A joint venture is a type of business partnership where two or more companies come together to establish a new entity or undertake a specific project, task, or transaction. Joint ventures can be established for a wide range of purposes, such as entering new markets, developing new products or services, or sharing resources and expertise. In a joint venture, the participating companies contribute capital, resources, and expertise to the new entity or project and typically share the venture's risks, costs, and profits. Joint ventures can take many forms, including equity joint ventures, contractual joint ventures, and limited liability partnerships. Joint ventures can be an effective way for companies to achieve strategic objectives and pursue new opportunities, but careful planning and management are necessary to ensure their success.

What is Joint Venture?

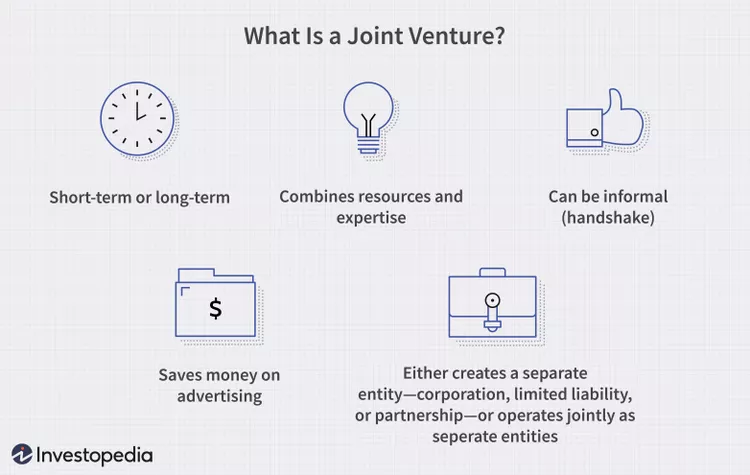

A joint venture, or JV, is a business partnership where two or more organizations pool their resources together to gain a competitive advantage in the market. Joint ventures are often formed to pursue specific projects, which can include launching a new product or service or establishing a brand-new company with different core business activities. Joint ventures can also be formed for various reasons, such as sharing expertise, accessing new markets, gaining economies of scale, reducing risks and costs, and leveraging complementary strengths and resources. Joint ventures can take many forms, such as a 50/ 50 partnership or one party owning a larger share of the venture than the other. They can also have a limited or indefinite duration, depending on the goals of the parties involved.

Even though a joint venture is commonly understood as a partnership, it can actually be established using any legal structure available. This means that corporations, partnerships, limited liability companies (LLCs), and other types of business entities can all be utilized to form a joint venture.

While joint ventures are usually created for a specific project or research purpose, they can also be established for an ongoing or continuous purpose. Joint ventures can bring together both large and small companies to undertake one or multiple projects or business deals. To initiate a joint venture, companies must enter into a contractual agreement that outlines the terms and conditions of the partnership. In a joint venture, profits and losses are shared among all participants according to the terms of the agreement.

Why Form Joint Venture?

The main reasons companies form joint ventures:

Advantages of the Combined Resources

Enables companies to leverage their combined resources to achieve a common goal. It involves using each company's strengths to maximize the venture's effectiveness. This could involve combining one company's manufacturing expertise with another's superior distribution channels or pooling financial resources to develop a new product or service. Through a joint venture, both companies can access resources that would be otherwise unavailable to them, leading to increased efficiency and effectiveness.

Cut Down Expenses

A joint venture can lead to cost reductions as both companies can leverage economies of scale to produce goods or services at a lower per-unit cost. This is especially useful for implementing expensive technological advances. Additionally, cost savings can be achieved through sharing advertising or labor costs.

Combining Expertise

The process of merging the specialized knowledge, skills, and experience of two companies involved in a Joint Venture to create a more robust and versatile entity. By collaborating through a joint venture, each company can bring its unique expertise to the table, which can enhance the overall knowledge base of the venture. This can lead to a greater understanding of complex issues and better decision-making capabilities. Additionally, combining expertise can also result in a more diverse and well-rounded workforce, enabling the joint venture to tackle a broader range of challenges and opportunities. By leveraging the expertise of both companies, the joint venture can achieve greater success than either company could alone.

Enter Foreign Markets

A joint venture can be a useful tool for companies to enter foreign markets, particularly in countries where restrictions on foreign ownership exist. This can be an effective way for companies to expand their distribution network, gain access to new customers, and increase their revenue streams. Entering foreign markets can be challenging due to regulatory restrictions, cultural differences, and language barriers. However, by partnering with a local business, a company can benefit from its knowledge of the local market, existing infrastructure, and established relationships. This can help to mitigate some of the risks associated with foreign market entry and increase the likelihood of success. Through a joint venture, both companies can pool their resources, share risks and rewards, and work together to achieve mutual goals in the foreign market.

Types of Joint Venture

Joint ventures can take various forms, and how you set one up depends on your goal. Some of the types of joint ventures include:

Contractual Joint Venture

This is the simplest type of joint venture, where two businesses agree to work together on a specific project or contract. The agreement is usually time-bound, and the businesses involved continue to operate independently.

Equity Joint Venture

This type of joint venture involves creating a new company in which the partners invest equity. Each partner has a share in the company and is involved in its management. This type of joint venture is commonly used for long-term projects or in cases where the partners want to share resources and risks.

Partnership

This is a more informal type of joint venture, where the partners pool their resources and skills to operate a business. Each partner shares the profits and losses of the business, and all partners are involved in its management.

Limited Liability Partnership

This hybrid form of partnership provides some protection for partners against personal liability for the actions of the business.

Merger

In a merger, two or more companies combine to form a new entity. This type of joint venture is more complex and involves a complete integration of the two companies' operations.

When creating a joint venture, seeking legal advice is crucial to ensure that the agreement is legally binding and easy to understand. The agreement should include details such as the roles and responsibilities of each partner, how profits will be shared, and what will happen in case the venture fails. Having a well-defined legal agreement will help prevent any misunderstandings or conflicts that might arise in the future.

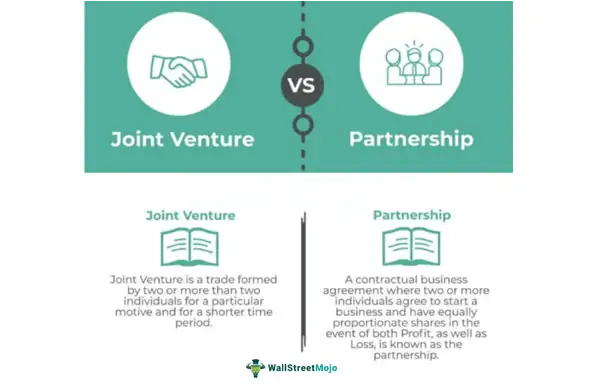

The Differences: Joint Ventures vs Partnerships

While there are various types of joint ventures, they are distinct from partnerships as they are limited to a particular venture, whereas partnerships are not. Joint ventures can involve corporations or entities, while partnerships are only formed between two or more individuals. Joint ventures are typically established for a specific period of time and are focused on achieving a particular goal, such as entering a new market or developing a new product. The length of a joint venture can vary, depending on the terms of the agreement and the objectives of the partnership, but they usually last between five to seven years.

Furthermore, joint ventures are regulated under business formation and dissolution laws, unlike partnerships in the U.S., which are governed by state laws, usually under contract law. In a joint venture, each party retains ownership of their assets and is only liable for expenses related to the specific agreement, which is a significant advantage over other types of partnerships.

Advantages of Joint Venture

The benefits of joint ventures are numerous for those involved. They can accelerate business growth, boost efficiency, and yield extra revenue.

Shared investment, also known as joint investment or collaborative investment, refers to a business arrangement where two or more parties contribute funds to finance a project or initiative. Each party agrees to invest a specific amount of money in the project, and the funds are pooled together to fund the venture. Shared investment is a common strategy companies, especially startups, use to reduce the financial burden of launching a new product or service. By sharing the investment, each party can leverage its resources and expertise to create a more significant impact than it would be possible alone.

Shared expenses refer to the practice of pooling resources and sharing the costs of a project or initiative among multiple parties. This can include sharing the costs of equipment, infrastructure, marketing, and other resources required to operate a business. In a shared expenses arrangement, each party contributes a certain amount of money to a common pool, which is then used to cover the costs associated with the project. By sharing expenses, each party can benefit from economies of scale and reduce the overall cost of the project.

Specialized Skills

Specialized skills refer to the unique skills, knowledge, and experience that each party brings to a collaborative business venture. By combining their strengths, each party can have a more significant impact than they would have individually. In a joint venture, each party contributes its specialized expertise to achieve common goals. This can include technical skills, industry-specific knowledge, research and development capabilities, and other capabilities needed to operate a successful business. By pooling their expertise, the group can benefit from the collective experience and knowledge, resulting in more effective solutions, improved productivity, and better overall performance of the joint venture.

Market Expansion

Market expansion refers to the practice of entering a new market or geographic region to expand the customer base and increase revenue. Joint ventures can be an effective way to enter new markets quickly, as they provide access to local expertise and infrastructure that may be challenging to establish on one's own.

New Revenue Streams

Joint ventures can help small businesses to access new revenue streams that may not have been available to them otherwise. Small businesses often have limited resources and may struggle to access capital for growth projects. By partnering with a larger company with more financial resources, the small business can expand more quickly and efficiently. In a joint venture, the small business can leverage the larger company's extensive distribution channels to reach new customers and expand its market share. This can provide the smaller firm with larger and/or more diversified revenue streams, which can help them to achieve their growth objectives.

Intellectual Property Assets

Joint ventures can provide companies with access to advanced technology and intellectual property assets that would be challenging or costly to develop in-house. By partnering with technology-rich firms, companies can gain access to these assets without investing significant time and resources into their development. In a joint venture, it is crucial to address intellectual property ownership and licensing issues upfront to ensure that each party's contributions are appropriately recognized and protected. By doing so, the parties can leverage each other's strengths to develop new products or services and generate new revenue streams.

Collaborative Benefits

Joint ventures can offer various collaborative benefits that can help companies to achieve their business objectives. These benefits are similar to what companies often seek in mergers and acquisitions, including financial synergy and operational synergy.

Financial synergy refers to the reduction in the cost of capital that occurs when two companies combine their financial resources. In a joint venture, each party can contribute its financial resources to the partnership, which can reduce the cost of capital for the joint venture as a whole. This can help to finance growth initiatives, fund research and development, or invest in new projects.

Operational synergy occurs when two companies working together can increase operational efficiency and productivity. In a joint venture, each party can contribute their expertise, knowledge, and resources to achieve common goals. This can result in more efficient and effective operations, streamlined processes, and better overall performance of the joint venture.

Enhanced Credibility

For startups and young businesses, building market credibility and a strong customer base can take a significant amount of time and effort. However, by forming a joint venture with a larger, well-established brand, they can achieve enhanced marketplace visibility and credibility more quickly. The larger brand can provide the smaller company with access to its established customer base, marketing channels, and distribution networks. This can help the smaller company to reach a broader audience and build brand awareness more quickly than they would have been able to achieve on their own.

Barriers to Competition

Forming a joint venture can also help companies avoid competition and pricing pressure by creating barriers for competitors. When businesses collaborate with other companies, they can create a strong market position, making it difficult for competitors to enter the marketplace.

Economies of Scale

Joining forces in a joint venture can also lead to improved economies of scale for all parties involved. Companies can combine their resources and increase their purchasing power, production capacity, and distribution capabilities by working together. This can help reduce costs and increase efficiency, leading to higher profits and a better return on investment for all parties involved.

Risks of Joint Venture

While joint ventures offer many advantages, such as increased resources and expertise, they can also pose significant challenges. Establishing a joint venture with another company requires a significant amount of time and effort to build a strong business relationship. As a result, joint ventures can give rise to various issues, such as divergent objectives, cultural mismatches, and investment imbalances.

The partners may have different objectives for the joint venture, which can threaten the success of the venture. It is crucial to clearly define and communicate the objectives of the venture to everyone involved at the outset to avoid this issue.

Cultural differences and varying management styles between the companies involved in the joint venture can also lead to integration and cooperation problems. To avoid this, it is best to consider joint venture opportunities with companies with a similar corporate culture.

A risk of imbalance in the levels of expertise, investment, or assets brought into the venture by the different parties. This may lead to problems and create resentment between the parties involved. To avoid this, it is important to have open and honest discussions and clear communication during the formation of the joint venture, ensuring that each party understands and accepts its role in the venture.

Conclusion

Joint ventures are partnerships between two or more businesses in which each contributes capital, resources, and expertise to create a new venture. Joint ventures can provide a variety of benefits to the participating companies, including access to new markets, increased scale and efficiency, and the ability to share risks and costs. However, joint ventures also carry certain risks, such as potential conflicts between partners, differences in management styles and corporate cultures, and imbalance levels of expertise.

Overall, whether a joint venture is a good choice for a business depends on a variety of factors, including the goals of the partners, the resources and expertise they can bring to the venture, and the potential risks and rewards. Joint ventures can be a powerful tool for companies seeking to grow and expand their businesses when established and managed effectively.