Fintech is not a new sector; it has grown tremendously in recent years. Whether it's the launch of credit cards in the 1950s or ATMs, electronic trading floors, personal finance applications, and high-frequency trading in the centuries following. To some extent, technology has always been a vital element of the financial sector.

Understanding What is Fintech?

Generally, "Fintech" is the term "financial technology" refers to any advancement in how people do business, from the introduction of digital money to double-entry accounting. However, the financial system has advanced rapidly because of the Internet and mobile Internet/smartphone revolutions, and fintech, which originally referred to computer technology applied to the back office of banks or trading firms, now refers to a wide range of technological initiatives into personal and commercial finance.

Fintech refers to a wide variety of financial activities that perform without the assistance of a person, such as money transfers, check depositing with your smartphone, requesting credit without visiting a bank branch, seeking capital for a business start-up, or monitoring your investments. According to EY's 2017 Fintech Adoption Index, one-third of customers utilise two or more fintech services, and these customers are growing more knowledgeable about the role of fintech in their daily lives.

The Emergence Of Fintech

Machine learning/artificial intelligence, predictive behavioural analytics, and data-driven marketing are examples of fintech apps that will remove speculation and habit from financial choices. "Learning" applications will not only study users' hidden patterns but will also involve users in learning games to improve their habitual, unconscious spending and saving decisions.

Fintech is also an early adopter of automated customer care technologies, employing chatbots and AI interfaces to assist clients with simple tasks while simultaneously lowering personnel expenses. Fintech is also being used to combat fraud by using payment history information to detect transactions that are out of the ordinary.

Types Of Fintech Uses In Malaysia

Fintech is an early supporter of automated customer care technologies, employing chatbots and AI interfaces to assist clients with simple tasks while simultaneously lowering personnel expenses. Fintech is also being used to combat fraud by using payment history information to detect transactions that are out of the ordinary.

Below are the various types of fintech uses:

Digital Banking

Digital banking is a major field of fintech in Malaysia. Consumers have increasingly demanded simple digital access to their bank accounts through their mobile devices. Digital banking is regarded as the golden egg for fintech startups. This is largely due to its role in the automation of financial transactions and other traditional banking services.

Banking service consumers are especially pleased about digital banking since it allows them to access a wide range of banking goods and services without having to visit financial institutions. Digital banking was catering for less than 10% of smartphone users in 2011.

However, that number has risen sharply to 69% in less than seven years. Mobile banking accounts for the bulk of investments and uses since it has the largest application of any FinTech category.

Investment & Saving

Investment and stock market options may appear quite difficult to get into. Holding an investing application supports the development of a product that is desirable to micro-investors. Fintech has led to an increase in the number of investment and savings apps in recent years. Investment applications, on the other hand, manage your finances, shift your money into investing accounts, track your trading, and even handle day-to-day financial responsibilities.

There are several investment applications available on the internet that you may use to meet your demands. For instance, you invest your money into a portfolio of ETFs, known as Exchange Traded Funds, based on your chosen risk level. You may always look through your investment portfolio. Furthermore, investment applications may forecast your year profits if you continue to contribute on a monthly basis.

P2P Payment

Peer-to-peer (P2P) payments enable you to pay money directly to another individual. P2P payment systems, sometimes known as money transfer apps, such as Touch n Go, PayPal, and Cash App, enable users to send and receive money via their mobile devices using a connected bank account or credit card.

Transaction notifications are issued immediately, and you may use the money you get in a P2P app to pay money to someone else in the app straight away. If you select to move your money out of the app, it may take one to three business days for the cash to arrive in your associated bank account.

Insurance

While "Insurtech" is gradually becoming its own business, it is currently classified as a subset of fintech. Insurance has been a somewhat hesitant adopter of technology, and many fintech companies are partnering with traditional insurance firms to assist simplify operations and increase coverage.

Fintech business concepts like these exist at the crossroads of financial and insurance technology. "Insurtech" applications are products designed to let customers apply for and pay for their insurance fees online, from vehicle insurance to personal insurance. The digitalization of financial operations has resulted in an increase in online insurance app usage, as typical insurance subscribers are becoming more interested in "InsurTech".

Cryptocurrency

The emergence of cryptocurrencies and blockchain is parallel to the rise of fintech. Blockchain technology enables cryptocurrency mining and marketplaces to exist, and developments in cryptocurrency technology can be linked to both blockchain and fintech. Though blockchain and cryptocurrency are distinct technologies that can be regarded outside the scope of fintech, both are required in principle to produce practical applications that advance fintech.

The Crypto exchange platform enables users to trade cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others for fiat currency. In some situations, they can also assist with the transfer of cryptos for other assets. People may use the platform to track their daily trading activity and the daily performance of the cryptocurrency.

RegTech

There are basic ground principles that all businesses must follow, regardless of size or industry. There is now a whole subset of regulatory technology known as "RegTech" that is meant to traverse the difficult world of compliance and regulatory concerns in businesses such as fintech. RegTech solutions help businesses satisfy regulatory standards while conserving energy and time. As a startup, keep in mind that RegTech applications are one of the most underappreciated, yet profitable, fintech solutions to develop.

Crowdfunding

A crowdfunding app is a virtual environment where individuals may raise funds for a cause or a person. A huge number of individuals give monies that are required to commence a certain project here. Even during the Covid-19 outbreak, when many businesses faced financial difficulties, the crowdfunding sector still thrived.

Over the next 10 years, crowdfunding platforms are expected to grow at an exponential rate. Crowdfunding sites often will charge fundraisers a fee if the fundraising campaign is successful. In exchange, crowdfunding sites are required to deliver a safe and simple service. Crowdfunding platforms included services such as peer-to-peer lending, equity crowdfunding, rewards-based crowdfunding, donation-based crowdfunding and profit-sharing or revenue-sharing.

Why Do We Need To Use Fintech Apps In Malaysia?

Fintech Malaysia is constantly altering and adapting to satisfy the demands of investors, customers, and regulators. Thus far, the emergence of fintech apps such as mobile and cashless payments in 2020 has marked a shift in consumers' transaction methods and how banks offer services. Simply put, consumers are increasingly relying on digital transactions to help them deal with the COVID-19 epidemic.

1. More Alternatives

Fintech maintains multinational websites tailored to certain areas, allowing customers to make decisions based on their living zone. Some businesses, for example, give access to their websites in many languages, while others allow clients from most nations to register on their platforms. This adaptability opens up a wider range of options for those seeking for ways to make worldwide payments. Fintech payment systems enable users to make transactions borderless.

2. Cost savings

Fintech solution suppliers frequently avoid additional expenses, such as alteration fees, cancellation fees, and other hidden charges. There are technologies available to assist businesses in sending and receiving money from their accounts in several currencies without incurring high conversion fees.

Fintech has enabled the integration of physical and digital payment mechanisms, allowing various bank accounts or cards to be consolidated using a single interface. This feature provides organizations with simplified transaction processes and lower overall expenses.

3. Great compliance and security

Fintech can simply navigate regional regulations and legislation due to its unique position as an innovator and expert. With cybersecurity in the spotlight, we have invested more money than ever in establishing a world-class compliance department to guarantee that every transaction that passes through us is properly verified.

When compared to traditional banking systems, which frequently have a lot more on their plates due to diversification, our next-generation IT system allows us to spot irregularities and respond to them rapidly and efficiently.

4. Faster and Convenience

Of course, two of the most obvious benefits are effectiveness and convenience. Transactions, processes, and systems across a range of businesses and sectors have become considerably faster as a result of technological innovation. Some fintech solutions also allow consumers to choose from a number of delivery alternatives, including a fast delivery technique that speeds up the transfer procedure even more.

Conventionally, customers used to go to their particular bank locations or use online banking programs to transfer money out of the nation. Certain banks were only open for a limited period. When it comes to a fintech-enabled payment system, transactions may be conducted at any time and from any location.

5. More Transparency

Apart from efficiency and cost savings, fintech has begun to pave the way for more transparency in the banking industry. International payment solutions are raising the bar in terms of how people perceive the worldwide remittance process.

Whether they are sending or receiving payments via a specific payment method, users of fintech platforms enable track their transaction history. There is frequently dedicated customer assistance available 24 hours a day, seven days a week, as well as real-time updates and strict security precautions. Trust and reliability have been influenced by technological empowerment.

In Conclusion

Cross-border payments have progressed significantly. Fintech has made things much simpler for ambitious enterprises and merchants trying to expand globally. According to International Monetary Fund (IMF) analysis, developments in fintech Malaysia are changing the country's financial industry environment. For example, although conventional financial institutions' offerings of fintech products are expanding, the number of physical commercial branch offices is decreasing, and the number of bank machines is decreasing during the previous two years.

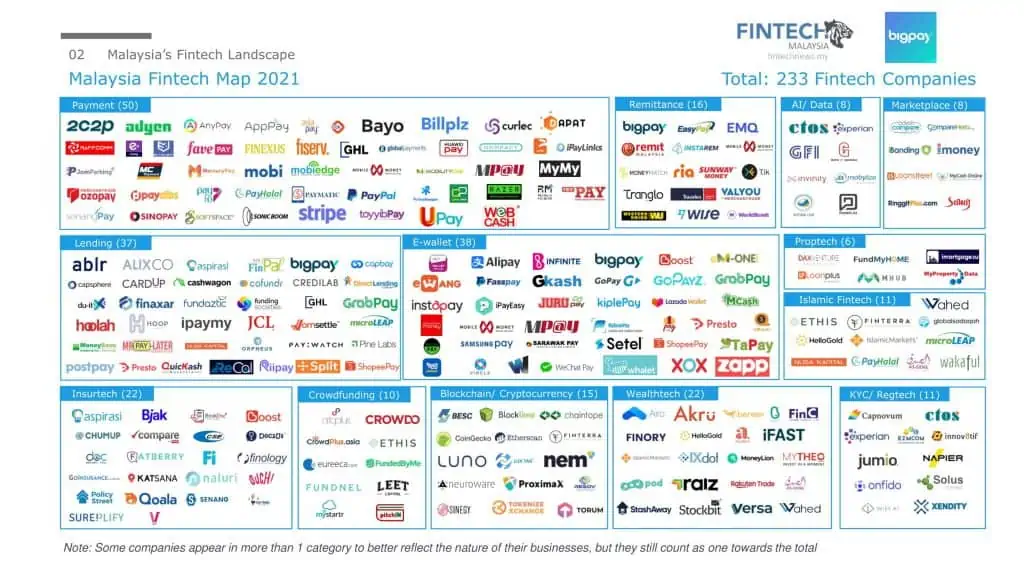

Traditional Malaysian banks maintain their dominance in deposits, lending, and capital raising while adopting new technology and competing or partnering with emerging IT companies. As of April 2019, Malaysia had around 200 businesses in various fintech industries, including payments, loans, and blockchain. The growth of Malaysian fintech has to improve and attract more talent in critical tech sectors such as data analytics and machine learning, regulatory constraints, and capital availability.