Updated on 18 March 2022.

Peer to peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman. This article will be going in-depth about the trend of P2P lending in Malaysia and how it has impacted businesses and their workings.

What is P2P Lending?

This method allows borrowers to obtain loans without having to go through the strict requirements of banks. Considering that the primary objective of introducing market-based financing is to help build small businesses which in turn help to spur and promote the growth of the economy.

Hence the P2P operator is not permitted to facilitate individuals seeking personal financing. Through the SC registered P2P platform, an investor may invest in an investment note or an Islamic investment note issued by businesses or companies for a specified tenure with the expectation of a predetermined financial return.

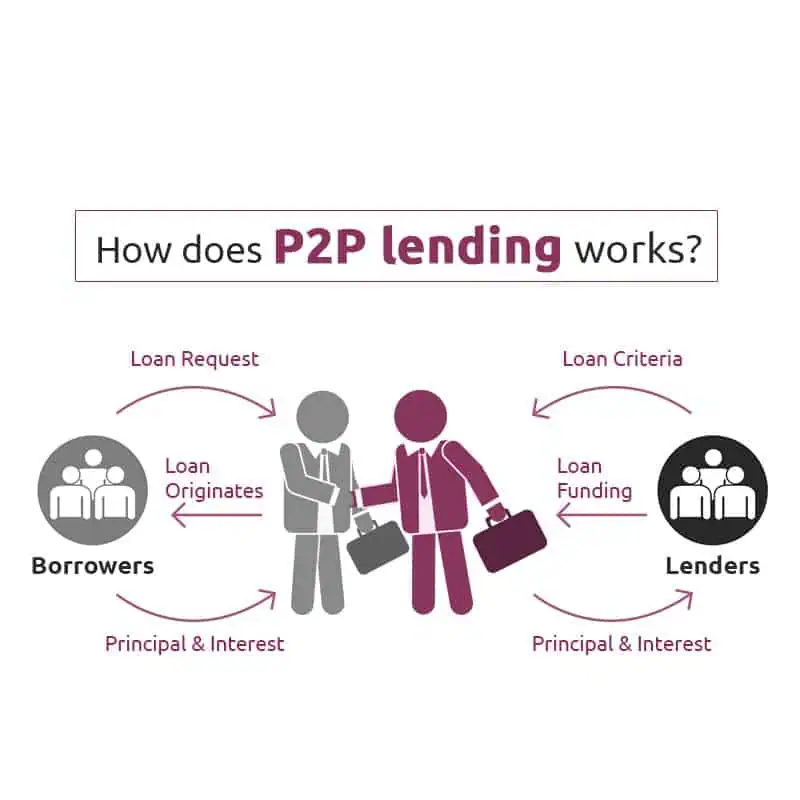

How Does P2P Lending Work?

Peer-to-peer lending works differently than getting a loan from a bank or credit union. When you get a loan from the bank, the bank will use some of its assets, which are the deposits made into accounts by other customers, to fund the loan.

With peer-to-peer lending, borrowers are matched directly with investors through a lending platform. Investors get to see and select exactly which loans they want to fund. Peer-to-peer loans are most commonly personal loans or small business loans.

P2P lending websites connect borrowers directly to investors. Each website sets the rates and the terms and enables the transaction. Most platforms and websites will have a wide range of interest rates based on the creditworthiness of the applicant.

First, an investor opens an account with the website and deposits a sum of money to be sent out in loans. The loan applicant posts a financial profile that is assigned a risk category that determines the interest rate the applicant will pay. The loan applicant can review offers and accept one. The money transfer and the monthly payments are handled through the platform. The process can be entirely automated, or lenders and borrowers can choose to have a Q&A over interests rates and loan terms and conditions.

There are other ways to acquire finances for your business such as angel investors and venture capitals. See our relevant pages for more information on these methods of financing.

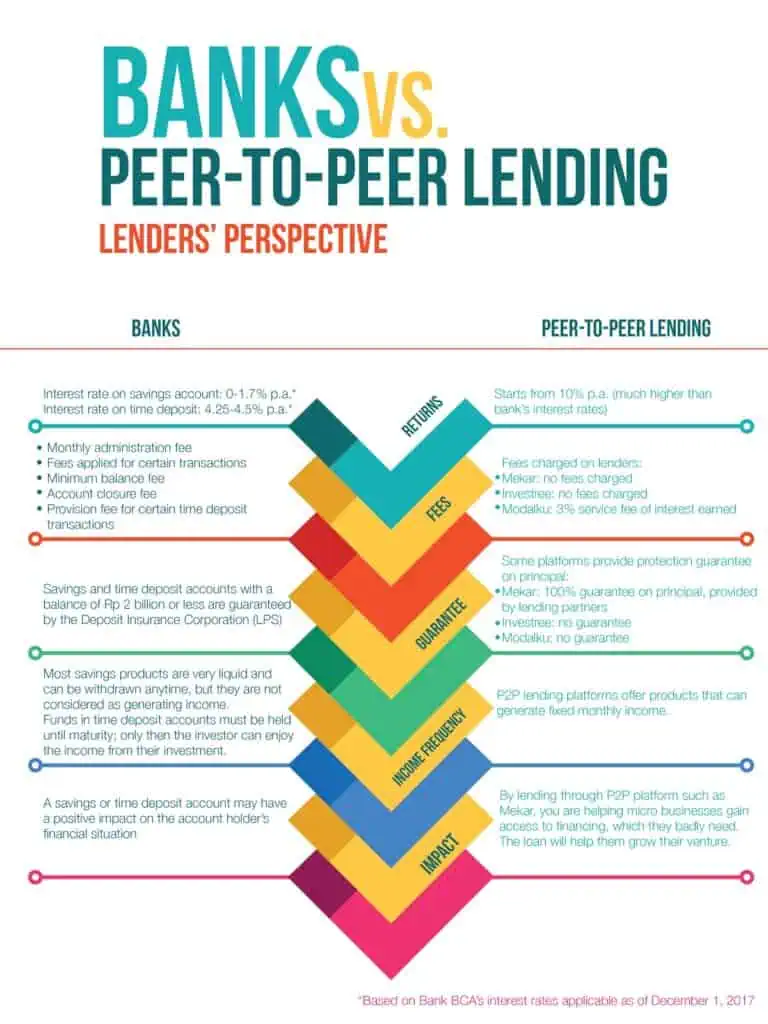

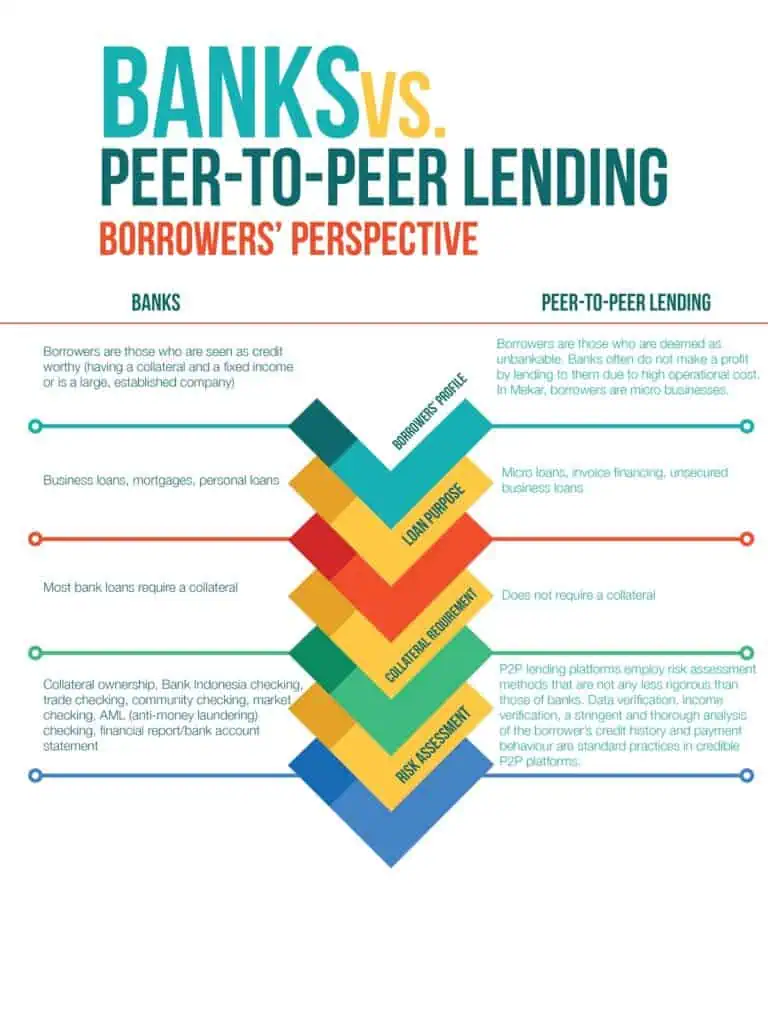

Banks vs. P2P Lending

P2P lending can also be compared with loans obtained from banks. There are two perspectives to visualise P2P lending, from the lender's perspective as well as the borrowers. The image below depicts the lenders’ perspective.

In the working of Peer to Peer lending Malaysia, the process for investing through a P2P platform may differ from operator to operator depending on the rules set by the operators. From a borrowers’ perspective, the scenario differs as follows:

Peer to Peer Lending Malaysia and Its Trends

The concept of Peer to Peer lending in Malaysia was introduced in the country in May 2016 after the approval of the Securities Commission (SC) Malaysia. They introduced a regulatory framework for Peer to Peer lending Malaysia, setting out requirements for registration and obligations to be a P2P operator as provided in the revised Guidelines on Recognized Markets (the Guidelines) in 2016.

The P2P framework will enable eligible businesses and companies to access market-based financing to fund their projects or businesses via an electronic platform.

There are multiple platforms in the country that support Peer to Peer lending in Malaysia. They compare as follows below:

| Name | Default Rate | Minimum Investment | Fees |

| AlixCo | 2.59% | RM500 | 0.35% -2% of repayment |

|

B2B Finpal |

3.15% | RM1,000 initial deposit, RM100 per campaign |

30% of interest earned |

|

CapitalBay P2P Financing platform |

0% | RM10,000 | 10% to 30% of interest earned |

|

Capsphere |

0% | RM200 initial deposit, RM50 per campaign |

Up to 2% of monthly repayments |

|

Cofundr |

not stated | RM1,000 initial deposit, RM100 per campaign |

For investments that are 12 months or under: 20% of interest For investments that are over 12 months: 2.0% p.a. on the principal |

|

MicroLEAP |

not stated | RM50 | 2% of the first monthly repayment of each campaign |

|

Funding Societies |

3.58% | RM1,000 initial deposit, RM100 per campaign |

Business term financing: 2% p.a. of each repayment Accounts receivable financing: 15% of interest earned Accounts payable financing: 30% of interest earned |

| Fundaztic | 10.42% |

RM2,000 initial deposit (if using “Smart Invest” feature); otherwise, no initial deposit is required, RM50 per campaign |

Monthly repayments: 2% of the repayment amount Bullet repayments: 1% of the repayment amount |

| QuicKash | 1.34% | RM100 | 1.35% – 1.50% per repayment |

It’s best to choose P2P platforms that are reputable. As of 2018, Funding Societies, B2B Finpal and Fundaztic had the biggest market shares in Malaysia. Funding Societies takes the lead with over RM4.97 billion funds raised to date.

Understand the Risks of Peer to Peer Lending Malaysia

- The most apparent risk of investing in P2P lending is the risk of default by the borrowers. Default occurs when the borrowers fail to make scheduled repayments on time to the lenders. P2P lending operators generally disclose to investors the measures that are put in place to minimise the risk of default. Other than having a rigorous and transparent credit assessment process as required by SC, such measures include obtaining personal guarantees from the Directors of the borrowers.

- Secondly, P2P lending platforms offer loans that are not secured or collateralised. In contrast to traditional banks, some borrowers pledge their assets as collateral to obtain financing. In the event of default, the banks will take possession of the assets to recover part or all of the bad debts.

Collateral helps mitigate the risk of default thus provides a layer of protection to the lenders. Therefore, the risk of default on P2P lending loans is higher than the traditional bank loans. In other words, you as the lender or investor could end up walking away empty-handed in a worst-case scenario.

Strategies to Minimise Risk and Maximize Returns

These are the following strategies that are used to minimise risk while at the same time being able to maximise your returns.

-

Diversification. Investors always use diversification to reduce concentration risk in their investment portfolios. It helps avoid the risk of losing all money in a particular investment when the investment fails. Many P2P lending investors think that they have diversified their loan portfolios perfectly by spreading their investments across different borrowers.

Diversification is the concept that for example, if one project ends up failing, investors will always have others in their portfolio to back them up. It is also recommended to not invest more than 1% of your net worth

-

Doing your own due diligence. Based on SC requirements, each P2P lending Malaysia platform is obliged to verify the relevant information or documents submitted by the borrowers. This information is made available to all investors through the platform. Each investor may have a different approach to how much risk they are willing to take. Therefore you should always perform your own due diligence before you invest.

- Consider Economic Conditions. During an economic crisis, or such that we are passing through at the moment, a pandemic, it is advised to not take part in P2P lending methods. This is because many businesses tend to fails therefore, they will fail to payback. A good strategy to minimise risk is to avoid considering P2P lending at such times.

Pro’s and Con’s of P2P Lending Malaysia

Using P2P lending in Malaysia has its advantages and disadvantages as well. The advantages of P2P lending Malaysia include:

-

Medium-High returns. Your return on investment with P2P lending can range from 10% to 18% (according to data provided by the platforms themselves). These are pretty high returns when compared to other investment options:

Fixed deposits: Fixed deposits in Malaysia offer interest rates of around 2% per annum.

Unit trusts: Most of unit trust funds available on Fundsupermart reported an annualised return of under 10% in the past three years.

EPF: The Employees Provident Fund (EPF) declared a dividend rate of 5.45% for Conventional Savings and 5% for Shariah Savings for 2019.

Malaysian stock market: The KLCI (the stock market index that tracks the 30 largest Malaysian companies) has an annualised return of -1.1% over the past five years.

-

Monthly returns. With P2P lending Malaysia, you’ll generally start receiving monthly repayments a month or two after your initial investment, which is great if you like consistent returns on a monthly basis.

-

Low initial investment. With P2P lending Malaysia, you need as little as RM50 to RM100 to start investing in P2P lending, although some platforms may require an initial RM1,000 investment.

- Control. Within the perspective of P2P lending Malaysia, you have direct control over which businesses to invest in. If you choose to not invest in education-related businesses or only want to invest in Shariah-compliant businesses? It’s your call.

The drawbacks of using P2P lending Malaysia include the following:

-

High-risk. Businesses who apply for loans with P2P lending platforms tend to be startups or small businesses that aren’t well established – and startups are well-known for their high failure rate. These businesses tend to have lower credit ratings that make them ineligible for bank loans.

When you invest with P2P lending platforms, you’re exposing yourself to higher credit risk, so be prepared for the possibility that a borrower will default on their loan. And there is no guarantee that you will be receiving your money back.

- You could lose your entire principal. If borrowers default on their payments, you could lose the principal you have invested. Some platforms may take legal action against borrowers or work with them to propose alternative repayment solutions. Even so, your repayments are not guaranteed as you are an unsecured creditor.

P2P versus Other High Risk Investment Options

P2P lending Malaysia is regulated by the Securities Commission Malaysia (SC). Before you start investing in a P2P lending platform, check if it has been licensed under the SC. Malaysia became the first country in ASEAN to regulate P2P lending. To date, there are only eleven licensed operators licensed for P2P lending in Malaysia.

Other types of high-risk investment options as an alternative to P2P Lending Malaysia, include investing in the stock market. Market risk is a type of systematic risk that may cause investors to suffer losses due to the factors affecting the financial market’s overall performances, such as stock market changes, recession and other external economic factors may be of cause as well.

There are strict guidelines on who these platforms can offer loans to. SC-licensed platforms are required to conduct background checks on all potential issuers to verify their business proposition and assess their creditworthiness. P2P platforms reject around 70% of potential issuers.

To Conclude

Just like the teaching of Sun Tzu, “To Know One’s Own Strength And The Enemies Is The Sure Way To Victory”. Thus, maximum and continuous profits come from well versed with the market, planning and strategising options to minimise risk for your wealth and business in a well-balanced manner.

In conclusion, P2P lending Malaysia has been growing at an exponential pace since its emergence and approval to regulate in 2016. The most obvious reason is because of its promising high returns with more than 10% per annum. Also, it doesn’t require specialised financial knowledge or day-to-day monitoring. Not to also mention it requires only RM100 to start investing.

Read more on our P2P Insights here.