Many people are drawn to the concept of entrepreneurship, but figuring out how to get started can be intimidating. What should you put on the market? Who should you offer your product to? What strategy will you use to attract customers? If that wasn't enough, it seems like there's a new business trend online every other week. Chatbots, Facebook advertisements, Instagram influencers, and a few other options are available. What should you be looking out for? What is it that really matters?

Definition Of Small Business

Before we can consider starting a small business, we should understand the definition of it first. The definition of small business and medium business (SME) in Malaysia was renewed given the various changes in the economy since 2005, such as price inflation, structural changes, and changing business trends.

Services, manufacturing, agriculture, construction, and mining and quarrying are all included in the concept. The two factors utilised in creating the definition with the "OR" premise are as follows: sales turnover and the number of full-time employees. Small businesses in the manufacturing industry are defined as businesses with a sales turnover of less than RM15 million or less than 75 full-time employees.

Where To Begin

You should be prepared before establishing a business, but you should also be aware that things will almost probably go wrong. You must adapt to changing circumstances in order to manage a successful firm. Conducting extensive market research on your industry and the demographics of your target market is a crucial element of developing a business plan.

Surveys, focus groups, and SEO and public data research are all part of this process. Before you begin selling your product or service, you must first establish your brand and cultivate a fan base of individuals who will be eager to buy when you open your doors. The obvious tasks, like naming the company and designing a logo, are well-known, but what about the less-publicized but equally significant steps?

The effort may quickly build up, whether it's selecting your business structure or developing a detailed marketing strategy. Rather than spinning your wheels and unsure where to begin, consider the following tips to help your company grow from a lightbulb above your head to a viable reality.

Perform Market Research

In order to visualise if there's a possibility of your idea becoming a successful business, you will need to perform market research. It's a method of gathering information about new customers and existing businesses in your neighbourhood. Make use of this data to gain a competitive advantage for your company. Consumer behaviour and economic trends are used in market research to confirm and improve your business idea. It's critical to get a good understanding of your target market right away.

Even if your company is still a glimmer in your eye, market research allows you to mitigate risks. To better understand the opportunities and restrictions for obtaining customers, gather demographic data. This could contain demographic information such as age, money, family, and interests, as well as anything else important to your business.

Investing time and resources in high-quality market research before launching your initial product will help gain valuable knowledge that can be used to discover requirements, create relationships, and forecast change, all of which boosts your chances of becoming the market leader.

Some of the important information that you should know about your market includes:

- Demands for your product or service

- The size of your market

- Economic Indicators of your market

- Most suitable location for your business

- Competition available

- Prices your potential customers are paying your competitors

Market research can be conducted in many different ways, here are some of the well-known methods that are being used.

- Surverys

- Questionnaires

- Social Media

- Observation

Writting A Business Plan

Your company's living structure is a business plan. It lays out revenue, marketing, hiring, profit margins, competition, and competitive advantages plans, as well as a path to success. You'll also utilise your strategy to pitch potential investors, bank loan officials, and even new company managers and branding experts on your vision.

A good business plan will walk you through each step of beginning and running a company. Your business plan will serve as a road map for how to establish, run, and grow your new company. It's a method of considering the most important aspects of your company. Your company's business plans can assist you in obtaining funds and attracting new business partners. Investors want to know they will get a good return on their money. Your business plan will be the instrument you use to persuade others that working with you or investing in your firm is a wise investment.

There are many methods to creating a business plan. There is no one-size-fits-all approach to writing a business plan. What matters is that your plan fits your requirements. Below are the two most common categories business plans would fall under.

-

Traditional Business Plan. This is more thorough, takes longer to write, and is more comprehensive. Traditional business plan format would include an executive summary, company's description, market analysis of your company's target market and competitive research, organization and management structure, service or product line, marketing and sale strategy, fundings, financial projections and an appendix.

- Lean Startup Plan. This plan has a high-level focus, is quick to write, and only contains critical aspects. More information may be requested by some lenders and investors. Lean startup plan includes the key partnerships, key activities, key resources, value propositions, customer relationships, customer segments, channels, cost structure and revenue streams.

Evaluate Your Fundings

One of the most difficult aspects of launching a new business is ensuring that you will have enough cash to get you through the first few months. Your company will struggle to find its foothold if it has insufficient financial resources. Entrepreneurs must also be realistic about how long revenues will take to catch up to costs. You might have to suffer losses for a year or two or even longer. It's critical to analyse your financial needs before establishing a new business to guarantee you have enough money. The first step is to calculate your costs. These can be divided into one-time start-up costs and recurring expenses.

Legal and professional fees for forming or registering your company, initial inventory, licence and permit fees, office supplies and equipment, long-term assets like machinery, a vehicle, or real estate, consulting services, and website design are examples of one-time charges. Salaries, rent or lease payments, raw materials, marketing expenditures, office and plant overhead, finance charges, maintenance, and professional fees are examples of recurring expenses.

After you've estimated your initial and ongoing costs, you'll need to calculate how much money you'll have available. Now you can create a set of financial projections for your business using your expected financial resources and estimated expenses. If you have a financial gap, a brief review of your projections can reveal it. To fill any funding gaps you may have, here are some options:

-

Personal Investment. is described as a person who invests in and manages their own financial assets, such as stocks, bonds, real estate, and other assets. Personal investing strives to increase the liquidity and efficiency of an individual's equity and capital. Individual investors must essentially design their own investing plan and structure based on their unique features. This is due to the fact that personal investing is highly subjective, since it is entirely dependent on the qualities and risk tolerance of the individual investors. Individual investors, on the other hand, should construct an investment plan and strategy before investing in financial products.

-

Family and Friends. Many fledgling entrepreneurs rely on family and friends for funding (sometimes known as "love money"). Family and friends are typically willing to wait to be compensated until revenues start coming in, but balancing business and personal connections can be difficult. Love money usually has no set repayment terms and is sometimes provided in exchange for shares in a business. With a more formal and structured agreement, love money can even be advanced as a loan or a convertible note. When giving love money investments to family and friends, it is recommended that investors only employ risk capital—money they are willing to lose—regardless of the structure.

-

Venture Capital. Venture capital (VC) is a type of private equity and a type of financing provided by investors to startups and small enterprises with the potential for long-term growth. Well-heeled investors, investment banks, and other financial institutions are the most common sources of venture capital. It does not always have to be in the form of money; it can be be in the form of technical or management skills. Small businesses with outstanding development potential, or businesses that have expanded swiftly and are poised to expand, are frequently given venture capital.

-

Angel Investors. An angel investor (also known as a private investor, seed investor, or angel funder) is a wealthy individual who invests in small businesses or entrepreneurs in exchange for a share of the company's ownership. Angel investors are frequently found among an entrepreneur's friends and family. Angel investors may make a one-time investment to help a firm get off the ground or a continuous injection to support and carry the company through its early phases.

- Business Incubators. Business incubators are programmes that are specifically geared to assist nascent businesses in innovating and growing. For startups or lone entrepreneurs, they usually provide workspace, mentorship, education, and access to investors. During the early stages of business incubation, these resources enable companies and ideas to take shape while operating at a cheaper cost. Incubators require an application process and, in most cases, a commitment for a set period of time.

Determine The Legal Structure

Analyzing your organization's goals and examining local, state, and federal laws are the first steps in determining the best legal structure for your company. You can choose the legal structure that best suits your company's culture by establishing your aims. You can adjust your legal form as your company expands to meet its new needs.

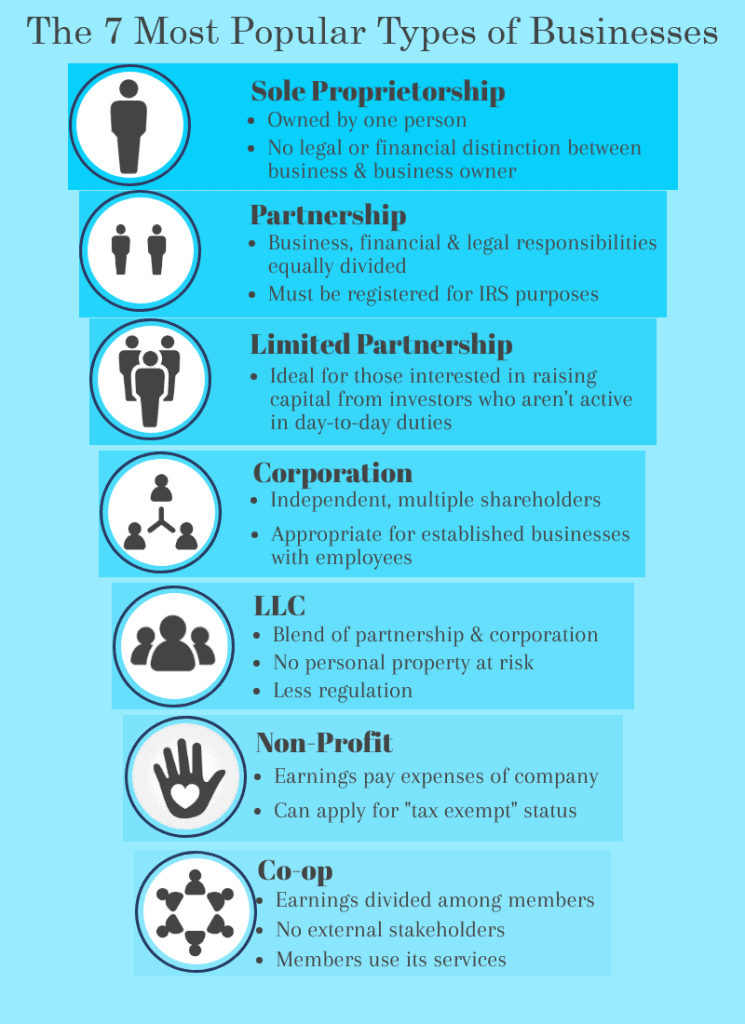

To assist you in deciding on the right legal structure for your company, here are some of the most common legal structures.

-

Sole Proprietorship. There is no legal distinction between the owner and the business when it is owned and operated by a single person. The most common legal structure for small businesses is the sole proprietorship. The company does not have to file a tax return.

Instead, the income or loss passes through to the owner and is reported on his or her personal tax return. The single proprietorship's owner is personally liable for any liabilities the company incurs. Insurance and sound contracts can help to limit this risk. The sole proprietorship is the most straightforward business structure. The fees of starting a single proprietorship are quite inexpensive, and there is very little paperwork involved.

-

Partnership. A type of business arrangement in which two or more owners share ownership. It is the most basic form of business structure. A partnership and a sole proprietorship have a lot in common. The business, for example, does not exist as a separate legal entity from its owners, thus the owners and the entity are handled as if they were one person.

The profits and losses of the business are passed on to the partners when filing taxes, and each partner must submit the information with their personal tax returns. In addition, depending on their portion of the company's profits, partners must pay self-employment tax. A partnership business arrangement has a number of benefits.

There is less paperwork involved in forming a partnership, and the partners are not required to meet the same level of criteria as limited liability firms. In addition, partnerships have a specific tax arrangement in which participants must record their portion of the business' profit or loss on their income tax return. On the downside, the partners are personally liable for the company's debts and liabilities, and their personal assets may be liquidated to cover the company's commitments. Disagreements between partners are also possible, which can slow down corporate operations.

- Limited Partnership. There are both general and limited partners in a limited partnership. To form a limited partnership, you'll need at least one general and one limited partner. Limited partners are typically only investors in the business and have no business decision-making authority. General partners own and operate the company while also taking on the partnership's liabilities. You have control and duty as a general partner. Limited partners gain ownership without taking on the responsibilities or dangers that come with it.

Creating A Brand Presence

You must begin marketing yourself even before you have a product to sell. This helps in the identification of possible customers, beta testers, and even collaborators in the product development process. How do you obtain publicity on a budget? By making most of your internet potential. You may target your ideal consumer base by properly using keywords that define your organisation or service. Social media such as blogs and social media sites can also help in providing a low-cost or free source of publicity.

Join in the conversation on blogs, Facebook groups, forums, and other areas where people with similar interests to your company gathers. As a small business startup, instead of rushing into promotions, focus on building relationships. Sharing and retweeting content rather than posting self-promotional content would be more effective.

Attend industry conventions where your consumers will be present. In addition to meeting with investors and consumers, they are wonderful places to interact with possible talents for your team. When you establish yourself as a reliable source, you get followers, expand your network, and customers are more willing to buy from you rather than from an unknown.

Hiring The Right Team

Small firms have the problem of hiring new employees in addition to generating profitability and securing industry expansion. Why? Recruitment is time-consuming, and you'll need the correct systems in place to find the ideal employees for your organisation. While hiring can be intimidating, there are methods you can employ to ensure a successful recruitment process. The appropriate technique can help you build a talented staff that can help you grow as a company in the long run. Here are some helpful hints for streamlining your recruitment process to assist you to achieve these objectives.

-

Passion should be measured. While skills and talent are vital, you must also consider whether prospects are enthusiastic about working with you. Did they conduct pre-interview research to learn more about your company? During the interview, do they seem enthusiastic? Do they use stories from their past to demonstrate their abilities and passion? Answers to these types of inquiries will help you determine whether potential workers are truly interested in working for your firm or are merely seeking for a job.

-

Allow the personality of your brand to shine through in the job description. If you're seeking to attract the greatest talent but don't yet have a well-known brand, you'll need to stand out among applicants who have a plethora of job choices at their fingertips. One approach to achieve this is to write a job description that highlights what makes your organisation distinctive and intriguing. Your job description must be memorable for applicants who are scanning through numerous career alternatives, whether you explain how you're disrupting an industry or give examples of recent media attention.

-

An Intense Focus On Recruiting Candidates Who Fit In With The Culture. Company culture is critical for small enterprises in particular. Many small firms seem like a close-knit family, and with fewer employees, each person has a greater direct impact on the environment. Bringing in a new hire who doesn't get along with the rest of the team might make the working environment uncomfortable or impair morale for everyone, and this will be obvious immediately in a smaller office. Unfortunately, determining whether or not a candidate fits your company's culture isn't an exact science.

However, there are numerous ways to obtain insight into an employee's mentality before agreeing to pay them a wage and investing further time and resources in hiring and onboarding them. There are several pre-employment screening tools on the market that can identify a candidate's inner motives, preferences, and personality qualities and that match all needs and budgets. Furthermore, something as basic and inexpensive as conversing with a candidate over lunch or coffee (or, in today's world, a Zoom call) might help you get to know them in a more informal situation.

- Look for warning signs. Make a note of any concerns that occur during the hiring process and interview. Unprofessional behaviour such as inappropriate attire, being late without calling, typos or errors in resume and cover letter, lack of preparation such as not knowing much about your company or having relevant questions prepared, inability to answer common interview questions or provide examples of how they provided value to a previous employer, summarised experience on a resume that does not specify details, inability to answer common interview questions or provide examples of how they provided value to a former employer

The video below talks about the essentials of starting your own small business.

Tools Needed For Small Business

There are a variety of other useful technologies that every small business should employ in order to accelerate their company's growth over time. Starting a new business is difficult because unexpected obstacles arise, especially when it comes to startup finance. As the workload mounts and the bills build up, limited time, people, and budgets can all become an issue. However, with a strong team and the appropriate tools, you'll be well on your way to realising your full company potential. The following is a list of some of the must-have tools for all small business entrepreneurs.

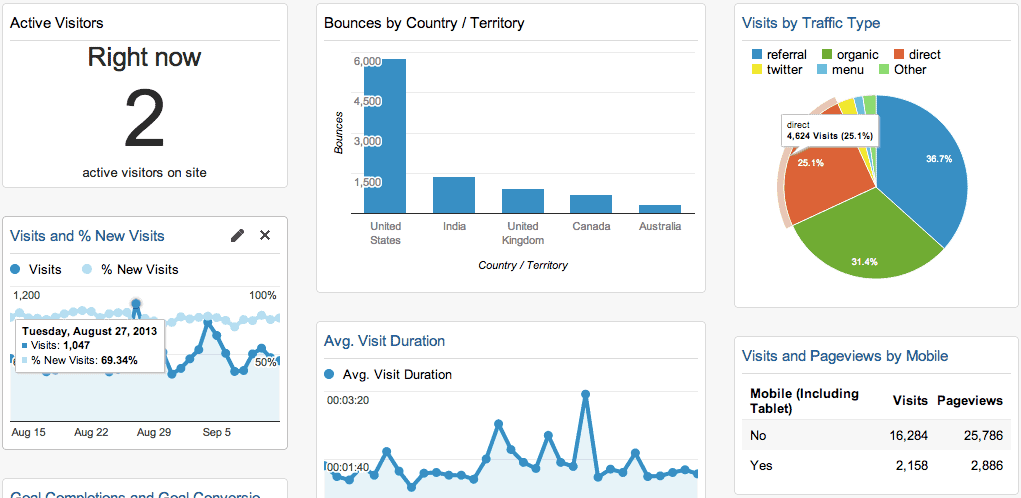

Google Analytics

It's all about the numbers when starting a new firm. What is the amount of traffic that your website receives? What is the source of the majority of that traffic? What are some of your target audience's major demographics? All of these questions are crucial to a startup's success, and keeping track of them is no easy task. This is where Google Analytics enters the picture. It's all about the numbers when starting a new firm.

What is the amount of traffic that your website receives? What is the source of the majority of that traffic? What are some of your target audience's major demographics? All of these questions are crucial to a startup's success, and keeping track of them is no easy task. This is where Google Analytics enters the picture. Best of all, Google Analytics use clearly labelled charts and graphs, allowing even the least tech-savvy person to feel comfortable with their data.

Slack

We all need a team to assist us to get things done; no entrepreneur can accomplish everything on their own. Keeping in touch with teams or individuals is critical, and sending emails or making phone calls won't suffice. Slack is suggested for staying organised and communicating efficiently.

Slack offers rapid and easy communication thanks to its sleek design and mobile app. It's simple to set up many channels for different themes and teams, as well as to send private messages to any number of team members. Messages automatically sync between devices, making switching between your phone, desktop, and laptop even easier.

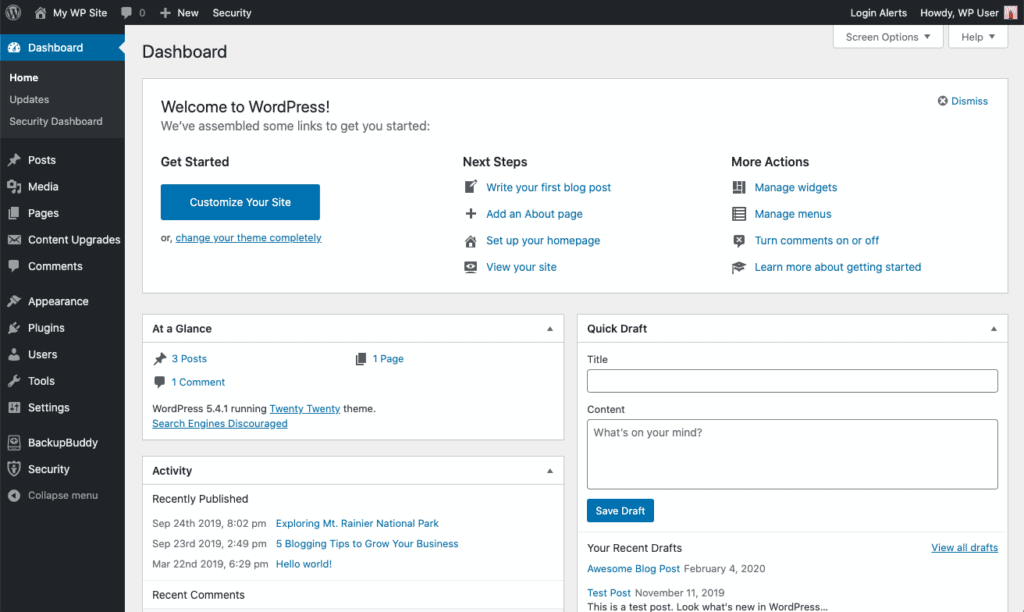

WordPress

In today's online environment, any business must have an appealing and effective website. Using a DIY website builder is inexpensive, and the wide range of options available makes it simple to customize a website to meet your specific requirements.

For any business, WordPress's customizability and built-in tools are unrivalled. Do you want to start a blog? WordPress is the greatest blogging platform with the best SEO features. Do you want to sell something? WordPress may be turned into an eCommerce solution with the help of a few of the thousands of plugins available. And if your company expands, your website will be able to keep up.

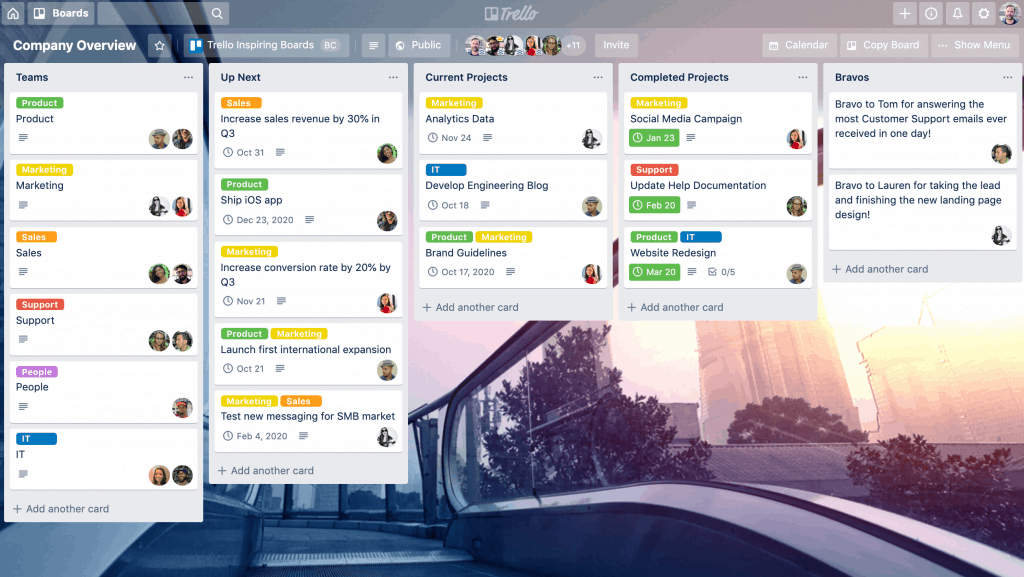

Trello

Every business needs to be organised. Trello is the solution for organising all of your tasks, from leveraging technologies like Slack to keep teams organised to using GSuite to keep all of your documents in one place. Trello is a cheap, visible, and flexible project management tool recommended by small business expert Michael Kurko on The Balance and a slew of other entrepreneurs.

Trello allows users to add custom details, images, links, checklists, and more to a Kanban-style board that monitors projects and workflows every step of the way. It can integrate your complete workflow by integrating with other recommended products like Slack and Google Drive. The tools you'll need to succeed, whether you're building a mobile app or opening a physical store, are extremely similar.

Small company success hinges on maintaining a solid network, developing a distinct social media presence, and communicating with your employees. Starting with the correct tools will assist you from the start and ensure that your business journey follows the path you intended.

Pros and Cons of Starting A Small Business

One of the most satisfying and challenging things you can do is start your own business. It might be enjoyable at times, but it can also be emotionally draining. If you're considering starting your own small business, you should ask yourself, "Do I gain genuine satisfaction from establishing something from the ground up and watching it grow?" If you can say yes, the highs of establishing your own company will outweigh the lows.

Consider the following pros and cons to make sure you understand what you're getting into:

| Advantages | Disadvantages |

| Independence. Entrepreneurs are in charge of their own destiny. They are the ones who make the decisions. | Time commitment is required. When someone starts a small firm, they are likely to only have a few employees, at least at first. |

| Control. It allows the entrepreneur to be a part of the entire business activity, from concept to design to creation, from sales to business operations to customer service. | Risk. Risk cannot be totally minimized, even if the firm has been organised to reduce risk and obligation to the owner. |

| Equity. It allows the entrepreneurs to accumulate equity that can be preserved, sold, or passed down to the next generation. | A financial commitment is required. Even the tiniest business initiatives require some form of financing to get started. |

To sum up the advantages, entrepreneurs are able to be independent. They get to choose who they do business with and what kind of work they do. They select how long they will work, how much they will be paid, and whether or not they will take holidays. The ability to control one's own future is enough for many entrepreneurs to outweigh the hazards.

Entrepreneurs that are driven by passion and creativity and have a "vision" of what they want to achieve will find this ability to be completely engaged in the business incredibly fulfilling. This level of participation enables the business owner to actually build something unique. The business becomes equity to entrepreneurs as they frequently own many firms during the course of their careers.

They start a business, manage it for a period, and then sell it to another person. This sale's proceeds can then be utilised to fund the next enterprise. If they don't want to sell the company, the goal may be to create something that they can hand on to their children to help secure their financial future. One thing is certain: you must be the owner of a firm in order to completely reap the financial benefits.

To sum up the disadvantages, the entrepreneur is now in charge of all duties and responsibilities. Small business owners say they work more than 80 hours each week on everything from purchasing to finance to advertising. This time commitment can put a strain on family and friends, in addition to adding to the stress of starting a new business. All the risks are on the entrepreneurs as well.

For example, if a person quits a solid career to pursue an entrepreneurial passion and the business fails, the financial consequences might be difficult to overcome. Small business owners must consider product liability, employee conflicts, and regulatory requirements. Personal savings, investments, or retirement assets are often the first source of finance for those launching small businesses.

Conclusion

When others would quit up, successful businesses keep going. A successful business owner is defined by their inner desire. Your mindset will play a role in whether or not your company succeeds. So keep going, and your efforts will be rewarded. While having a solid foundation is vital when beginning a small business, it does not ensure success. Only you, with your hard work, wise decisions, and excellent workers, can accomplish this.