This article is part of a study of popular businesses & their business and revenue models so that people can understand how investors look at startups. Examples of which can be seen in our Grab and Lazada articles. Most information are facts collected publicly, and some are our own assumptions – which are pointed out as such. In this article, particularly, we will be looking at the Setel business model.

E-wallets are becoming more and more popular as a digital payment form not just in Malaysia but all over the world. Many people use E-wallets at restaurants and convenience stores. Recently, Malaysia has seen its first petrol e-payment solution being introduced - by Setel, a startup run by PETRONAS, Malaysia's Oil and Gas conglomerate.

Setel offers an E-wallet that lets you pay for fuel at PETRONAS petrol stations in Malaysia. Queuing up at the payment counter or even swiping your card will no longer be necessary as you can pay straight from your mobile phone. Fast and convenient.

Setel was first introduced by PETRONAS at the end of 2018, allowing people to pay for their petrol transactions at a few participating PETRONAS petrol stations. The app also allows you to select the type of fuel, the amount of fuel you need, while paying for it from the comfort of your car seat. On top of that, it offers incorporated security measures to protect the customers' funds, personal data, and information.

According to the CEO of Setel, Iskandar Ezzahuddin: “As of January 2020, Setel has recorded more than 3 million transactions and received positive responses from customers in the Klang Valley.”

Setel at a Glance - History, Facts & Statistics

- 1st introduced by PETRONAS in 2018

- available to download for free on iOS and Android

- No RM200 hold when paying for fuel (unlike when paying with your card)

- Malaysia's first Pay, Pump & Go app

- available at 700 PETRONAS stations nationwide

- 273 stations within Klang Valley

- no queuing anymore to make your payment

- get a weekly notification on the latest fuel price for all types of fuel

- Convert 100 Mesra points to RM1.00 Setel fuel credit

- downloaded: 500,000+ in March 2020

- downloaded last month: 50k

*Note that the statistics used may be slightly dated*

The E-Wallet Business In Malaysia

E-wallets gain more and more fame in Malaysia and all around the world. Many entrepreneurs are talking about this niche. What exactly is an e-wallet? What are the advantages of using one?

A digital wallet often called E-wallet is a software-based system that stores the buyers' payment information (passwords, account details) securely and compactly for different payment methods as well as websites. An E-wallet can make the users' life way more comfortable. Through applying an E-wallet in their daily life, buyers can complete purchases fast and convenient.

Rather than going to stores and paying with a debit card, the whole transaction is made online with near-field communications technology. On top of that, the customer has the option to create strong passwords without worrying about forgetting them as everything is stored online. Also, both the seller/retailer often incurs smaller transaction fees compared to the use of a credit card.

Not just consumers can benefit from the digital wallet, but companies take advantage of the increasing use of E-wallets. Some users of E-wallets have privacy concerns, as companies collect consumer data through the digital wallet to learn more about their customers' habits, so the companies can market their clients more efficiently and adapt their marketing strategies accordingly to the collected data.

To use an E-Wallet, it must first be loaded with the desired credit before it can be used. There are several ways to top up the wallet. Mostly it is topped up by credit card or bank transfer. Wallet users have two ways to use it for payment. The first option involves topping up the wallet and using it later until the credit is used up. If this method is used, it is also called a prepaid wallet, which works similar to a prepaid credit card. With the second variant, the holder deposits a reference account. If the client uses the Wallet for a transaction, the money is collected via the reference account. The solution can, therefore, be used until the deposited reference account is no longer covered.

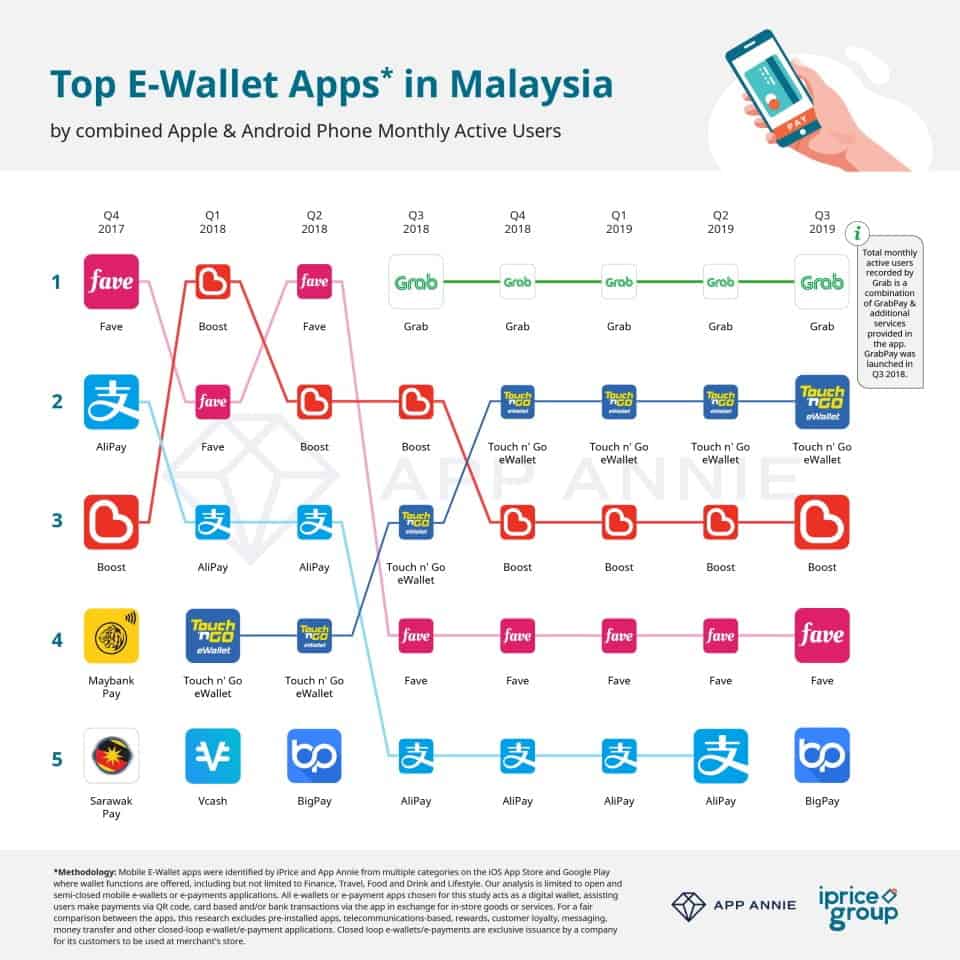

The one E-wallet that may be one of the most famous ones in Malaysia is provided by the ride-hailing app Grab. It allows its users to use their E-wallet to make online payments for Grab's own service offerings such as GrabFood, GrabRide or in-store items. To motivate their customers to keep using those online payments, each transaction enables users to earn points that can be used to get free Grab rides and discounts on GrabFood.

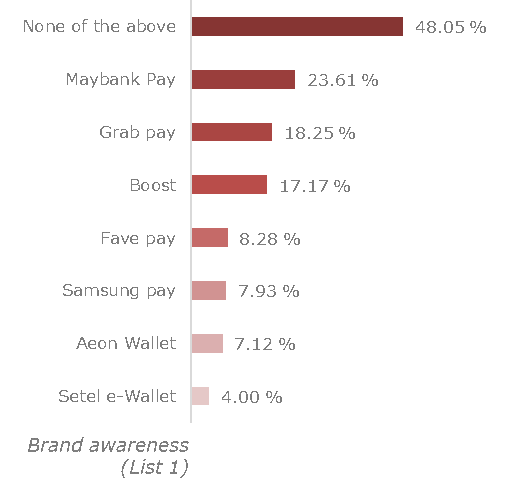

According to a survey by Vodus that studied awareness and consumer usage and attitude towards E-wallets in Malaysia, Malaysians are more and more willing to use E-wallets. Nevertheless, almost 50% of the 8,000 participants have never heard of any of the E-wallets listed in the statistic below. With regards to the E-Wallet app Setel, 4.00% of the participants of they survey have heard heard from the app.

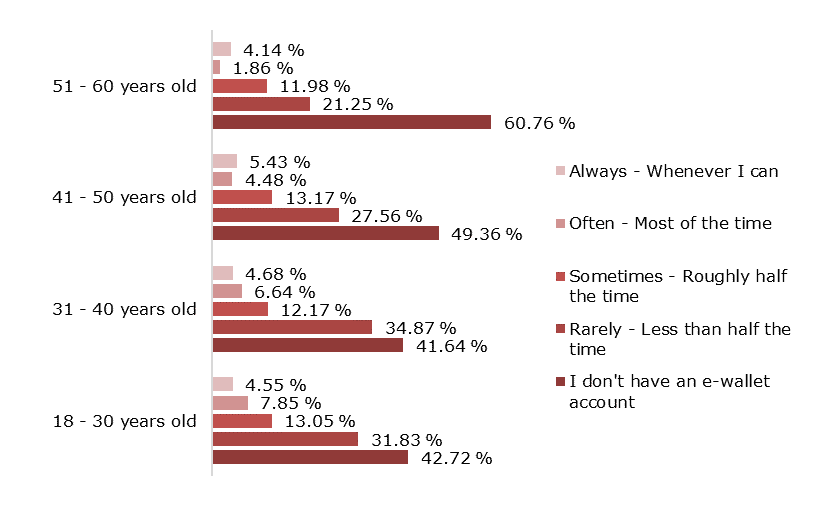

The survey also illustrated that millennials are more willing to use E-Wallets. However, there is a trend towards a general increase in the use of E-wallets across all age groups.

As illustrated in the statistics, companies whose business model is an e-wallet, or who use an e-wallet as a payment method, need to do more marketing to increase brand awareness and bring e-wallets closer to the older generations.

Having a closer look at the e-wallets that have been used most in Malaysia over the last three years reveals clear favorites. The ride-hailing giant Grab has the most active users from the year of introduction of its e-wallets in 2018. Touch n'Go and Boost are ranked second and third in terms of active users, followed by Fave and BigPay.

Setel - What makes it so unique?

Setel is the first e-wallet app integrated with PETRONAS fuel pumps in Southeast Asia, allowing customers to pay for their fuel without leaving their cars. It is part of the PETRONAS Dagangan Bhd (PDB) initiative, which aims to engage the start-up communities in jointly developing innovative solutions to improve the customer experience.

Minimize contact, maximize safety

This is the company's mission statement, which, after being founded in 2018, is still showing success in early 2020. In addition to cashless payment through the e-wallet at around 700 service stations across Malaysia, Setel also supports connectivity to PETRONAS Mesra Cards (with over 7 million circulations in Malaysia) and features such as converting Mesra points to e-money that are already included in the roadmap.

Setel is of particular benefit to customers who do not have a credit card. Since you can top up your e-wallet account with the desired amount without having to hold RM200, you can top up your Setel account with your credit or debit card or by using online banking. For credit card payments, there is even an automatic top-up function for added convenience.

Only three steps are necessary to pay. Open your App. 1) Select the pump number of where your car is currently located. 2) Select how much fuel you wish to pump - you can and pick a full tank or a preset amount. 3) Authorize the payment via keying in a 6-digit PIN. Once done with the authorization, the pump will be activated and you can start refueling. For this, however, the user still has to get out of the car and pump petrol in a traditional manner.

In comparison to credit card transactions, Setel doesn't provide any paper receipts. Instead, the user receives a digital receipt within the application itself. All historic transactions are stored there as well.

Setel itself is a company about which not much information can be found online. But through its connection to PETRONAS and its product, the fuel e-wallet, the company Setel represents a very interesting business that can be analyzed to a large extent even from the outside. In order to better understand the company and its idea, the CANVAS model of the company will be examined more closely in the following, as well as the Startup Fundamentals.

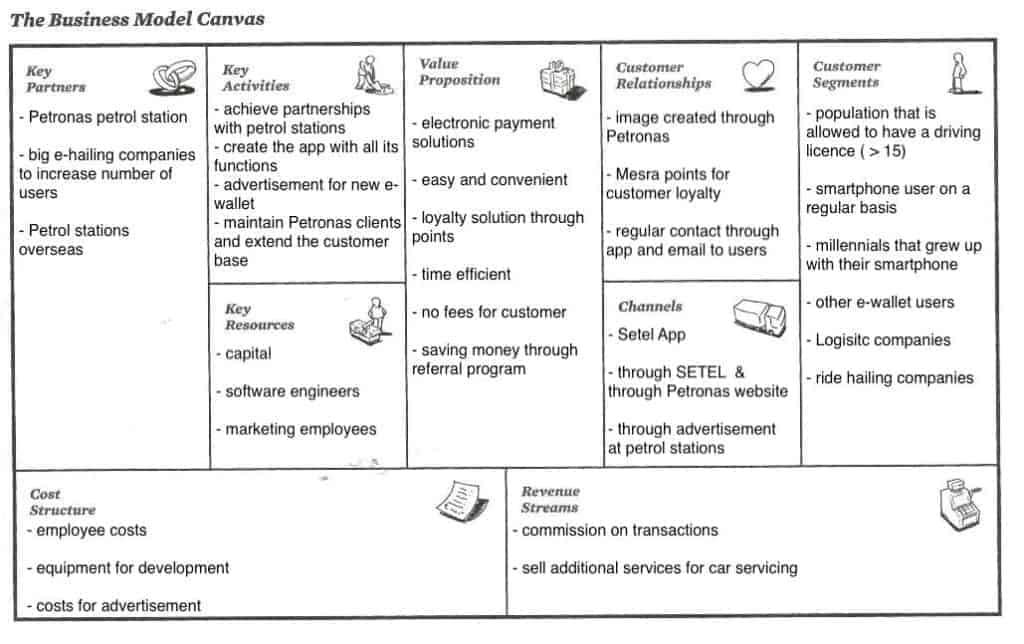

The Setel Business Model Canvas

Who are Setel's Key Partners?

As Setel is a company introduced by PETRONAS and aiming for its customers, the primary key partners Setel has to get on board are the PETRONAS Petrol stations in Malaysia. Though not all stations are likely to be receptive, with PETRONAS' backing for Setel, the partners are likely to be successfully onboarded.

Furthermore, the company could partner up with big e-hailing companies like Grab to increase the number of users. E-hailing drivers need to go to the petrol station quite often. They could have advantages through Setels' loyalty program. Having e-hailing companies as their partner, Setel would remarkably increase its client base.

In the long term, to expand beyond the PETRONAS owned petrol stations, Setel could look at partnering with other petrol companies. Most likely, because of the Setel business model, local stations other than PETRONAS would not be open to that, as Setel is built and owned by their competitor (PETRONAS), but overseas, such partnerships could become possible. That is given that Setel aims to grow beyond being a service improvement tool for PETRONAS itself alone.

What are Setel's Key Activities?

The main activity that needs to be done is establishing partnerships with the petrol stations to ensure the ability to use the e-wallet app. These activities are should be always in line with the Setel business model. Apart from that, the app needs to be created in a customer-friendly way. All the functions need to be part of the app to ensure the use of it by its clients. The app should be improved from time to time to encourage the use of digital wallets. Looking at the app store ratings of Setel, the company appears to be doing a good job there. On top of that, advertisement needs to be done to both, convert existing PETRONAS customers into using the app as a payment method and to establish a new customer base of users that previously were not (frequent) PETRONAS petrol station users, but become loyal customers with the help of Setel.

What practical resources does Setel need to operate?

The key resources that should be available for the smooth functioning of the app are sufficient capital, employees who develop the software and keep the app up to date and employees who take care of the marketing around Setel and its product.

What value does Setel create for their customers?

The values that the app is intended to convey to customers are very diverse. The app is an electronic payment solution that is very easy and convenient to use. In addition, by using the app regularly, the customer will receive points on his or her account, which will save money in the further course of the use. When paying by credit card, there are usually fees, which are eliminated when using the Setel app. On top of that, using the Setel app is time-saving. There is no need for the client to physically leave the car and pay at the store.

How does Setel interact with their customers?

Setel uses a very personalized approach in terms of customer relationship. New users are welcomed via email with a personal note from the CEO. The language used to communicate to the users is casual and easy. Through regular contact with customers through the app and through emails, the customer relationship is built and maintained. This also allows Setel to get feedback and to quickly identify and solve problems. Setel also offers Mesra points to generate a certain loyalty of the customers to the app and to generate new benefits.

How does Setel inform customers about their value proposition?

Setel focuses on bringing the app to users. The website of Setel, for example, is fully focused only on communicating to the visitor to download the app. The channels used to promote the app include PR, billboard advertising and on the ground advertising via promoters (at the stations itself). With most visitors at the PETRONAS petrol stations being the ideal target market, promoting the app at the stations itself seems to be the most effective way, and Setel is focusing on that. Apart from promoters who encourage and assist new customers with the installation of the app, various signs at the petrol stations itself bring the attention of the potential customers to the new app and its benefits.

Which groups of people are Setel solving the problem for?

The customer segment of the Setel app appears to be wide and versatile. Every resident of Malaysia who has a driver's license for a car or motorbike could potentially use the Setel app. Assuming a 100% smartphone penetration, any driver aged 16+ is a potential Setel customer.

Drilling down a bit further, existing PETRONAS station users are surely the immediate focus, as it will be easier to change their payment method along, and not change their routine of which station to go to to pump petrol. Also, existing Mesra points users will be more attracted by the Mesra points promotions offered by Setel.

Further, the app is particularly interesting for users of a lower income group who either don't own a credit or debit card or for whom the hold of RM200 (as practised by cards) is an inconvenience.

This also includes students, who generally have less funds available. In addition, their higher tech savyness compared to other age groups should make them a prime target market.

What are the type of costs Setel incurs?

The app is designed to provide services on a large scale, serving new customers at virtually zero additional marginal cost. Meaning, once the business has loyal customers, the main cost is the upholding and updating of the technology and customer service.

It appears that currently, the company spends probably the majority of its cost on acquiring new customers. Apart from promoting the app via the various acquisition channels, Setel incurs cost to incentivize users to download and to repeat-use the app - with various promotions such as discount on the fueling bill or additional Mesra points.

How does Setel generate revenue?

It can be assumed, through research from other fuel e-wallets, that Setel takes the savings in credit card fees. However, it is unclear how high these savings will be. We discuss this on more detail later. Besides this revenue stream, Setel can increase its revenue by selling additional services for cars.

The savings come from the usage of credit/debit card terminals to using one digital terminal via their app. Payment modes like FPX can be very cheap depending on volume, sometimes even down to 0.5% or less. For credit card payments, this is higher than 0.5%, up to 2 or 3% for small businesses. For Setel's case, they would be getting a bulk discount.

For the illustration and simplicity of this article, we will just stick to 1% as the main assumption for savings. Just as an assumption and example, if Setel is charging petrol stations 1.5%, and they pay 0.5% to the credit/debit card terminal, then they are making 1% in revenues from the full petrol price.

Competitors - locally and worldwide

Boost & Touch'nGo

Setel is not the only company that offers a petrol e-payment solution. At Shell's petrol stations nationwide, customers are able to pay their consumption of fuel with an e-wallet provided through the app Boost as well as another application called Touch'n Go e-wallet. It is an easy 4-step way to make your payment fast and secure, but it is primarily to make payment and lacks the pump activation features of Setel. Touch ‘n Go’s e-Wallet was mainly introduced to make toll payments convenient as it is one of the easiest ways to pay for tolls in Malaysia.

Walletfactory

Besides those two options that can be used at Shell petrol stations, there is a big competitor called walletfactory. They offer e-wallets not only for fuel retail but in many different industries like Banking & Financial Industry, FMCG& E-commerce, postal industry, Crypto wallet 7 Blockchain and telecommunication. Their product mWallet is a Payment App and Mobile Wallet platform turning a smartphone into a cashless payment tool and storage for different digitised values.

Mobile Wallet provides a convenient way for users to make On-Line, In-App and In-Store payments (using NFC or QR-code), make P2P transfers, manage loyalty cards, electronic tickets, mobile gifts, financial products etc.

But mWallet is also an excellent way for unbanked people to pay, send, receive and manage money. Wallet factory is based in Ukraine and Poland. They have clients all around the world, as well as many collaborations with international enterprises. Furthermore, they have offices operating in many different countries. They can be recognised as a massive competitor in terms of their offers. Nevertheless, walletfactory, as it is not based in SEA, hasn't taken over the Malaysian market yet.

Total

Another fuel e-wallet is also taking off in Europe, named Total. Total is an e-wallet that enables customers to pay on the move. The fuel card stored in the e-wallet makes refuelling even more convenient and time-saving. The card also ensures the safety of your vehicle and reliable mobility. The advantages of the Total wallet fuel card are numerous:

- fast and contactless payment via smartphone directly at the petrol pump, customers can also pay in the shop if required

- innovative, safe and dynamic service

- Access to the data of your own transactions at any time

- Protection against incorrect refuelling by depositing the right fuel for the client

Part of the TOTAL App is the TOTAL e-wallet, in which the fuel card can be deposited as a mobile method of payment. The app informs customers about petrol stations, services, and current campaigns. It also compares fuel prices from different petrol stations so that customers can choose the best offer. With the Total fuel card, the client not only saves time and money but can also pay their bills conveniently directly in their car. In addition, the latest security equipment and encryption mechanisms based on modern banking standards ensure maximum reliability.

CaltexGo

Despite those substantial international competitors, there also can be found one that is highly represented in Malaysia. The enterprise I am talking about is Caltex and its product CaltexGo. The client needs to set up its preferred credit/ debit card, and the customer can pay for fuel from the comfort of his car. By using the CaltexGo app, the client can collect loyalty points and rewards. Caltex has collaborations with petrol stations all across Malaysia, especially in huge cities like Kuala Lumpur and Melaka. Apart from the service they are providing regarding online payment, they also offer products for the customers' vehicles.

Despite all the competitors that are illustrated above, Setel has one huge advantage as it is introduced by PETRONAS. PETRONAS is a company well known in Malaysia and abroad. They are a huge enterprise with many essential and significant connections to other companies. Furthermore, PETRONAS is a fully integrated oil and gas company which allows them to have deep insights in this industry. Those facts make it easier for PETRONAS to establish another business like Setel and gain many customers in the short term.

Startup Fundamentals

What is the Setel’s problem statement?

When we talk about the problem with Startup fundamentals, we are talking about the problem that Setel is trying to solve. Setel was developed to eliminate the pain points car owners face when refuelling their vehicle by integrating payment and loyalty benefits into one application.

It also addresses the problem that the customers are facing money and time loss through conventional payment methods when filling up their cars with fuel. According to Setel's motto, minimise contact, maximise safety, the company tries to face up to these problems with its app.

What is Setel’s proposed solution to these problems?

The solution to this problem should be completely solved by the Setel app and at best, be ten times better and cheaper. The app that Setel has brought onto the market should be the solution to this problem. With the app, you can pay for your fuel from the comfort of your car and have the assurance that it is a very secure payment method. The app also gives you an overview of your monthly fuel expenses. Whether the app is really ten times better and cheaper is unclear, but users of the app will save money and time.

What is the e-payment industry market size?

When we talk about the potential market size, we first need to take a closer look at some numbers. To calculate the potential market size in Malaysia, the number of PETRONAS Petrol stations in Malaysia is multiplied by the average revenues per Petrol station per year. The result is the market size of petrol stations. Assuming that Setel has a fee of 1%, which seems realistic by comparing it with other fuel e-wallets, the total market size must be calculated by taking 1% of the market size of PETRONAS Petrol Stations.

PETRONAS currently owns about 1000 petrol stations throughout Malaysia, and the number is increasing. The revenue in total of PETRONAS was RM 7.6 billion in the 2nd quarter of 2019 according to online research. The retail business generated revenues of RM 3.87 billion in the 2nd quarter, reflecting a 7% increase in sales volume due to improved station productivity, an increased number of stations in operation and the introduction of the new PETRONAS Primax 95 with pro-drive fuel. Taking those numbers into account, PETRONAS' revenue in the retail business would be around RM 15.48 billion per year.

Now the market size can be calculated. (1000 petrol stations x 15,480,000 revenue/ petrol station) x 1%. This gives a potential market size of RM 154.8 million. The 1% is just an assumption and can differ from the original percentage.

This market size refers only to Malaysia. Setel can go overseas for more markets that are not restricted to PETRONAS. This can quickly grow the business by 10X to 100X or more.

What makes Setel unique relative to their competitors?

As described in the previous paragraph, Setel has many competitors in Malaysia but also worldwide. So the question is, what is their competitive advantage? Firstly, Setel offers its customers a points system that rewards loyalty. On the other hand, Setel benefits extremely from the PETRONAS image in Malaysia. PETRONAS is a well-known oil company in Malaysia and all of Southeast Asia. Unlike some other fuel e-wallets, there is no need for an RM 200 hold when paying for fuel. There are incorporated security measures to protect Setel customers' funds, personal data, and information.

Is Setel able to scale?

Setel is in many ways scalable like a Software As A Service (SaaS) model. Cost are mainly to maintain the tech and to gain new customers - similar to SaaS companies. However, the Setel business model seems to be following a typical platform model, where a percentage for each transaction is being charged (rather than a subscription by users for e.g. monthly use of the app).

Does Setel have a strong team?

When determining the team in relation to the Startup Fundamentals, the background experience of the team members is of primary importance. It is also important how many employees a start-up has that are available full-time for the company. We usually evaluate through interviews to find out about their GRIT, if they have the right attitude, if they work well together and if we believe they can take the company all the way to become a unicorn. However, in this article, it is not possible as we did not interview the team so we could not evaluate those aspects.

With PETRONAS' support for Setel, it can only be assumed that the available budget for hiring the team will allow attracting talents. Looking at the information available on Linkedin, Setel as at the very least 74 employees. Many of them have prior experience in FinTech companies. Setel's management team consists of a group of experienced professionals of mainly corporate background. Even though Setel is not a typical startup company, in terms of team, the team's motivation and commitment to the business is crucial, therefore it would be important that the leadership is holding some sort of stake or shares in the company, to be fully committed to its success.

What is Setel’s revenue?

In terms of revenue traction, doesn't provide any public figures. However, with the user data found online, one can make some assumptions:

It is assumed that 200,000 customers are actively using the app (as of March 2020). Assuming each fills pumps petrol once a week (4 times a month), pumping on average 65 litres at a price of RM1.40/litre, that would be RM 364 of transactions per customer per month. We assume Setel gets 1% of the total price the customer pays. With this information, the revenue of the startup can be calculated: (200,000x(RM1.40x65l*4))x0.01= RM728,000 Sales Revenue/month. This relatively large sales revenue is mainly due to the Setel business model.

Based on a full year, we estimate that the sales revenues could be around RM 8.7 million as of now. Of course, these estimated figures will not correspond exactly to reality. However, they will help to draw a big picture, which will help to understand the startup better.

Setel Business Model (How does Setel Make Money?)

When talking about monetisation in Startup Fundamentals, it means how the Setel business model can be turned profitable when needed and on how high the margins are in a long-term view. Through the use of the app, Setel can take a fee of the transactions which we estimated to be around 1%.

As the company has been in existence for two years, it is safe to assume that it is growing rapidly and Setel is investing in its employees. Through various online researches, it can be assumed that an employee earns on average RM 5000 per month. Setel, at this moment, has at the very least 74 employees. With these figures, it is now possible to calculate the costs that Setel spends each year to pay its employees. 74 employees x RM 5000 x 12 months results in RM4,440,000.

The above excludes other costs like office expenses, marketing costs, sales costs, and so on. Let's say, these add up to 30% of the estimated revenues above, which is typical of high growth companies which are RM2.9m (8.7m/3). So we can calculate their rough profitability: RM8,7m - RM 2.9m - RM4.4m = RM1.4m. Therefore, we can assume that Setel may be already making money. In reality, though, they may still choose to go hard on growth and reduce profitability to 0 so that they can invest in more growth as any high-growth Startup should.

Customer Acquisition Cost based on their promotion

Additionally, Setel does promote their product quite heavily. 10% cashback on registration, and 10% with qualified credit cards signal a few things. First, they are recouping their Customer acquisition costs of an estimated RM6 (10% of RM60) with terms. For example, it stops when you accumulate RM50 of cashback.

Let's talk about CAC (Customer Acquisition Cost), and let's say a customer gets a full 10% cashback on registration of RM9 after the terms and conditions. Assuming they make RM0.65 (1% of RM65) per week from a customer, they will need the customer to pump an additional 11 times over the initial 3 times (see image above) to break even, or about 3.5 months in total. That is very good, as SaaS companies have an average payback period on CAC of about 14 months. This means, given the money velocity flowing through the Setel system, they can theoretically grow 3X faster than a typical SaaS Startup.

Future Of E-wallets

In Malaysia, the e-wallet market is estimated to grow to US$20 billion (RM83.8 billion) by 2024, regarding professional services firm PricewaterhouseCoopers Malaysia. Despite the small ticket size per transaction, the company figured that since e-wallets can be used for a variety of payments, the retail, food and beverage, e-commerce and peer-to-peer transfer, e-wallets will gain more and more popularity and become very profitable.

Users worldwide are delighted with the functions of the e-wallet. However, in today's society, issues such as data security and consumer protection are to be taken seriously as there are many customers who do not want to release this personal data in an app. But mostly the millennials use one or more e-wallets almost daily.

According to WARC, Boost and Touch 'n Go each have more than 5 million subscribers, while GrabPay declares that it is used by two out of three Malaysians. Not just the young generation is pushing forward to a cashless society but the Malaysian government is also encouraging their citizens. The finance minister of Malaysia Lim Guan Eng pointed out that going towards a cashless society would help promote efficiency and transparency as it is hard for corruption to go undetected.

Afterthoughts

The question that now arises for many entrepreneurs is whether they should also integrate an e-wallet into their business when founding a start-up. E-wallets prove to be a blessing for all users - customers and dealers. That's because they help keep track of every transaction and offer a wide range of discounts and cashback offers.

As people prefer mobile payment methods for all types of transactions, the future of e-wallet looks rosy. This is true as even the e-commerce business relies heavily on such a mechanism to attract customers for increased purchases.

This will lead people to accept and use e-wallets for a range of transactions such as payment of bills, online/offline shopping, and even transferring cash to a third party.

All of this is possible because e-wallets offer users the ability to perform several transactions in a highly secure way while being user-friendly. The use of this type of e-wallet payment is not limited to retail and e-commerce, but there are many ways in which B2B and B2C companies can take advantage of its services.

By law, every payment system should have a permit. The founder should keep a complete set of documentation and ensure that the payment system meets all the applicable regulations. In some cases, it must also be PCI DSS certified.

Although the wallet business sounds very tempting, the risks should not be underestimated. The competition in this area is very strong, and it can be assumed that, just as with mobile phone providers, only 3-5 per country can really succeed. Almost every competitor is burning cash therefor this game is more for bigger players that have already secured the market.

If one were to make a prediction now about how the e-wallets will develop in the next few years, one could definitely assume that there will be many in the market and that the number of users will also have increased significantly, but there will only be 2-4 large companies left that will benefit considerably from the e-wallet.

Should you, as an entrepreneur consider integrating an e-wallet into your business, please inquire about the prescribed regulations and laws of your country to avoid disappointment in the future.

Sources

https://sensortower.com/android/my/setel-ventures-sdn-bhd/app/setel/com.setel.mobile/overview

https://sensortower.com/ios/publisher/setel-ventures-sdn-bhd/1460532183

https://www.investopedia.com/terms/d/digital-wallet.asp

https://www.universum-group.de/glossar/wallet/

https://www.ecinsider.my/2018/12/malaysia-ewallet-battle-landscape-analysis.html

https://www.gobear.com/my/blog/bearvsbear-comparing-malaysias-petrol-stations

https://walletfactory.com/news

https://www.warc.com/newsandopinion/news/the-war-of-malaysias-e-wallets/42990

https://themalaysianreserve.com/2019/10/29/the-best-e-wallets-in-malaysia-as-ranked-by-users/

https://www.carsifu.my/news/petronas-launches-setel-e-payment-solution

https://www.soyacincau.com/2019/06/13/setel-refer-a-friend-free-petronas-credit/

Tested: Setel – The Petronas E-Wallet that allows you to pay for petrol

https://www.total.de/services/tankkartenkunden/total-e-wallet

https://www.digitalnewsasia.com/digital-economy/setel-now-available-all-petronas-stations-klang-valley https://customerthink.com/how-to-develop-an-e-wallet-mobile-application-with-the-help-of-top-tips-and-necessary-features/