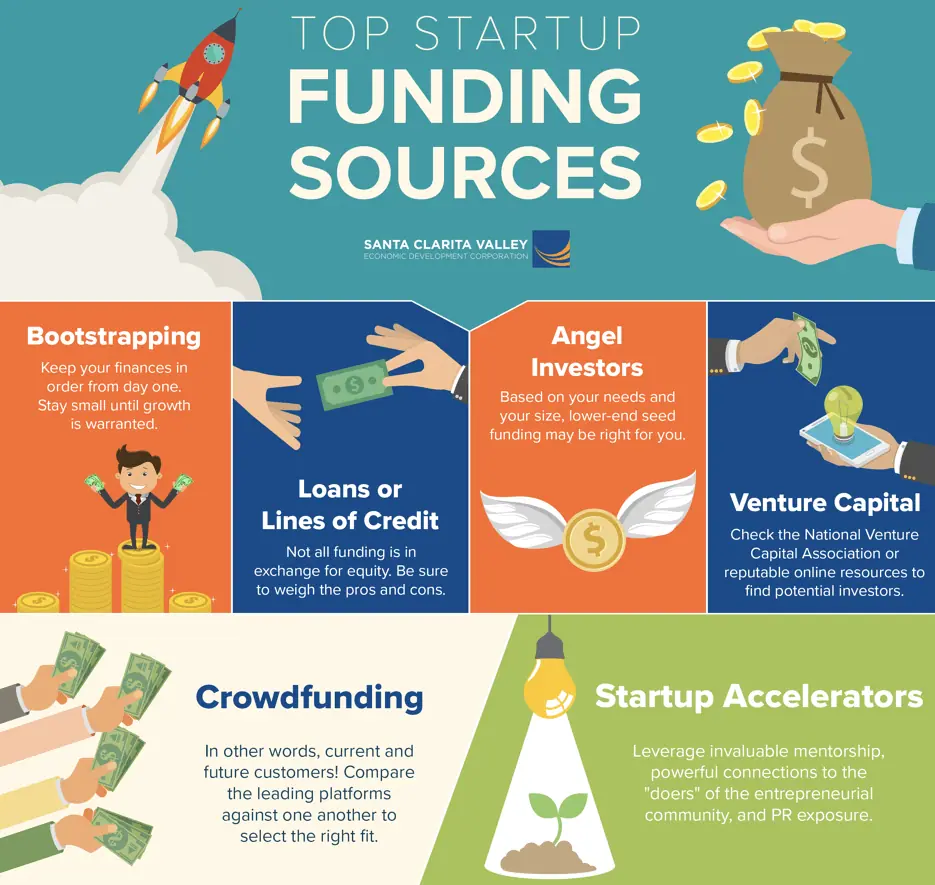

There are many ways that startups are funded according to research by Santa Clarita Valley. In order to understand how to invest in startups, you first need to identify yourself and your source of funding to the startup amongst the following.

Read more on Startup Capital here!

How Are Startups Funded?

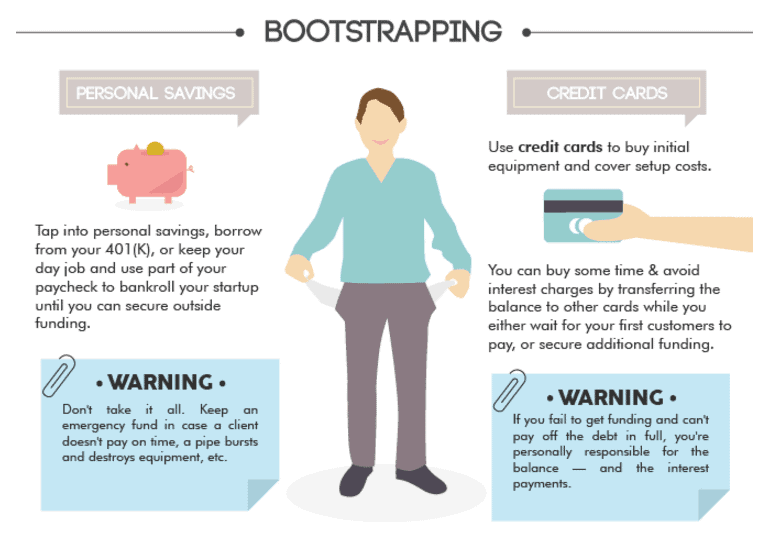

- Bootstrapping (self-financing): This refers to funding the startup using personal savings, assets, or revenue generated from the business itself. Bootstrapping allows founders to maintain full ownership and control over their venture. However, it may not always be feasible due to the substantial costs involved, and there is a risk of losing personal funds if the business fails.

- Taking out a loan: Another option is to secure financing by obtaining a loan from a bank or financial institution. This approach enables founders to retain complete ownership of the startup. However, loan repayment, often with interest, begins immediately, and the loan application process can be complex and time-consuming.

- Finding investors: Many startups raise capital by attracting investors who are willing to provide funding in exchange for equity or ownership stake in the company. Venture capital firms, angel investors, and crowdfunding platforms are common sources of investor funding. This approach is particularly popular for startups with high growth potential. Investors provide financial resources, expertise, and networking opportunities to support the startup's development. However, founders may need to give up a portion of their ownership and decision-making authority in return.

How To Invest In Startups

How do you find startups to invest in? There are so many ways online to be able to find startups in your own country to invest in based on the number of finances that you have. The platforms listed below offer a sampling of the avenues available to anyone who wants to invest in a startup with limited funds. While it’s unlikely that you’ll become the next Silicon Valley billionaire, these platforms can help diversify your broader investment portfolio and give you the satisfaction of supporting a young company you believe in. How to find startup companies to invest it? The listed below platforms will be your aid into finding startups.

-

WeFunder. Wefunder has a stated goal of funding more than 20,000 startups by the year 2029. It hopes to do this by accepting investments of as little as $100 at a time. Through Wefunder, an average investor can inject capital into a wide range of companies. At last glance, it was accepting investments into dozens of companies including a fan-owned entertainment company, a vegan marketplace, a dog cancer cure, and a brewing company, answering the question of how to invest in startups and where to find them.

-

Seed Invest. SeedInvest is a crowdfunding platform that allows individuals insight on how to invest in startups, to invest in early-stage companies that have been pre-screened for potential viability. According to SeedInvest, less than 1% of companies that seek funding through the platform are accepted. The company claims it has more than 250,000 investors, with more than 150 companies successfully funded.

When you sign up for an account on SeedInvest, you are presented with a list of companies seeking money. Many companies are open to receiving investments from anyone, but some require large investments and are open only to accredited investors who had an income exceeding $200,000 in each of the past two years. You are provided with a “pre-money valuation” as well as the total value of funds being sought and the amount already raised. Each company has its own minimum investment requirement and a time by which the money needs to be raised.

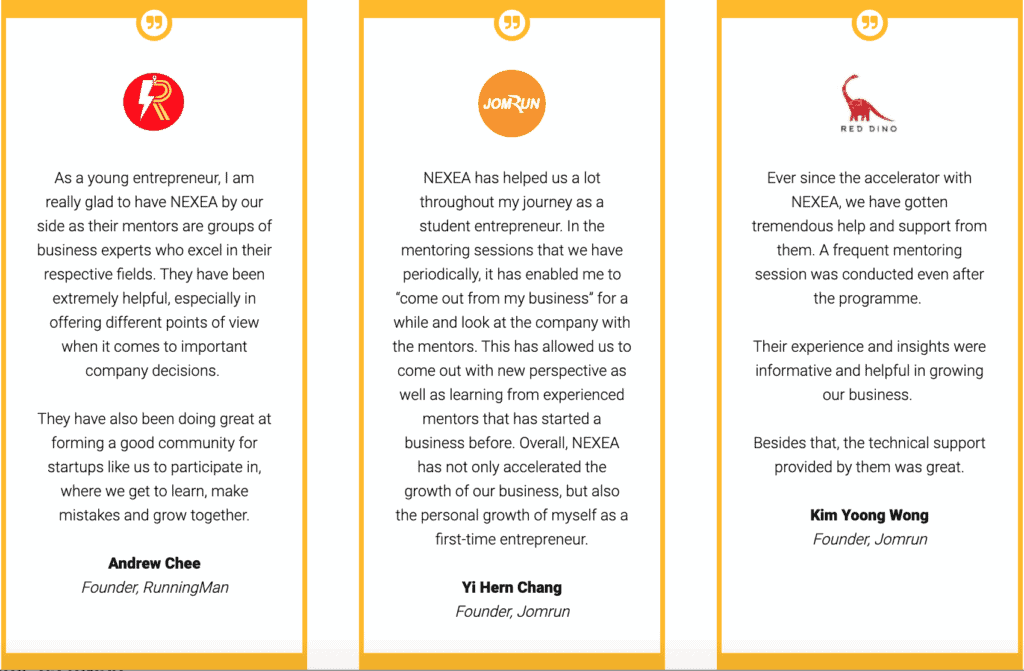

From the perspective of companies and how to invest in startups, NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd) offers startup support as well as investing in startups.

- NEXEA Angel Investors. NEXEA Investors/Mentors seek investment opportunities in technology startups which can showcase revenue and potential future growth. NEXEA’s Angel Investors are all experienced business owners and/or C-level professionals who are able to provide more than just funding for your startup. We also provide mentorship & support through industry experts & mentors.

The video below answers this question in more details adding to more questions in terms of how to invest in startups specifically.

Startup Investing Process

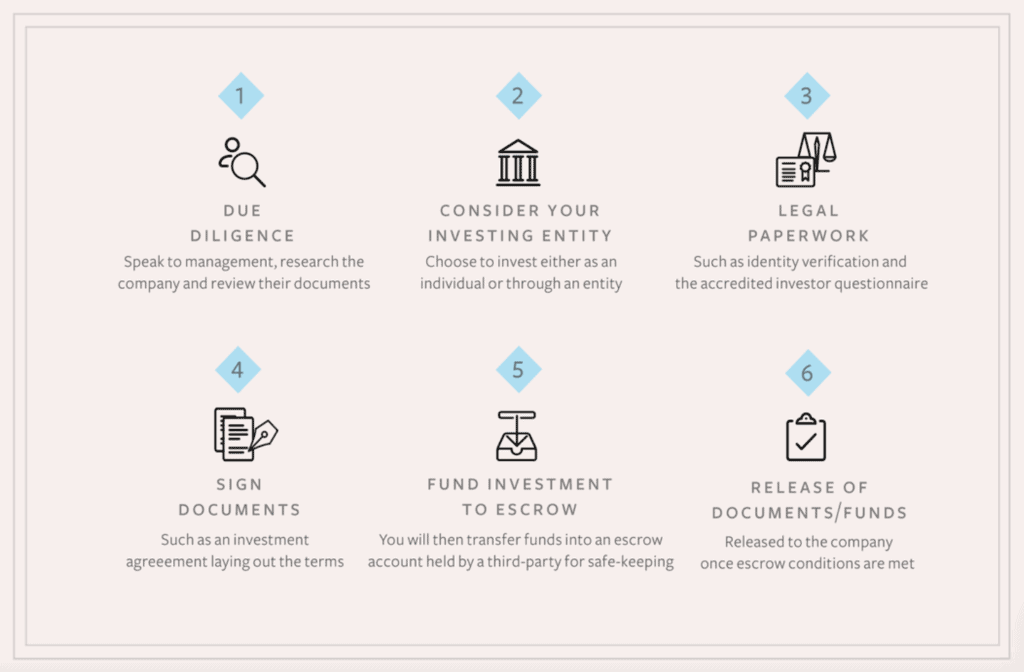

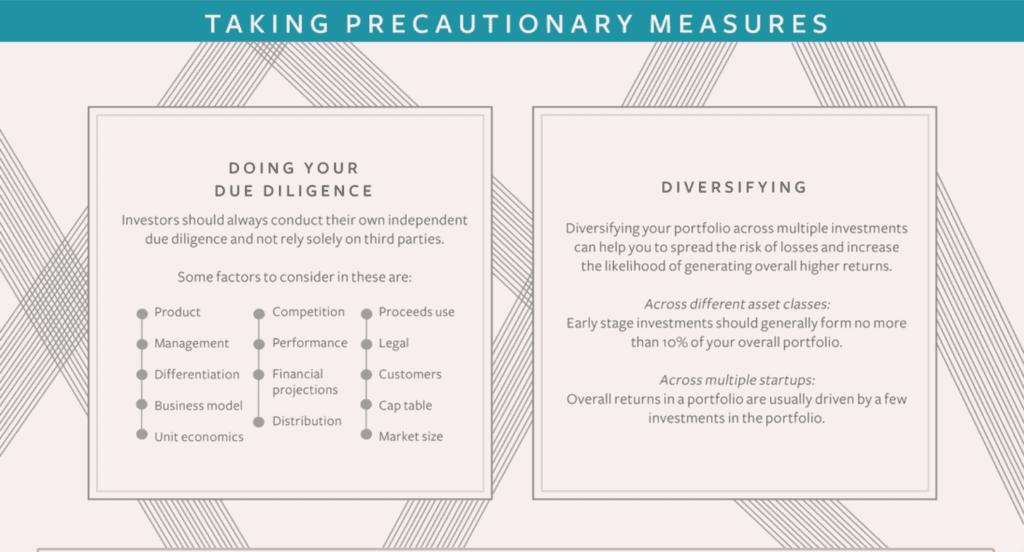

The startup investing process is part of our initial question to “How to Invest in Startups?”. There are a few important steps that need to be done before the investing process begins.

- Preliminary steps: preliminary steps include a business plan – a detailed case for your business, which will include your market research, any traction to date, financial forecasts, the amount of investment being sought, and for what. Pitch Deck – you will present and send this out as reading material, so prepare two versions tailored to your investors.

An executive Summary – this is the written ‘elevator pitch’ for your business. Investors should want to read more but not be left wondering what the core of the business is.

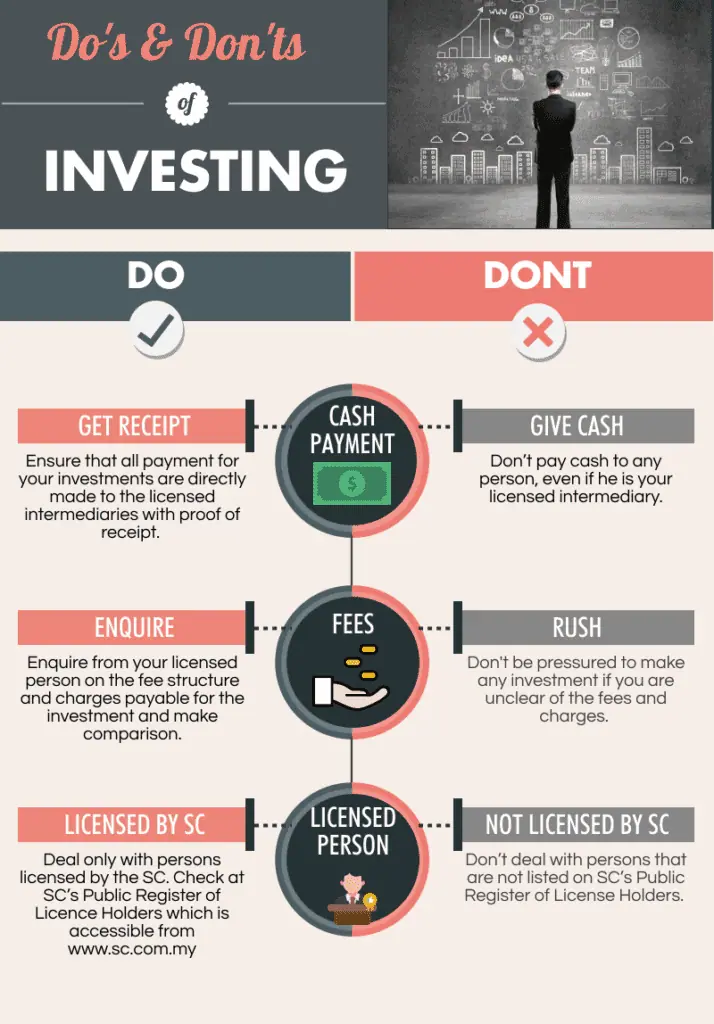

- Due Diligence: Due diligence is the term given to the investigatory work done around a transaction such as investment where the investor conducts detailed research into the financial, corporate and contractual status of your company. Your investors will usually make a preliminary request for you to provide documents which will include: corporate information, budgets, forecasts, key supplier/customer contracts in place, employee-employment contracts, schedule of intellectual property, a schedule of property or leases, a list of equipment owned by the company, details of other investors, shareholders, and bank loans, any existing or future litigation, tax and VAT filings and insurance documentation, and, if applicable, your data protection policies.

- Consider investing entity. Correct legal structure – it is worth noting that you can’t give away shares in your business in exchange for investment monies unless you have a legal entity with shares, i.e. a private limited company. So, if at the moment you are operating as a sole trader, or you haven’t started trading yet but intend to seek investment in the future, you will need to incorporate as a company and transfer all property owned by the ‘business’ into the company name.

- Legal paperwork. Once terms have been agreed and the due diligence has been completed, your (or the investor’s) solicitor will start to prepare the long-form documentation which will implement the funding arrangement. The following documentation will usually be involved: Shareholder’s Agreement or Investment Agreement, Vesting Provisions, Subscription Agreement, Articles of Association etc.

Sign and release of documentation.

Once you have external investors, your accounts and bookkeeping will need to be in immaculate condition and completely up to date. You will probably also have reporting obligations as part of your investment terms so at any given time you may need to report on the financial health of the company.

The process of how to invest in startups does not just start and end with funding only, there is a lot of ‘behind the scenes’ work and effort that goes into finding and investing in the methods of how to invest in startups.

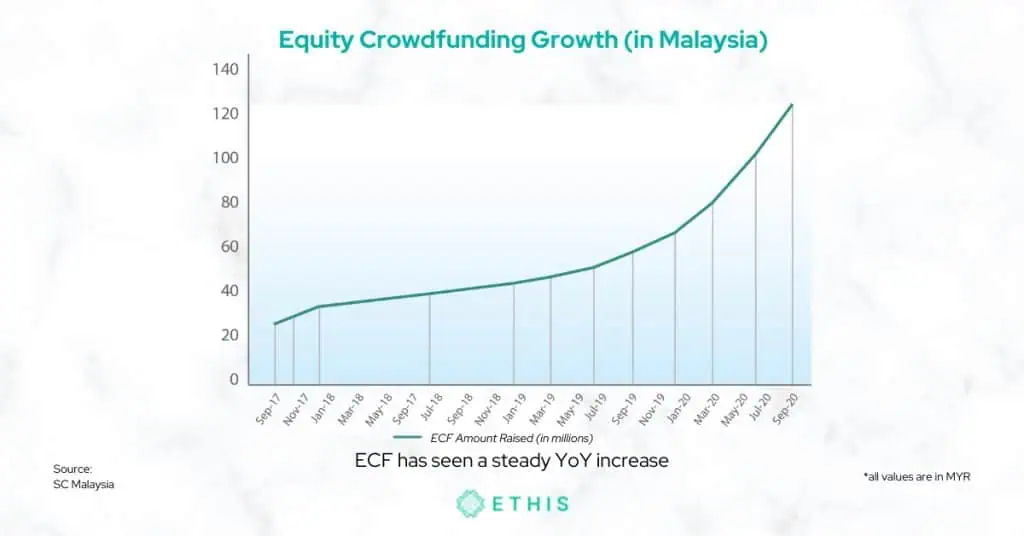

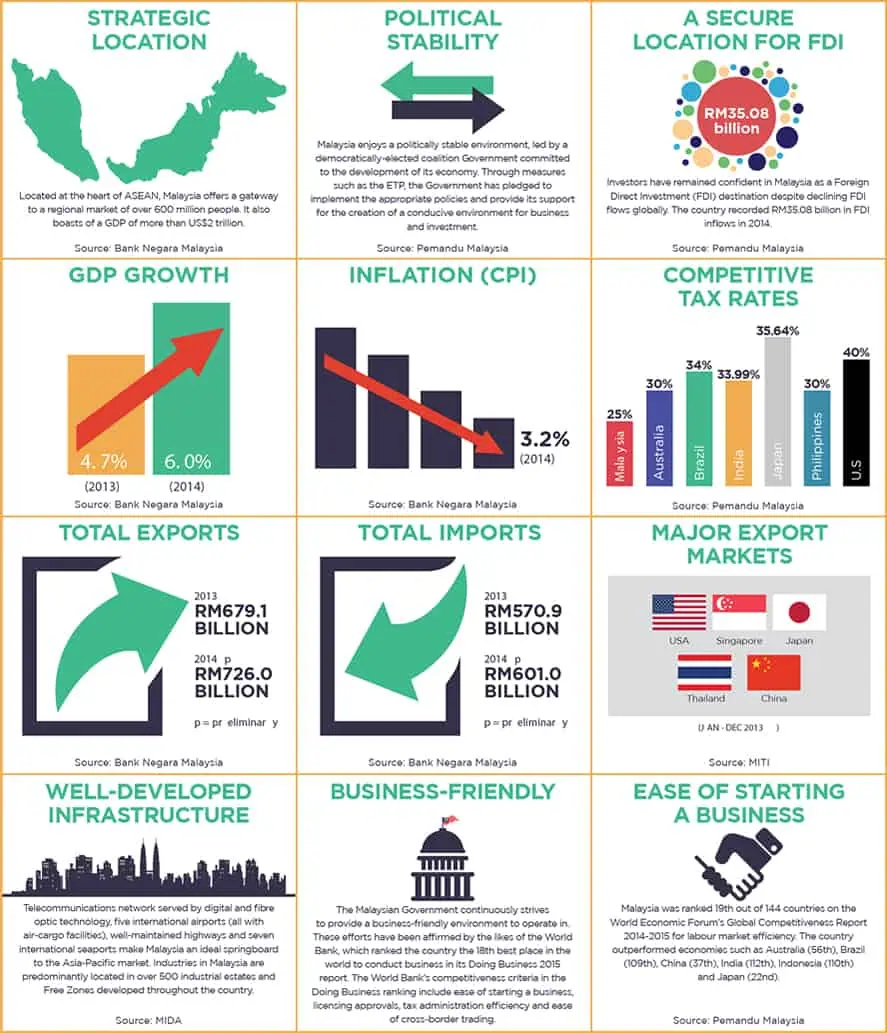

Startup Investments in Malaysia

How to invest in startups in Malaysia? This section will be solving this problem for you if you are an investor or anyone looking for startups to invest in Malaysia.

Joining NEXEA’s Angel Investor Club Malaysia as an angel investor gives you access to at least 1000+ companies per year to bring you about 3-10 quality investments each year. The companies are filtered via our proprietary Startup Fundamentals Methodology. Each startup has to pass our due diligence process, background checks, and investment committee.

NEXEA’s Angels not only teach you how to invest in startups but they also consist of experienced businessmen who own multi-national business, and who have exited via a trade sale, or IPO, or are currently running a listed company. This knowledge is particularly useful for new Investors, we encourage members to share their Investment & Business Experiences. Increase the success rate of startup investment together.

The NEXEA Angel Investors Network is available in Malaysia to sophisticated investors that can support young Entrepreneurs running startups only. This group includes those who are either considered as a High Net Worth Individual or a High-Income Earner.

Also, see our insight on how startups get funding in Malaysia in detail.

Risks and Rewards of Investing in Startups

Is investing in startups a good idea? The answer to how to invest in startups might seem like an easy process, but there are risks and rewards associated with it. According to Investopedia:

- Startup companies are in the idea phase and do not yet have a working product, customer base, or revenue stream.

- Around 90% of startup companies funded will not make it to the initial public offering (IPO).

- Investing in startup companies is a very risky business, but it can be very rewarding if the investments do pay off.

Several high-profile company success stories have proven that putting money into a startup is one of the few great ways to invest and reap high returns. Here’s what motivates investors to put their money into startups:

- Potential high profit. With good planning, startup investments can be very profitable. Pay attention to companies that provide solutions, bring value and develop new trends in the ever-evolving knowledge-based economy. All it takes is an original idea and a solid execution for a startup to become successful. There could be a huge return on your investment if you know the exact skill on how to invest in startups and understand how to grow them.

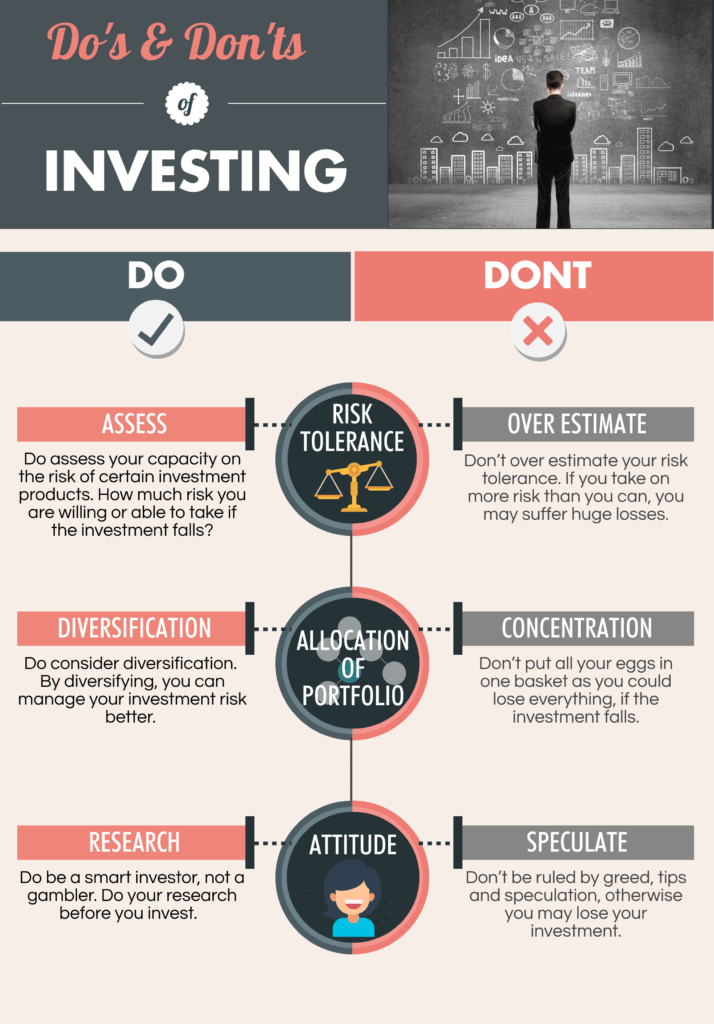

- Diversification. Startups are an asset class that allows you to explore a different investment channel. Investments are risky and a diverse portfolio means you can minimize the possibilities of taking a big hit during a downturn.

- Buy-out potential. Many startups are bought by large corporations that see them as a potential competitor or want to leverage the technology created by the startup. If the startup you invest in sells at a lucrative price, you’ll enjoy great returns on your investment.

Even with their growth potential, startups are considered high-risk investments since only a small percentage succeeds. Consider these cons before you dig further into how to invest in startups:

- High risk. As fruitful as it may be, you could invest in a company that never succeeds. Startup investments are high-risk and your return on investment depends on the new venture becoming a success. Some markets are extremely competitive or saturated and some business ideas simply don’t work. Take the time to carefully analyze the company you’re thinking about investing in to assess the chances of this startup.

- Personality and attitude of the owner. You are a highly experienced investor with extensive knowledge of how to invest in startups but many angels and VC investors indicate that the personality and drive of the company founders are just as, or even more important than the business idea itself. Founders must have the skill, knowledge, and passion to carry them through periods of growing pains and discouragement.

They also have to be open to advise and constructive feedback from inside and outside the firm. The success of a startup partially depends on how hard the entrepreneur behind the idea is willing to work. To alleviate this risk, get to know the entrepreneur better, find out the history of their past business ventures.

In Conclusion

To conclude, the process of how to invest in startups goes beyond just financing methods. If you feel that startups are a good investment option for you, make sure you, as an investor take the time to look for good business startups and allocate a small percentage of your portfolio to this type of high-risk investment.

Investing in startups is an excellent opportunity for investors to expand their portfolio and contribute to an entrepreneur’s success but investing in a startup is not foolproof. Even though a company may have strong cash flow projections, what looks good on paper may not translate to the real world. Taking the time to execute due diligence when researching a startup investment is something investors can’t afford to skip.

Investopedia

References

Investing in Startups Without Being Wealthy

Initial Public Offering (IPO) Playbook

More About Startups Investment

To lower the risk of market volatility, diversification is a popular investment strategy that involves purchasing various types of investments. It is a component of asset allocation, which refers to how much of a portfolio is invested in different asset classes.

The most popular asset classes are stocks, bonds, and cash (or cash equivalents). Investors will combine disparate assets (such as stocks and bonds) to achieve diversification so that their portfolio does not have an excessive amount of exposure to one particular asset class or market.

Numerous investment options are available to investors, each with unique benefits and drawbacks. To diversify your portfolio by asset class, within asset classes, and outside of asset classes, we've identified carefully 12 top tips :

12 Tips For a Diversified Portfolio

Discover The Importance Of Diversification

A diversified investment portfolio offers the best balance for your savings plan by assisting your overall investments in absorbing the shocks of any financial disruption. However, diversification goes beyond just the type of investment or classes of securities; it also includes the individual securities that comprise each class of security.

Invest across a range of sectors, interest rates, and time periods. For instance, even though the pharmaceuticals sector is one of the best-performing sectors during the Covid-19 pandemic, you shouldn't place all of your investments in it. Consider diversifying into other booming industries, like information or education technology.

Allocation Of Assets

Stocks and bonds are the two main categories of investment, generally speaking. Bonds are typically more stable with lower returns, whereas stocks are considered high-risk with low returns. Divide your funds between these two options to reduce your risk exposure. The trick is to find a balance between the two, or an equilibrium between risk and certainty.

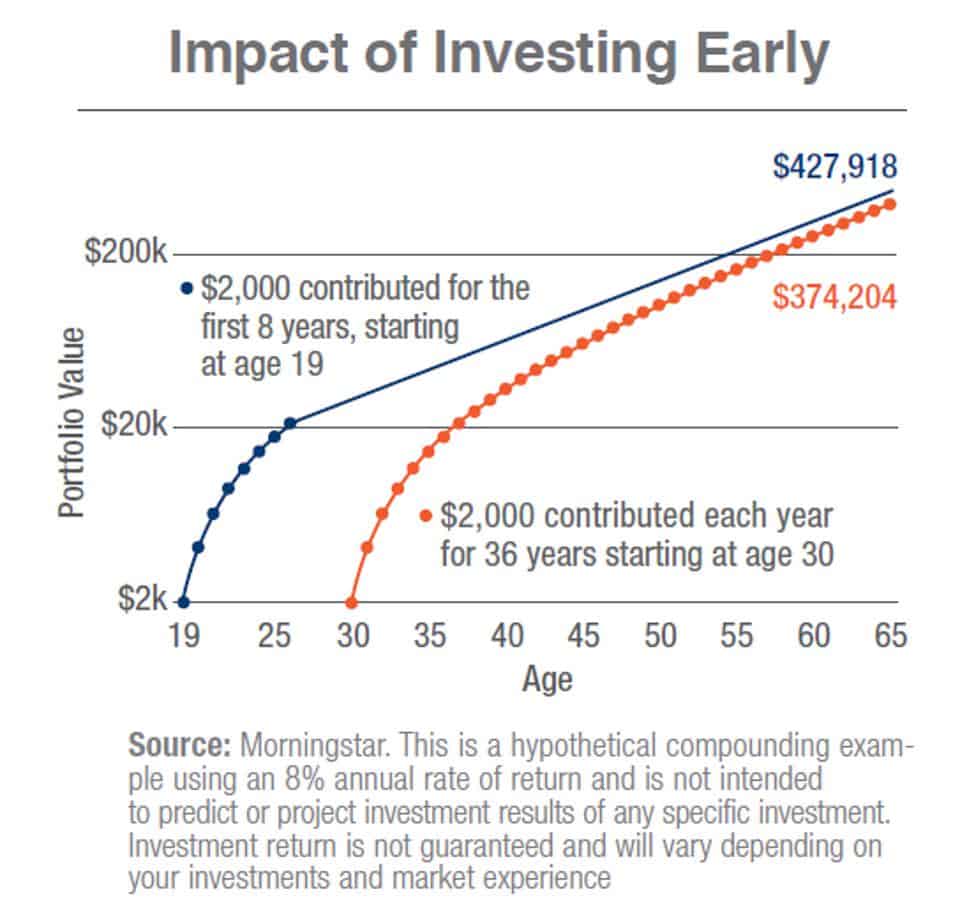

Distribution of assets is frequently based on lifestyle and age. You can take a chance when you're younger by choosing stocks with high returns.

Subtracting your age from 100 and using the result as the percentage of stocks in your portfolio is a good allocation method. A 30-year-old, for instance, could maintain 70% in stocks and 30% in bonds.

However, a 60-year-old should limit their risk exposure; as a result, the stock-to-bond allocation should be 40:60. When making these choices, you might need to consider your family's finances.

You should be more careful with your investments if you contribute significantly to the family's expenses. It would reduce the amount of available capital, so you might want to play it safe by tilting more heavily towards bonds.

Evaluate The Qualitative Risks Of The Stock

Before buying or selling a stock, use qualitative risk analysis to reduce the unpredictability of the transaction. A qualitative risk analysis gives a project's success a grade based on a predetermined scale. You must evaluate the stock using particular criteria that show its stability or potential for success in order to apply the same principle.

These criteria will cover a strong business model, senior management's integrity, corporate governance, brand value, compliance with laws and regulations, efficient risk management procedures, dependability of the company's goods or services, and competitive advantage.

Invest Money For Cash In Money Market Securities

Certificates of deposit (CDs), commercial papers (CPs), and Treasury bills (T-bills) are examples of instruments used in the money markets. The simplicity of liquidation is these securities' main benefit. It's a risk-free investment because of the lower risk.

T-bills are the most risk-free marketable securities that can be purchased individually. These government securities, also known as g-secs, are issued by the Reserve Bank of India, the country's banking watchdog. They offer a perfect, safe alternative for making short-term investments.

G-secs are well known for their safety but not for their high returns. A G-sec is secure because it is protected from market fluctuations, but doing so also eliminates the possibility of making a significant profit, as with stocks. If you want to park your money in a secure location temporarily, you can invest in g-secs. Additionally, you can use it to balance out other "riskier" investments in your portfolio, like high-value, high-risk stocks.

Purchase Bonds With Regular Cash Flows

Mutual funds are regarded as a dependable and secure form of investing. However, many options exist for investing, earning interest, and redeeming within mutual funds.

Consider investing in mutual funds with systematic cash flow, also known as a systematic withdrawal plan (SWP), if you want access to your money while it is locked away in a savings plan. You can take a set amount out of these investments monthly or quarterly. You can personalise withdrawal by choosing a fixed amount or a percentage of profits.

A systematic transfer plan, also known as STP, is an alternative where you can transfer a set amount between various mutual funds. STP aids in keeping your portfolio in balance.

Providing access to investments at predetermined intervals is the goal in either scenario.

Adopt A Buy-Hold Approach

Your long-term savings plan is essentially your investment plan. You must therefore begin to think strategically and refrain from making snap decisions. Instead of using a continuous trading strategy, consider buy-hold. It entails maintaining a largely stable portfolio over time, despite market fluctuations.

It's a more passive strategy where you let your investments grow instead of constantly trading. Having said that, don't be afraid to reduce holdings that have grown too quickly or occupy more space in your investment portfolio than is necessary or wise.

Recognise Elements That Affect The Financial Markets

You must first comprehend the variables affecting the financial markets before investing. Stock exchanges, foreign exchanges, bond markets, money markets, and interbank markets are examples of financial markets. These essentially function as a market for financial instruments and, like any other market, are driven by supply and demand.

Like any other market, its dynamics are influenced by outside factors like interest rates and inflation. The other significant factor is the Reserve Bank of India, the country's central bank, and its monetary policies.

Gain Knowledge Of World Markets

The potential for quick, high returns exists in the global markets. These markets are typically characterised by a dynamic that moves extremely quickly and requires an investor to navigate numerous financial rules. It may take some time for a novice investor to become familiar with its workings, comprehend trends and fluctuations, and determine what causes these shifts. However, it can be very profitable, particularly when the Indian market is going through a protracted downturn.

Start with a mutual or exchange-traded fund (ETF) with a low-cost structure and lots of liquidity. It will enable you to invest safely with little capital, allowing you to observe and comprehend how the world market functions.

Regularly Rebalance Your Portfolio

Both in life and in investing, balance is crucial. It's critical to regularly review your investment portfolio to ensure that all of your assets are in balance. This assessment should be based on your objectives and significant life achievements and, where you started, and how far you have come.

Your investments should be compared to your lifestyle, and a financial advisor can also advise you on other possibilities. While keeping you informed of your investment's annual growth, this exercise also helps you become more disciplined. These two elements will eventually aid in your decision-making and help you better understand future investments.

Try A Disciplined Investment Plan

A SIP (systematic investment plan) is a good choice if you want to invest a small amount over time rather than a large sum simultaneously. With this approach, you can make fixed investments in mutual funds regularly. It is perfect for those who can only afford to invest a small amount each month but cannot access a large sum of money.

A SIP can be started with as little as 500 INR. Young investors should use SIPs because they help them develop discipline in their investment strategy. The investment amount is taken out of your bank account directly, which helps you get used to regularly setting aside a set amount of money for your future. Additionally, it makes your investment secure because it is based on compound interest and has a low overall risk.

Always keep in mind that diversification is the key. Invest in various industries and interest-format types.

Purchase Life Insurance

In India, few young adults consider purchasing life insurance. When you're young, it can be difficult to think about dying, especially if you don't have any children or other dependents. However, the conventional wisdom that life insurance should be treated as a crucial investment option is still valid, particularly when you are young, due to the low premium rates your insurance company will likely provide you with at a younger age.

The younger you are, the lower your premiums will be, according to how life insurance companies determine premiums. Even though you might not currently benefit from life insurance, your loved ones will be protected if you pass away.

By investing in unit-linked insurance plans (ULIPs), which combine life insurance with market-linked investments, you can also profit from your life insurance. The insurance premium is paid in part of the investment sum; the remaining sum is placed in the market. This is a long-term strategy, so getting started early can help you save for upcoming milestones. Always compare ULIPs before making an investment.

Recognise Your Financial Prejudices

You should be aware of the biases and beliefs likely to affect your investment decisions. Outside forces frequently influence us, particularly risk tolerance, familial character, good fortune, and cultural values.

Your level of risk tolerance is referred to as your risk aptitude, and it frequently depends on your family history and cultural norms. The likelihood of young adults from wealthy families choosing high-risk, high-return investments is higher. People from modest backgrounds, on the other hand, are more likely to invest in secure portfolios. Family values also impact how much we are willing to believe in luck.

The cultural influence on our investments is another distinctive quality. For instance, some communities favour gold investments, while others favour real estate.

About Investment Portfolio

Are Index Funds Diverse Enough?

An index fund or ETF replicates an index by definition. The degree of diversification may vary depending on the index. For instance, the Dow Jones Industrial Average has only 30 stock components compared to the S&P 500's more than 500, making the latter much less diversified.

Even if you own an S&P 500 index fund, your portfolio may not be sufficiently diversified if you don't also have modest allocations in low-correlation asset classes like bonds, commodities, real estate, and alternative investments, among others.

Can a Portfolio Be Over-Diversified?

Yes. Diversification objectives are not met if adding a new investment to a portfolio raises its overall risk and/or lowers its expected return (without appropriately lowering the risk). When a portfolio contains the ideal number of securities or when you add closely correlated securities, this "over-diversification" is more likely to occur.

Why Do I Need to Diversify?

Investors who diversify their portfolios avoid "putting all of their eggs in one basket." According to the theory, if one stock, industry, or asset class declines, others might increase. This is particularly true if the securities or assets held do not have a high degree of correlation. Diversification reduces the portfolio's overall risk mathematically without lowering the expected return.

What Goes Into A Diversified Portfolio?

A wide variety of investments should be included to diversify. For many years, financial advisors frequently advised creating a 60/40 portfolio, in which 60% of the capital would be invested in stocks, and 40% would be in fixed-income securities like bonds. Others, especially younger investors, have argued for greater stock exposure.

Conclusion

Owning a wide range of various stocks is one of the keys to a diversified portfolio. This entails holding various stocks from various sectors, including energy, healthcare, and technology. An investor doesn't need exposure to every industry; instead, they should concentrate on owning a wide range of top-notch businesses. Investors should also consider dividend stocks, growth stocks, value stocks, large-cap stocks, and small-cap stocks.

Investors should consider holding some non-correlated investments to a diversified stock portfolio (i.e., ones whose prices don't fluctuate daily with stock market indexes). Bonds, bank certificates of deposit, gold, virtual currencies, and real estate are some non-stock diversification options.

References

Understanding Portfolio Diversification from Fool.com

Investing in Southeast Asia can reward long-term investors looking for growth opportunities in emerging markets. However, finding quality and undervalued companies in this region is complex. Many challenges and risks are involved, such as political instability, currency fluctuations, corruption, and lack of transparency.

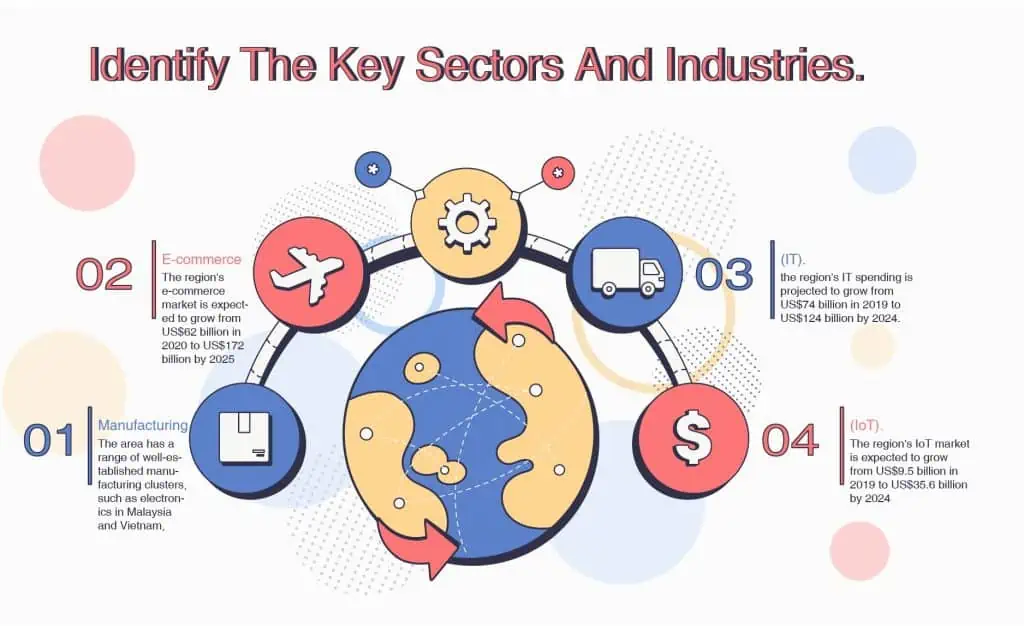

Identify the key sectors and industries.

Suppose you are looking for investment opportunities in Southeast Asia's fast-growing and diverse region. In that case, you might consider some quality and undervalued companies operating in critical sectors and industries that drive growth and innovation in the region, such as manufacturing, e-commerce, IT, IoT, and life sciences.

Manufacturing

Manufacturing is one of the most essential sectors in Southeast Asia, accounting for a large share of the region's GDP and exports. The area has a range of well-established manufacturing clusters, such as electronics in Malaysia and Vietnam, automobiles and packaged foods in Thailand, machinery and petrochemicals in Indonesia, and semiconductors, biopharmaceuticals, and aerospace components in Singapore. These clusters benefit from the region's large and growing market, extensive manufacturing base, new trade pact (the Regional Comprehensive Economic Partnership), and access to next-generation Industry 4.0 technologies. Some of the quality and undervalued companies in this sector include ARB Berhad, a Malaysian IT and IoT solutions and services company that ranked 72nd on the 2020 Asia Pacific Technology Fast 500 list, and vKirirom Pte. Ltd., a Singaporean software company that provides cloud-based solutions for education institutions.

E-commerce

E-commerce is another booming sector in Southeast Asia, as more consumers shop online for convenience, variety, and affordability. The region's e-commerce market is expected to grow from US$62 billion in 2020 to US$172 billion by 2025, according to a report by Google, Temasek, and Bain & Company. The region has several e-commerce platforms that cater to different segments and needs of online shoppers, such as Lazada, Shopee, Tokopedia, Bukalapak, Zalora, and Qoo10. Some quality and undervalued companies in this sector include PT Tokopedia, an Indonesian technology company specialising in e-commerce and ranked 94th on the 2020 Asia Pacific Technology Fast 500 list, and Involve Asia Technologies Sdn Bhd. This Malaysian media company connects e-commerce merchants with online publishers.

Information Technology(IT).

IT is another key sector in Southeast Asia, as more businesses adopt digital technologies to enhance their productivity, efficiency, and competitiveness. According to IDC, the region's IT spending is projected to grow from US$74 billion in 2019 to US$124 billion by 2024. The region has a vibrant IT ecosystem includes software developers, hardware manufacturers, cloud service providers, data analytics firms, cybersecurity experts, and digital transformation consultants. Some quality and undervalued companies in this sector include Blue Wireless Pte. Ltd. This Singaporean communications company provides wireless broadband solutions for enterprises across Asia Pacific and Africa, Cresco Data Pte. Ltd., a Singaporean software company that provides data automation and integration solutions for e-commerce businesses, Ivy Mobile Technologies Pte Ltd., a Singaporean software company that develops mobile applications for various industries, and PatSnap Pte. Ltd. This Singaporean software company provides intellectual property analytics and management solutions.

Internet of Things(IoT).

IoT is another emerging sector in Southeast Asia, as more devices and objects are connected to the internet to collect and exchange data. The region's IoT market is expected to grow from US$9.5 billion in 2019 to US$35.6 billion by 2024, according to Frost & Sullivan. The region has a solid potential to leverage IoT for various applications such as smart cities, manufacturing, agriculture, healthcare, transportation, and energy. Some of the quality and undervalued companies in this sector include Terminus Technologies.

Research the Leading Companies.

One of the most important skills for investors is to identify quality and undervalued companies that can generate consistent returns in the long term. In this article, we will share some tips on how to find such companies in Malaysia and Southeast Asia, a region with high growth potential and diverse opportunities.

Research the leading companies.

Research the leading companies you want to invest in each sector and their competitive advantages, such as market share, technology, customer base, and profitability. For example, in the e-commerce sector, you may want to look at companies like Shopee, Lazada, and Tokopedia, which have strong brand recognition, user loyalty, and network effects. In the banking sector, you may want to look at companies like Maybank, DBS, and CIMB, which have large customer deposits, digital innovation, and regional presence.

Analyze the financial performance.

You can use various metrics and ratios to assess the quality and undervalued aspects of the companies, such as earnings growth, return on equity, dividend yield, price-to-earnings ratio, and price-to-book ratio. You can also compare these metrics with their peers and industry averages to understand their relative value.

Evaluate the prospects and risks.

You can use various sources of information to gather insights and opinions on the companies, such as annual reports, analyst reports, news articles, podcasts, and forums. You can also consider the macroeconomic factors and trends that may affect the companies, such as interest rates, inflation, currency fluctuations, consumer behaviour, and regulations.

Following these steps, you can find quality and undervalued companies to invest in in Malaysia and Southeast Asia. However, you should also do your due diligence and research before making investment decisions. Investing involves risks and uncertainties; you should be prepared for possible outcomes.

Evaluate each company's financial performance and valuation.

Clear investment objective and strategy.

What are your investment goals, risk tolerance, time horizon, and preferred sectors or industries? This will help you narrow your search and focus on the most relevant companies for your portfolio.

Some market research and analysis.

What are the macroeconomic trends, political risks, regulatory environment, and competitive landscape in Malaysia and Southeast Asia? How do these factors affect different sectors and industries' growth prospects and profitability? You can use various sources of information, such as news articles, reports, databases, and websites, to get a comprehensive overview of the market conditions and opportunities.

Screen and select potential companies based on your investment criteria

You can use various tools and platforms, such as stock screeners, financial websites, and online investors, to filter and sort companies based on various parameters, such as market capitalization, sector, industry, dividend yield, growth rate, etc. You can also use qualitative factors, such as management quality, competitive advantage, brand recognition, customer loyalty, etc., to assess each company's potential.

Using multiple metrics to evaluate.

Evaluate each company's financial performance and valuation using revenue growth, earnings per share, return on equity, price-to-earnings ratio, and market capitalization. These metrics will help you measure how well the company generates income and creates value for its shareholders. You can compare these metrics with the industry averages and historical trends to determine if the company is overvalued or undervalued. You can also use other valuation methods, such as discounted cash flow analysis, relative valuation, or intrinsic value estimation, to estimate the fair value of each company.

Investment decision based on your analysis and judgment.

You should consider both the potential returns and risks of each investment opportunity. You should also diversify your portfolio across different sectors, industries, countries, and regions to reduce exposure to specific risks and enhance your overall performance. You should also monitor your portfolio regularly and adjust your strategy based on your investments' changing market conditions and performance.

Compare the valuation of each company.

One of the most important skills for investors is identifying quality and undervalued companies in the market they want to invest in. Quality companies have substantial competitive advantages, consistent profitability, high returns on capital, and good growth prospects. Undervalued companies trade below their intrinsic value, meaning the market has not fully recognized their potential.

One way to find quality and undervalued companies in Malaysia and Southeast Asia is to compare the valuation of each company with its peers and the industry average, looking for signs of undervaluation or overvaluation. Valuation estimates a company is worth based on its financial performance and future prospects. There are various valuation methods and metrics that can be used, such as price-to-earnings ratio (P/E), price-to-book value ratio (P/B), price-to-sales ratio (P/S), price-to-cash flow ratio (P/CF), dividend yield, earnings growth rate, return on equity (ROE), and free cash flow yield.

By comparing the valuation of each company with its peers and the industry average, investors can get a sense of whether a company is cheap or expensive relative to its competitors and the market. For example, suppose a company has a lower P/E ratio than its peers and the industry average. In that case, it may indicate that the company is undervalued, which generates more earnings per share than the market is willing to pay. Conversely, suppose a company has a higher P/E ratio than its peers and the industry average. In that case, it may indicate that the company is overvalued, generating less earnings per share than the market expects.

However, valuation is not an exact science. Many factors can affect the valuation of a company, such as its growth prospects, competitive position, risk profile, capital structure, accounting policies, and market sentiment. Therefore, investors should not rely solely on valuation metrics to make investment decisions but also consider other aspects of a company's business model, strategy, financial performance, and future outlook. Additionally, investors should be aware of the limitations and assumptions of each valuation method and metric and use them with caution and common sense.

Conduct due diligence

Company's management team

You want to look for leaders with relevant experience, vision, and integrity and align with shareholders' interests. You can check their backgrounds, track records, reputations, and incentives. You can also assess their communication, strategic thinking, and decision-making abilities.

Evaluate the company's business model.

You want to understand how the company creates value for its customers, suppliers, partners, and shareholders. You can analyze its products or services, target markets, competitive advantages, revenue streams, cost structure, and profitability. You can also examine its innovation capabilities, customer loyalty, and market share.

Examine the company's growth strategy.

The third step is to You want to see how the company plans to expand its business in the future, both organically and inorganically. You can review its goals, objectives, milestones, and action plans. You can also consider its opportunities and threats in the external environment, such as industry trends, customer preferences, regulatory changes, and competitive forces.

Identify the company's risks and challenges.

You want to know the potential pitfalls and uncertainties that could affect the company's performance and valuation. You can evaluate its financial health, operational efficiency, risk management practices, and contingency plans. You can also monitor its performance indicators, such as revenue growth, earnings per share, return on equity, and free cash flow.

Estimate the company's intrinsic value.

You want to compare the company's current market price with its fair value based on future cash flows. You can use various valuation methods, such as discounted cash flow analysis, multiples analysis, dividend discount model, or residual income model. You can also adjust your valuation for different scenarios and assumptions.

Invest in companies that have strong fundamentals.

Quality companies have strong fundamentals, such as solid balance sheets, competitive advantages, loyal customers, and proactive management. These companies can withstand market fluctuations and deliver sustainable growth and profitability over time. Undervalued companies have an attractive valuation, meaning their current share price does not reflect their true worth or future potential. These companies are often overlooked or misunderstood by the market, creating a margin of safety for investors who can recognize their value.

To find quality and undervalued companies in Malaysia and Southeast Asia, we need to adopt a bottom-up approach, focusing on each company's characteristics and performance rather than the macroeconomic factors or industry trends. This requires us to do thorough research and analysis of the company's financial statements, business model, competitive landscape, growth prospects, risks, and valuation. We also need to monitor the company's news and developments regularly and be alert for any changes affecting its outlook.

Some of the criteria that we can use to screen for quality and undervalued companies are:

Return on equity (ROE).

This measures how efficiently a company uses its shareholders' equity to generate profits. A high ROE indicates that the company has a strong competitive edge and can reinvest its earnings to grow its business. We can look for companies with an ROE of at least 15% or higher than their industry average.

Earnings growth.

This measures how fast a company's earnings are increasing over time. A high earnings growth indicates that the company has a high growth potential and can increase its market share and profitability. We can look for companies with an earnings growth of at least 10% or higher than their industry average.

Price-to-earnings ratio (P/E).

This measures how much investors will pay for each unit of a company's earnings. A low P/E indicates that the company is undervalued or has a low expectation from the market. We can look for companies with a P/E of less than 15 or lower than their industry average.

Dividend yield.

This measures how much a company pays out in dividends relative to its share price. A high dividend yield indicates that the company rewards its shareholders with consistent and generous payouts. We can look for companies with a dividend yield of at least 3% or higher than their industry average.

Conclusion

In conclusion, finding quality and undervalued companies to invest in Southeast Asia can reward long-term investors. However, it requires careful research, patience, and discipline to avoid falling into value traps or missing out on growth opportunities. Some metrics that can help investors identify undervalued companies are the price-to-earnings ratio, price-to-book ratio, and price/earnings-growth ratio. These metrics can help compare companies across different industries and markets and reveal their intrinsic value relative to their current price. By applying these metrics, investors can build a diversified portfolio of value stocks with strong fundamentals, attractive valuations, and potential for future growth.

Reference

Opportunities for companies in Southeast Asia to reimagine

Investing in Southeast Asia: What’s Behind the Boom

How to Find Undervalued Companies

Updated 29/8/2022

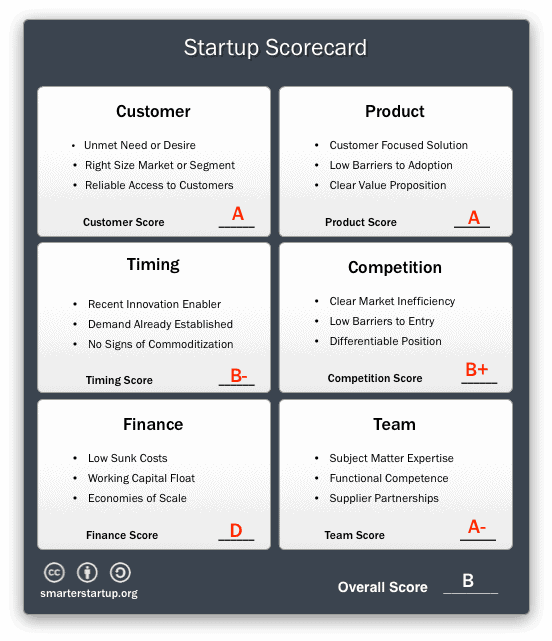

Startup valuations reveal a company's ability to employ new cash to expand, exceed consumer and investor expectations, and achieve the next goal. Unicorn valuations, or companies worth $1 billion or more, now number in the hundreds. There are now "decacorns," or startups worth $10 billion or more, as well as "hectocorns," or companies worth more than $100 billion.

These calculations, while remarkable, aren't as objective as you may believe. A startup valuation may take into account your team's experience, product, assets, business model, total addressable market, competition performance, market opportunity, goodwill, and other criteria.

What Is Startup Valuation?

For any corporation, valuing its assets is never simple. The task of assigning a valuation to businesses with little or no revenue or profits and uncertain futures is extremely difficult. It's usually a matter of valuing mature, publicly-traded businesses with consistent revenues and earnings as a multiple of their earnings before interest, taxes, depreciation, and amortisation (EBITDA) or based on other industry-specific multiples.

However, valuing a new enterprise that isn't publicly traded and may be years away from sales is much more difficult. There are numerous factors to examine, including the management team and industry trends, as well as product demand and marketing hazards.

Important Factors For Pre-Revenue Starup Valuation

The majority of the time, early-stage firms are valued in the middle, which means that founders don't get as much as they expected and investors may invest higher than they intended. Here are some major elements to consider when valuing a startup before it generates income.

Traction Is Demostration Of Concept

If you are trying to figure out how to value a firm with no income, one of the most important factors to consider is traction. e

- Number of Users. Demonstrating that you already have clients is critical. The greater the number, the better.

- Marketing Effectiveness. If you can demonstate that you can recruit high-value consumers for a low acquisition cost, you will draw the interest of pre-revenue investors

- Growth Rate. Demonstrating that your business has expanded on a limited budget is advantageous, since many investors will see the potential for expansion if you have some funding.

There is a link between these three ideas, as a strong marketing plan will result in significant growth. When that happens, the number of users will skyrocket. As a result, you automatically add value to your startup by demonstrating that you have a solid, scalable business idea. Investors will begin to view their money as fuel for the fire.

The Importance Of A Founders' Team

Pre-revenue investors want to know that they are investing in a team that's going to be successful. They will think about the following:

- Proven Experience - A startup with personnel who have had previous success with other startups will be more appealing than one with inexperienced first-timers.

- Skills Diversity - A startup team should ideally consist of a mix of professionals with complementary skills. A brillant programmer cannot do everything on her own, but when she joins forces with a marketing expert, the startup becomes more valuable.

- Commitment - Great individuals are simple one piece of the puzzle. Those individuals must have the time and commitment to ensure the startup's success. A team of part-time workers will not be appealing.

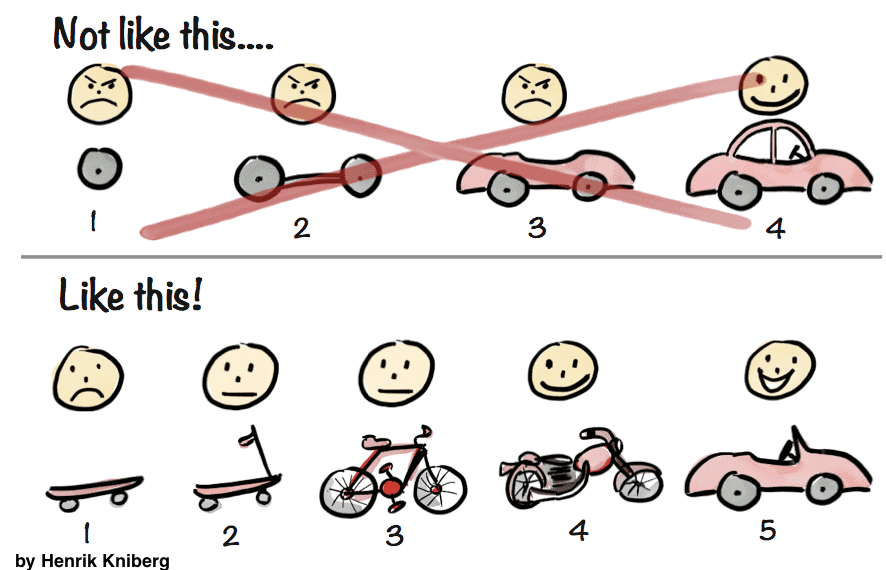

Prototypes / Minimum Viable Product (MVP)

A prototype is a game-changing addition, regardless of which pre-money valuation method you choose. Being able to display a functioning model of your product to pre-revenue investors not only demonstrates your persistence and vision for turning ideas into reality but also accelerates the business's launch date.

If you have a Minimum Viable Product (MVP) and some early users, you might be able to raise $500k to $1.5M in funding. If your company is evaluated using the valuation-by-stage method, which is utilised by many venture capitalists and angel investors, a working prototype could fetch you even more money. This might result in a $2 million to $5 million investment.

Demand and Supply

Your startup valuation will be impacted if you operate in a market where the number of business owners outnumbers the number of willing investors. Many business owners are desperate for investment in such a competitive environment, and may even sell themselves short to do so.

On the other hand, you have a unique patented idea for a startup that is causing a stir in the industry. This may increase investor demand, increasing the value of your firm.

Hot Trends and Emerging Industries

Many investors will be prepared to pay a premium in booming businesses like Artificial Intelligent (AI) or mobile gaming. The internet age is rife with prospects that many regards as "the next great thing," so if your startup is in the proper field, it could be worth more.

High Margins

Investors aren't interested in high-margin products with low-profit margins. A high-growth business, on the other hand, with good margins and excellent revenue growth estimates, may be able to attract greater financing.

Common Startup Valuation Method

It may seem difficult to perform a pre-revenue business valuation on your own, but you may benefit from the knowledge and wisdom of other entrepreneurs, angel investors, and venture capitalists. Furthermore, by familiarizing yourself with the most common startup valuation methods, you will not only be able to analyze a firm with no revenue but you will also be able to negotiate a better deal with pre-revenue investors.

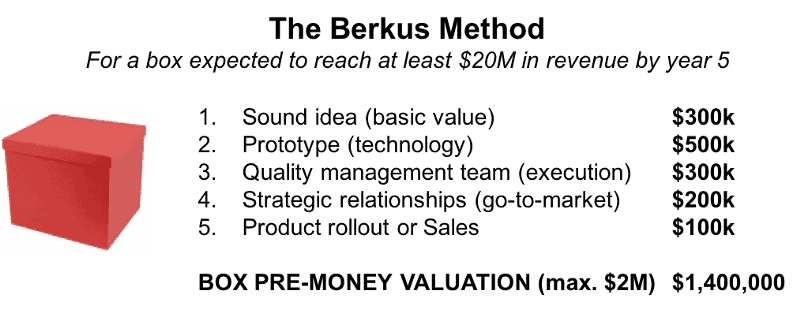

The Berkus Method

Investors, according to angel investor Dave Berkus, should be able to see the company reaching $20 million in five years. His approach evaluates five key components of a startup.

- Concept. The product provides basic value while posing a manageable risk

- Prototype. This lowers the danger of technology failure.

- Quality Assurance. If it isnts already in place, the startup intends to hire a quality assurance staff

- Connections. There are already some strategic partnerships in place, which lessens market competitive threats.

- Launch Plan. There is some evidence of sales strategy and preparation for product launch. (Note that this does not apply to all pre-revenue businesses)

Each facet is assigned a grade of up to $500,000, implying a maximum valuation of $2.5 million. The Berkus Method is a straightforward estimating technique popular among software firms. It is a good technique to estimate worth, but it lacks the flexibility that some people want because it doesn't consider that market.

Scorecard Valuation Method

Another option for pre-revenue enterprises is the Scorecard Valuation Method. It also compares startups to companies that have already received funding, but with additional criteria.

To begin, first, determine the average pre-money valuation of comparable businesses. Then look at how your company compares to the traits listed below. After that, assign a comparison percentage to each quality. When compared to your competition, you can be on par (100%), below average (<100%), or above average (>100%) for each characteristic.

| Criteria | Weight | Target Company | Factor |

| Team | 30% | x | = 0.3*x |

| Size Of The Opportunity | 25% | x | = 0.24*x |

| Product/Technology | 15% | x | = 0.15*x |

| Competitive Environment | 10% | x | = 0.10*x |

| Sales/Marketing | 10% | x | = 0.10*x |

| Need For More Financing | 5% | x | = 0.05*x |

| Other | 5% | x | = 0.05*x |

| Total | Sum of all factors |

For example, you give your e-commerce team a 150% score since it's complete, well-trained, and staffed with experienced developers and marketers, some of whom have previously worked for competitors. To get a factor of 0.45, multiply 30% by 150%.

Calculate the sum of all factors for each startup quality. To calculate your pre-revenue valuation, multiply that sum by the typical valuation in your industry.

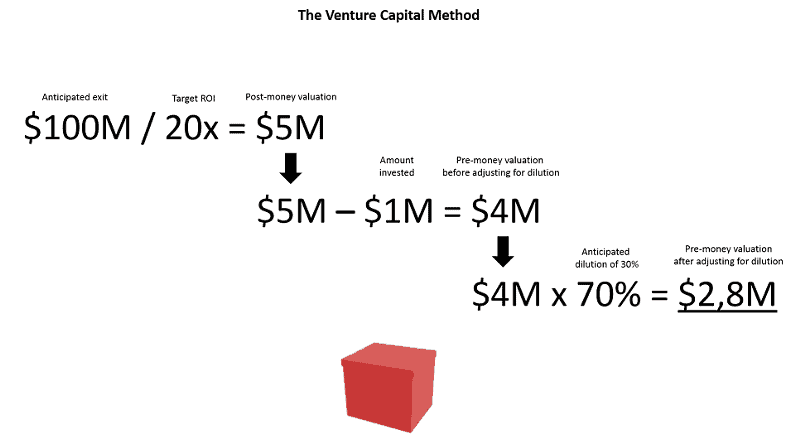

Venture Capital (VC) Method

The venture capital approach was popularised by Harvard Business School Professor Bill Sahlman. The venture capital technique is a two-step procedure that necessitates the use of a number of pre-money valuation algorithms.

First, determine the business's terminal value in the harvest year. Second, determine the pre-money valuation by working backwards from the predicted return on investment (ROI) and investment amount. The harvest year is the year in which an investor will depart the firm. Terminal value is the estimated value of the startup at a specific point in the future. The Industry Price-Earning Ratio (P/E ratio), or stock price-to-earnings ratio, is another phrase you will need to grasp. A P/E ratio of three, for example, suggests that the stock is worth three times its earnings.

Calculating Terminal Value

To calculate the terminal value, the following figures are required.

- Estimated revenue for the harvest season

- Profit margn forecasted for the harvest year

- P/E ratio of the industry

You may uncover industry averages for the P/E ratio and predicted profit margins by doing some research online. Once you have gathered your data, perform the following calculation:

- Terminal Value = earnings x P/E

For example, in five years, a tech company expects to generate $10 million in revenue, with a 10% profit margin. The P/E ratio is 20. As a result, the terminal value is $10 million multiplied by 10% and multiplied by 20 to equal $20 million.

Calculating The Pre-Money Valuation

The following items are required for the second step.

- Required Return On Investmetn (ROI)

- Investment Amount

Then calculate it based on the formula below.

Pre-Money Valuation = Terminal value/ROI - Investment amount

Imagine a pre-revenue investor is looking for a 10x return on his $1 million investment.

Pre-Money Valuation = $20M/10 - $1M = $1M in this scenario.

We may calculate the current pre-revenue startup valuation to be $1 million using this method. With a $1 million investment and reasonable growth and industry profits estimates, the company may be worth $20 million in five years.

Risk Factor Summation Method

This approach combines elements of the Scorecard Method and the Berkus Method to produce a more precise evaluation of an investment's risk. It takes into account the following risk:

- Management

- Stage of the Company

- Capital/Funding Risk

- Manufacturing Dangers

- Technology Risk

- Risks in Sales and Marketing

- Threat of Competition

- Political/Legislation Risk

- Litigation Risk

- International Risk

- Risk to One's Reputation

- Potential Lucrative Risk

Each of these risk areas will be given a score based on the following criteria:

- - 2 (-$500,000) - Extremely Negative

- - 1 (-$250,000) - Negative for scaling the startup and carrying out a successful exit

- 0 ($0) - Neutral

- + 1 ($250,000) - Positive

- + 2 ($500,000) - Excellent for scaling the business and execiting a successful exit

The pre-revenue company valuation will increase by $250,000 for every +1 and by $500,000 for every +2. For every -1, the pre-revenue value drops by $250,000 and for every - 2, it drops by $500,000.

This method is useful for assessing the risks that must be addressed in order to achieve a successful exit, and it can be combined with the Scorecard Method to provide a comprehensive assessment of the startup's value.

Comparable Transactions Method

Because it is based on precedent, the Comparable Transactions Method is one of the most common startup valuation methodologies. You're responding to the question, "How much did startups like mine cost to acquire?"

Consider the case of Rapid, a fictional shipping firm that was purchased for $24 million. It had 700,000 subscribers on its mobile app and website. That works out to about $34 per user. Your shipping company has a user base of 120,000 people. This gives your company a market value of around $4 million.

You can also look up revenue multiples for companies in your industry that are similar to yours. It's possible that SaaS companies in your market produce 5x to 7x the prior year's net sales.

You must include ratios or multipliers in any comparison model for everything that is significantly different between your two businesses. If another SaaS company has proprietary technology and you don't, for example, you might want to choose a multiplier on the lower end of the spectrum, such as 5x (or lower) in our example.

Cost To Duplicate Approach

This strategy involves evaluating the firm's tangible assets before calculating how much it would cost to replicate the startup elsewhere. When looking for pre-revenue investors, it's helpful to remember that no wise investor will invest more than the assets' market value.

A tech startup, for example, might think about the costs of producing their prototype, patent protection, and research and development. Unfortunately, this strategy does not account for future possibilities, nor does it incorporate intangible assets such as brand value or current market hot trends.

As a result, because it is such an objective approach, it is best utilised to acquire a lowball estimate of a startup's pre-revenue worth.

Conclusion

You must balance all of the things that your startup must supply in order to present yourself with the highest valuation for your pre-revenue business. Before approaching individuals who might be interested in investing in your company, it is equally critical that you, as the owner, learn how to value it.

Experimenting with different valuation methodologies will allow you to show your investors that your company has the ability to grow and is worth their money.

Reference

Understanding Startup Valuation

Unicorn firms are those companies that attain a $1 billion value without being listed on the stock market, and they are every tech startup's goal. What elements contribute to the success of these businesses? Which are the most valuable in the world? What are the pros and cons of investing in one? We address these and other concerns in the sections that follow.

The Origin of the Term "Unicorn Company"

The name was coined in 2013 by venture capitalist Aileen Lee to emphasise the rarity of such enterprises at the time. Lee sorted over 60,000 software and internet firms that received funding between 2003 and 2013, discovering that just 39 startups were valued at more than $1 billion, making them exceptionally exclusive and opportune investments.

Unicorn companies have grown far less common over the years. Although reaching unicorn status is more frequent today than ever before, these $1 billion+ post-money values are still tremendously astounding. Unicorn businesses are being scrutinised and reported on by individuals with an interest in the most prominent participants in the private markets.

What Kind of Companies Make Unicorns?

Entrepreneurs always wonder about the keys to becoming the next unicorn but constructing a road map for creating a unicorn company is a difficult task. Many factors are involved in the success or failure of a startup, but, in the absence of miracle formulae, it is nevertheless possible to provide a series of common pointers:

Social media are a great ally

They use social media platforms such as Facebook, Twitter, and Instagram to spread their message. Because of segmentation, businesses are able to amplify their message and impact their target demographic for a much lower investment.

The customers are always at the fore

They use a customer-centric business strategy. In other words, they consider the consumer before, during, and after throughout the customer's journey. The importance of user experience is one of the keys to success. In the past, the focus was only on the product. However, the purchasing experience is now equally or even more crucial.

Global and rapid expansion

Good businesses start with a global mindset and follow a get big fast strategy in order to, as the name suggests, get big as quickly as possible. Going all-in on internationalisation and having a scalable model is critical to attaining both of these goals.

Wide-ranging team

Unicorn companies are multidisciplinary and cross-cultural organisations. As a result, they have a highly diverse professional profile, which is one of their assets when it comes to developing new ideas. Furthermore, they are young companies that value talent and creativity.

Uncertainty is part of the daily routine

The distinction between success and failure is razor-thin. Because these companies are fully aware of this, they learn to take the rough with the smooth and develop a special resilience.

How Many Unicorns Companies Are There?

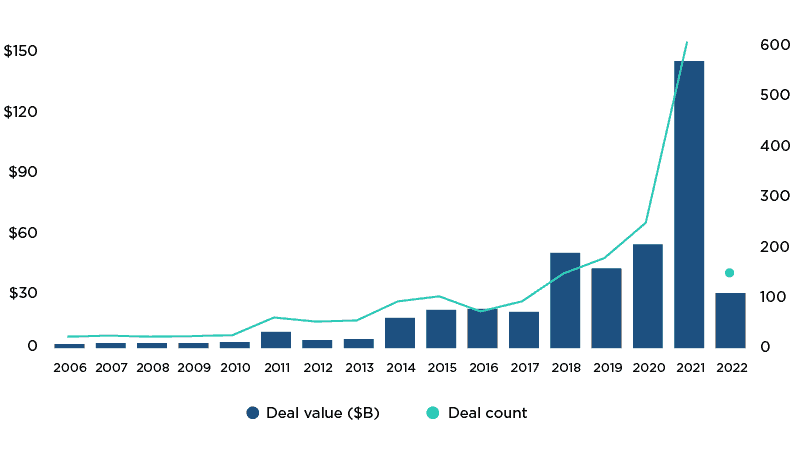

In 2019, there were 354 active unicorn firms worldwide, up from 348 the previous year. There were 439 active unicorn firms by the end of 2019, including 139 new startups. In 2020, 162 new firms gained unicorn status throughout the world, bringing the total number of active unicorn companies to 538. In 2021, there were 355 new unicorn firms, and the year finished with 537 active companies, about the same as the previous year.

According to CB Insights, the globe had 1,068 unicorn enterprises as of March 30, 2022. 519 of these privately held firms valued at $1 billion or more were "born" in 2021 alone. The worldwide unicorn herd surpassed 1,000 at the start of the current year.

Why Are There So Many Unicorn Companies Emerging?

One factor for the explosion of unicorn companies is the growing convergence of the private and public markets. Historically, corporations depended on initial public offerings (IPOs) to raise financing to grow operations. Today, companies may now raise higher sums of private capital early on, allowing them to attain billion-dollar valuations without going public.

The Most Valuable Unicorn Businesses

Unicorns are rare and difficult to come by. Something similar occurs in these types of startups. Below, we list the 5 most highly valued:

- Uber: mobile taxi app

- WeWork: job sharing company

- Airbnb: holiday & tourist accommodation platform

- Stripe: a company that allows individuals and businesses to receive payments via the Internet.

- Epic Games: video games company

Advantages & Disadvantages of Investing in Unicorns

Investing in a unicorn firm, like any other investment, has advantages and disadvantages.

| Advantages | Disadvantages |

|---|---|

| You Likely Know the Company | Billion-Dollar Valuations Don’t Necessarily Mean Profits |

| Some Unicorns Really Do Fly | Ridiculous Overvaluations |

| Innovation Has Long-Term Value | Lack of History |

Advantages of Investing in Unicorns

Investing in unicorn firms has various advantages which include:

You likely know the company. Unicorn firms don't reach billion-dollar valuations before going public for no reason. These businesses have produced something really unique. If they have a product on the market, it is most certainly a very popular one. If it hasn't yet entered the market, a huge portion of the population is probably aware that it is on the way. Investing in firms you've heard of and are familiar with has a strategic advantage. Remember that intelligent investment increases the investor's chances of witnessing growth.

Some unicorns really do fly. Some unicorn firms, like their mythological counterparts, soar after their initial public offering. Zoom is an excellent example of a successful unicorn firm. The stock debuted in 2019 at a low price of $36 per share. After a year, the stock was trading much above $100 per share, momentarily exceeding $500 per share in late 2020. Even after major consolidation, the corporation is now valued at well over $40 billion, with shares trading in the triple digits.

Innovation has long-term value. Unicorn firms are the kings of innovation, and their worth is enormous. Those who do strike tend to hit hard, resulting in massive long-term rewards. Consider the case of Tesla. Since its IPO at $17 per share in 2010, the stock has never gone below its IPO price. After only 11 years, the stock is now worth approximately $1,000 per share.

Disadvantages of Investing in Unicorns

While there are several obvious advantages to investing in unicorn companies, even the most beautiful rose has thorns. When investing in these equities, there are a few downsides to consider.

Billion-dollar valuations don't necessarily mean profits. Although all unicorn firms have a valuation of $1 billion or greater, many of them lack one key component: earnings. Consider Uber, which has a market capitalization of more than $65 billion. However, it has yet to make a single profit. Every quarter, the corporation loses millions of dollars. Many other unicorn firms follow suit, making them riskier investments. After all, a corporation that is losing money will ultimately run out of money.

Ridiculous overvaluations. In general, unicorn firms are valued differently than others in their industry. As a result, when looking at basic valuation criteria like price-to-sales or price-to-book value, these firms are often overvalued. That is, when you invest in a unicorn firm, you are betting on the company being enormously successful and expanding at a significantly higher rate than the typical company in its field. That might be a hazardous bet to make.

Lack of history. The billion-dollar value of a unicorn firm comes from venture capitalists and institutions that invest in it early on. However, because these firms are pre-IPO, the market hasn't had a chance to price them. Often, the market does not feel the firm is as valuable as institutions do, resulting in a drop after the shares are listed on the public stock exchange. However, without a trading history, it is impossible to predict how the broader market will value the firm.

Conclusion

Unicorn stocks are fascinating. These firms develop technology or services that are so far ahead of their time that they have the potential to alter the whole industry in which they operate. As a result, they fly to billion-dollar valuations well ahead of their peers.

There is, however, a catch. Unicorns in the market, unlike the mythological animals after whom they are called, are not all flawless and lovely. While some have the ability to yield substantial returns, others have the potential to cause substantial losses.

So, instead of making a FOMO (fear of missing out)-driven move, if you're thinking about investing in these companies, do your homework and critically assess if the technology that keeps the unicorn's ticker ticking is something you believe to be revolutionary. Dive into the company's accounts and make an informed judgement whether the company’s billion-dollar valuation is justified.

References

Do startups dream of unicorns?

Global Unicorn Herd Now Counts 1,000+ Companies

What Is a Unicorn Company and Should You Invest in a Startup Business?

Many people automatically think of profit when they are asked how well a company is doing financially. However, profit might signify different things depending on what factors are used while determining it. A failed business is one that does not make a profit, regardless of how many clients it has.

The startups, on the other hand, do not necessarily highlight profitability. Indeed, many firms are acquired or go public years later without ever generating profit. This grow-big strategy is not possible for self-funded startups unless they are producing enough money to sustainably fuel expansion.

Irrespective of how you choose to create your company, the leading criteria for every business is achieving a healthy return on investment (ROI) in your startup. So, why you should focus on your return on investment in your startup?

What is Return on Investment?

Return on investment (ROI) is a performance metric that is used to assess the efficiency or profitability of an investment or to compare the efficiency of many investments. ROI attempts to directly assess the amount of return on a certain investment in relation to the cost of the investment. In short, when you make investments into an investment or a company venture, ROI helps you comprehend how much profit or loss your investment has generated.

Return on investment may be conceived of in four different ways, depending on the observer's viewpoint and objectives.

An Investor

From the point of view of an investor, such as an angel investor, who effectively lends money to the company. In all circumstances, investors anticipate a return on their investment, which is generally in the form of interest or dividends.

The money allotted by the organisation to finance the interest and any other agreed-upon payments to investors is indicated as an expenditure on the cash flow statement and is commonly referred to as a return on investment.

Organisation Itself Is An Investor

When the organisation itself is an investor, lending money to other organisations and/or investing its own cash in interest-bearing bank accounts. The interest earned is also included as a receipt in the ROI section of the cash flow statement.

Performance Of The Organization's Investments In Capital Equipment

The performance of the organization's investments in capital equipment such as plants and property. Obviously, an organisation hopes to generate money as a reward for these investments, and the return on capital employed (ROCE) is a measure of its performance. ROCE is one of the financial statistics that are important in assessing return on investment.

Comparative Return On Investment

Last but not least, the issue of comparative return on investment arises during the consideration of capital investment options. There are several approaches for evaluating the relative advantages of various capital investments.

How do you calculate ROI?

There are several methods to determine ROI, one is to divide net profit by total assets, then, multiplied by 100.

The other is by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost of the investment, then finally, multiplying it by 100.

Since it is stated as a percentage, it is possible to compare the efficacy or profitability of various investment options. It is closely connected to metrics such as return on assets (ROA) and return on equity (ROE).

However, while evaluating ROI, additional aspects that may be less prominent, such as time, hidden expenses and fees, and even emotional ones such as stress, must be included. All of these factors might have a big influence on your ROI.

Advantages and Disadvantages of ROI

Here are some advantages and disadvantages that Return of Investment (ROI) can bring:

| Advantages | Disadvantages |

|---|---|

| A better measurement of profitability | Profit is subjective |

| Minimize conflict of interest and achieve goal congruence | Might be incomparable with other companies |

| Acting as a comparative analysis | Encourage management to invest in a short-term project and discourage them from making new investments |

| Breakdown segment or division performance | The time factor is omitted |

Advantages Of ROI

A better measurement of profitability

ROI ties net income to divisional investments, providing a more accurate measure of divisional profitability. All divisional managers are aware that their performance will be reviewed based on how they used assets to generate a profit; this encourages them to make the best use of assets.

It also guarantees that assets are only bought when they are certain to provide profits in accordance with the organization's policy. As a result, the primary focus of ROI is on the needed amount of investment. A cost-benefit analysis of this sort assists managers in determining the rate of return that could be expected from various investment options.

This enables them to select an investment that will improve both divisional and organisational profit performance while also allowing them to make better use of current investments.

Minimize conflict of interest and achieve goal congruence

The greater the interest rate, the larger the company's return. Using it as a tool to analyse investment ideas ensures that management will operate in the best interests of the company. It helps to ensure that both the company and its managers have the same goal in mind: to enhance shareholder value.

As a result, ROI guarantees goal congruence among the various divisions and the company. Any rise in divisional ROI will result in an increase in the overall ROI of the company.

Acting as a comparative analysis

ROI may also be used to compare the profitability and asset utilisation of different business divisions. It can be utilised for inter-firm comparisons if the businesses whose results are being compared are of comparable size and in the same industry, where the management will be able to benchmark the ratio in the market. ROI is a useful metric since it can be easily compared to the associated cost of capital when deciding on investment options.

Breakdown segment or division performance

Using ROI allows the organisation to examine the performance of a division or area. Based on the prospective earnings or growth, they will be able to determine whether to sell or extend the operation of such business units.

From an investment perspective, ROI is important in assessing performance which focuses on maximising profits and making sound judgments about the acquisition and disposal of capital assets.

Disadvantages Of ROI

Accounting profit can be very subjective

Profit can be manipulated by accounting policy and management judgment as they can reduce depreciation expenses by establishing an extended usable life in order to increase profit. Other than that, they will grant a lower allowance for the bad debt even if it is not reasonable.

Might be incomparable with other companies

It will also be challenging to compare ROI with other companies due to variances in accounting policy in each organisation. As we can see from the preceding statement, profit might vary depending on the firm. It is the same as investment cost, and some may use original investment, but others may use net book value, fair value, and so on.

Encourage management to invest in a short-term project and discourage them from making new investments

Only short-term ROI will have an influence on their current performance, whereas long-term projects take too long to provide results. Thus, there will be a higher chance that the management will sacrifice the company’s long-term benefits even if certain projects generate higher returns.

The same goes for when new investments are made, the current ROI will decrease investment in a new IT system, fixed asset, factory, and product line will unlikely generate profit in the short term. However, if we do not complete them on time, the company would face a significant problem that will even impact the company.

The time factor is omitted

When calculating ROI, each project term is completely discarded in favour of focusing solely on the return. It will take a longer period of time to archive a greater return. When the time value of money is considered, a highly profitable enterprise may turn out to be less profitable.

How Do You Use ROI in Your Business?

ROI calculation provides several benefits, but how? What is the first and most obvious? Understanding the impact of your investment on your business. If you discover that you are spending money on an expense, it is obvious that something has to be changed. Many different forms of ROI may assist you in making key business choices, including, but not limited to:

- Purchasing a new asset: Adding new tools, equipment, and goods to your business may be a good thing, but they must be chosen intelligently. Determining the ROI on an equipment purchase enables you to ascertain the cost of your new item and what sorts of equipment to invest in in the future.

- Hiring new staff: Is your new staff improving or lowering the profitability of your company? Monitoring your staff's ROI will help you better identify the kind of individuals to employ (or fire).

- Having a new department: Adding a new department to your company, like employing new staff, may be wise if it helps raise profitability. You might not want to make assumptions here; compute return on investment to measure the profitability of your departments and uncover chances for improvement.

- Sales strategies: Did a certain tactic contribute to a sale? Tracking which kind of sales methods produce results will offer you an idea of how to enhance your company's profitability.

Conclusion

Know your figures since utilising ROI to evaluate an investment is a fine place to start, but don't stop there. Even though companies at the idea stage might be unpredictable, keep in mind that development is the accumulation of modest moves ahead.

You can safely gauge your progress and the needed investment when you focus on a few steps at a time. However, ROI cannot be the only indicator used by investors to make decisions because it does not account for risk or time horizon and necessitates a precise measurement of all expenses.

References

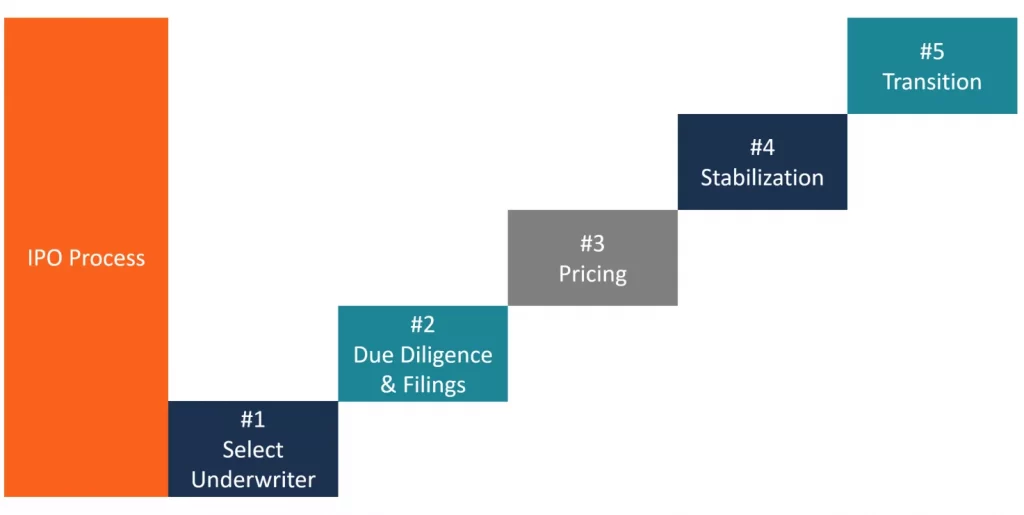

An investment in an initial public offering (IPO) has the potential to provide substantial profits. Prior to investing, however, it is critical to understand how the process of trading these assets differs from typical stock trading, as well as the unique risks and laws involved with IPO investments. In this article, we will be diving deeper into the understanding of IPO.

Definition of an Initial Public Offering (IPO)

An IPO, or initial public offering, is the procedure through which a private firm issues shares of stock to investors for the first time. When a firm goes public via an IPO, we frequently refer to it as "going public."