Is Uber Actually a Non-Profit Organisation? What Exactly is Uber's Revenue Model?

I remember debating with my team on this a while back. Is their revenue model based on a transaction fee or is it based on subsidies? The latter, of course, is not a revenue model as it does not make any revenues. Anyway, which one exactly is Uber going for?

Ideally, they would be charging transaction fees. But this is not the case. Ask any Uber driver and/or passenger, and they will tell you there are incentives and promotions. These are both forms of subsidies to displace the market price for transportation. Let me illustrate;

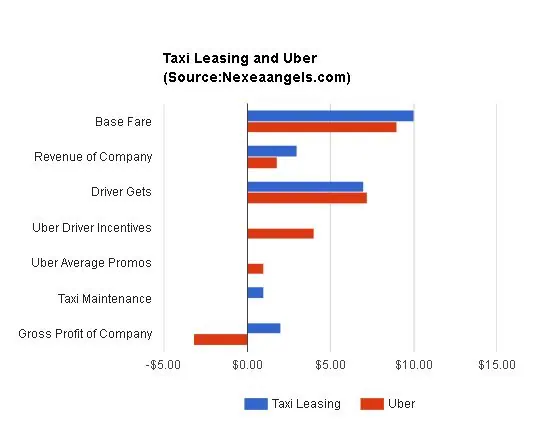

Now, this is what most of us do not see - Uber's profit per ride (just an illustration), vs taxi leasing companies (closest thing I can compare it with?). Uber makes $1.60 in Revenues where the leasing company would make $3 (explaining why Taxis cost more). The taxi leasing companies make a gross profit of $2 a ride whereas Uber loses $3.40 per ride. What?? Innovation!

That's what's called a subsidy model. It's what Non-Profits and Governments use to do social good. They lose money so that people are able to live better lives. Likewise, Uber makes transportation cheaper for the general public, and the driver gets paid more.

Calling All Backup...

To back up my thoughts, let's consider what Sameer found in 2015:

(I do recommend you read his full post as well for the full view!)

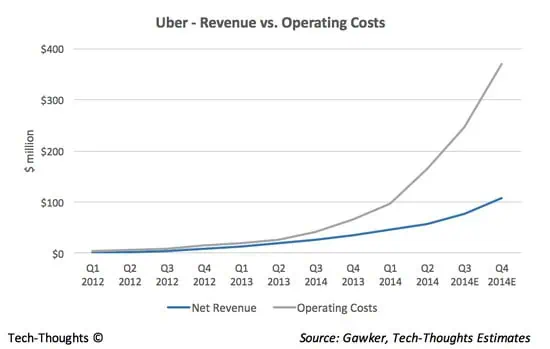

As you can see, Costs per Revenue earned is skyrocketing - meaning they are spending more and more but they are not getting back as much. Compare this chart with the previous chart above, and you can see my calculations are not too far off. Here, Uber makes 100M and Loses almost 400M. That's 500M in between that went somewhere else.

As mentioned, Uber operates at a negative operating margin. For you non-financial people:

Operating Margin = Operating Earnings / Revenue

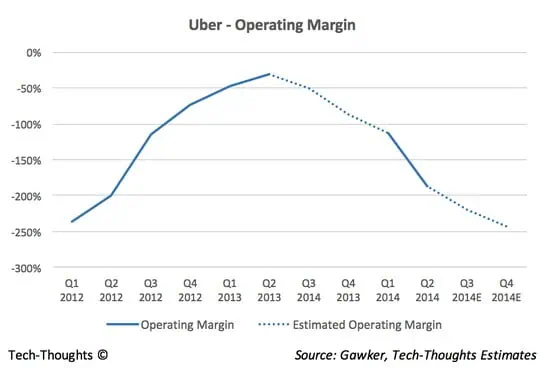

Funny thing is that it improved - and then got worse. Now, numbers without context make a dangerous assumption. I do not know their exact strategy but let's assume they have it under control and move on to the next charts.

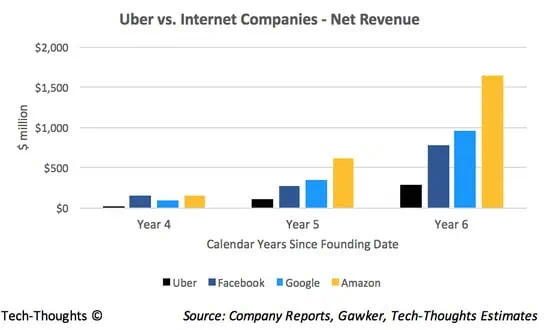

This is where it gets interesting. The chart above shows the benchmarked revenues in their stages of growth. Uber's revenues hardly grew compared to the others - an unfair comparison since the rest are tech companies that can grow faster. However, I think it is fair in the sense that if you were an investor, where would you put your investment dollars? The above makes it obvious. It is also fair in a sense that tech companies tend to be of higher risk by nature, and Uber being half-tech, should have a lower risk by the nature of the industry.

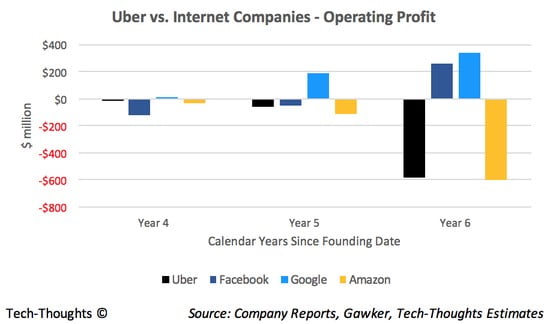

Looking at the above, we can see Google was the first to make a profit, followed by Facebook. The context that is missing from the numbers above is that Amazon's growth was much much larger by comparison (1.5b by year 6 vs Uber's ~0.3B by year 6). So it would seem that Amazon's cash burn is better justified as Amazon actually had their growth results back up their losses.

Uber, by their actions, seem to have not bothered to try and make a profit. Some may say they can't because driverless cars are still not here, and that their competition is forcing them to burn more cash (by burning cash themselves). However, if we looked into their actions, they seem to be competing by price more than they are trying to compete by service level. It could be that it is very hard to differentiate service levels in the on-demand ride industry.

What Next For Uber?

I tend to think that Uber really needs their driverless cars to finally materialise so that they can cut costs and finally make the profit they never had. However, from the looks of Uber's driverless technology hitting road bumps, plus all the spying and anti-competition manoeuvres Uber has been pulling, I am not sure about their Investors' confidence levels. Less funding means less time - meaning less chance of turning a profit. In addition, those manoeuvres seem to be messing around more than focusing on doing business properly.

On top of all this, I have a crazy theory that their competition, who have burned a lot less (and therefore look MUCH better financially), would have better chances at securing large funding to buy up driverless car technology and immediately turning a profit. Or, do you think that Apple & Google would come up with their own driverless taxi service to kill off Uber? Let me know below in the comments!