Crowdfunding equity comes with risks, including a higher risk of failure, fraud, shaky returns, exposure to hacker attacks, and subpar investments. But it also comes with benefits like the potential for enormous returns, a higher level of personal satisfaction, the ability to invest like accredited investors, and the chance to boost the economy by generating new companies and jobs.

What Is Crowdfunding?

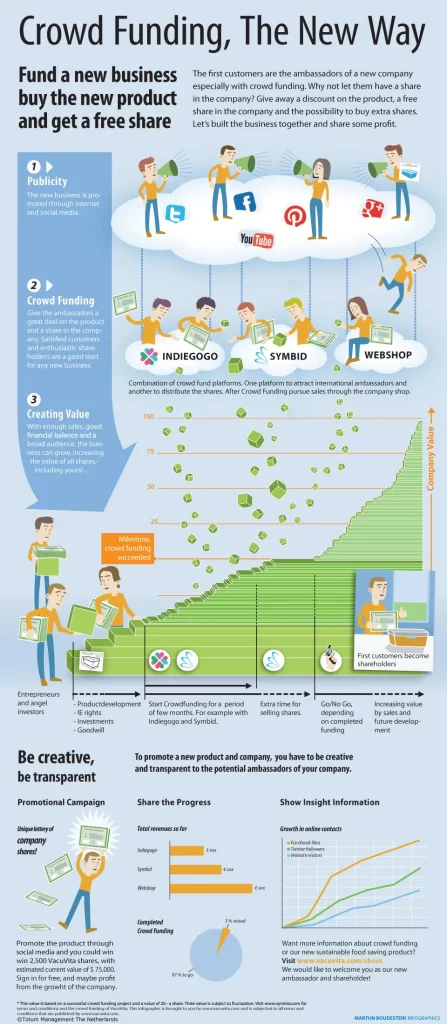

Crowdfunding is the use of small amounts of capital from a large number of individuals to finance a new business venture. It uses the easy accessibility of vast networks of people through social media and crowdfunding websites to bring investors and entrepreneurs together, with the potential to increase entrepreneurship by expanding the pool of investors beyond the traditional circle of owners, relatives, and venture capitalists.

Serious Business Model

Crowdfunding uses modest sums of money from many people to finance a new business endeavour. It uses social media and crowdfunding websites to connect investors and entrepreneurs. By enlarging the pool of investors beyond the traditional circle of owners, relatives, and venture capitalists, this practice has the potential to boost entrepreneurship.

In most jurisdictions, there are limitations on who can fund a new business and how much they can contribute. These regulations are meant to prevent novice or less wealthy investors from putting too much of their savings at risk, much like the restrictions on investing in hedge funds. Investors in new companies run a high risk of losing their principal because new businesses fail so frequently.

Crowdfunding equity has ushered in a remarkable era of opportunity for entrepreneurs, granting them the ability to secure substantial funding ranging from hundreds of thousands to millions of dollars from a wide array of potential investors. This revolutionary approach enables individuals, regardless of their background or connections, to leverage crowdfunding platforms and present their innovative business models to a vast audience of interested investors. Anyone with a compelling idea now has the potential to captivate and attract financial support, propelling their entrepreneurial aspirations forward and turning their visions into tangible ventures.

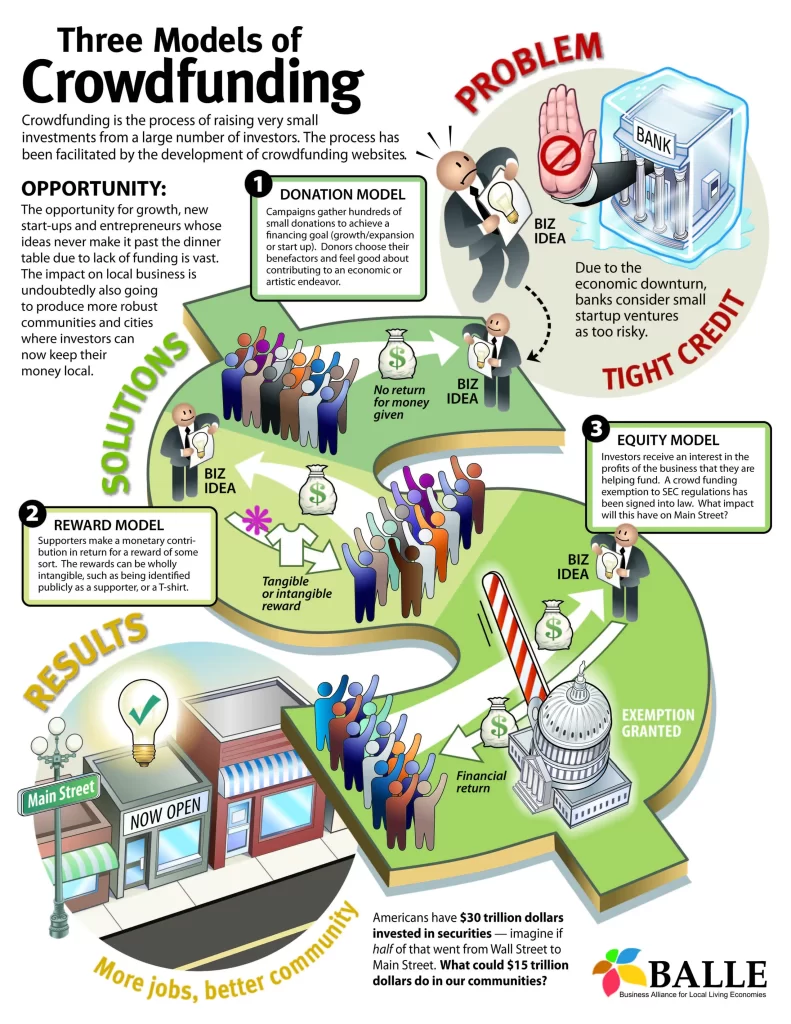

Types of Crowdfunding

Crowdfunding offers different methods tailored to businesses at various growth stages. The choice of crowdfunding method depends on the product/service and growth goals. The three primary types are donation-based, rewards-based, and equity. Donation-based involves seeking donations without financial return, rewards-based offers incentives to backers, and equity crowdfunding involves selling shares/stakes. Understanding these types helps entrepreneurs select the right approach for their offerings and growth plans.

Donation-Based Crowdfunding

Donation-based crowdfunding refers to campaigns where individuals contribute funds without expecting financial returns. This crowdfunding type is often associated with initiatives to support charitable causes, disaster relief efforts, nonprofit organizations, or helping individuals cover medical expenses. In donation-based crowdfunding, contributors are motivated to positively impact or support a meaningful cause rather than seeking financial gains or rewards. This form of crowdfunding relies on the generosity and goodwill of the crowd, allowing individuals to come together and make a collective difference in addressing pressing social, environmental, or personal needs.

Rewards-Based Crowdfunding

Rewards-based crowdfunding is where individuals contribute to a business in exchange for a non-financial reward, often in the form of a company's product or service. While this method provides backers with a tangible incentive, it falls under the broader category of donation-based crowdfunding because it doesn't involve financial or equity returns. Platforms like Fundable, Kickstarter, and Indiegogo are popular choices for rewards-based crowdfunding, as they allow business owners to incentivize their contributors without significant additional costs or selling ownership stakes. This approach enables entrepreneurs to leverage the support of their backers while maintaining control and ownership of their business.

Equity-Based Crowdfunding

Equity-based crowdfunding stands apart from donation-based and rewards-based methods as it allows contributors to become shareholders in your company in exchange for their investment. By trading capital for equity shares, these contributors become part-owners of the business. Equity owners are entitled to a financial return on their investment, typically in the form of dividends or distributions from the company's profits. Equity-based crowdfunding provides a unique avenue for entrepreneurs to secure funding while involving investors in the venture's long-term success. This method aligns the interests of the business and its contributors, fostering a mutually beneficial relationship where both parties share in the financial gains of the enterprise.

Benefits For Investors

Profitable Investments

Crowdfunding provides diverse investment opportunities, including startups, innovative projects, and emerging businesses. These ventures often have high growth potential, offering investors the chance to generate significant investment returns. By participating in crowdfunding campaigns, investors can get in on the ground floor of exciting ventures and potentially benefit from their success as they grow and mature.

Broadened Investment Portfolio

Crowdfunding provides access to various investment opportunities across various industries and sectors. This allows investors to spread their risk and avoid over-reliance on any asset class. By diversifying their portfolio through crowdfunding, investors can potentially enhance their chances of achieving higher returns and mitigate the impact of any individual investment's performance. Furthermore, crowdfunding often enables investments in early-stage startups and innovative projects that may have been traditionally inaccessible to individual investors. This access to early-stage opportunities can offer significant growth potential and the possibility of being part of the success story of a promising venture.

An Easy Start

Crowdfunding offers a relatively simple and straightforward entry point compared to traditional investment avenues. Investors can easily browse through various crowdfunding platforms, explore investment opportunities, and make their investments with just a few clicks. The process is often streamlined and user-friendly, making it accessible to individuals with varying levels of investment experience. Additionally, crowdfunding platforms typically provide comprehensive information about investment opportunities, including project details, financials, and risks, allowing investors to make informed decisions. This ease of entry and user-friendly interface of crowdfunding platforms make it convenient for investors to begin their investment journey and participate in exciting projects that align with their interests and financial goals.

Small Investment Opportunities

Unlike traditional investment avenues that require substantial capital, crowdfunding allows individuals to invest smaller amounts of money. This opens up investment opportunities to a broader range of investors, including those with limited funds. Crowdfunding platforms often have lower minimum investment thresholds, allowing individuals to participate in projects and startups with even modest amounts of capital.

Tax Incentives

In some jurisdictions, governments have implemented tax programs and incentives to encourage investment in startups and small businesses through crowdfunding platforms. These incentives can include tax credits, deductions, or exemptions on investments made through crowdfunding. Such programs aim to stimulate economic growth, support entrepreneurial endeavours, and provide investors with additional financial advantages. By taking advantage of these tax incentives, investors can potentially reduce their tax liability and enhance their overall investment returns.

Benefits Of Crowdfunding For Startups

Protect From Risks

Starting a business is a difficult and risky journey. There are frequently difficult-to-predict costs, issues with business validation, and other people who want a piece of the company to help it get off the ground, in addition to the need for adequate financing. Starting a crowdfunding campaign mitigates these risks and is a worthwhile educational opportunity. Crowdfunding, as it stands today, aids an entrepreneur in getting market acceptance and preventing equity surrender before going all in and selling a product idea.

Provides Access To Funds

You might believe that accredited investors, venture capitalists, and banks operating outside their network are the only sources of early capital. This is not true. Crowdfunding is an exciting alternative to raising money for a business, and it is possible to do so even without sacrificing equity or taking on debt.

Serves As A Marketing Tool

Crowdfunding is a fantastic opportunity for small businesses. It may be an option for you if you are a small business owner with an excellent idea but lack venture capital. Customers will hear about the idea, and if they like it, you can raise money to start development.

Crowdfunding is also a great marketing channel because you can give your backers the first samples of your products. In this scenario, the only intermediary would be the crowdfunding website.

As a result, if you want to start something novel but aren't sure if your idea is cool enough, you can test it out with a group first. If they like it, you can then proceed with full-scale creation.

Gain Early Adopter

Early adopters and potential brand advocates support the social evidence for your idea. They have enough faith in your narrative, product, or service to stake their financial future on its long-term viability. These early adopters are crucial to the success of your crowdfunding campaign because they are most likely to share your vision and spread the word about it to their friends and family on social media.

Provides The Chance Of Pre-Selling

Starting a crowdfunding campaign can pre-sell a product or concept that has not yet hit the market. This is a great way to gauge consumer opinion and assess demand to decide whether or not to implement a particular idea.

When you launch the campaign, you can share your product and business model with the people you are trying to sell to, giving you an important chance for feedback. Early contributors might identify conceptual flaws they'd like to see fixed or suggest new features to improve your model.

Limitations of Crowdfunding Equity

Greater Risk of Failure

Compared to venture capital or other conventional funding sources that provide seasoned professionals to help a start-up navigate early development challenges, equity crowdfunding may carry a higher risk of failure for a business. A business's success cannot be guaranteed by funding alone. Even successful ventures can fail without a solid business plan and supporting infrastructure.

Fraud

Since they provide a broad audience, scalability, convenience, and ease of record keeping, online forums and social media are the perfect platforms for crowdfunding equity. But these characteristics also make it simple for con artists to set up dubious ventures to draw equity crowdsourcing from gullible or novice investors.

Years to Materialize

Unlike traditional investment options, where liquidity and exit strategies may be more readily available, crowdfunding equity investments can take time to generate returns. Startups and early-stage ventures typically require significant time and effort to grow, scale, and reach a point where investors can realize meaningful returns on their investments. This means that investors in crowdfunding equity campaigns may need to exercise patience and have a longer-term investment horizon. Investors must consider their investment goals, risk tolerance, and liquidity needs before committing to crowdfunding equity, as it may not offer immediate or short-term gains. However, crowdfunding equity can potentially provide attractive returns in the long run for those willing to wait and support the growth of innovative ventures.

Lower-Quality Investments the Norm

The issue of whether a business would only use crowdfunding equity as a last resort is raised by sceptics. For instance, a business might turn to crowdfunding equity if it cannot secure funding from traditional start-up funding sources like angel investors and venture capitalists. If so, those businesses will probably be more average investment opportunities with little room for expansion.

Equity Crowdfunding in Malaysia

Crowdfunding in Malaysia has been possible since 2021, thanks to the launch of the ECF platform, registered with the Securities Commission. There are currently ten registered ECF platforms. ECF enables small businesses to give equity in their businesses to investors, who then invest in the idea they believe has promise. Investors can diversify their holdings outside conventional asset classes with the help of ECF.

Since 2016, Malaysian ECF platforms have experienced impressive growth in line with the government's request that financial services providers adopt technology and create more open, progressive, and effective capital markets. In line with the economic slowdown, movement restrictions in 2020 initially caused ECF funding to sputter, but during subsequent easings, it eventually recovered. ECF platforms have experienced consistent growth as businesses have resumed operations. Since its creation at the end of December 2021, ECF has assisted 248 issuers in raising RM420.9 million.

The ECF licence enables platforms to raise money for sole proprietorships, partnerships, incorporated limited liability companies, private limited companies, and unlisted public companies registered in Malaysia. Only RM3 million can be raised by an issuer through various campaigns in a calendar year. An issuer can raise a total of RM10 million.

Conclusion

Crowdfunding has transformed how entrepreneurs raise capital and provided new opportunities for investors and startups. It offers benefits such as access to diverse investment opportunities, the potential for profitable returns, and the ability to support innovative startups and projects. However, there are limitations to consider, including the time it takes for investments to materialize and the presence of lower-quality investments in the crowdfunding space. To navigate these challenges, investors should conduct thorough research, assess risks carefully, and make informed investment decisions. Overall, crowdfunding has democratized the funding landscape, empowering individuals to participate in the growth of promising ventures and fostering innovation and entrepreneurship in diverse industries.