Seeking funds is not a new thing for startup companies and there are various reasons why a company needs them. Their goals would play a crucial part in deciding the best way for it to generate funding.

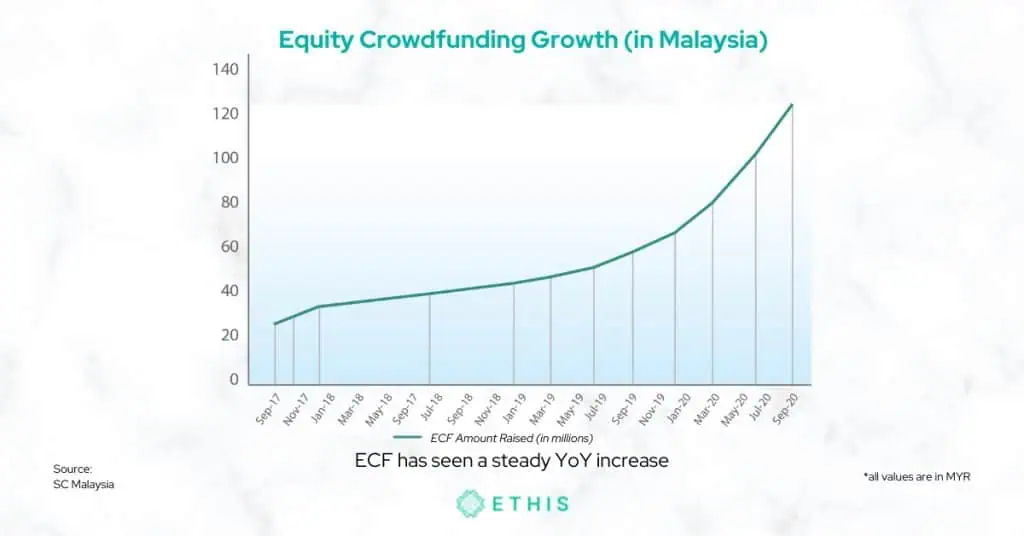

Venture Capital (VC) and Equity Crowdfunding in Malaysia (ECF) are two of the most prevalent ways for businesses to generate funds. Traditional financing techniques, such as Venture Capital, give significant quantities of money from a small number of people, whereas ECF provides many small sums of money from a large number of people. According to the Securities Commission, Equity Crowdfunding has grown in popularity in Malaysia in recent years.

What Is Crowdfunding?

The utilisation of fair sums of funds from a large number of people to support a new business initiative is known as crowdfunding. Crowdfunding uses social media and crowdfunding platforms to connect investors and entrepreneurs, with the intention to encourage entrepreneurship by broadening the pool of investors beyond the typical circle of owners, families, and venture capitalists.

Types of Crowdfunding

There are many various forms of crowdfunding just as there are many different sorts of capital round raises for firms at all phases of development. The sort of product or service you offer, as well as your development objectives, will determine the crowdfunding approach you use. Donation-based, rewards-based, peer to peer-based and equity crowdfunding are the four main forms.

Donation-based

Donation-based crowdfunding, in general, refers to any crowdfunding effort in which the investors or donors do not receive a financial return. Disaster assistance, charities, organisations, and medical expenses are all examples of donation-based crowdfunding campaigns.

Rewards-based

Individuals who participate in rewards-based crowdfunding are expecting an exchange for a "reward," which is often a form of the product or service your firm provides. Despite the fact that this technique provides a reward to supporters, it is still considered a subset of donation-based crowdsourcing because there is no cash or equity return.

Equity Crowdfunding

Unlike donation- and rewards-based crowdfunding, equity-based crowdfunding allows contributors to become part-owners of your business by exchanging money for equity shares. Your contributions will receive a financial return on their investment as equity owners, as well as a portion of the earnings in the form of a dividend or distribution.

Peer to Peer Crowdfunding

This type of crowdfunding is often known as debt crowdfunding, which works similarly to a bank's term loan. You don't get the money from an institution; instead, you get it from individual people. This sort of crowdfunding is a little more sophisticated, involving mini-bonds, invoice financing and peer to peer lending.

Crowdfunding in Malaysia

Crowdfunding in Malaysia succeeds and grows through the supports given by the government who sees it as an opportunity to strengthen capital markets. Equity crowdfunding (ECF) providers have raised RM199 million (about $48 million) in the last five years. Despite the worldwide economic slowdown during the pandemic, the local market has grown by 278%. This is an incredible achievement for a country where alternative funding is still in its infancy. Let's look at how Malaysian equity crowdfunding got started, where it is today, and what the future holds for the industry.

The crowdfunding sector in Malaysia first started in the year 2015. The Deputy Finance Minister declared that Securities Commission (SC) Malaysia has allowed six businesses to provide crowdfunding services. Since then, 150 issuers have benefited from RM199 million collected through 159 campaigns.

In the aftermath of the COVID-19 pandemic, SC Malaysia took steps to boost the investment demands on markets:

- Individuals are now eligible for a limited tax deduction for sums invested in ECF enterprises

- Limit for ECF fundraising has been increased to RM10 million.

- Companies having paid-up capital of up to RM10 million were granted access to the crowdfunding market.

- To provide exit alternatives for ECF and Peer to Peer (P2P) supporters, a secondary trading platform was developed.

As a result, issuers successfully raised RM631.04 million via ECF and P2P financing platforms in 2020 (compared to RM441.56 million in 2019). According to the regulator, 57% of funds were collected for business growth, while 97% were raised for working capital. In addition, issuers shifted to greater fundraising sums in 2020, with 84% of campaigns raising more than RM500,000.

What is Venture Capital?

Venture capital (VC) is a type of private equity and funding provided by investors to startups and small enterprises with the potential for long-term growth. Well-heeled investors, investment banks, and other financial institutions are the most common sources of venture capital. It does not necessarily have to be in the form of money; it may be in the form of technical or management skills. Small businesses with outstanding development potential, or businesses that have expanded swiftly and are set to expand, are frequently given venture capital.

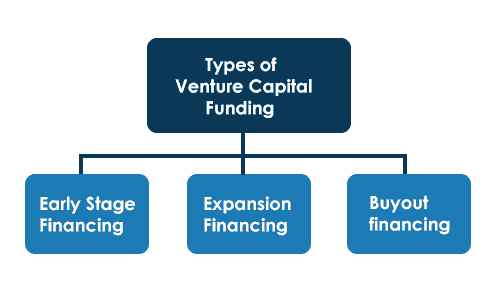

Types of Venture Capital

Many forms of venture capital are categorised according to how they are used at different phases of a company's life cycle. Early-stage funding, growth financing, and acquisition/buyout financing are the three main forms of venture capital.

Early Stage Financing

Seed financing, start-up financing, and first-stage financing are the three types of early-stage financing.

Seed financing is a fair sum of money given to an entrepreneur in order for them to be eligible for a start-up loan.

Companies are provided start-up financing in order to complete the creation of goods and services. Those companies that have spent all of their initial money and require financing to launch full-scale commercial operations are the primary beneficiaries of First Stage Financing.

Expansion Financing

Second-stage finance, bridge financing, and third-stage financing are all types of expansion funding.

Second-stage finance is given to businesses to help them get started on their expansion plans. It is offered with the intention of supporting a certain firm that is expanding significantly. Companies that use Initial Public Offerings (IPOs) as the main business strategy may be eligible for bridge financing as a short-term interest-only loan or as a kind of monetary support.

Acquisition or Buyout Financing

Acquisition finance and management or leveraged buyout financing are two types of acquisition or buyout financing. Acquisition finance enables a corporation to purchase specific components or the complete company. Management or leveraged buyout finance assists management groups to acquire a specific product from another firm.

Venture Capitalist in Malaysia

Malaysia's venture capital market has always been maintained by domestic companies, and it has lagged behind industrialised nations such as Japan, Singapore, Hong Kong, Taiwan, and Korea. However, independent venture capital companies in Malaysia in the last two to three years has marked another important change in the sector.

Previously, the majority of Venture Capital Corporations (VCC) were either government or bank-owned, and all of them preferred to manage their own funds rather than outsource to professional fund management firms. In 2004, the overall amount of funds, total investments from both domestic and international sources, the number of venture capital fund management businesses, and the number of investee companies all increased.

There are 2 types of VC companies in Malaysia namely:

- Venture Capital Corporation (VCC): being a corporation that manages on its own behalf, investment in securities of venture companies in early business stages.

- Venture Capital Management Corporation (VCMC): that manages on behalf of a VCC, investment in securities of venture companies in early business stages.

Venture Capital vs Crowdfunding in Malaysia

There are some main differences between Venture Capital and Equity Crowdfunding in Malaysia. One of the main differences between them is that Venture Capital usually needs lesser effort since companies only need to convince a small number of investors to fund their business. Whereas crowdfunding usually requires more marketing momentum since companies are needed to convince a larger group of people to fund their business.

Moreover, for Venture Capital, companies need to pique the interest of the right individuals through business partner introductions or self-introductions, pitch meetings, and networking events but in crowdfunding, companies are more towards digital and online marketing such as using pay-per-click advertising, mobile marketing campaigns, e-mail informative teasers, and other digital materials to reach the largest number of investors.

| Crowdfunding | Venture Capital |

| It expands your network, allowing you to reach a broader audience and spread the word about your brand. | More advantageous for firms to aim to generate money rather than seeking to have a major social impact. However, there are chances to have contacts in key financial vehicles, which may attract the attention of other larger investors. |

| Criteria set are less strict & more flexible | Follow criteria to select investment targets & less flexible |

| More likely to get "passive investors" or "spectators, will get lesser guidance | Usually comes with a higher level of engagement, will get more guidance from investors |

| The platforms used for crowdfunding usually take 5-10% of the fundraising round on average, which is also known as "success fee" | Enable the firm to keep all of the money they received |

| The crowdfunding investor has all of the necessary information, after reading it, you can just click to invest, completely on your terms. | The valuation may not necessarily be on your terms. Venture Capitalists may request a larger stake in your business if they see the potential. |

Which One Should You Go For?

Both Equity Crowdfunding and Venture Capital funding are viable options for raising capital for your company. Make your choice depending on where you are in the lifecycle of your business and the significant differences that each of these crowdfunding techniques has to offer.

You are not limited to one single source of investment. Malaysian startups and business owners now have a lot of options because of the recent emergence of alternative business finance sources. All you need is a decent idea, a compelling pitch, and awareness of the fundings options available to you for the lifecycle of your business.

Here is some advice from the experts:

“If you have two choices, VC would be better. Because the money they are giving is very smart money. They are going to support you much more than anything. If you are running your startup alone, without VCs backing you, this means you are doing everything from scratch, but when you invite the VC on board, they have a lot of connections and a lot of experience.”

Dr Amr Hussein, CEO from Gainwells - Interviewed by Ethis

“Depending on the nature of the investor, the startup may want investors who actively help out or may want no disturbance. So, if you’re an issuer who is certain about what you are doing, go for VC, otherwise choose ECF.”

Umar Munsh, Co-Founder of Ethis

Final Thoughts

From Venture Capital to Equity Crowdfunding, there are now more diversified routes to acquire startup finance. Even though it can be challenging when it comes down to choosing whether you should focus on Venture Capital or Crowdfunding for your business, ultimately, what works best for you is determined by the nature of your firm and its objectives.

It's crucial to remember, too, that you should look into all of your financing alternatives. This may entail using crowdfunding to get your firm off the ground, followed by Venture Capital when you're ready to scale up.

References

Development of the Venture Capital Industry in Malaysia

General Overview of Venture Capital in Malaysia

How to Decide Between Crowdfunding and Venture Capitalists

Overview of Crowdfunding in Malaysia

Venture Capital vs Equity Crowdfunding: Which method is better when raising funds for your business?

10 differences between equity crowdfunding vs. traditional VC funding

VC Funding For Your Startup