Since 2016, NEXEA has been running quality Startup Accelerator programs once a year. We have achieved interesting results with our Startups, Investors, Mentors, and Corporate Partners - results which we did not expect, and results that pleasantly surprised us.

When we started out, our first 2 programs had very low success rates. 1/3 and 1/4 companies would survive.

NEXEA Accelerator Program Results

However, our methodology ensured these 'survivor' companies grew like crazy. 25X in under 1 year to be exact. To put things in perspective, most decent Startups only grow 2-3X a year.

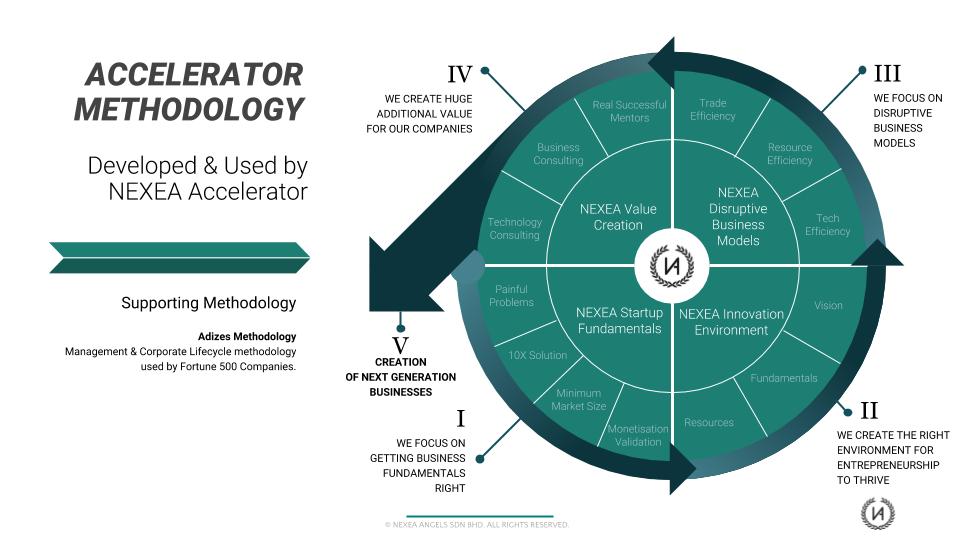

First, let me explain how the program is structured in the first place. This will help you understand how we create 10X companies.

In our 3rd program which we co-ran with Sunway iLabs & the rest of the conglomerate (more than 10 businesses including Malls, Hospital, Property, etc), we actually managed to tune our methodology to produce 3/4 (75%!) surviving and growing companies.

From our observations, there are no signs of slowing down & our Startup Accelerator methodology continues to improve.

Results by Accelerator batches:

In our first Accelerator program (co-ran with Watchtower & Friends), the ROI is more than 4X in ~3 years. That's 82% per year compounded. The RM150,000 we put in is now worth about RM600,000.

Our second Accelerator program proves to be a little more interesting. The RM200,000 we put in is now worth more than 6X (RM1,200,000).

The first and second batches were done with our first ever partner Watchtower and Friends. We learned so much from Sam Shafie & Kashminder - and we hope to see our companies become unicorns soon.

Our third Startup Accelerator program is still too early to observe for results as not all require follow-on funding yet. Interestingly, they are all cash-flow positive almost right out of the program.

This third batch was co-ran with Sunway iLabs - a great partner to have. Matt and Evan definitely got our eyes opened with how they are innovating the entire conglomerate with Startups.

How The Program Is Structured

There is a lot of engineering that went into the NEXEA Startup Accelerator program that is hard to duplicate.

The program works in 3 parts;

- Filter - Narrowing down the top companies to the top 1%

- Accelerate - Grow the companies 10X using our 10-point Accelerator Methodology

- Post-Accelerator Support & Continuation - Extremely high quality mentoring plus fundraising support

Filter - Narrowing down the top companies to the top 1%

With experience from our previous accelerator program, we expect more than 300-500 applications.

But the top startups we will fund have to meet some criteria like having a solution to a very painful problem. You can find all the criteria on our Accelerator page.

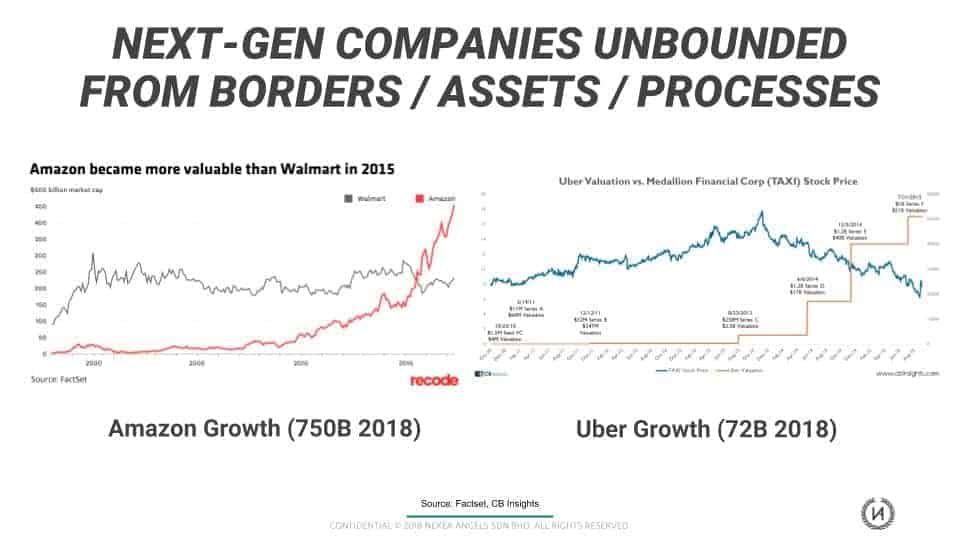

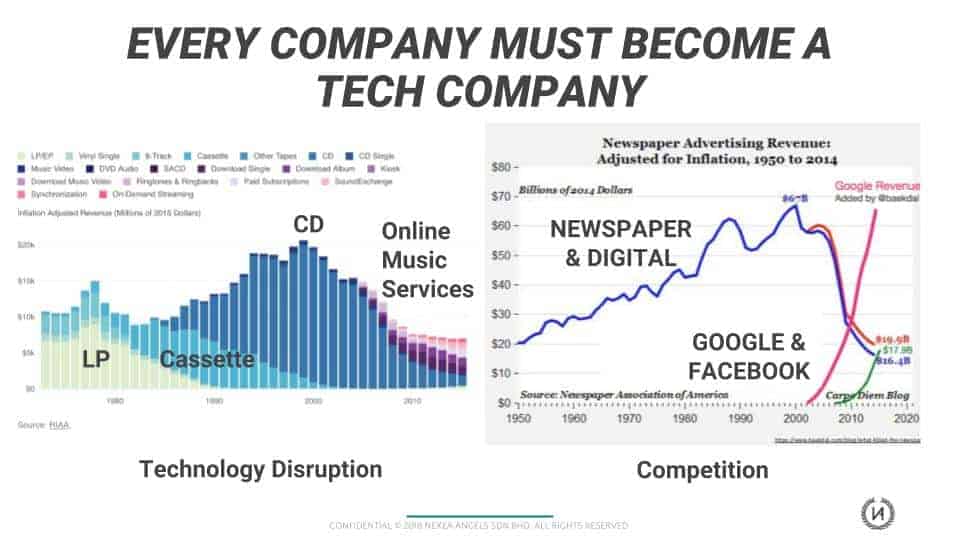

Being a Tech company is one of the main condition as we do not accept traditional businesses.

The main reason is that we believe that every company has to become or must become a Tech company in some way or form to be competitive in the future.

Traditional companies (see the Music industry slide above) tend to phase out as technologies change. This is particularly fast-moving in the music industry compared to other industries (like Food & Beverages) of course.

We pick the top 15-30% for first-round interviews based on their ability to fulfil some basic Startup fundamentals.

Then, we pick the top 3-8% (usually about 20 companies) to undergo 1 month of mentoring and benefits to see how the companies perform. This is extremely expensive for us to do as our mentors are top-notch guys.

Finally, the top 1-3% get picked based on Startup Fundamentals again, but this time, along with deep Founder profiling. We use the Adizes Methodology to understand entrepreneurs, their team, and their company to do see if there is a good fit & working model.

That said, we have been known to make special decisions on rare occasions - for example, to pick a company 99% based on the Founder only. This has, of course, paid off as a few good decisions were made - these companies have now returned gains many times over.

Accelerate - Grow the companies 10X using our 10-point Accelerator Methodology

1. Follow-on Fundraising Support

Our Startups that impress investors continue to be funded over time. NEXEA has funding programs up to RM 1 million (if co-investments happen, then we take up to that amount of a RM3 million round for example).

Apart from that, we have built up a network of other Angel Investment networks, Venture Capital, Family Offices, Government Grant Agencies, and more.

2. Finding The Right Startup Fundamentals

Most Startups do not have all the right fundamentals from the start - those that do are incredibly rare (definitely less than 0.5% of all Startups we have met in our experience).

That's why >99% of the time, we work towards finding the right startup fundamentals for the company to succeed. Once it is right, most other things fall into place, and "unicorns are born".

In a way, this is how we "hunt for unicorns":

The problem being solved is very painful to specific target markets

The solution provided is 10X better than existing solutions, plus cheaper.

The potential revenues in the target market are huge enough to create a unicorn.

The business model is built to be monetised from day 1 (some may lose money, but can eventually turn extremely profitable as and when needed)

The above are the basics but do not cover everything, for example, the team and the competition.

3. Mentoring Only By The Best Business People

At NEXEA, we are extremely proud to have extremely capable mentors who also invest (put their money where their mouth is).

Their backgrounds are not ordinary either. Many are entrepreneurs themselves, having gone through many rounds of M&A activities, and more than half of them (we have 30+) have been through an IPO or exited their companies via a trade sale.

They are committed to mentoring on an average of once a month.

They are the best fit because they have been through what most entrepreneurs are just starting to experience. To put things into perspective, we find that it takes 5 years to get to know your own business. Our mentors have been at it for easily 10-30 years each.

How do mentors exactly help Startups 10X their growth?

- Industry knowledge - they have given tonnes of deep insights to our entrepreneurs navigating uncharted territories

- Networks - they have introduced million dollar deals, connected vital partners, and also other strategic investors.

- Entrepreneur hardships - only entrepreneurs know what other entrepreneurs go through in life. This is no easy journey to go through alone.

- Right decisions under high pressure - mentors tend to guide entrepreneurs under high pressure towards making the right decisions. Mistakes are often costly in the business world.

Non-mentor Investors

That said, we also have a group of investors who are non-mentors. They too, have extremely strong networks in corporate environments. Many are also extremely good at what they do - for example in law, finance, marketing, and so on.

4. Experts

We have a panel of experts to help Startups with years of experience. For example:

- We have a group of partner-level people from a big-four company that shall remain unnamed. They have offered to help our companies with financial & business advice at no cost.

- Danny has dealt with AI/ML for many years, and has been a solutions architect for more than 15 years. He is now helping Startups plan ahead along with the ability to act as a temporary CTO if needed.

- Michelle was CFO in Asia for a listed company and is now supporting Startups with financial and governance mentoring.

- We also have many more experts in fundraising, marketing, SEO, etc.

5. Partners that help Startups 10X

We onboarded many types of partners, but there are some that are specifically to help Startups 10X their growth.

Cloud services & Office Software

- Amazon AWS - US$10k credits

- Google Cloud - US$20k credits

- Microsoft for Startups - $120k credits

- Digital Ocean - US$10k credits

- IBM - US$ 120k credits

Marketing

- Hubspot - 90% off

- Enginemailer - $100/yr

Grants

- Cradle - RM300k grant

6. Finding The Right Business Models That Can Grow >100X

This is largely a market size play.

NEXEA looks out for companies that have the potential for huge market size.

The way we look at it, it's more of "this business has potential revenues of XXX million" rather than "this industry is worth X billion".

We ensure this so that both our investors and entrepreneurs do not waste their time chasing a ghost unicorn.

This is estimated via existing markets, adjacent markets, similar global markets, and trending markets.

Startups do tend to be able to 2X YoY even through their later stages. Because of this, the mathematics are pretty simple.

2^10 = 1024X

2X growth compounded of 10 years. This is how unicorns are made.

We have seen our stronger companies do 2-4X YoY and yet we know there is room for more growth. The best performing so far did 16X in 1 year.

However, this is not a defining factor as there are rare cases where we backed a founder without a market size in hand. We have learned that sometimes, the right entrepreneurs create the right markets.

7. Creating A Strong Environment For Startups To Thrive

For any ecosystem to thrive, we need parties with stakes in it.

Investors need Startups for strong returns, and they need Corporates to help their Startups grow.

Corporates need Startups for their own continuity, and Investors to help pick the right Startups.

Startups need (strategic) Investors/Mentors for growth, and they need Corporates to support their growth.

NEXEA powers these connections via the right programs, events, and partnerships.

The Best Corporates

We partner with the best government agencies, financial institutions, cloud solutions providers, marketing & sales partners, and corporates.

This is because we know Startups need all these partnerships put together for them, but they do not have the time to do it on their own.

The Best Investors

We also partner venture capital, angel networks, family offices - all locally and regionally.

This is because we know fundraising is hard - and we want to make it easier for the best companies to get the best funding possible.

8. Introductions, Introductions, Introductions

Many of our people, mentors, and partners are from strong networks such as Vistage and Entrepreneurs' Organisation.

We make introductions all the time for potential partnerships, business opportunities, and key people in all kinds of industries.

We also make many introductions to Cradle for Startup grants.

Recently, we started to make many more introductions for Startups to corporates as well for pilot projects.

We have also built up relationships with the local + regional media - so we do help Startups get good exposure for their fundraising rounds, partnerships, and more.

9. Measure To Validate & Grow

This is a no-brainer, but still needs to be highlighted time and time again.

A huge part of the program is measuring to validate & grow the company.

We advocate metrics and analytics to help companies understand their problems:

Financials

We require the basic numbers - Revenue, COGS, Gross Profit, OPEX, EBITDA.

There is a misconception of investors "monitoring" startups to be scrutinised etc. However, I have to say, most Startups that have said this are not our Startups.

These numbers are mostly for the founders themselves to benefit. By us requiring it, entrepreneurs then understand which parts of their business are shaky - as they always show up in the numbers. This is the entry point for mentors and experts to provide support. Without measurement, there can be no diagnosis and remedy.

Digital Analytics

Quick Example: If you have a website but don't know what Google Analytics is, then you are missing out on tonnes of useful data about your customers.

We advocate measuring your web, apps, ads, and even operational data that is in some way or form digital. This is how companies get really good at what they do.

This allows analytics & optimisation - which for example, can effectively triple up operational efficiencies and therefore "scalability".

How We Use This to Help Companies 10X Growth

Throughout the accelerator, the mentors, partner engineers, and experts require information to help companies overcome hurdles.

- Market Validation - We use it to ensure there are signs of an actual, sizeable market before exploring the possibilities of monetising.

- Product Validation - We ensure there is a product-market fit using data and not hunches to make accurate decisions.

- Growth Validation - We look out for growth metrics to ensure there is room to grow and build out a unicorn.

10. Post-Accelerator Continuation - Supporting Your Company Further

If you are still reading, you are either a Startup founder, one of our beloved investors or a competing accelerator trying to 'get inspiration' from our methodology ????. Either way, thank you for reading this far!

Continuation of support (especially in mentoring and follow-on funding) is why the NEXEA Startup Accelerator program continues to grow strong.

Startups that go through any program via NEXEA continue to get the following:

- Mentoring & support from NEXEA & our partners.

- Fundraising opportunities from NEXEA & its Angel Investors

- Introductions to local & regional funding options:

- Corporates

- Venture Capital

- Family offices

- Angel Investors.

- Engage & network with NEXEA Alumni of other Startup founders to support each other as we grow in numbers.

- Receive opportunities & offers from NEXEAs corporate & government partners like:

- Grants via government agencies like Cradle

- Free credits from cloud providers like AWS, Azure, Digital Ocean, IBM, and more

- Support from partners like HERE and Hubspot

- Private invites to Business & Educational Events

- Exclusive invites to partner programs

- Learning opportunities

Reviews On the Accelerator Program From Startups

Our NEXEA mentors are our role models as they help us get out of being stuck and to transform professionally. Their technology team has also helped us tremendously in terms of design & process. – Lapasar

The NEXEA program has offered many types of support which were tailored to our company needs at our different stages of growth. One of the most valuable resources is the mentorship and the experts in NEXEA’s team who are very committed to their portfolios. - Runningman

The NEXEA Accelerator helped us understand what a startup truly is. They have opened doors for fundraising, recommended partnerships, and shared success and failure journies of other top Startups. They have also helped us see how we can further improve our technology & business model. - Jobworks

What Are You Waiting For? Join Our Accelerator Program!

https://www.nexea.co/startup-accelerator-malaysia/

Credits:

- Kenza - our wonderful analyst that helped to form the article

- Alan - one of our lead mentors, thanks for your great inputs

- Peter - one of our top mentors, thanks for the excellent feedback

- Noomi - one of our partners, for tirelessly improving this article